Dow & FTSE Warn Of Selling Pressure

By Colin Twiggs

May 22, 2009 1:30 a.m. ET (3:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

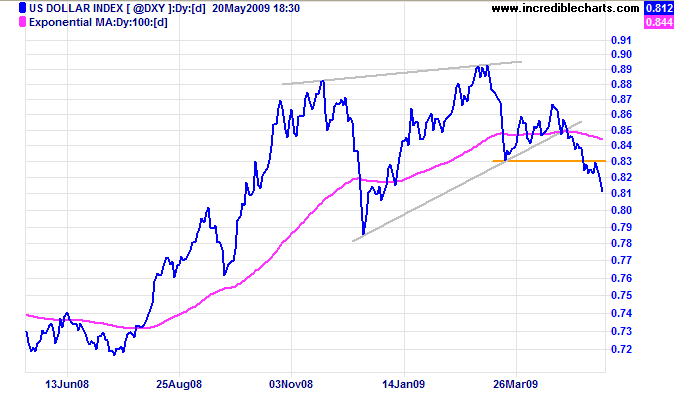

Correction to Thursday's Forex Newsletter

The US Dollar Index pulled back to test the new resistance level. Respect of 83 confirms the primary down-trend and offers a target of the December low of 79, calculated as 83 - [ 87 - 83 ]. Reversal above 83 is most unlikely, but would warn of a bear trap.

Stocks

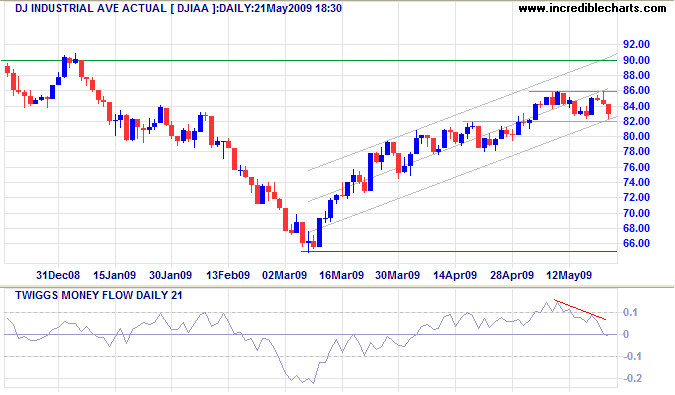

US: Dow Industrials

The Dow is consolidating between 8200 and 8600. Wednesday's large volume and weak close indicate strong resistance at the upper border. Bearish divergence on Twiggs Money Flow (21-Day) signals selling pressure. Breakout below 8200 would end the bear rally of recent months — and warn of a down-swing to test primary support at 6500. Reversal above 8600 is unlikely, and would test primary resistance at 9000.

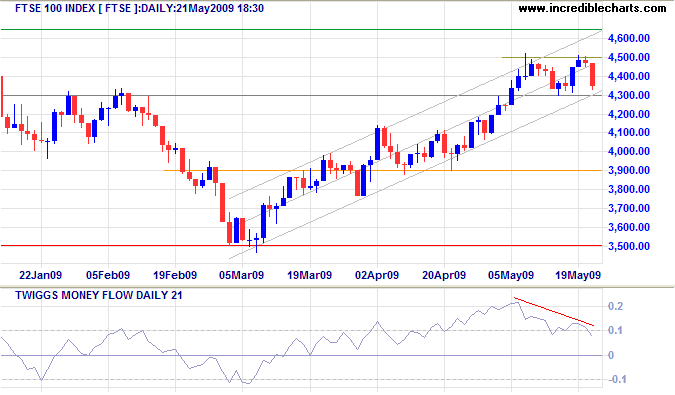

UK: FTSE 100

The FTSE 100 displays a similar bearish divergence on Twiggs Money Flow (21-Day). Reversal below 4300 would signal a primary decline to test support at 3500. Breakout above 4500 is unlikely, but would test primary resistance at 4650.

