Bear Trap

By Colin Twiggs

July 15, 2009 10:30 p.m. ET (12:30 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

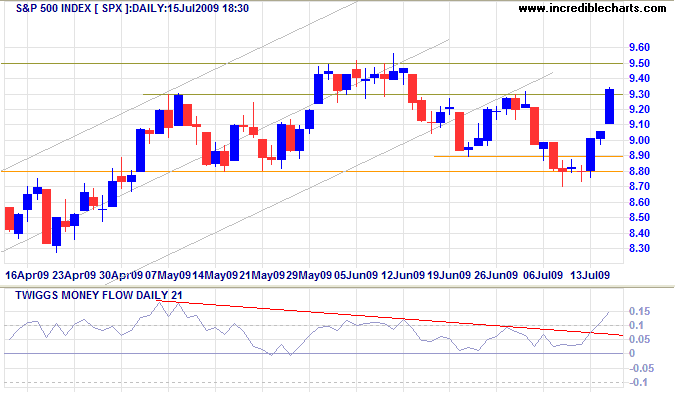

S&P 500

The S&P 500 failed to break through support at 880 and rallied strongly, warning of a bear trap. A strong bull signal. Breakout above resistance at 950 would confirm — and signal a primary advance with an immediate target of 1000.

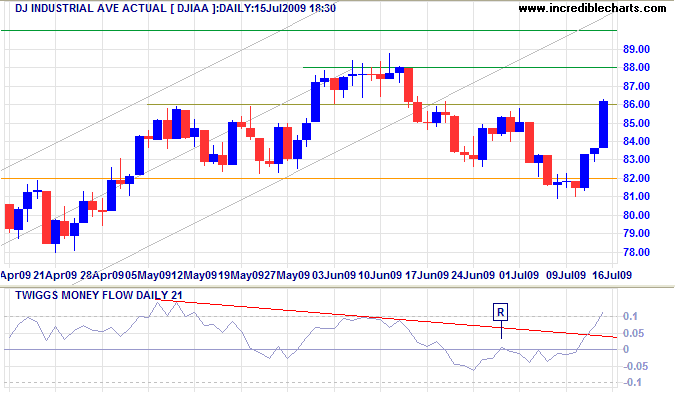

Dow Jones Industrial Average

The Dow reversed above 8600 warning of a bear trap — strengthened if 8800 is penetrated. Breakout above 9000 would signal a primary advance with a target of 10000. The sharp climb in Twiggs Money Flow (21-Day) signals buying pressure.

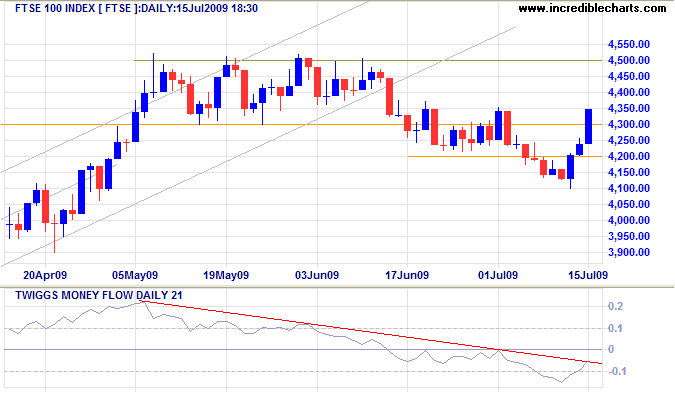

UK: FTSE 100

An FTSE 100 rise above 4350 would likewise warn of a bear trap. Breakout above 4500 would signal a primary advance with a target of 4900.

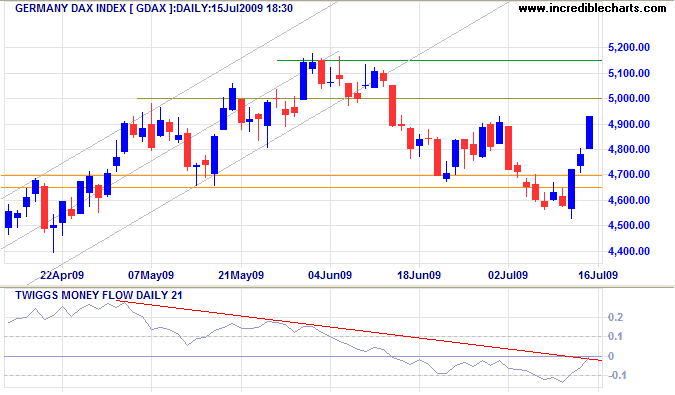

Germany: DAX

The DAX recovered above 4900, again warning of a bear trap. Breakout above 5150 would signal a primary advance with a target of 5750.

