Dow & Footsie Rally Lightens Mood

By Colin Twiggs

August 24, 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

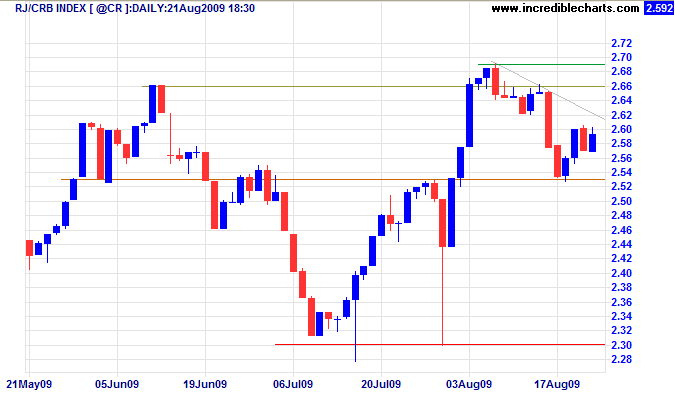

Commodities

The CRB Commodities Index, shaken by the prospect of falling demand from China, is undergoing a secondary correction. Respect of the declining trendline would indicate a further down-swing, signaling weakness for resources stocks — confirmed if short-term support at 253 is broken. Breakout above the trendline, however, would suggest that the correction is over; short duration indicating a strong primary up-trend.

USA

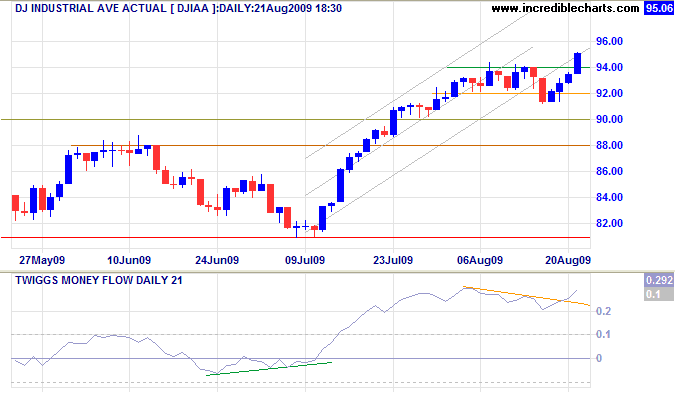

Dow Jones Industrial Average

The Dow completed a bear trap after a marginal break through support (9200) reversed above resistance at 9400. Short duration of the correction indicates a strong up-trend. Expect a test of the upper trend channel, with a target of 10000*. Reversal below 9400 is unlikely, but would indicate a bullish broadening (or megaphone) wedge formation. The primary advance is confirmed by the S&P500 and Dow Transport Index.

* Target calculation: 9000 + ( 9000 - 8000 ) = 10000

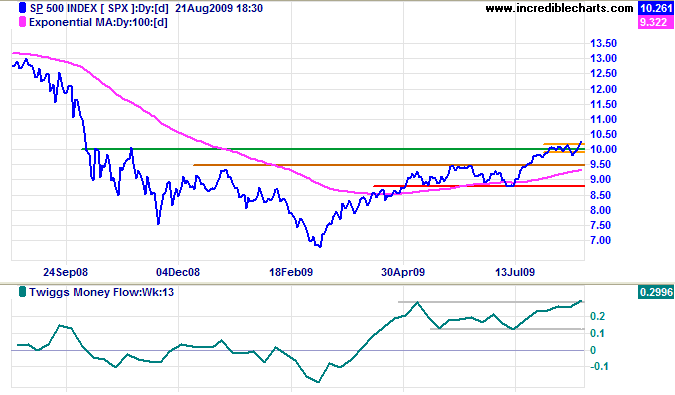

S&P 500

The S&P 500 broke out above its narrow consolidation around 1000, signaling a primary advance with a target of 1120*. Reversal below 1000 is unlikely, but would indicate a broadening wedge formation. The recent short correction is a bullish sign. In the long term, expect a test of the August 2008 high.

