The Dow Hesitates

By Colin Twiggs

May 18, 3:30 a.m. ET (5:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

USA

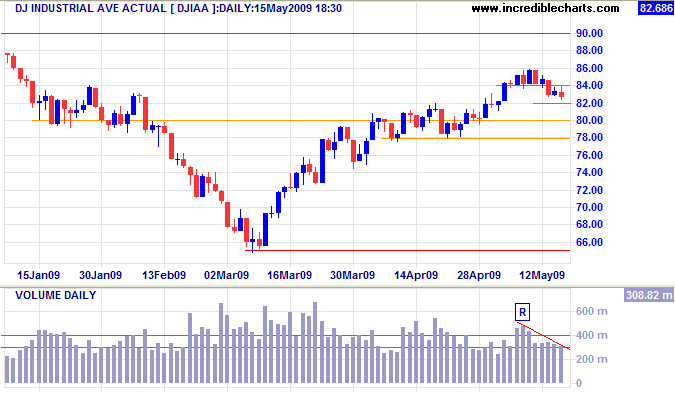

Dow Jones Industrial Average

The Dow encountered resistance at 8600, signaled by large volumes, and is now consolidating in a narrow range between 8200 and 8400. Low volume and a narrow range indicate hesitation on the part of both buyers and sellers. Upward breakout would indicate a test of 9000, but breakout below 8200 is equally likely and would test 7800. In the longer term, strong resistance is expected at 9000. Breakout is unlikely and reversal of the recent up-trend would test primary support at 6500. A correction that stops short of 6500, however, would signal a trend change if followed by breakout above 9000.

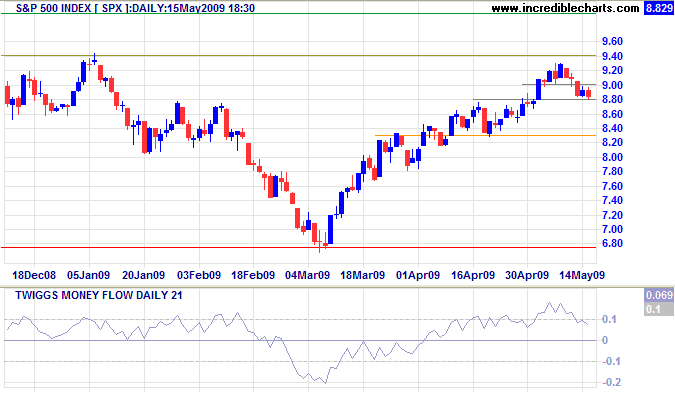

S&P 500

The S&P 500 retreated from strong resistance at 940 and is similarly consolidating in a narrow range on low volume. Reversal above 900 would signal another test of 940, while breakout below 880 would test 830. In the longer term, the bear rally is expected to fail. Twiggs Money Flow (21-Day) reversal below zero would warn of a correction to test primary support at 675. Penetration of resistance at 940, however, would give a weak (primary) up-trend signal. But readers should beware of a bull trap.

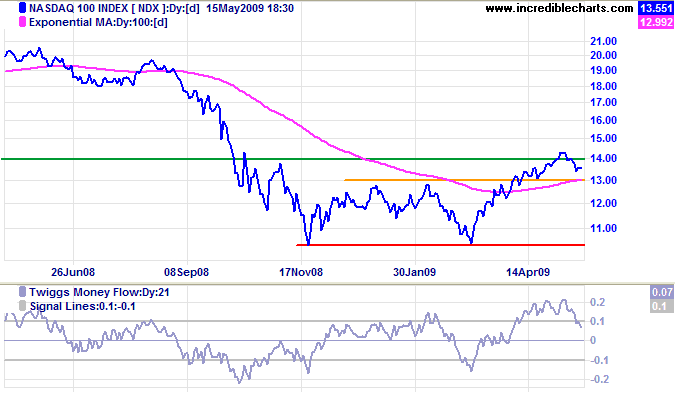

Technology

The Nasdaq 100 is retracing to test the new support level at 1300, after completing a wide double bottom reversal to a primary up-trend. Respect of support is likely to confirm the up-trend, offering a target of 1550, calculated as 1300 + [ 1300 - 1050]. Failure of the new support level, however, would warn of another test of primary support at 1050.

