Fedex Reinforces Dow Warning

By Colin Twiggs

June 22, 7:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

USA

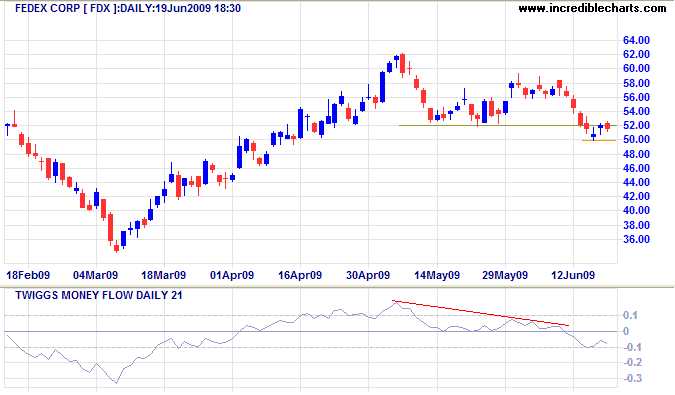

Fedex

Bellwether transport stock Fedex broke support at $52, signaling the end of the bear market rally and warning of a test of primary support at $34.

Follow-through below $50 would confirm.

The breakout also reinforces warning signals (below) on the Dow and S&P 500.

Fund managers will continue to support stock prices until the quarter end,

in order to present their balance sheets in the best possible light.

But diminished support thereafter is likely to result in a significant fall across most major markets

— testing earlier lows from March 2009.

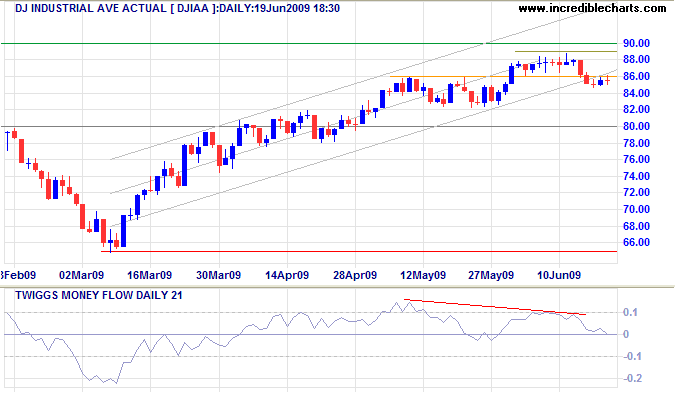

Dow Jones Industrial Average

The Dow broke downwards from a narrow consolidation between 8600 and 8900, reinforcing the warning on Twiggs Money Flow — where a bearish divergence on the 21-Day indicator indicates selling pressure. Follow-through below 8400 would strengthen the signal. In the longer term, expect a secondary correction to test primary support at 6500.

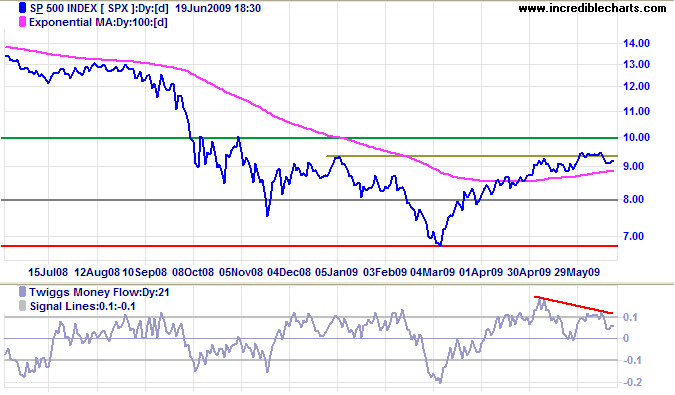

S&P 500

The S&P 500 bearish divergence on Twiggs Money Flow (21-Day) would be strengthened if the indicator retreats to zero. Breakout above 950 is unlikely, while reversal below 900 would test primary support at 670.

