The Trend Is About To Bend

By Colin Twiggs

June 15, 7:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

A rash of bearish divergences on Twiggs Money Flow warns of heightened selling pressure across a number of markets. Fund managers are also dressing up their balance sheets for the quarter end. Expect prices to hold until June 30th. Then all bets are off.

USA

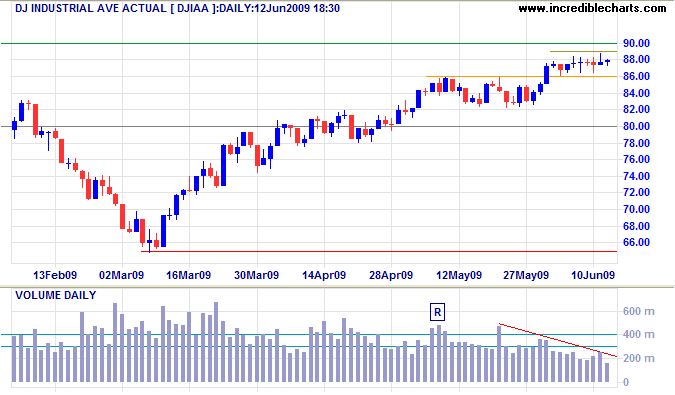

Dow Jones Industrial Average

The Dow is consolidating in a narrow range between 8600 and 8900, with declining volume. This normally signals continuation, but if we examine the pattern closely we find a series of doji candles, with closing price artificially supported at 8800 — rather than oscillating healthily between the upper and lower borders. In the long term, expect strong resistance at 9000 — followed by a secondary correction to test primary support at 6500. Breakout above 9000 is unlikely, but would offer a weak reversal signal — to a primary up-trend.

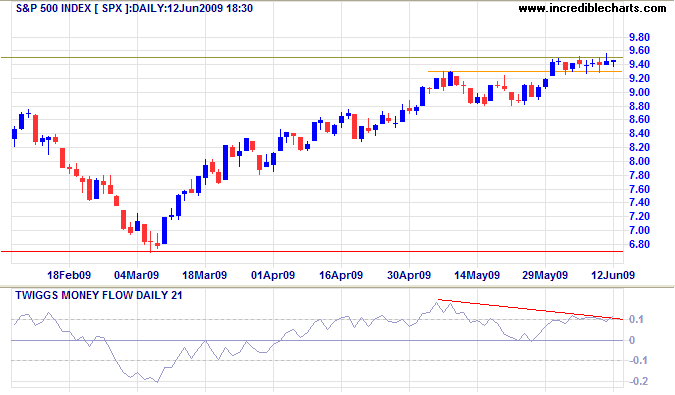

S&P 500

The S&P 500 displays a similar pattern to the Dow, consolidating between 930 and 950. Weak bearish divergence on Twiggs Money Flow (21-Day) would be strengthened if the indicator retreats to zero. Breakout above 950 would indicate a rally to test 1000, while reversal below 930 would signal the end of the bear market rally.

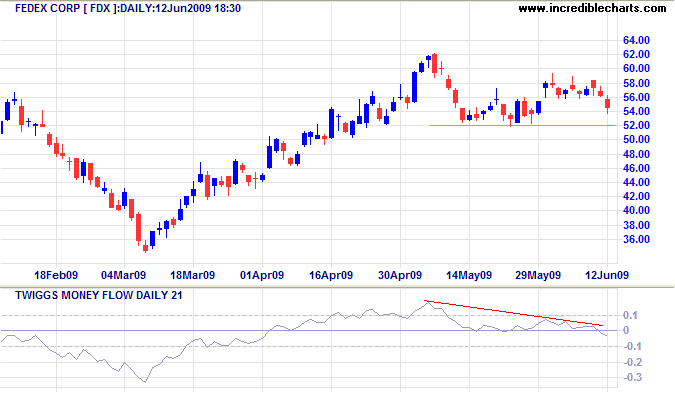

Transport

Bellwether transport stock Fedex is currently testing support at 52.00. Failure would signal a down-swing to primary support at 34.00.