* Target calculation: 1000 + ( 1000 - 880 ) = 1120

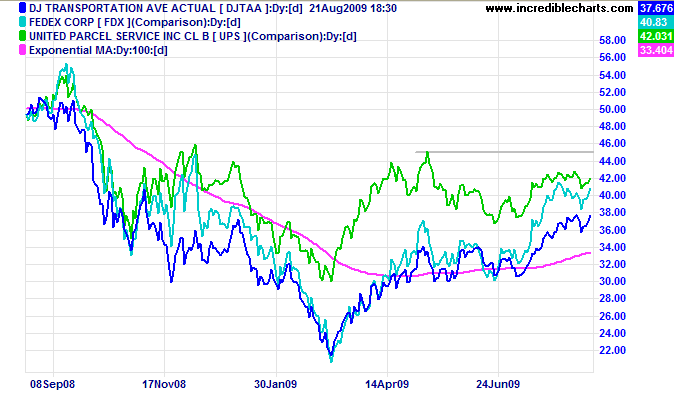

Transport

The Dow Transport Average and Fedex are advancing steadily, but UPS stubbornly refuses to follow. The primary up-trend is a positive indication for the broader economy.

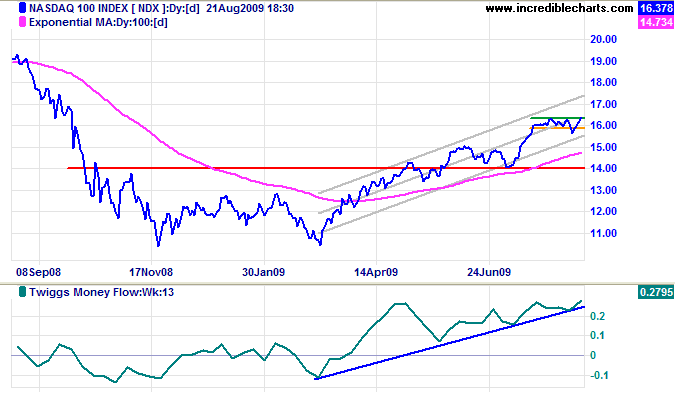

Technology

The Nasdaq 100 is testing resistance at 1640. Rising Twiggs Money Flow (13-Week) signals buying pressure. Expect an upward breakout, signaling a primary advance to the upper trend channel around 1800*. Reversal below 1590 is unlikely, but would indicate a broadening consolidation.

* Target calculation: 1600 + ( 1600 - 1400 ) = 1800

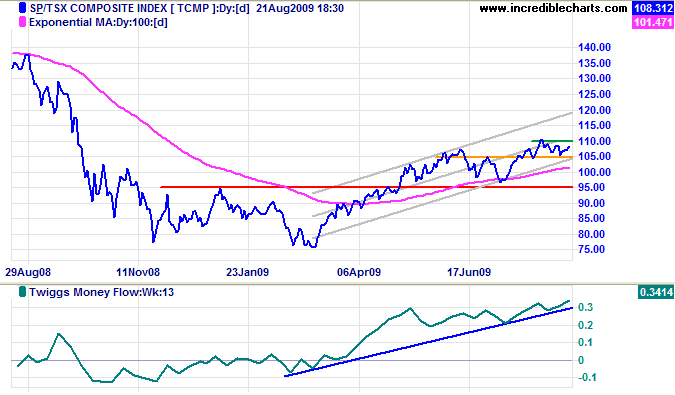

Canada: TSX

The TSX Composite respected support at 10500. Rising Twiggs Money Flow (13-Week) signals buying pressure. Breakout above 11000 would signal a primary advance with a target of 11700*. Failure of 10500 is unlikely, but would warn of a secondary correction.

