Dollar Threatens Plunge

By Colin Twiggs

July 1, 2009 11:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

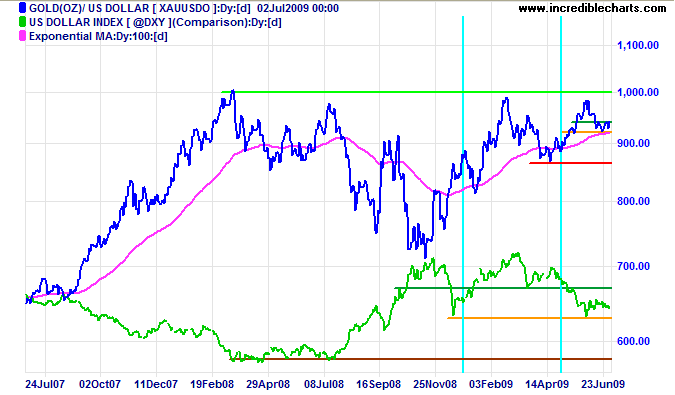

US Dollar Index

Since the start of 2009, the relationship between gold and the US Dollar Index deviated from its normal course. When the dollar weakens, the dollar price of gold normally rises, and vice versa. Gold being more volatile than the greenback, however, rises proportionately higher than the dollar weakens — and falls proportionately lower. The relationship went awry in early 2009, with the first vertical line on the chart below marking the point at which the dollar started to strengthen while gold and silver were rallying. The deviation continued until the end of April, when the normal relationship resumed.

The US Dollar Index is headed for a test of support at 78.50 [orange] while gold rises to test $1000/ounce. Breakout below support at 78.50, without a test of medium-term resistance at 83, would warn of a sharp fall in the dollar as the normal relationship reasserts itself. The target of 73 is calculated as 78 - ( 83 - 78 ).

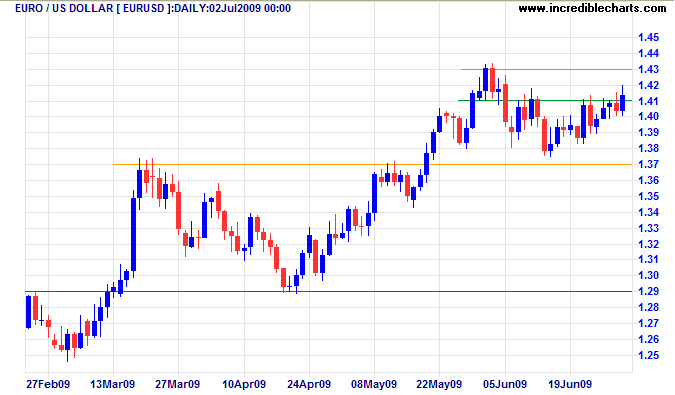

Euro

The euro closed above $1.41, indicating a primary advance with a target of $1.49/$1.50 — calculated as 1.43 + ( 1.43 - 1.37 ). Breakout above $1.43 would confirm the signal.

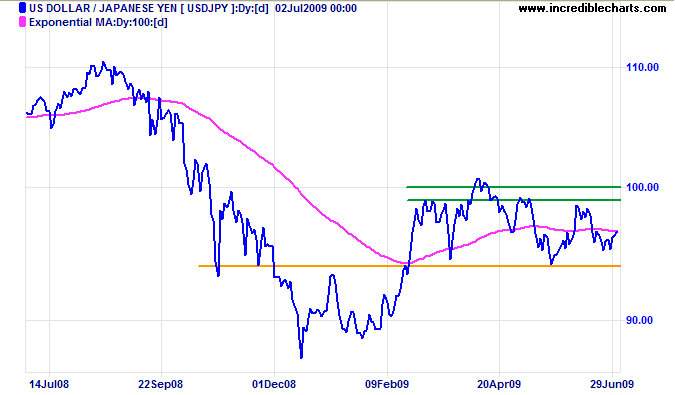

Japanese Yen

The dollar is in a primary up-trend against the yen, but undergoing a lengthy consolidation between ¥94 and ¥99. Breakout will signal future direction. Upward breakout would offer a target of ¥106, while downward breakout would test the December low of ¥87. Judging by the gold/dollar ratio, downward breakout is more likely unless there is further intervention by the two central banks.

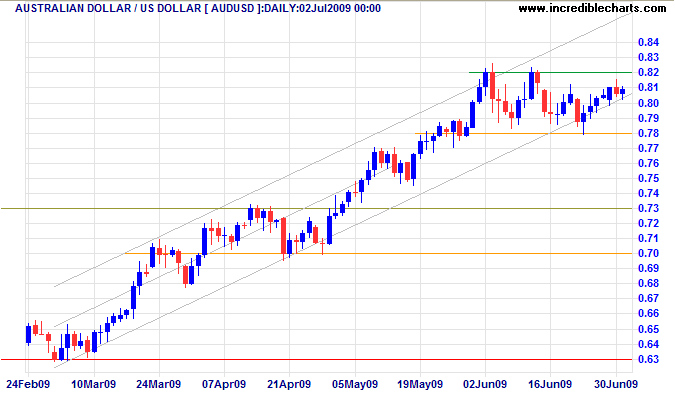

Australian Dollar

The Aussie dollar continues its primary up-trend against the greenback, currently consolidating between $0.78 and $0.82. Upward breakout is likely and would offer a target of the September high at $0.85, while downward breakout would warn of a correction to test support at the January high of $0.73.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

The mystery of government is not how Washington works

but how to make it stop.

~ P. J. O'Rourke

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.