Gold Watershed

By Colin Twiggs

June 2, 2009 2:30 a.m. (4:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Rising bond yields, rising gold and silver prices, rising crude, and a falling US Dollar index warn of inflation ahead. The anomaly is that we presently enjoy falling prices (deflation) caused by the global credit contraction. But steps taken to stabilize the financial system will lead to either massive instability or inflation — with the latter being the inevitable choice. The difficulty is in timing the switch from one strategy to the other. Perfect timing is as difficult to achieve as stepping from one moving train to another traveling in the opposite direction. A simpler approach would be to shift gradually over time, phased in a number of small steps.

For example, one strategy would be to hold treasury bonds in times of deflation, switching to shorter term bills and TIPS as the threat of inflation increases, and then to gold and stocks when inflation is confirmed. You could either try to pick the exact moment to switch your entire position — or phase in to each new position over a number of months.

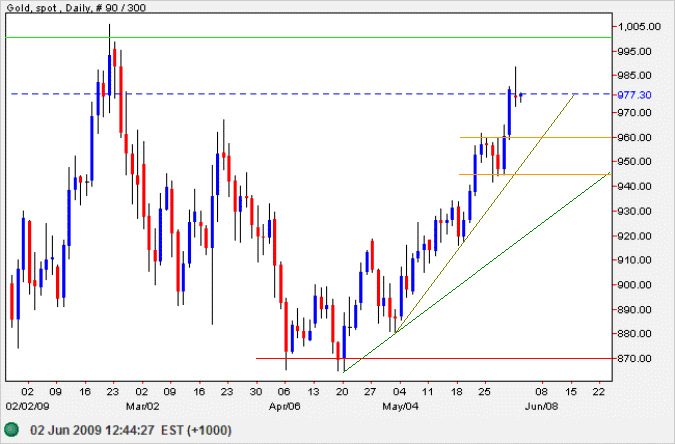

Gold

Spot gold is accelerating towards watershed resistance at $1000. Breakout followed by confirmation of the new support level would signal a primary advance with a target of $1130, calculated as 1000 + ( 1000 - 870 ). Respect of resistance, or a false break that reverses below $1000, however, would warn of another test of primary support at $870.

Source: Netdania

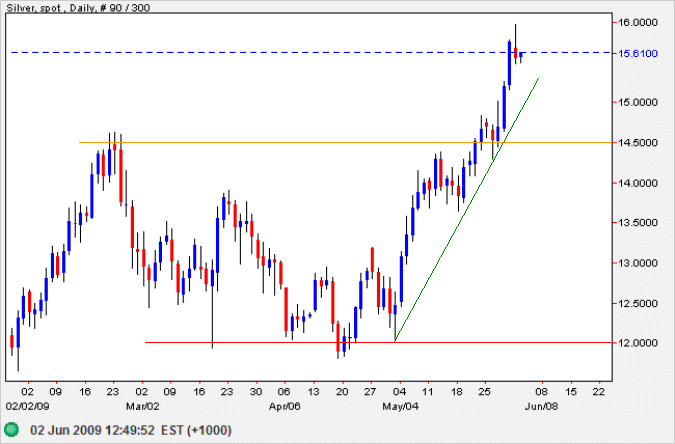

Silver

Spot silver continues in a strong primary up-trend — an encouraging sign for gold. The target of $17.00 is calculated as 14.50 + ( 14.50 - 12.00 ). Reversal below the rising trendline would warn of another test of the new support level at $14.50.

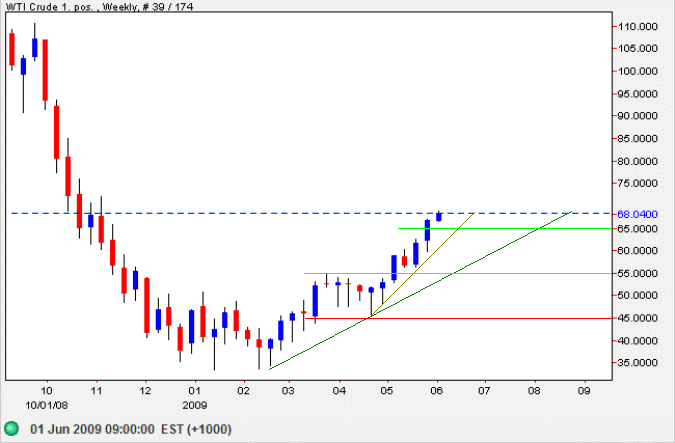

Crude Oil

West Texas Crude continues a strong primary advance, warning of rising inflation. The target of $65 has been exceeded and we can expect a correction to test the longer-term [green] trendline. Reversal below the long-term trendline is unlikely, but would signal trend weakness.

Source: Netdania

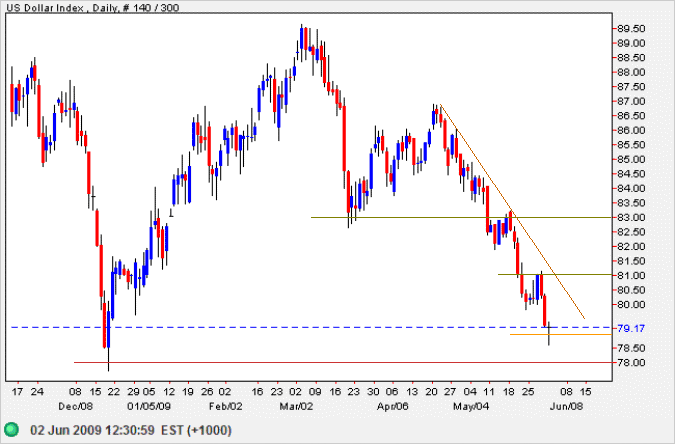

US Dollar Index

The US Dollar Index continues in a strong primary down-trend, also warning of rising inflation. The interim target of 79 has been reached and we can expect a retracement to test the declining trendline. The weakening dollar is a bullish sign for gold.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Liberty has never come from Government. Liberty has always come from the subjects of it.

The history of liberty is a history of limitations of governmental power, not the increase of it.

~ Woodrow Wilson

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.