Falling Dollar Lifts Gold & Crude

By Colin Twiggs

August 4, 2009 2:30 a.m. ET (4:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

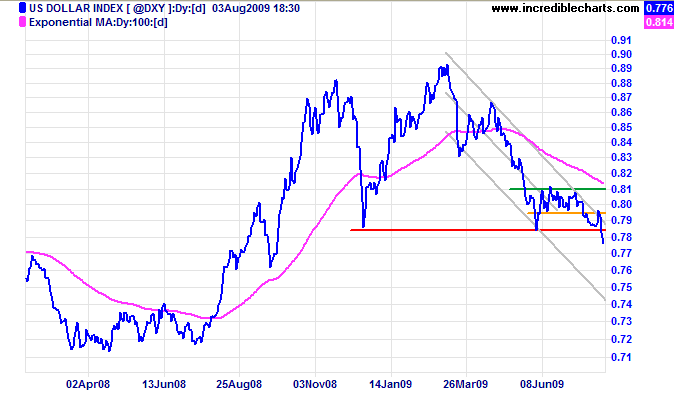

US Dollar Index

The US Dollar Index broke through primary support at 78.50, signaling a down-swing to test the lower channel border

around 74*.

Recovery above 79.50 is most unlikely, but would warn of a

bear trap.

A falling US dollar will boost gold and oil prices.

* Target calculation: 78.5 - ( 83 - 78.5 ) = 74

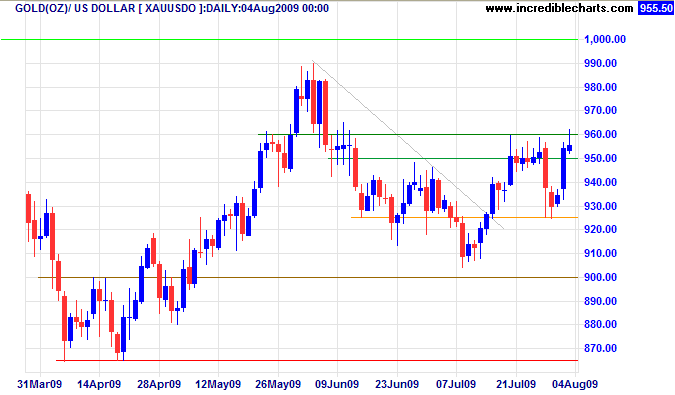

Gold

Spot gold is again testing resistance at $960. The falling dollar and rising gold miners index, silver and crude oil all point to a breakout — which would signal a test of $1000. Reversal below $950, however, would warn of another test of support at $925. In the long term, breakout above $1000 would signal a primary advance with a target of $1100*, while failure of support at $900 would test the April low of $865.

* Target calculation: 1000 + ( 1000 - 900 ) = 1100

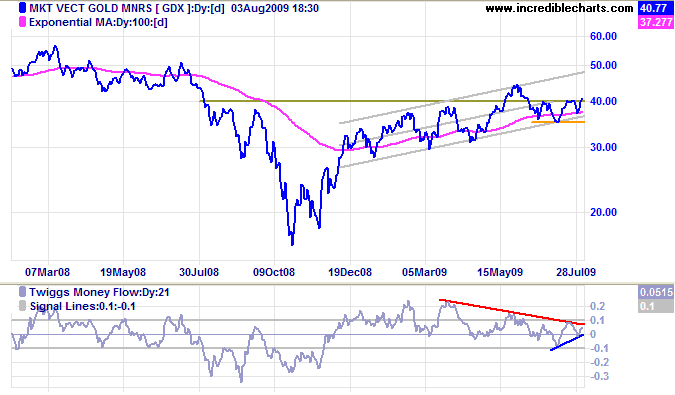

The Gold Miners Index [GDX] broke through resistance at $40, indicating a test of its upper channel border — and a similar rise for gold. Twiggs Money Flow (21-day) recovery above 0.1 would confirm the signal. Reversal below the trend channel or TMF reversal below zero would warn of a bull trap.

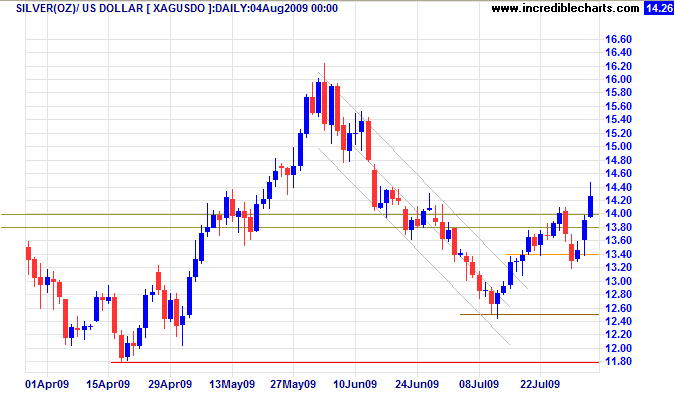

Silver

Spot silver broke through resistance at $14.00, confirming the secondary correction is over and indicating an advance to the June high of $16.00 — a positive sign for gold. In the short term, expect retracement to test the new support level. Reversal below $13.80 is unlikely, but would warn of a bull trap. In the long term, failure of support at $12.50 is unlikely, but would test primary support at $11.80; while breakout above $16.00 would offer a target of $19.00*.

* Target calculation: 16 + ( 16 - 13 ) = 19.00

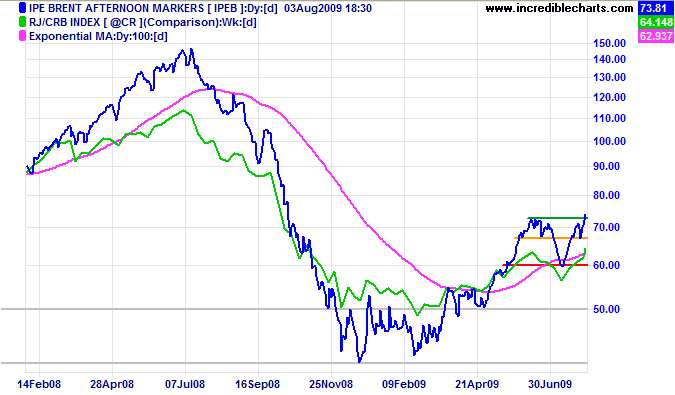

Crude Oil

Crude oil broke through resistance at $73 [green], in sync with a rising CRB Commodities Index, and signaling a primary advance with a target of $86*/barrel. Reversal below $67 [orange] is unlikely, but would signal a bull trap.

* Target calculation: 73 + ( 73 - 60 ) = 86

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

He that is of the opinion money will do everything may well be suspected of doing everything for money.

~ Benjamin Franklin (1706 - 1790)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.