Chances Of A V-Shaped Bottom

By Colin Twiggs

June 01, 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

A V-shaped market bottom remains unlikely. The best we can hope for is a W-shaped bottom; while a WWW-shaped bottom, similar to the 1970s, remains equally likely. The wild-card is inflation. If the Fed and other central banks monetize government debt by buying treasury bonds they will start a mad scramble for real assets. Whether they be stocks, commodities or real estate — a high risk investment is better than a certain loss.

USA

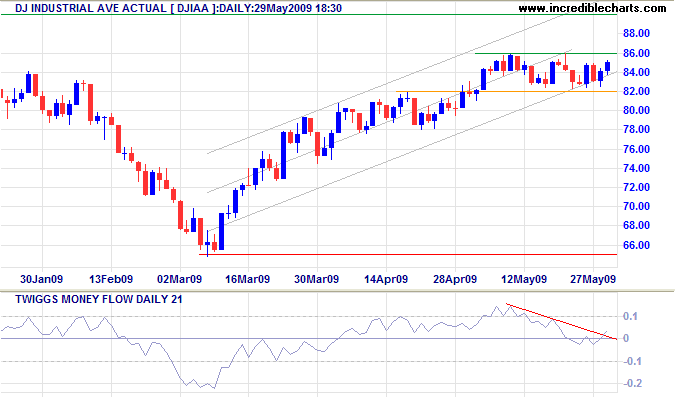

Dow Jones Industrial Average

The Dow continues in a narrow consolidation between 8200 and 8600. Rising Twiggs Money Flow (21-Day) signals buying pressure. Breakout above 8600 is now likely, signaling a test of primary resistance at 9000. Reversal below 8200 is less likely, but would signal the end of the 3 month rally. In the longer term, strong resistance is expected at 9000 — and a secondary correction to test primary support at 6500. Respect of 6500, however, would signal a trend change if followed by penetration of 9000.

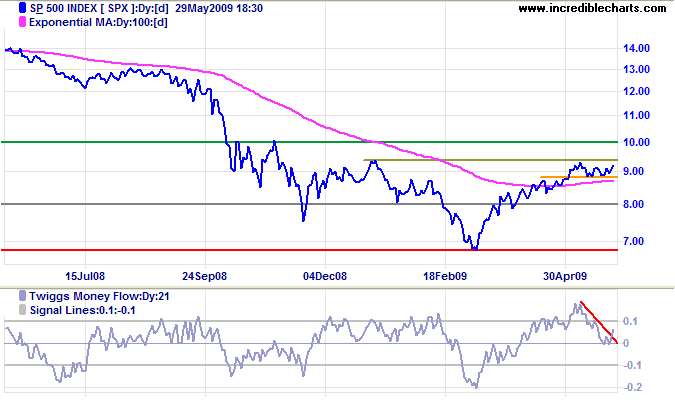

S&P 500

The S&P 500 is consolidating in a narrow range below resistance at 940. Rising Twiggs Money Flow (21-Day) signals buying pressure. Breakout above 940 is now expected and would give a weak (primary) up-trend signal. Readers should beware of a bull trap, however, until we see a secondary correction respect primary support at 675. Reversal below 880 is not expected, but would signal the end of the 3 month rally.

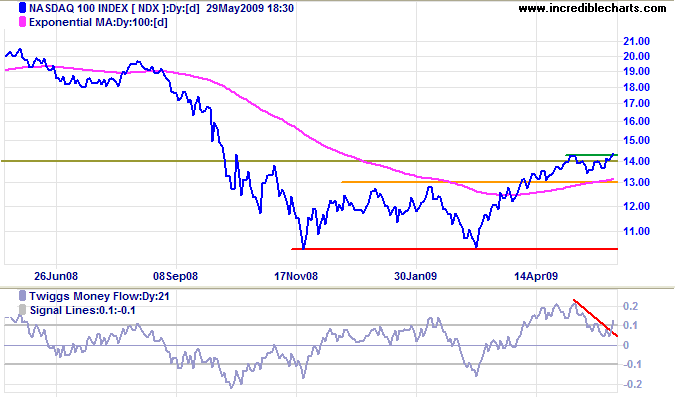

Technology

The Nasdaq 100 respected the new support level at 1300, confirming the primary up-trend. The target of 1550 is calculated as 1300 + [ 1300 - 1050]. Rising Twiggs Money Flow (21-Day) signals buying pressure.