* Target calculation: 10700 + ( 10700 - 9700 ) = 11700

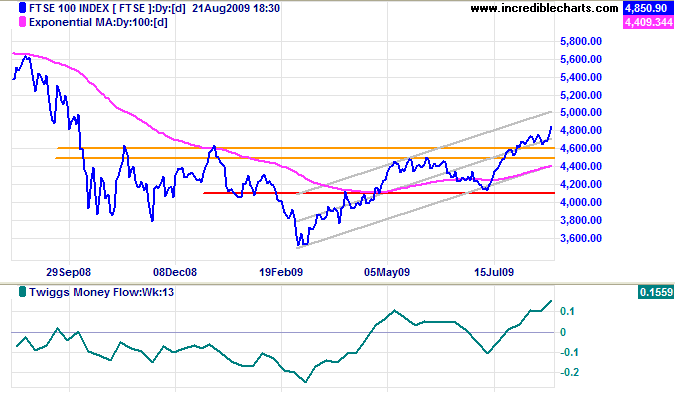

United Kingdom: FTSE

The FTSE 100 continues its primary advance, headed for a test of the upper trend channel at 5000*. Rising Twiggs Money Flow (13-Week) signals buying pressure. Reversal below 4600 is unlikely, but would warn of a secondary correction.

* Target calculation: 4500 + ( 4500 - 4000 ) = 5000

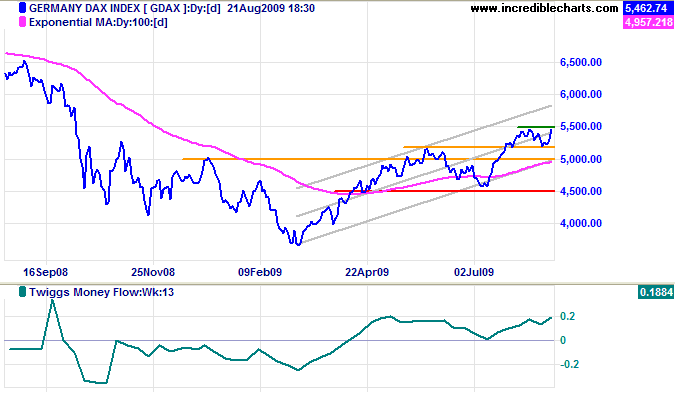

Europe: DAX

The DAX is testing resistance at 5500. Upward breakout would signal an advance to the upper trend channel, around 5700*. Rising Twiggs Money Flow (13-Week) indicates buying pressure. Reversal below 5200 is unlikely, but would indicate a secondary correction.

* Target calculation: 5100 + ( 5100 - 4500 ) = 5700

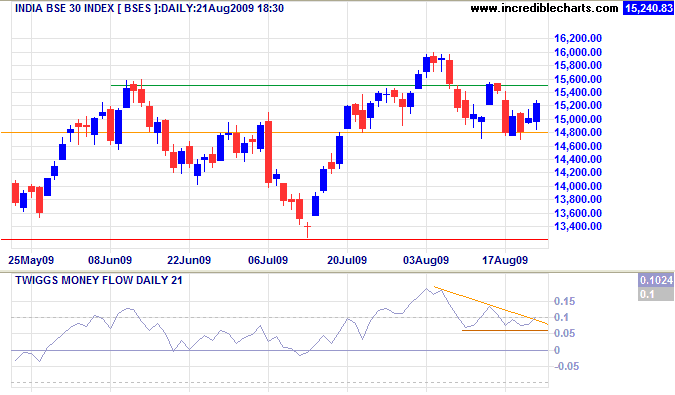

India: Sensex

The Sensex respected short-term support at 14800 and is headed for another test of resistance at 15500. Breakout would signal a primary advance with a target of 17500*. Twiggs Money Flow (21-Day) reversal below 0.06, however, would warn that the secondary correction will continue; and penetration of support at 14800 would confirm.