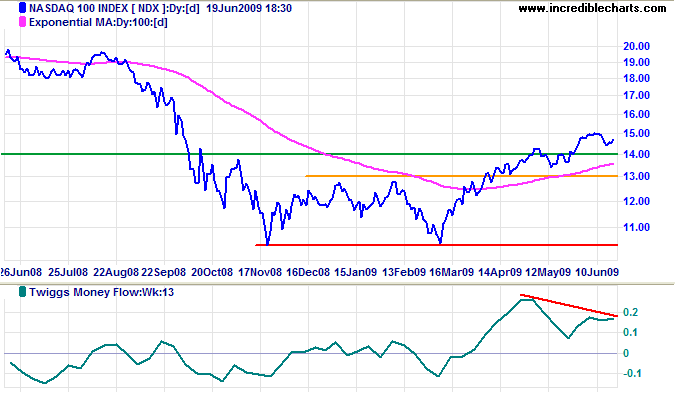

Technology

The Nasdaq 100 is stronger than the Dow and S&P 500 — though it does show a weak bearish divergence on Twiggs Money Flow (13-Week). Reversal of the indicator below zero (or the index below 1340) would warn of a secondary correction.

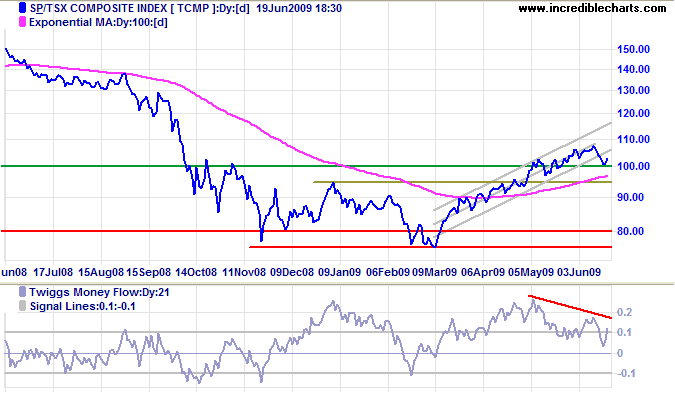

Canada: TSX

The TSX Composite found support at 10000, but breakout below the trend channel and bearish divergence on Twiggs Money Flow (21-Day) warn of a secondary correction.

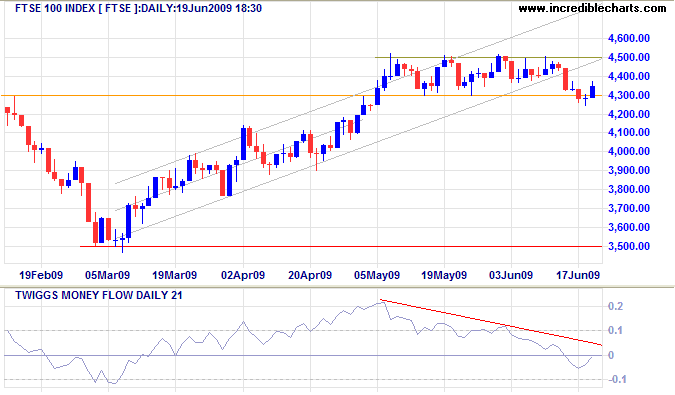

United Kingdom: FTSE

The FTSE 100 made a false break below the consolidation between 4300 and 4500, retreating above 4300 shortly afterwards. But bearish divergence on Twiggs Money Flow (21-Day) continues to signal selling pressure. Reversal below 4300 would warn of a down-swing to test primary support at 3500. Breakout above 4500 is unlikely, but would test primary resistance at 4650.