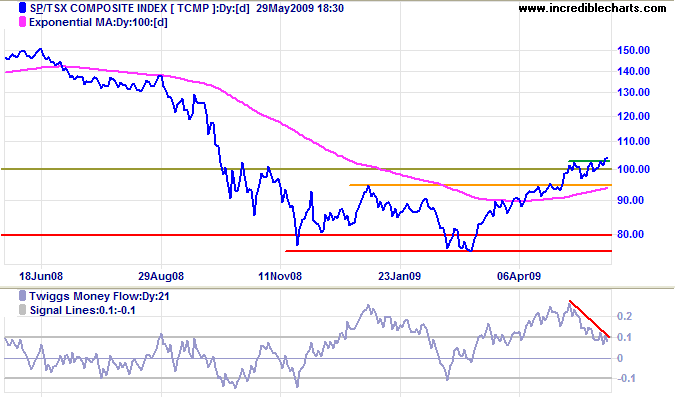

Canada: TSX

The TSX Composite likewise confirmed its primary up-trend, respecting the new support level at 9500. The target of 11500 is calculated as 9500 + [ 9500 - 7500 ]. Twiggs Money Flow (21-Day) is declining, however, and a fall below zero would warn of a secondary correction. Reversal below 9500 is not expected, but would signal another test of primary support at 7500.

Canada and Australia are increasingly viewed as safe havens, given the turmoil in US and UK markets.

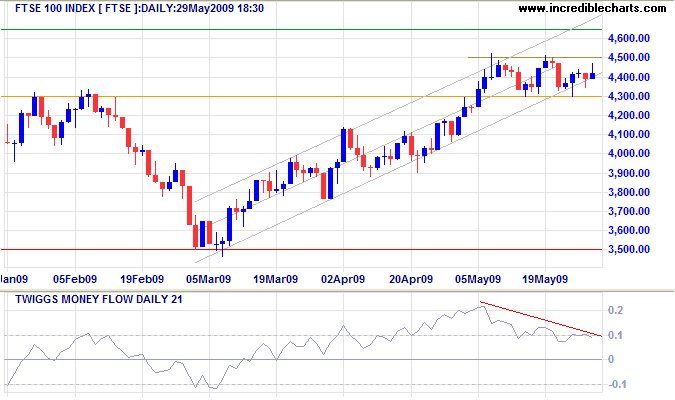

United Kingdom: FTSE

The FTSE 100 continues to consolidate between 4300 and 4500. Declining Twiggs Money Flow (21-Day) indicates selling pressure — and a cross below zero would warn of the end of the recent bear rally. Reversal below 4300 would signal another test of primary support at 3500. Breakout above 4500 is less likely, but would test primary resistance at 4650. In the longer term, a correction that respects primary support would signal a primary up-trend if followed by a new high (above 4650).

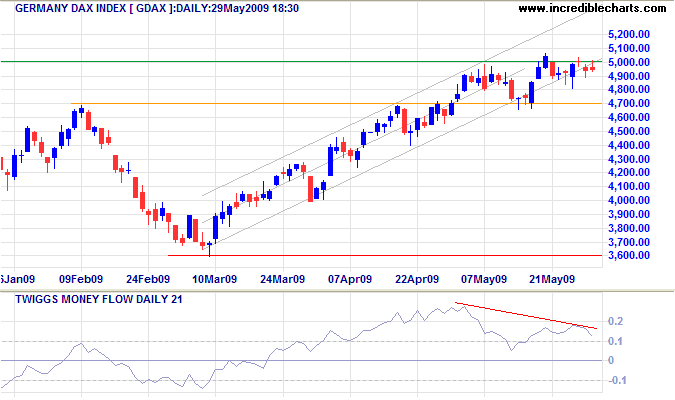

Europe: DAX

The DAX continues to display a bearish divergence on Twiggs Money Flow (21-Day), indicating selling pressure. Reversal (TMF) below zero would warn that the 3 month rally has ended. Breakout below 4700 would signal a test of primary support. Upward breakout, while less likely, would offer a weak (primary) trend reversal. Prudent investors, however, should wait for another secondary correction to respect primary support at 3600.

