Gold & Silver Rally

By Colin Twiggs

May 19, 2009 2:30 a.m. (4:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

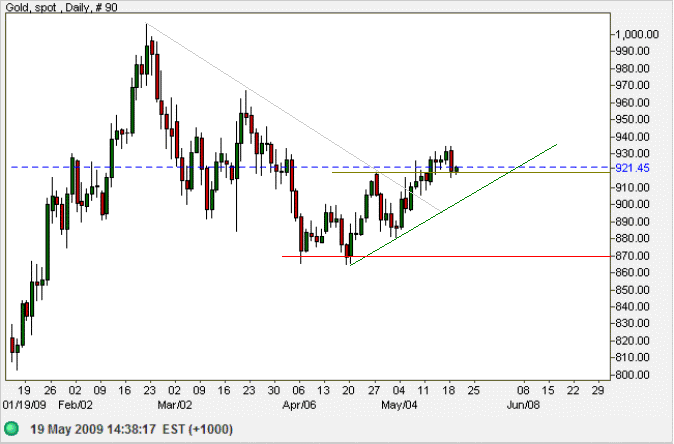

Gold

Spot gold broke through resistance at $920, marking the end of the two month correction, before retracing to test the new support level. Respect of support would confirm an advance to test primary resistance at $1000. Reversal below the rising (green) trendline is unlikely, but would warn of a failed signal and decline to primary support at $700 (confirmed if support at $870/$865 is penetrated).

Source: Netdania

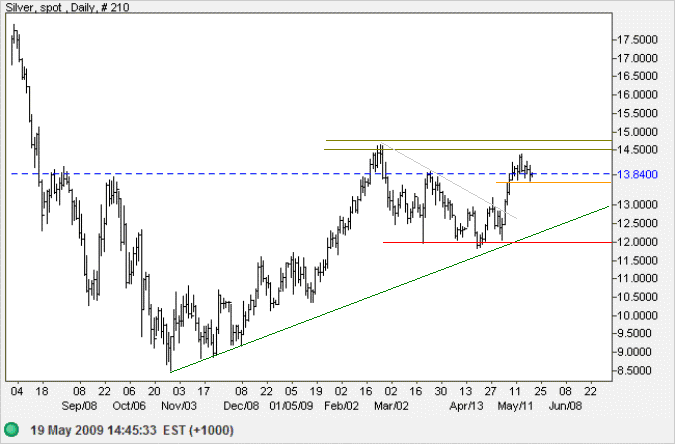

Silver

Spot silver is consolidating between $13.50 and $14.50. Upward breakout would signal a primary up-trend, with a target of $17.00 calculated as 14.50 + [ 14.50 - 12.00 ]. And a bullish sign for gold. Reversal below $13.50, however, would signal another test of primary support at $12.00.

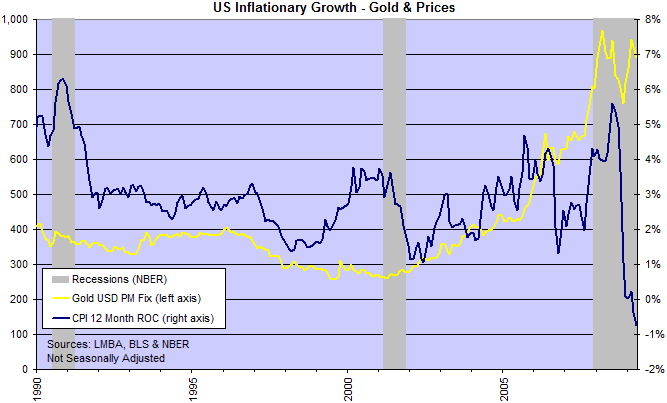

Inflation

Rising gold and silver prices provide a long-term view of inflation. Despite the sharp fall in the consumer price index, inflation is expected to return with a vengeance as the economy recovers. The Fed is likely to err on the side of caution and lift interest rates too late, rather than too early — with a resultant surge in inflation. The rise in precious metals reflects market concern.

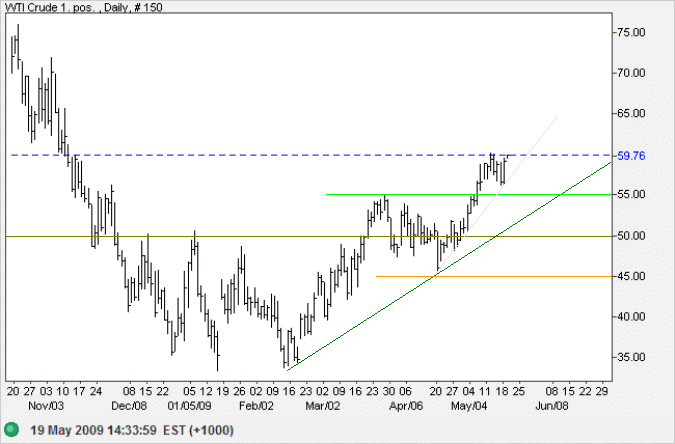

Crude Oil

West Texas Crude continues in a strong primary up-trend, with a short retracement respecting the latest support level at $55. The target for the advance is $65, calculated as 55 + [ 55 - 45 ]. Reversal below the rising (green) trendline is not expected, but would warn that the up-trend is weakening.

Source: Netdania

Rising crude prices also warn of inflationary pressure, with a positive impact on the gold price for two reasons: (1) gold is an inflation hedge; and (2) Middle Eastern producers often invest surplus oil profits in gold.

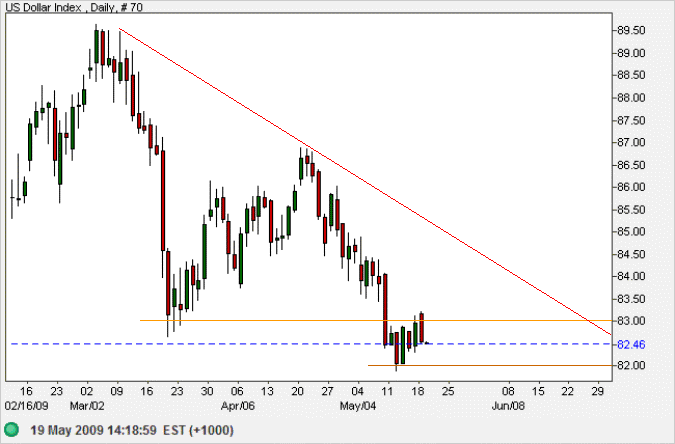

US Dollar Index

The US Dollar Index broke through support at 83/82.50, to signal a primary down-trend,

before retracing to test the new resistance level.

Respect of resistance at 83 would confirm the down-trend, with a target of 79

calculated as 83 - [87 - 83].

Reversal above 83 is unlikely, but would warn of a bear trap — confirmed if the declining (red) trendline is penetrated.

The weakening dollar is another bullish sign for gold.

One of the greatest pieces of economic wisdom is to know what you do not know.

~ John Kenneth Galbraith

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.