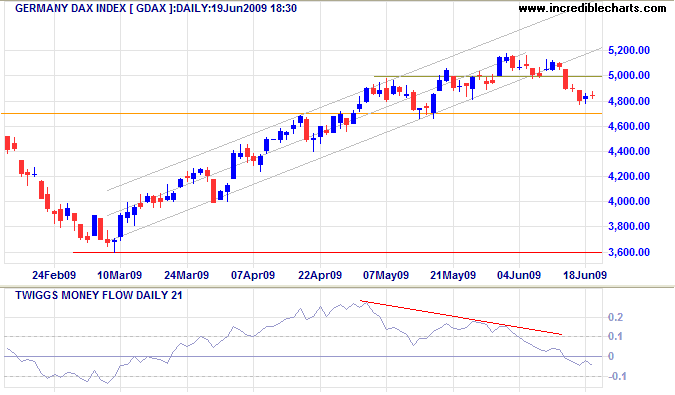

Europe: DAX

The DAX shows a similar bearish divergence on Twiggs Money Flow (21-Day) and breakout below its trend channel — warning of a down-swing to test primary support at 3600.

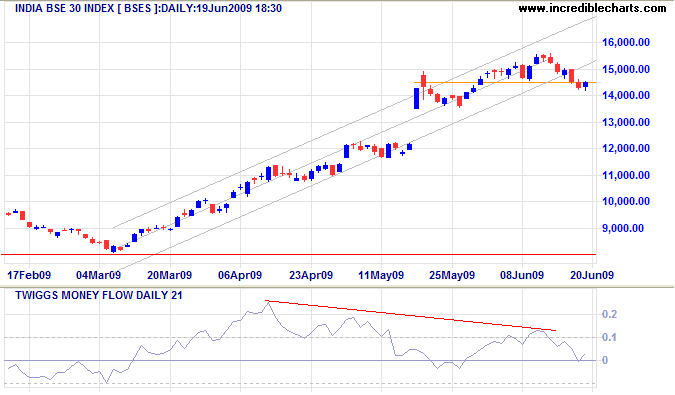

India: Sensex

The Sensex displays a bearish divergence on Twiggs Money Flow (21-Day), warning of selling pressure. Breakout below the trend channel (and 14500) warns of a secondary correction to test support at 12000. This would be confirmed by follow-through below 14000.

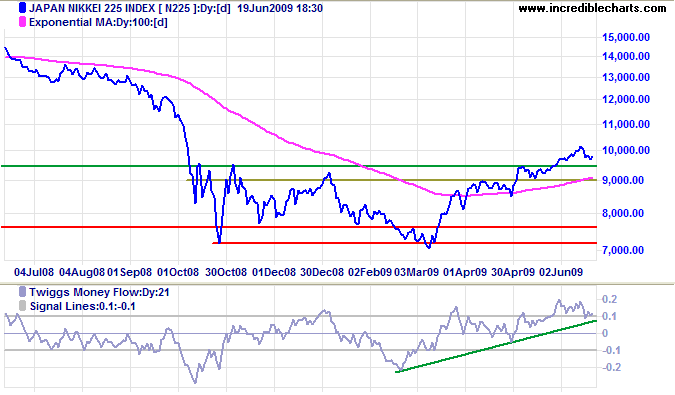

Japan: Nikkei

The Nikkei 225 continues its primary advance towards 12000, unaffected so far by bearish sentiment in other markets. Rising Twiggs Money Flow (21-Day) signals buying pressure. Reversal below 9000 is unlikely, but would warn of a correction.

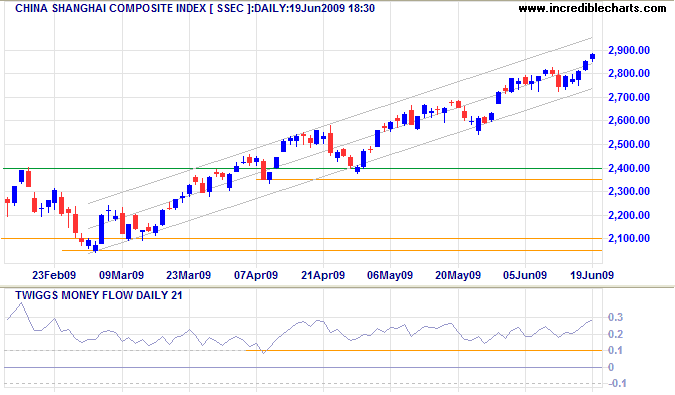

China

The Shanghai Composite Index continues in a strong primary up-trend. Breakout below the trend channel, or Twiggs Money Flow (21-Day) reversal below 0.1, would warn of a (secondary) correction.

