Gold Losing Glitter

By Colin Twiggs

August 20, 2009 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

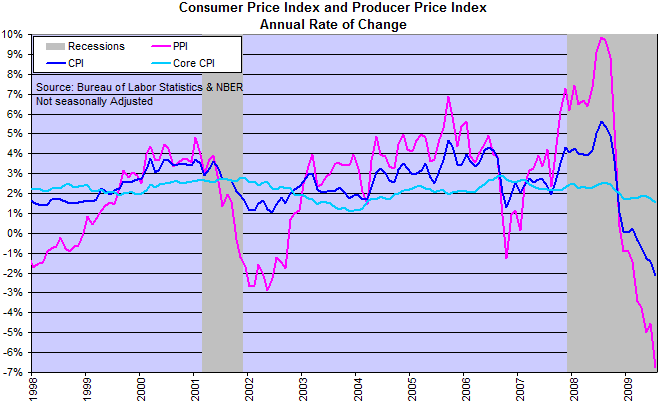

Consumer Price Index

Declining consumer and producer price indexes indicate that the US economy is undergoing a period of deflation. Despite their best efforts, the Fed and Treasury are unable to halt the deflationary impact of the credit contraction. To paraphrase Warren Buffett: the tide is going out and will soon reveal which financial institutions have been swimming naked.

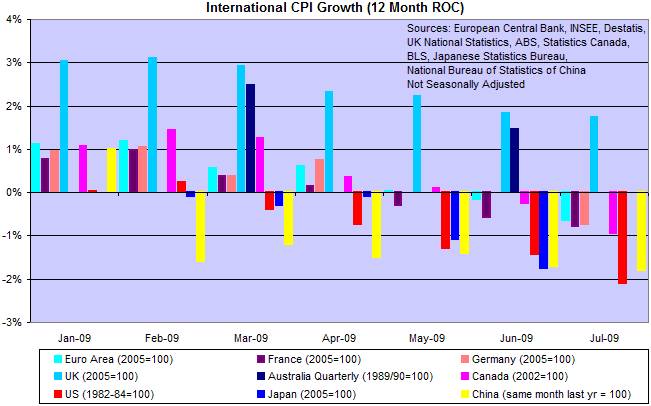

Deflationary effects of the global credit contraction have been echoed in most major economies. Starting with China in February, the contagion soon spread to the US and Japan, with France, Germany and Canada now joining in. Two exceptions are the UK, which is printing money at an alarming rate, and Australia, supported by a premature housing recovery.

July data for Australia and Japan is not yet available.

Mild deflation would do no harm to the economy. In fact, this is the natural rate of inflation. Advances in technology and productivity should lead to a gradual reduction in consumer prices over time, outstripping the inflationary effect that an expanding population has on prices of limited resources such as land. Unfortunately few of us have experienced deflation in our lifetime — because of insidious currency debasement by central banks.

A deflationary spiral, however, can have a devastating impact on the economy, especially on the financial sector. This is the Fed's worst fear: that contracting credit causes falling asset prices, in turn causing a further contraction of credit. Any hint of that would force the Fed to print money at a rate matching the Bank of England.

Signs that the Fed will be forced to debase the currency would send the price of gold soaring, while indications that a deflationary spiral has been averted would lead to a decline in demand for gold.

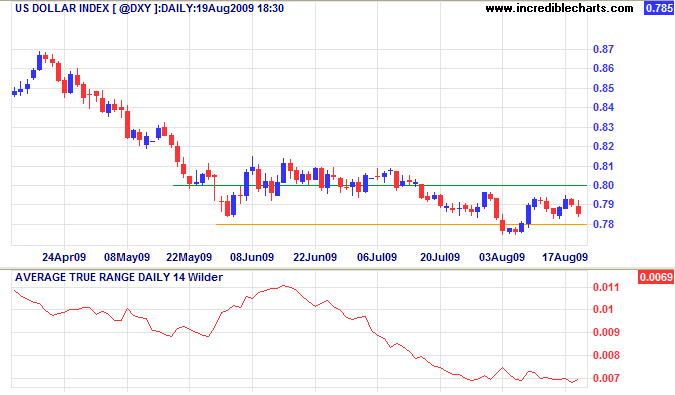

US Dollar Index

The US Dollar Index is consolidating below the 80 level. Recent TIC data indicates that China and Japan are buying large amounts of US treasuries — in effect supporting the dollar. Reader Gilles from Canada pointed out the sharp decline in daily trading range over the past month, illustrated by falling average true range below. Declining volatility may reflect an easing of pressures that built up before the recent fall or a move by central banks to support the dollar at this level. Either would indicate a lengthy period of consolidation, with future direction signaled by a breakout and rising volatility. Retreat below 78 would offer a target of 74* and signal stronger gold and oil prices, while recovery above 80 would warn of a primary up-trend and weaker gold and oil prices.