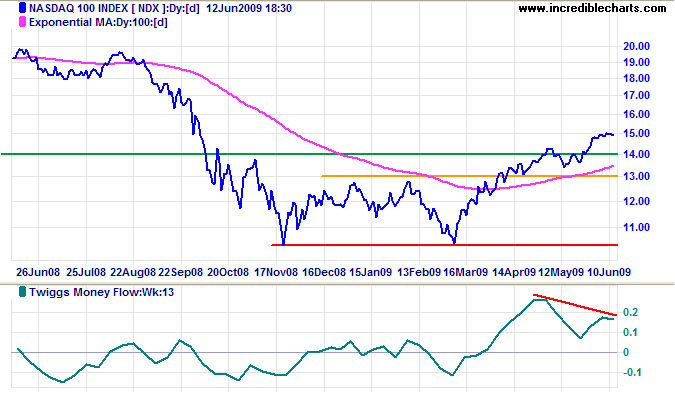

Technology

The Nasdaq 100 primary advance found resistance at 1500. Bearish divergence on Twiggs Money Flow (13-Week) warns of a secondary correction.

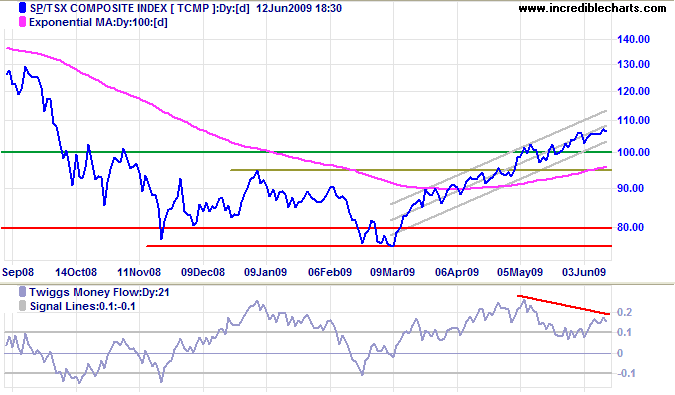

Canada: TSX

The TSX Composite continues its primary advance, but bearish divergence on Twiggs Money Flow (21-Day) warns of selling pressure. Breakout below the rising trend channel would indicate a secondary correction.

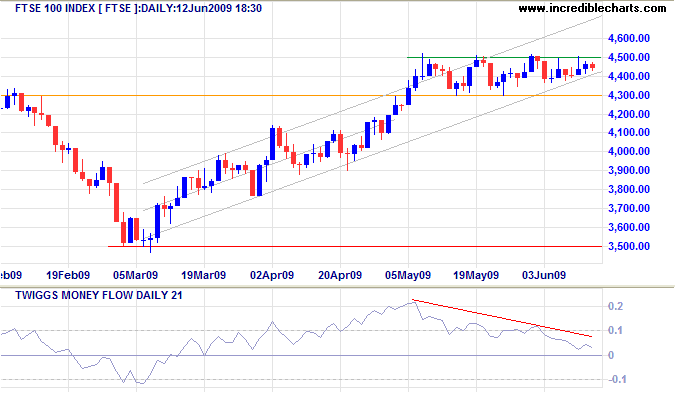

United Kingdom: FTSE

The FTSE 100 continues to consolidate below resistance at 4500. Bearish divergence on Twiggs Money Flow (21-Day) indicates selling pressure. Reversal below 4300 would signal another test of primary support at 3500. Breakout above 4500 would test primary resistance at 4650.

