Housing Affordability

By Colin Twiggs

May 27, 2009 4:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

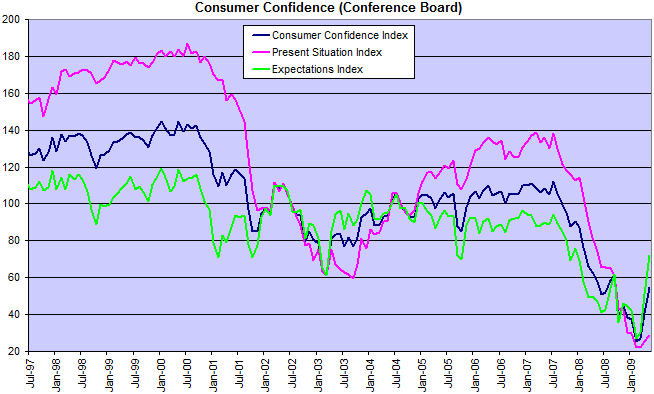

Consumer confidence as measured by the Conference Board has rebounded sharply off its early 2009 lows. This has yet to translate into increased spending. Areas that will be closely watched are housing investment, retail sales, consumer durables and auto sales.

Housing Prices

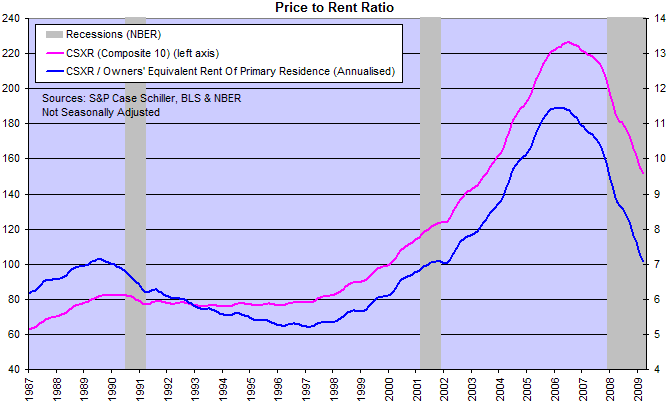

The S&P/Case-Shiller U.S. National Home Price Index (pink below) posted a 19.1% drop from a year earlier. But remember that these figures are for the first quarter — almost 2 months ago. Other indicators suffer from a shorter lag time and may respond quicker.

The (blue) Price-Rent ratio has fallen even further, indicating that house prices are falling faster than rentals. The price-rent ratio works the same way as the price-earnings ratio does with stocks: the lower the ratio, the better the return. Investment returns on residential property are improving, but still some way off those available in the mid-1990s.

Housing Affordability

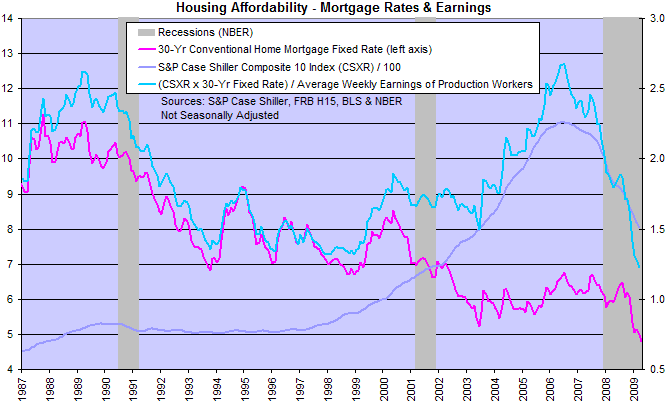

Declining fixed mortgage rates make real estate investment even more attractive. We calculate housing affordability by multiplying the Case-Shiller house price index by the 30-year fixed mortgage rates and comparing that to average weekly earnings of production workers. The result is illuminating. Affordability closely followed mortgage rates through the 1990s when house prices were relatively stable. Then a massive divergence started in 2001 as mortgage rates fell to a 50-year low. House prices escalated at such a pace that affordability shrank despite lower interest rates. A classic bubble. The 2007 crash initiated a sharp readjustment, with affordability improving to levels last seen in the mid-1990s.

Unfortunately we are not in a normal recession. The shift in consumer behavior is more consistent with a depression. Which means that affordability and rental returns will have to fall a lot lower before buyers are enticed back into the market.

Nature magically suits a man to his fortunes, by making them the fruit of his character.

~

Ralph Waldo Emerson

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.