* Target calculation: 15500 + ( 15500 - 13500 ) = 17500

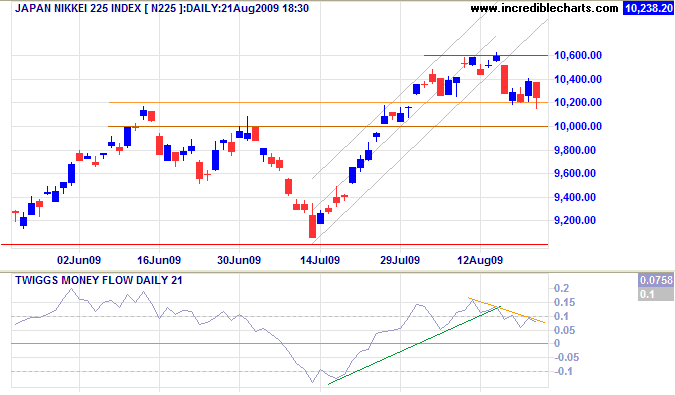

Japan: Nikkei

The Nikkei 225 is testing support at 10200. Failure would signal a secondary correction. Recovery above 10600, however, would indicate a primary advance with a target of 11000*. Declining Twiggs Money Flow (21-Day) indicates selling pressure.

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

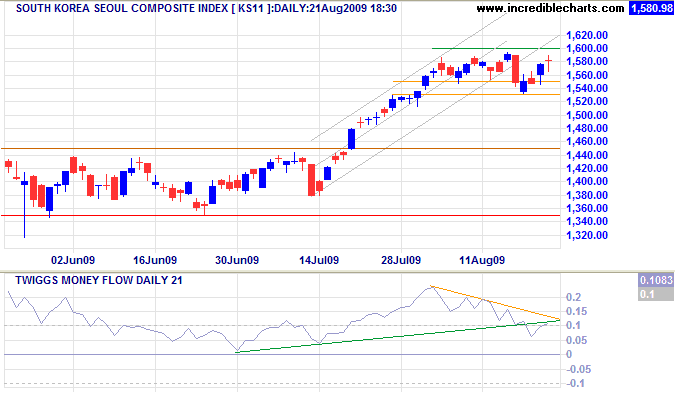

South Korea

The Seoul Composite Index is testing resistance at 1600. Upward breakout would continue the primary advance with a target of 1700*. Declining Twiggs Money Flow (21-day), however, indicates selling pressure — and reversal below 1530 would warn of a secondary correction.

* Target calculation: 1450 + ( 1450 - 1200 ) = 1700

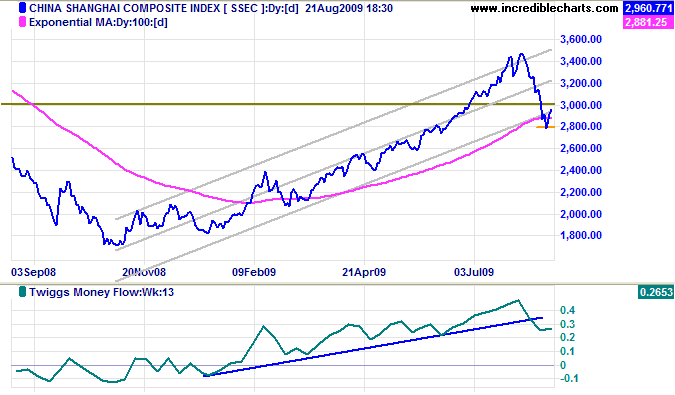

China

The Shanghai Composite Index is retracing to test the new resistance level at 3000. Respect would signal another down-swing; confirmed if short-term support at 2800 is penetrated. Primary support is a long way below, at 2100, after the runaway trend. Twiggs Money Flow (21-Day) reversal below the rising trendline indicates selling pressure.

