Big Dollar Weakens

By Colin Twiggs

May 14, 2009 1:00 a.m. ET (3:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

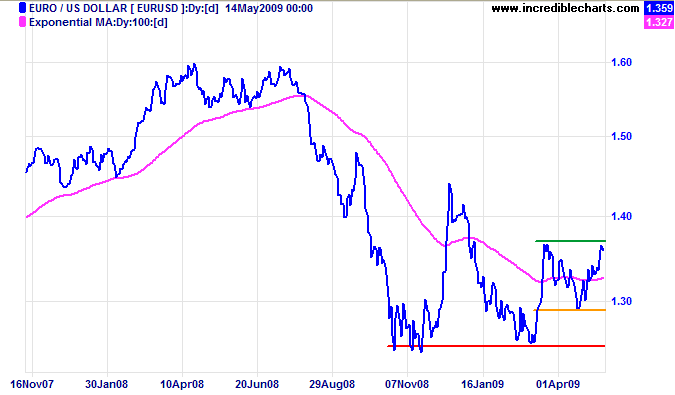

Euro

The euro is testing resistance at $1.37 against the greenback. Breakout would signal a primary up-trend with an initial target of $1.45, calculated as 1.37 + [ 1.37 - 1.29 ]. Reversal below support at $1.29 is unlikely, but would test primary support at $1.25.

I am testing a new forex data feed for Incredible Charts. If all goes well, this will be added to the menu at the end of May.

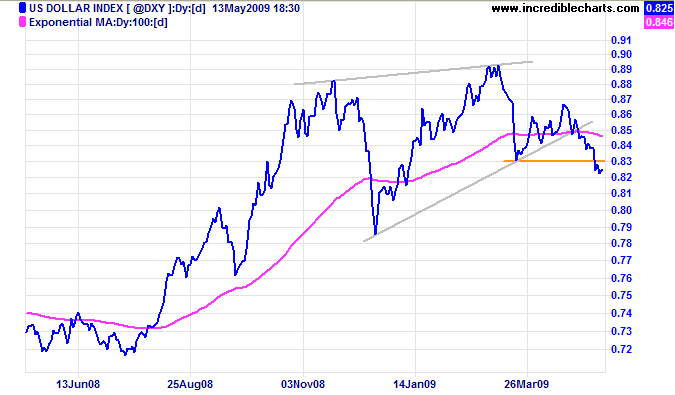

US Dollar Index

The US Dollar Index completed a large rising wedge reversal pattern,

indicating a primary down-swing.

Failure of support at 83 confirms the signal

and offers a target of 75, calculated as

85 - [88 - 78].

Reversal above 83, however, would warn of a false signal

— and another test of 87.

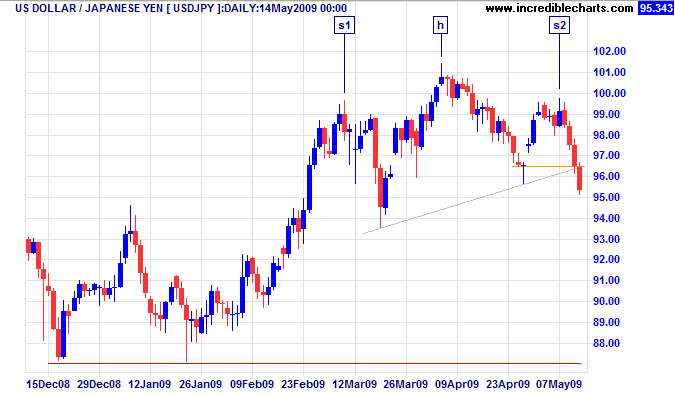

Japanese Yen

The dollar penetrated support at ¥96, completing a head and shoulders reversal. Expect a test of support at ¥87. Retracement that respects the new support level at ¥96.50 would confirm the down-trend. Reversal above ¥96.50, however, would warn of a false signal — and a test of ¥100.

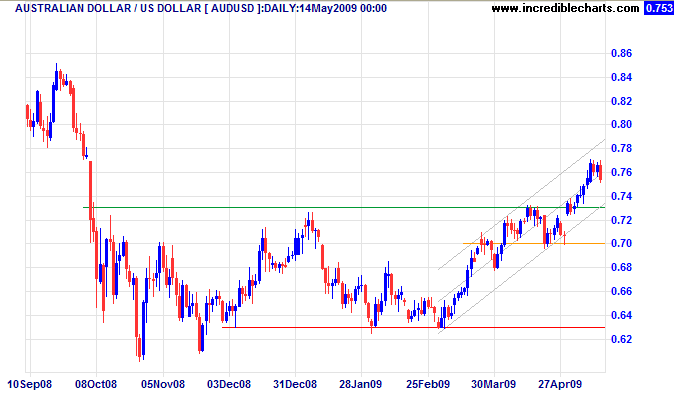

Australian Dollar

The Aussie dollar broke through resistance at $0.7300 against the greenback, signaling a primary up-trend. Expect retracement to confirm the new support level, but the long-term target is the September high at $0.8500. Reversal below $0.7000 is now unlikely, but would test primary support at $0.6300.

Craving or desire is like a great tree having many branches. There are branches of greed, of ill will and of anger.

The fruit of this tree is suffering, but how does the tree of craving arise? Where does it grow?

The answer is that the tree of craving is rooted in ignorance....... the inability to see the truth about things, to see things as they really are.

~ Zen Guide: The Second Noble Truth

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.