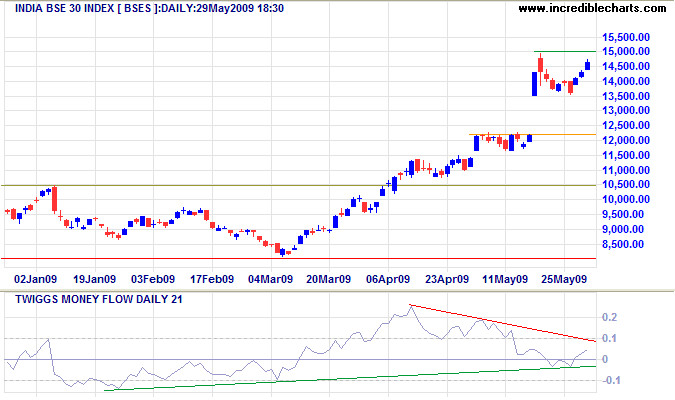

India: Sensex

The Sensex is forming a scallop continuation pattern. Breakout above 15000 would offer a calculated target of 18000, that is 15000 + [ 15000 - 12000 ], but the gap after the elections is unlikely to be repeated. I would lower the target to 16500, calculated using the range 15000 - 13500. Twiggs Money Flow (21-Day) is recovering, and a rise above 0.1 would confirm the primary up-trend. Reversal below 12000 is now most unlikely, but would warn of a test of primary support at 8000.

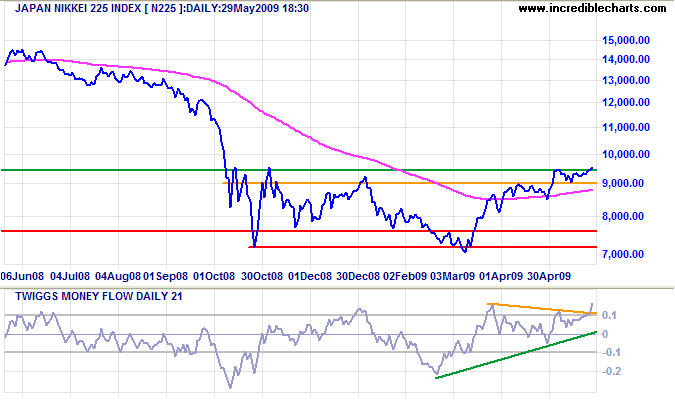

Japan: Nikkei

The Nikkei 225 broke through 9500 [green] to signal a primary up-trend, accompanied by a strong rise on Twiggs Money Flow. Expect retracement to test the new support level of 9000/9500. Respect would confirm the up-trend, with a target of 12000, calculated as 9500 + [ 9500 - 7000 ]. Reversal below 9000 is unlikely, but would warn of a test of primary support at 7000.

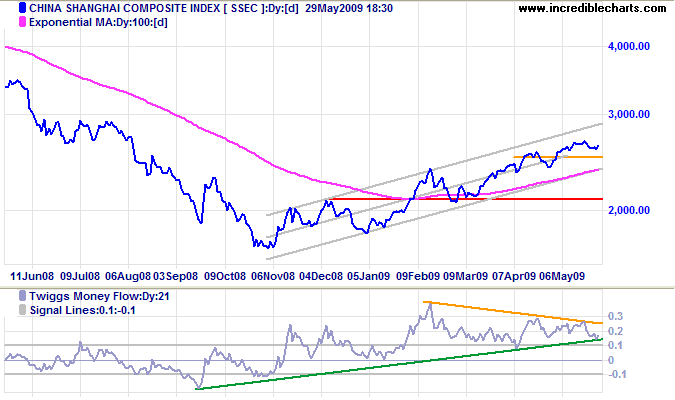

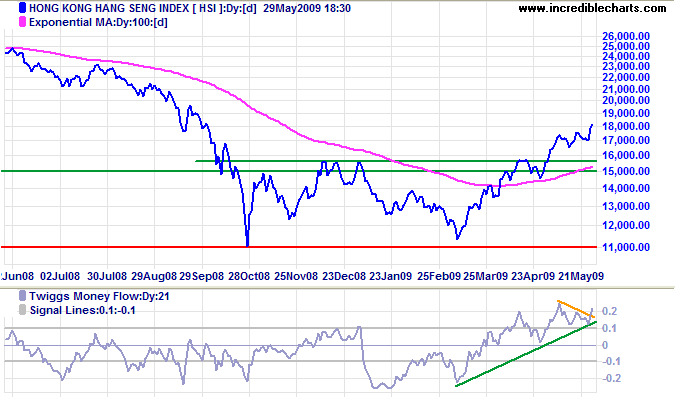

China

The Shanghai Composite continues in a strong primary up-trend. Having reached its medium term target of 2700, it is due for a test of the lower trend channel. Twiggs Money Flow (21-Day) above 0.1 confirms buying pressure.