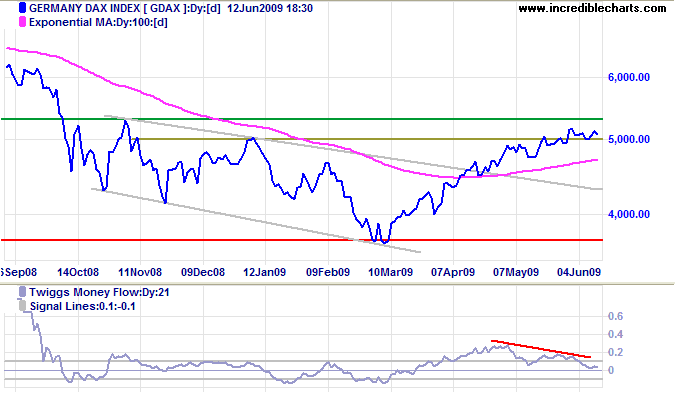

Europe: DAX

The DAX shows similar bearish divergence on Twiggs Money Flow (21-Day) — warning of a bull trap.` Reversal below 5000 would confirm — and test primary support at 3600.

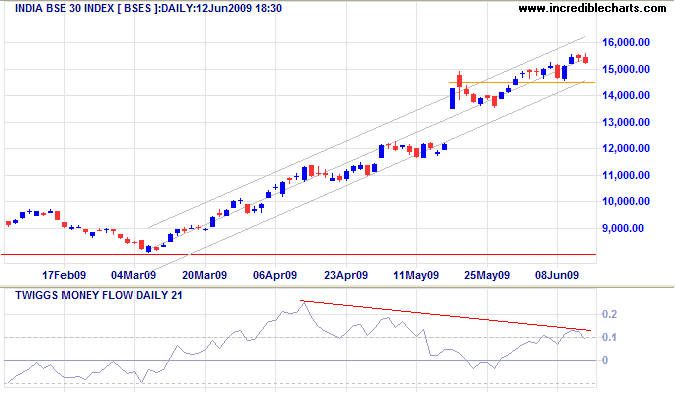

India: Sensex

The Sensex continues its primary advance, but bearish divergence on Twiggs Money Flow (21-Day) warns of selling pressure. Reversal below 14500 would signal a secondary correction — to test support at 12000. While respect of 14500 would confirm the primary trend target of 16500.

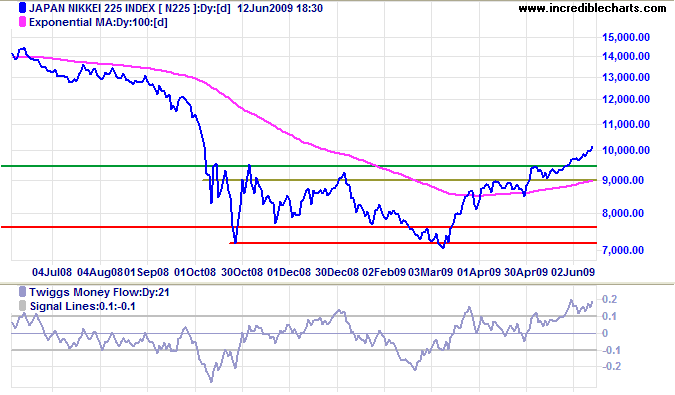

Japan: Nikkei

The Nikkei 225 continues its primary advance towards 12000, apparently unaffected by bearish sentiment in other markets. Rising Twiggs Money Flow (21-Day) signals buying pressure. Reversal below 9000 is unlikely, but would warn of a bull trap.

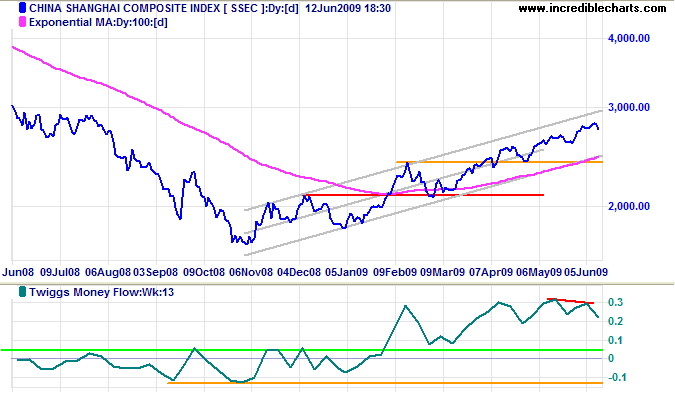

China

Even the Shanghai Composite Index displays a small bearish divergence on Twiggs Money Flow (13-Week), warning of selling pressure. Breakout below the rising trend channel would signal a secondary correction.