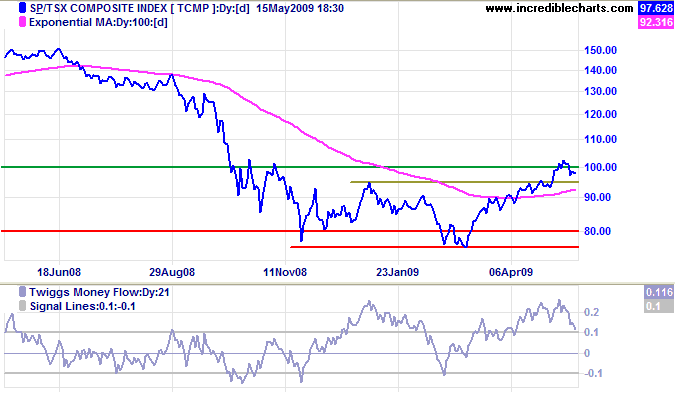

Canada: TSX

The TSX Composite is in a similar position to the Nasdaq: retracing to test support at 9500 after a wide double bottom reversal. Respect of support is expected and would confirm the target of 11500, calculated as 9500 + [ 9500 - 7500 ]. Twiggs Money Flow (21-Day) reversal below zero, however, would warn of a test of primary support at 7500.

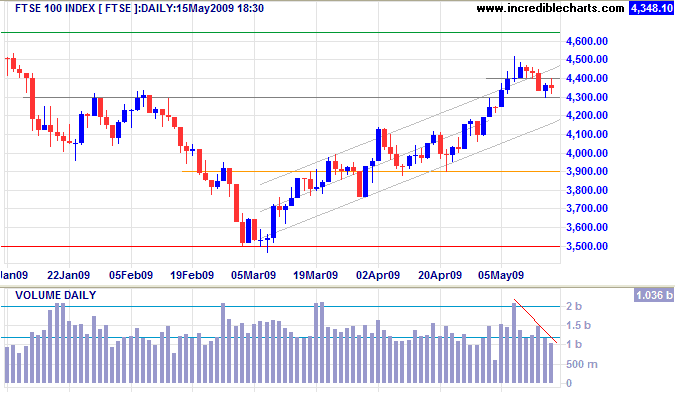

United Kingdom: FTSE

The FTSE 100 shows similar hesitation to the Dow, consolidating between 4300 and 4400 on low volume. Reversal above 4400 would test primary resistance at 4650, while downward breakout would test 3900. In the longer term, the bear rally is not expected to follow through and reversal of the recent up-trend would test primary support at 3500. Breakout above 4650, however, would offer a weak reversal signal (to a primary up-trend), but readers should beware of a bull trap.

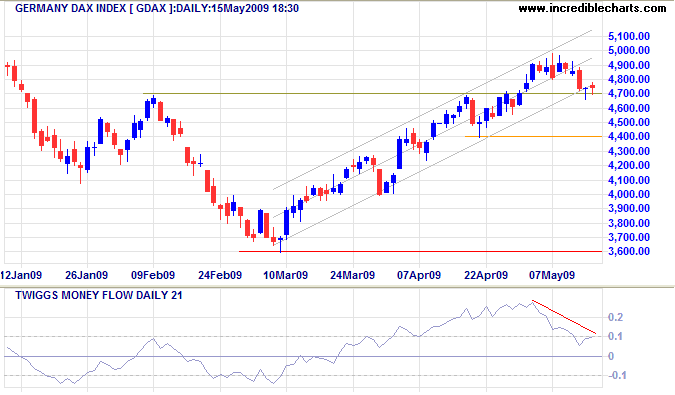

Europe: DAX

The DAX respected resistance at 5000 before testing support at 4700 — not surprising after a 3.8 percent quarter/quarter contraction in GDP. Breakout from the trend channel would warn of a down-swing to test primary support at 3600. Twiggs Money Flow (21-Day) reversal below zero would confirm. Respect of support at 4700 is now unlikely, but would signal continuation of the bear rally.

