Dollar Reaction

By Colin Twiggs

May 28, 2009 3:00 a.m. ET (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

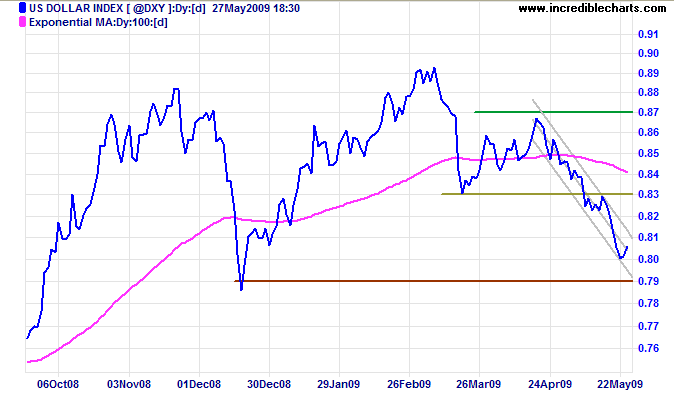

US Dollar Index

The US Dollar Index is in a strong primary down-trend.

The target of 79 is calculated as

83 - [ 87 - 83 ].

The latest retracement will test the upper trend channel.

Reversal above 83 is most unlikely, but would signal a bear trap.

I am testing a new forex data feed for Incredible Charts. If all goes well, this will be added to the menu next week.

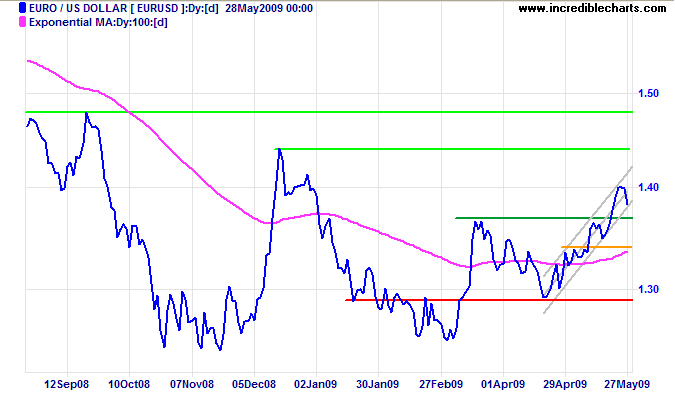

Euro

The euro is retracing to test the new support level at its March high of $1.37 [green] against the greenback. Respect of support would confirm the primary up-trend — with an initial target of the December high of $1.44. A fall below $1.34 [orange] is unlikely, but would signal a bull trap.

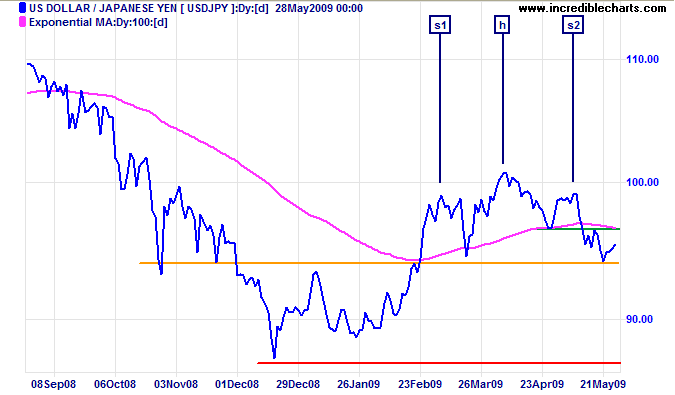

Japanese Yen

The dollar encountered support at ¥94.00 after recently completing a head and shoulders reversal signal. Breakout below ¥94.00 [orange] would confirm the primary down-trend — with a target of the December low of ¥87. Reversal above ¥96.50 [green] is unlikely, but would warn of a bear trap.

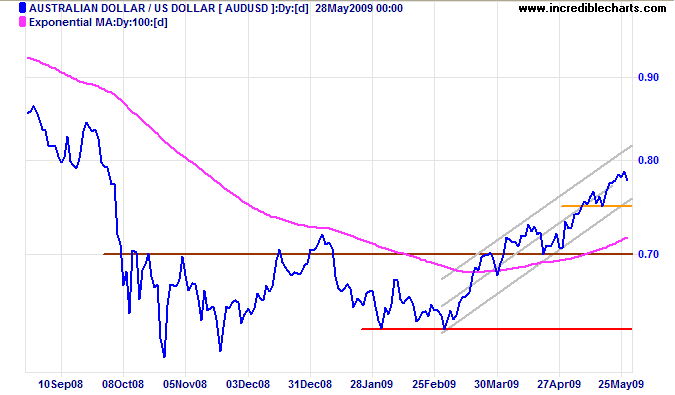

Australian Dollar

The Aussie dollar is retracing to its lower trend channel against the greenback. Respect of support at $0.75 [orange] would confirm the primary up-trend. Failure is unlikely, but would warn of trend weakness — and a test of $0.70. The long-term target is the September high at $0.85.

Throughout history, what the political class has done is they have turned to the central bank to print their way out of an unfunded liability.

We can't let that happen. That's when you open the floodgates.

So I hope and I pray that our political leaders will .... take this bull by the horns at some point. You can't run away from it.

~ Richard Fisher, President of the Federal Reserve Bank of Dallas, talking to the Wall Street Journal

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.