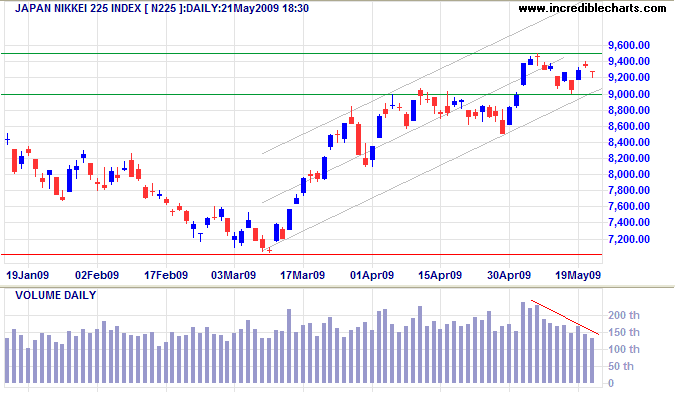

Japan: Nikkei 225

The Nikkei 225 is more positive, consolidating in a narrow range below primary resistance at 9500 on declining volume. Twiggs Money Flow (21-Day) is neutral. Breakout above 9500 would signal the start of a primary up-trend — with a target of 12000, calculated as 9500 + [ 9500 - 7000 ]. Reversal below 9000 is less likely, but would warn of a down-swing to test primary support at 7000.

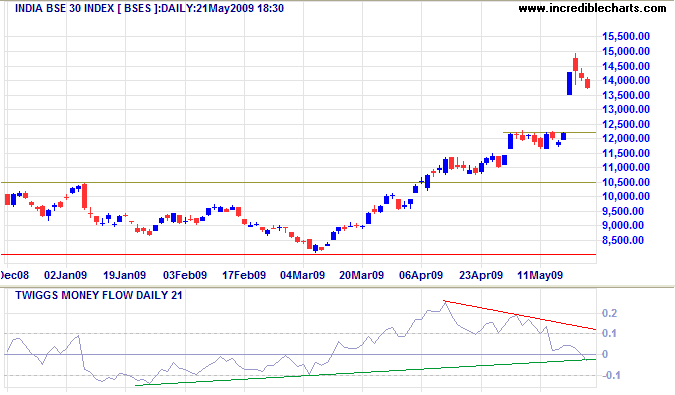

India: Sensex

The Sensex is in a primary up-trend. The upward gap, on the recent election results, should be a positive sign, but strong bearish divergence on Twiggs Money Flow (21-Day) warns of selling pressure. A fall to 12250 would close the gap, completing an island reversal and warning of a test of primary support at 8000. Confirmed if support at 10500 is penetrated.

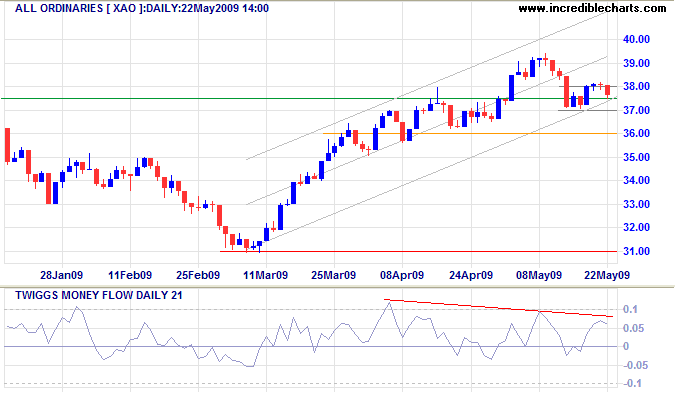

Australia: All Ordinaries

The All Ordinaries is also testing the lower border of its trend channel, following bearish divergence on Twiggs Money Flow (21-Day). Failure of support at 3700 would signal the end of the bear rally of recent months — and test primary support at 3100. Confirmed if 3600 is broken or Twiggs Money Flow (21-Day) crosses to below zero. Reversal above 3800 is unlikely, but would signal continuation of the bear rally.

A broad margin of leisure is as beautiful in a man's life as in a book.

Haste makes waste, no less in life than in housekeeping.

~ Henry David Thoreau

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.