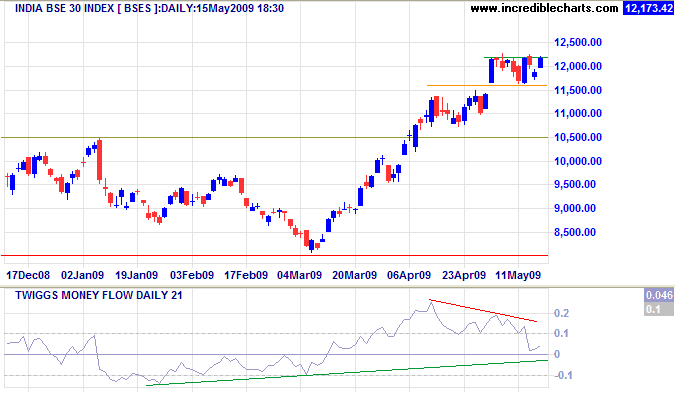

India: Sensex

The Sensex is consolidating in a narrow range between 11600 and 12200, signaling continuation of the primary advance. Bearish divergence on Twiggs Money Flow (21-Day), however, warns of retracement to test the new support level at 10500. Reversal below zero would strengthen the signal. Respect of support is likely to confirm the primary up-trend. Failure, however, would signal trend weakness and a possible test of 8000.

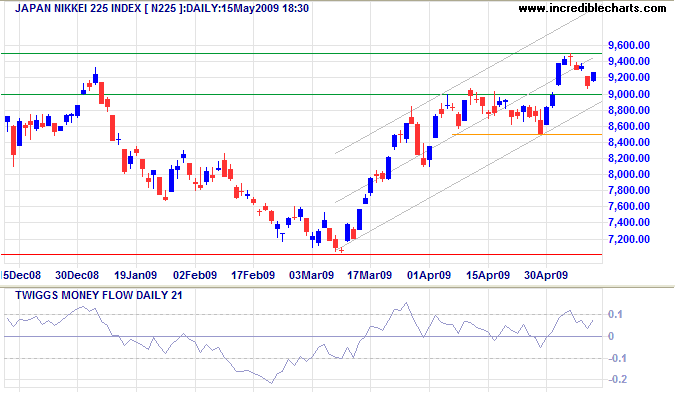

Japan: Nikkei

The Nikkei 225 respected primary resistance at 9500 before retracing to find support at 9000. Twiggs Money Flow (21-Day) holding above zero indicates buying pressure. Breakout above 9500 would signal a primary up-trend, with a target of 12000, calculated as 9500 + [ 9500 - 7000 ]. Reversal below 9000, while less likely, would warn of a down-swing to test primary support at 7000.

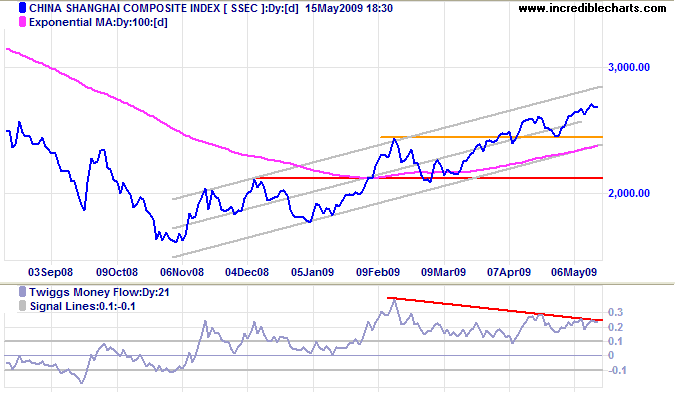

China

The Shanghai Composite continues in a strong primary up-trend. The medium term target is 2700, calculated as 2550 + [ 2550 - 2400]. Bearish divergence on Twiggs Money Flow (21-Day) is not cause for concern unless the indicator reverses below 0.1.

