Housing Investment

By Colin Twiggs

May 20, 2009 3:30 a.m. ET (5:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

A sharp rebound in residential investment and consumer spending on durable goods are two essential elements in a sustainable economic recovery. So far, there are signs that the decline is slowing, but no signs of a rebound. This could well be a dead cat bounce.

Sales of the two largest home improvement retailers in the US give a good indication of spending on consumer durables. After promising first-quarter results from Lowe's lifted the market, Home Depot's performance disappointed. Same-store sales fell 10 percent, with revenue down 9.7 percent. No significant deterioration in gross margins was the only encouraging sign. (WSJ)

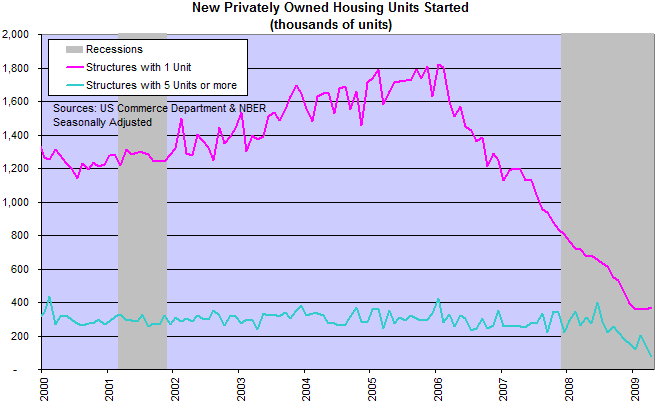

Housing Starts

April single unit housing starts improved slightly, but remain close to their 50-year low — while multi-unit starts continue to fall sharply. Single family units are a far better indicator of activity than more volatile multi-unit structures. But it is too early to tell whether low mortgage rates and first home buyer subsidies have managed to halt the housing decline — or merely slow the rate of descent.

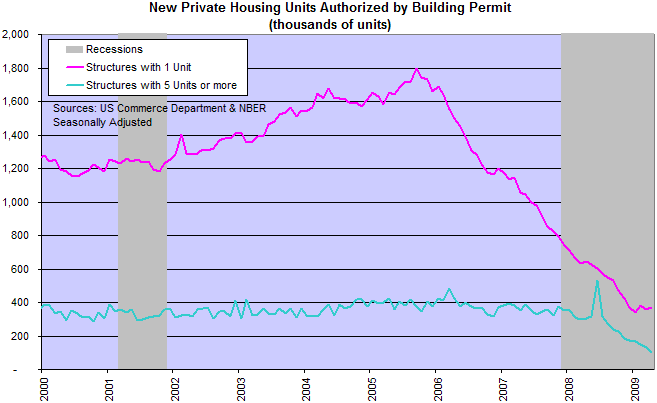

New Building Permits

There is no significant change in new building permits for single family units, while multi-unit permits fell sharply. Housing starts for single family units are therefore likely to remain constant over the next two months, while multi-unit starts shrink further.

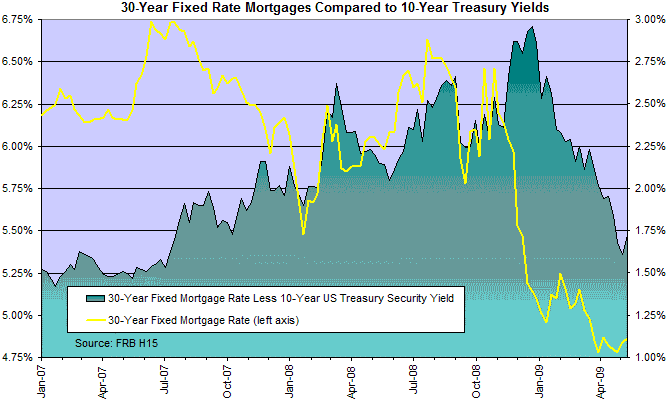

Home Mortgages

Mortgage rates are at their lowest levels since the 1950s, with the Fed driving them down by purchasing $1.25 trillion of mortgage-backed securities. Long-term treasury yields, by contrast, climbed by more than 100 basis points (1 percent) since the start of the year. Distortion of market signals is dangerous: leading both banks and borrowers into poor investment decisions.

To the extent that today's deficit explosion burdens the young with much more debt to be serviced,

then it is our moral obligation to dedicate the extra spending to investments that raise productivity growth and thus the size the future GDP.

Doing so clearly reduces the real burden on future tax payers of servicing the debt being accumulated today.

...Most of Mr. Obama's stimulus spending is devoted to social programmes rather than growth promotion,

which may exacerbate America's over-consumption problem and delay sustainable recovery.

~

Horace 'Woody' Brock, Strategic Economic Decisions

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.