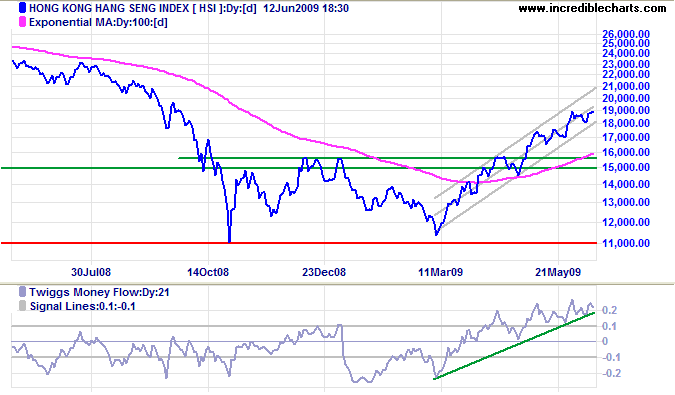

The Hang Seng Index, like the Nikkei, shows little evidence of selling pressure,

with Twiggs Money Flow (21-day) rising strongly.

The target for the primary up-trend is 21000,

calculated as

16000 + [ 16000 - 11000 ].

Reversal below the trend channel, however, would warn of a secondary correction.

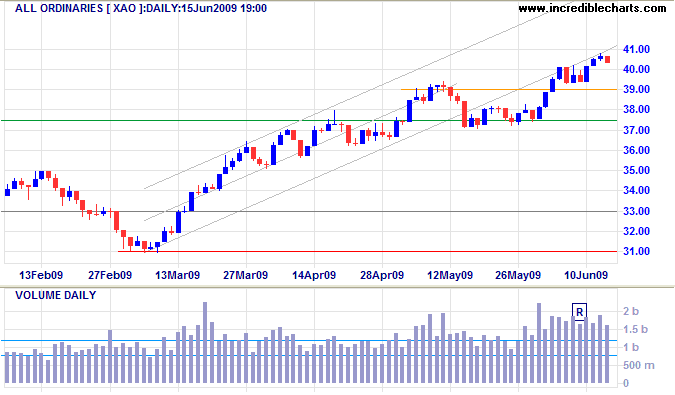

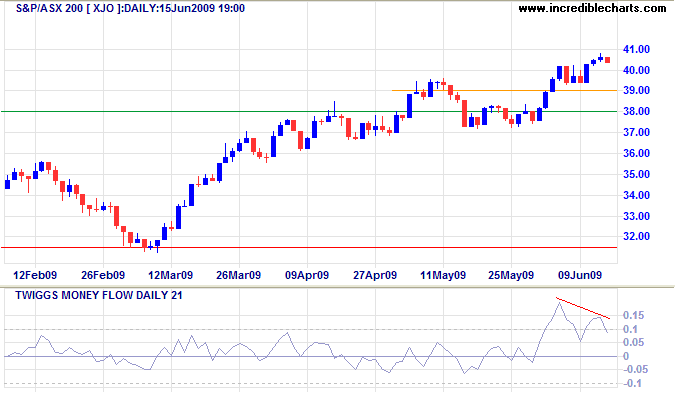

Australia: ASX

The All Ordinaries is under strong selling pressure — indicated by unusually high volumes over the past two weeks. Having already broken out below the rising trend channel, reversal below 3900 would signal the end of the bear market rally — and a test of primary support at 3100.

The ASX 200 encountered similar resistance, with bearish divergence on Twiggs Money Flow (21-Day) warning of selling pressure. Reversal below 3900 would warn of a secondary correction to test primary support at 3150.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Since 1913, when the Federal Reserve came fully into existence,

it has had a record against inflation and notably against recession of deep and unrelieved inconsequence.

~ John Kenneth Galbraith: The Economics of Innocent Fraud

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.