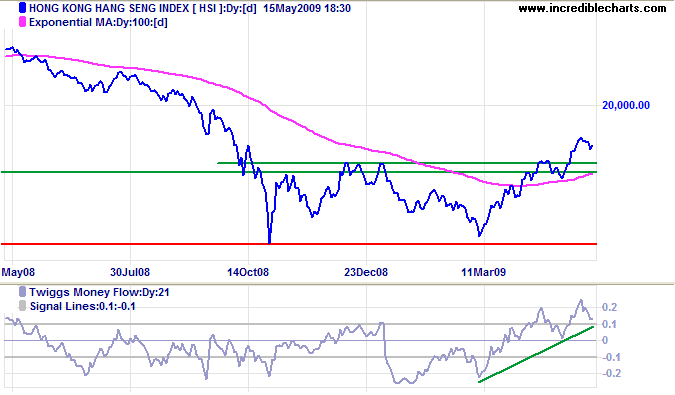

The Hang Seng Index is retracing to test the new support level at 15000 after a wide double bottom reversal. Rising Twiggs Money Flow (21-day) indicates buying pressure. Respect of support would confirm the primary up-trend — with a target of 21000, calculated as 16000 + [ 16000 - 11000 ]. Reversal below 14500 remains unlikely, but would test primary support at 11500.

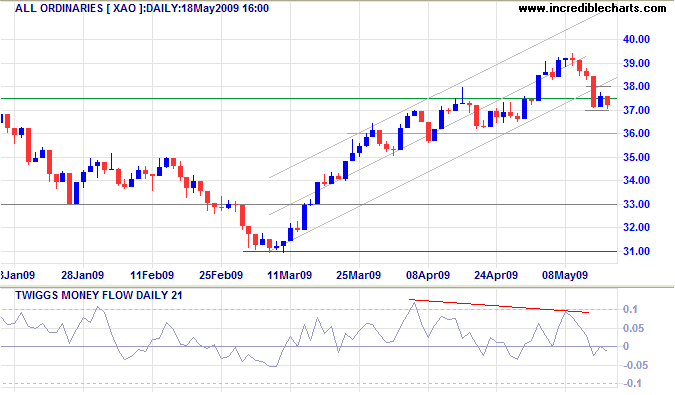

Australia: ASX

The All Ordinaries retraced to test the new support level at 3700/3750 after a weak primary trend signal. Bearish divergence on Twiggs Money Flow (21-Day) indicates weakness. Failure of 3700 would warn of a test of primary support at 3100 — confirmed if 3600 is broken. Reversal above 3800, however, would signal continuation of the bear rally.

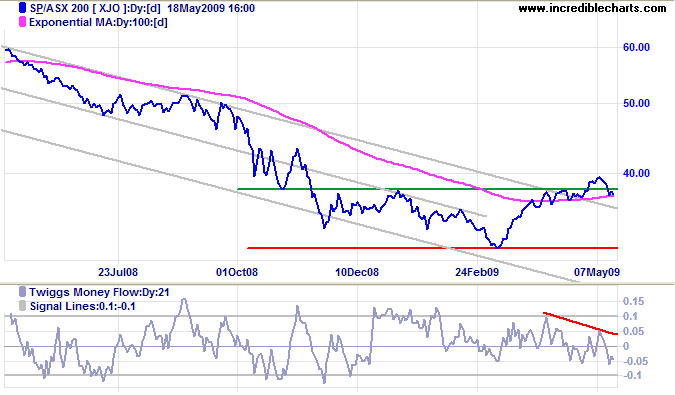

The ASX 200 displays a similar bearish divergence on Twiggs Money Flow (21-Day). Failure of support at 3650 would confirm the down-swing to test primary support at 3150. In the longer term, failure of support at 3150 would offer a target of the 2003 low of 2700 — while respect of support would signal a primary up-trend.

As a youth, Prince Siddhartha enjoyed the indulgent life of pleasure in his father's palace.

Later, when he renounced the worldly life and became an ascetic, he experienced the hardship of torturing his mind and body.

Finally, he realized the fruitlessness of these two extreme ways of life.

He realized that the way to happiness and enlightenment was to lead a life that avoids these extremes. He described this as the Middle Path.

~ Zen Guide: The Fourth Noble Truth

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.