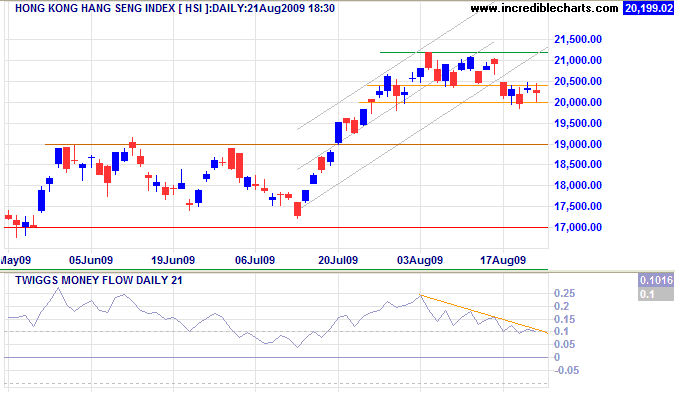

The Hang Seng slipped below support at 20400 and is now testing 20000. Breakout would signal a secondary correction. Declining Twiggs Money Flow (21-Day) warns of selling pressure. Recovery above 21200 is unlikely, but would signal an advance to the upper trend channel.

Australia: ASX

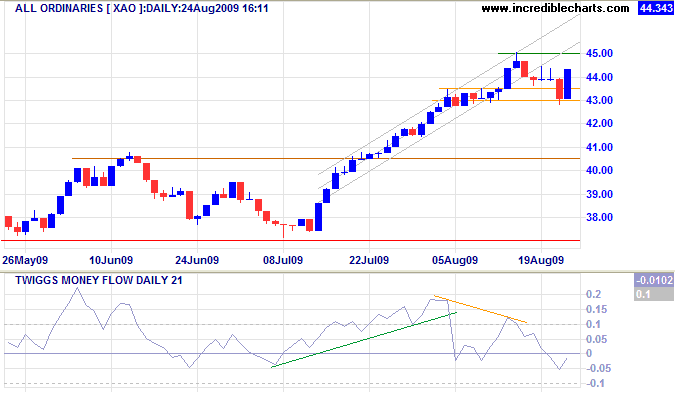

Australian stocks rallied on the strength of the Dow and Footsie, but the reaction is likely to be muted by the effect of the down-turn in China, and declining commodity prices, on resources stocks. Reversal below 4300 would signal a secondary correction, while recovery above 4500 would indicate an advance to the upper trend channel. Twiggs Money Flow (21-Day) highlights a flaw with all volume indicators: they can be distorted by exceptional volume on a single stock. This occurred with GPT last week and again, with Telstra, on Friday.

* Target calculation: 4050 + ( 4050 - 3700 ) = 4400

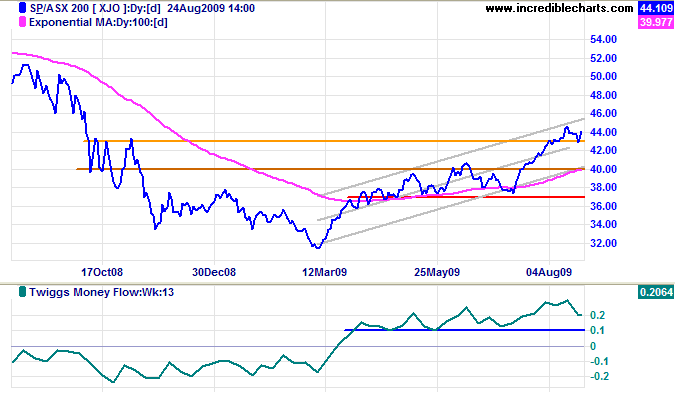

The longer term 13-Week Twiggs Money Flow suffers less distortion and indicates a healthy up-trend on the ASX 200. Reversal below 4300 would signal a secondary correction, while recovery above 4500 would indicate another test of the upper trend channel.

I will leave this as a reminder for the next few weeks:

This is no blue sky rally.

Enjoy it while it lasts.

But bear in mind that it could end badly.

And keep your stops tight.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

We are not to expect to be translated from despotism to liberty in a featherbed.

~ Thomas Jefferson (1743 - 1826)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.