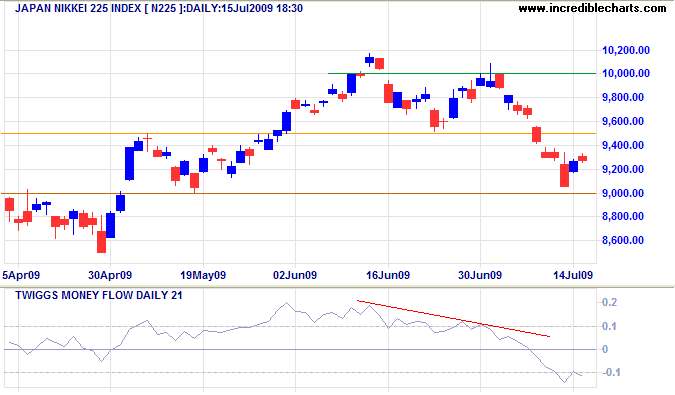

Japan: Nikkei 225

Nikkei 225 is weaker, with Twiggs Money Flow (21-Day) a long way below zero. Recovery above 10000 is unlikely, but would signal a primary advance to 11000.

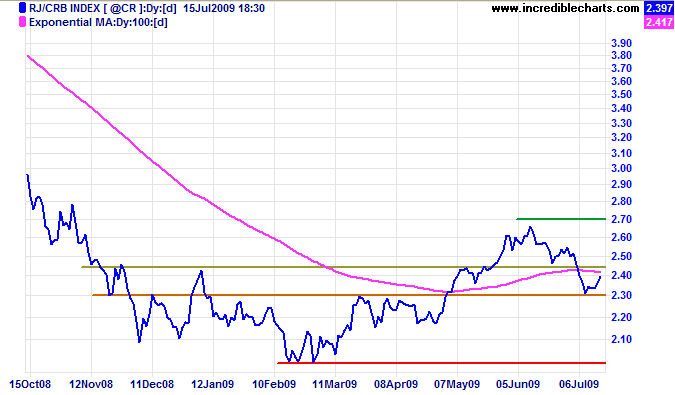

Commodities

CRB Commodities Index respected support at 230. Recovery above 245 would indicate another primary advance with a target of 310. Confirmed if resistance at 270 is penetrated.

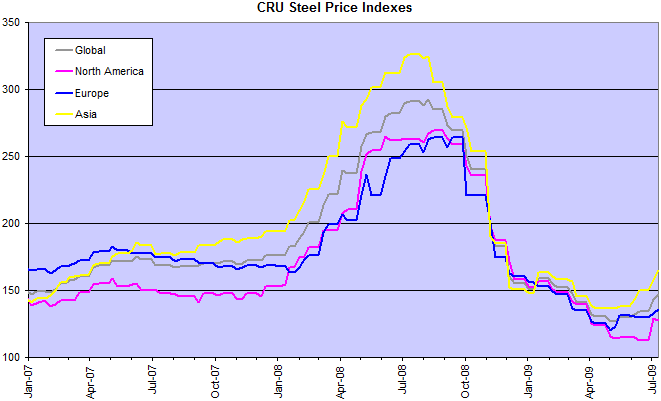

Global Steel Prices

The upturn on global CRU Steel Price Indexes signals recovery in demand for steel — indicating an upturn in manufacturing/construction activity.

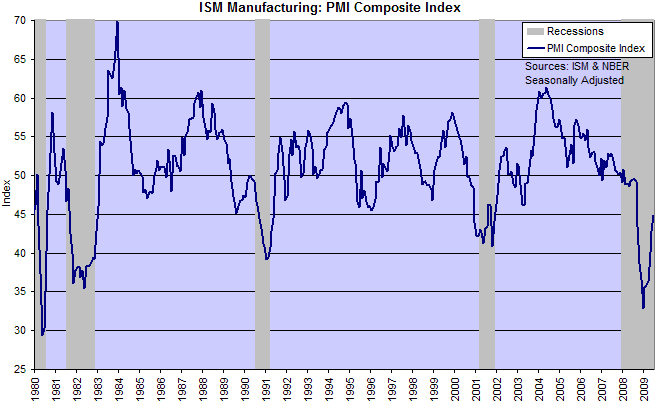

PMI Manufacturing Index

Less optimistic is the the PMI Manufacturing Index. While improving, it remains below 50, signaling contraction.

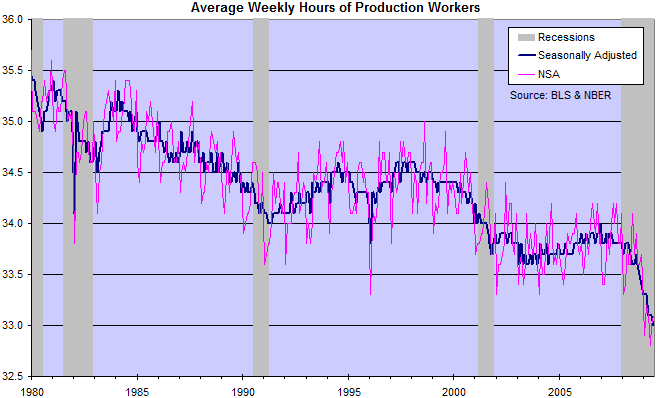

Labor Activity

Average hours of production workers fell to a record low of 33 hours/week, warning of spare capacity and continued high unemployment. The one positive is that inflation is likely to remain muted over the next 6 to 12 months.

Conclusion

Remember that we live in difficult times. Markets are exceptionally volatile and our economic woes are far from over. The contraction may be easing, but this is not a blue sky recovery. We are a long way from a bull market.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Nothing is more difficult, and therefore more precious, than to be able to decide.

~ Napoleon Bonaparte (1769 - 1821)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.