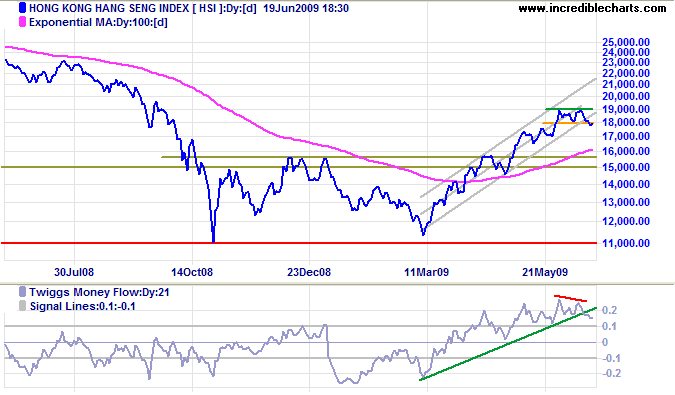

The Hang Seng Index retreated below short-term support at 18000, breaking out from its trend channel and warning of a secondary correction. Twiggs Money Flow (21-day) reversal below 0.1 would confirm the signal.

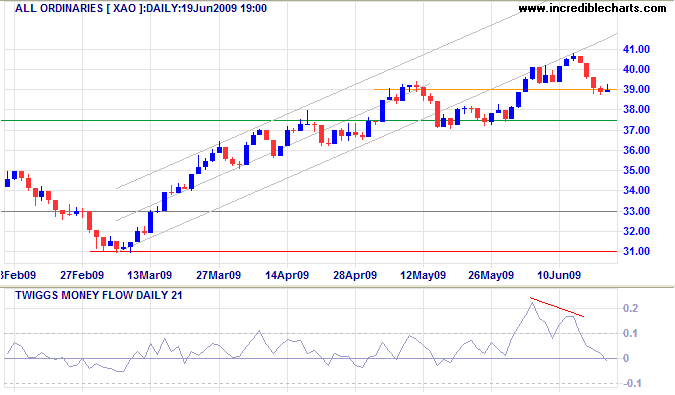

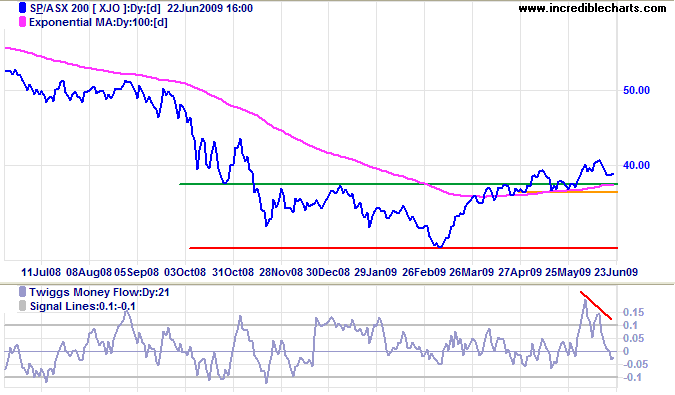

Australia: ASX

The All Ordinaries is testing support at 3900, with bearish divergence on Twiggs Money Flow (21-Day) warning of selling pressure. Having already broken out below the rising trend channel, follow-through below 3900 would signal a correction to test primary support at 3100.

Resistance at 4000 presents an obsacle for both the ASX 200 and All Ords. Bearish divergence on the ASX 200 Twiggs Money Flow (21-Day) warns of selling pressure. And retreat below 3900 would warn of a test of primary support at 3150.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Our real problem, then, is not our strength today; it is rather the vital necessity of action today to ensure our strength tomorrow.

~ Dwight D. Eisenhower

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.