The Hang Seng Index is going gangbusters, with Twiggs Money Flow (21-day) signaling strong buying pressure. Target for the primary up-trend is 21000, calculated as 16000 + [ 16000 - 11000 ]. Reversal below 15000 is highly unlikely, and would test primary support at 11000.

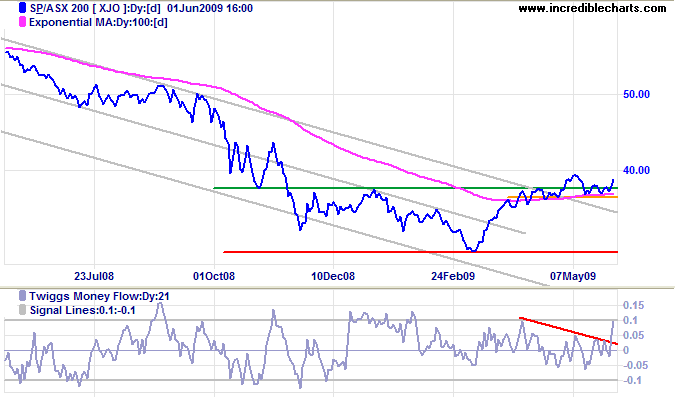

Australia: ASX

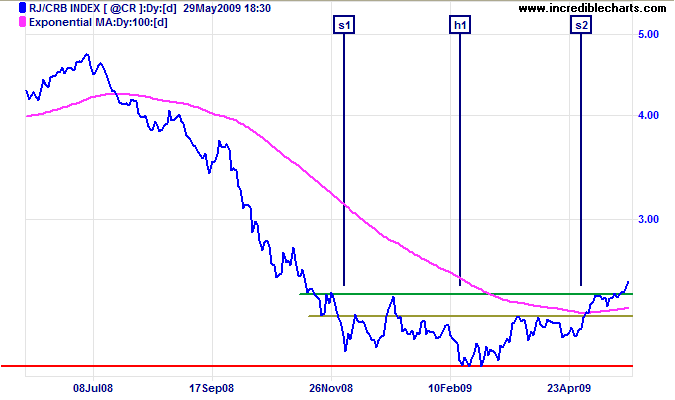

The CRB Commodities Index completed an inverted head and shoulders reversal pattern with a breakout above 245 [green]. The target of 290 is calculated as 245 + [ 245 - 200 ]. The primary up-trend for commodities is a promising signal for resources stocks. Confirmation from economic indicators that demand is sustainable would strengthen the signal. Price action driven merely by stockpiling or speculation, without reinforcement from rising manufacturing demand, could be short-lived.

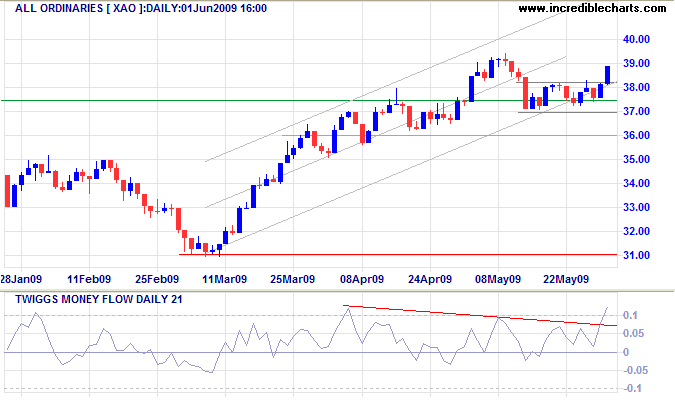

The All Ordinaries overcame strong resistance to break through 3800. Rising Twiggs Money Flow (21-Day) confirms buying pressure. Expect a test of the upper trend channel. Reversal below 3700 is unlikely, but would warn of a bear trap — and test of primary support at 3100.

The ASX 200 shows a similar surge on Twiggs Money Flow (21-Day) and breakout above short-term resistance. Follow-through above 4000 would indicate a long-term target of 5000. Reversal below 3700 is now unlikely, but would warn of a test of primary support at 3150.

I once had a sparrow alight upon my shoulder for a moment,

while I was hoeing in a village garden,

and I felt that I was more distinguished by that circumstance than I should have been by any epaulet I could have worn.

~ Henry David Thoreau (1817 - 1862)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.