* Target calculation: 78.5 - ( 83 - 78.5 ) = 74

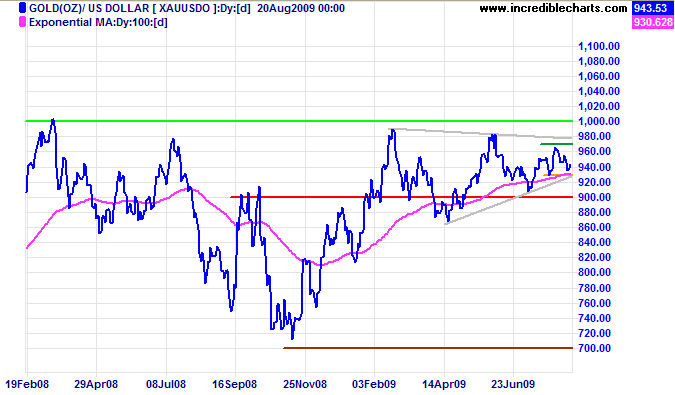

Gold

Spot gold is consolidating in a triangular pattern below resistance at $1000. Breakout below short-term support at $930 would test primary support at $900, while recovery above $970 would test $1000. In the long term, breakout above $1000 would signal a primary advance to $1100*, while failure of support at $900 would test the November low of $700.

* Target calculation: 1000 + ( 1000 - 900 ) = 1100

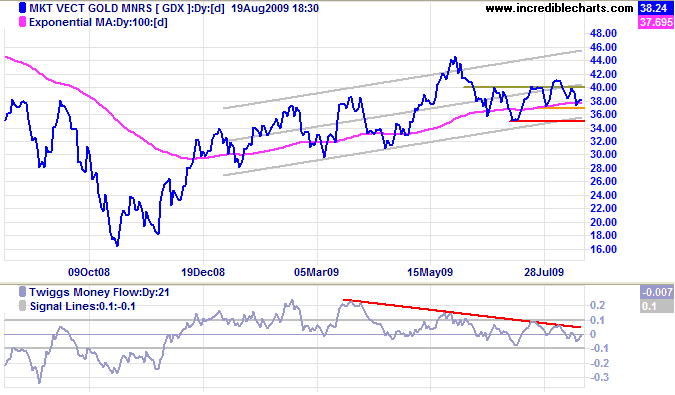

Gold miners often act as an advance indicator of gold direction. The Market Vectors Gold Miners Index [GDX] is headed for a test of its lower trend channel. Breakout below $35 would warn that the primary trend is reversing — a bearish sign for spot gold. Declining Twiggs Money Flow (21-day) warns of selling pressure.

Silver

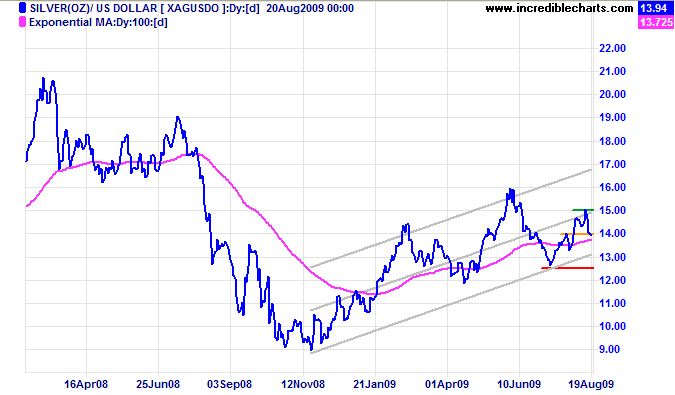

Spot silver is also headed for a test of its lower trend channel. Breakout below $12.50 would signal a primary trend reversal and strong bear signal for gold, while recovery above $15 would indicate a primary advance to the upper trend channel.

Crude Oil

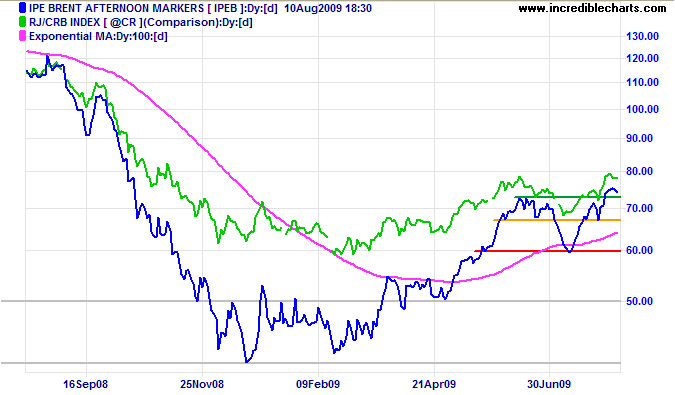

Crude oil recovered above $72 [green] in response to declining US inventories, signaling another primary advance. Reversal below $72, however, would warn of a bull trap — confirmed if the index retreats below $67 [orange]. With the Shanghai Composite Index falling sharply, I would be cautious until the CRB Commodities Index exceeds its earlier high at 268 to signal a primary advance.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

The tragedy of modern man is not that he knows less and less about the meaning of his own life,

but that it bothers him less and less.

~ Vaclav Havel

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.