Expectations Rise But No Recovery

By Colin Twiggs

April 29, 2009 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

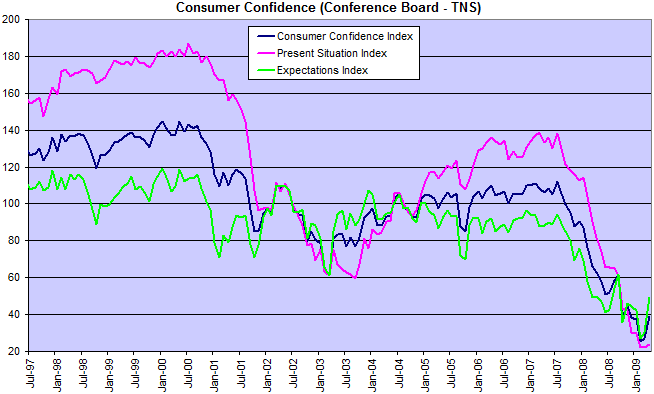

Confidence

Consumer confidence turned up from its 2009 low, but it is too early to call this a trend change.

This has so far not translated into an increase in activity levels......

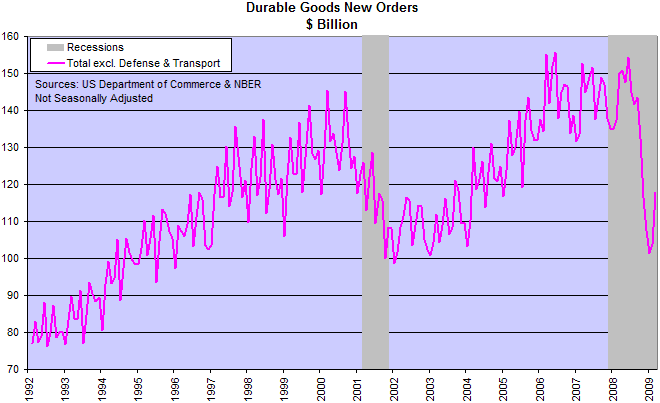

Activity Levels

Durable Goods Orders

The up-turn in durable goods orders is no more than normal seasonal variation, with no sign of a recovery.

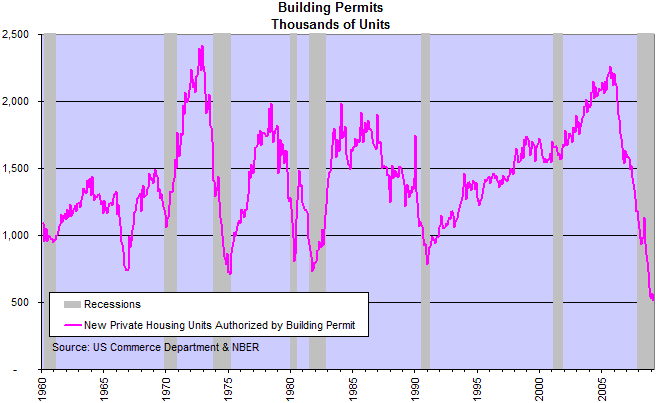

Housing Starts & New Building Permits

The decline in new residential building permits and new housing starts shows no sign of abating.

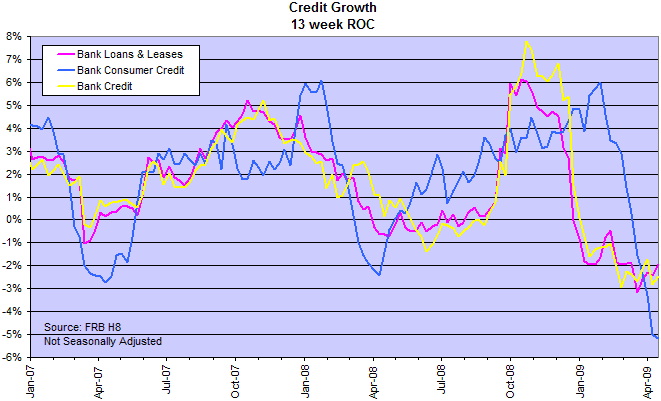

The Credit Contraction

Bank Credit

The contraction of bank and consumer credit continues.

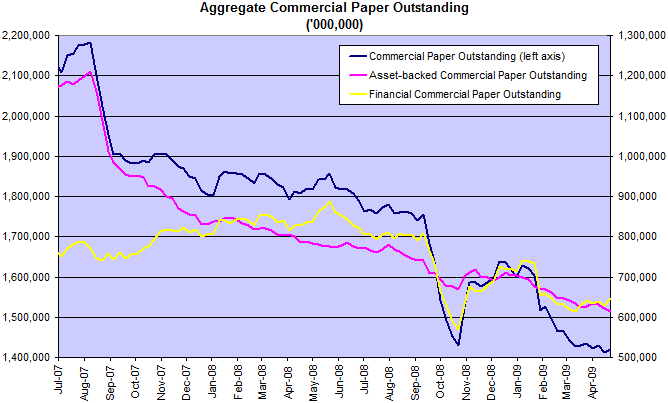

Commercial Paper

Total commercial paper issued has contracted by almost $800 billion from its peak in 2007. The contraction exceeds $1 trillion if we exclude Fed purchases of $240 billion (H.4.1).

Housing

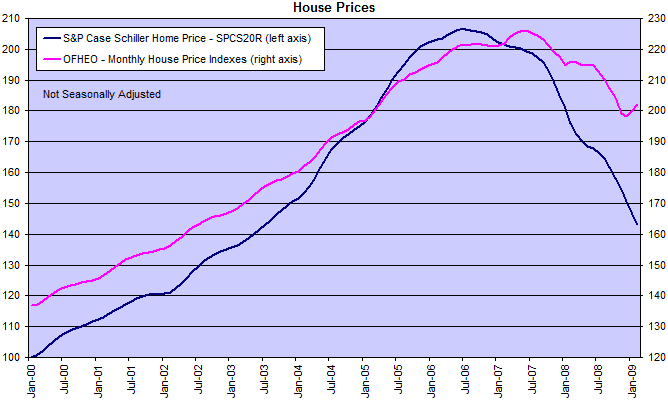

House Prices

House prices are now roughly 30 percent below their 2006 peak, according to the Case-Shiller index — and continue falling.

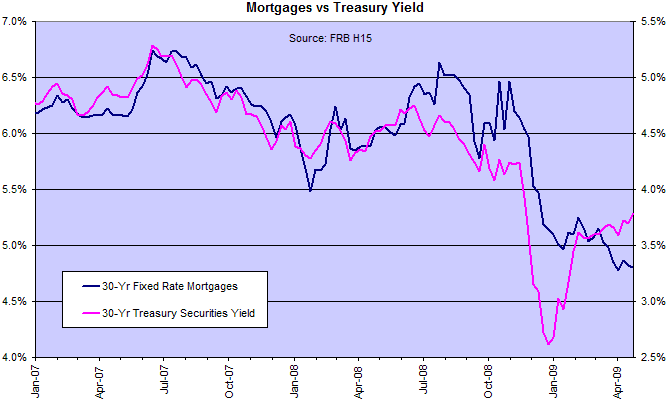

The Fed are suppressing home mortgage rates in an attempt to stabilize house prices — evident from the 30-year fixed home mortgage rate crossing below long-term treasury yields. House prices have so far failed to respond.

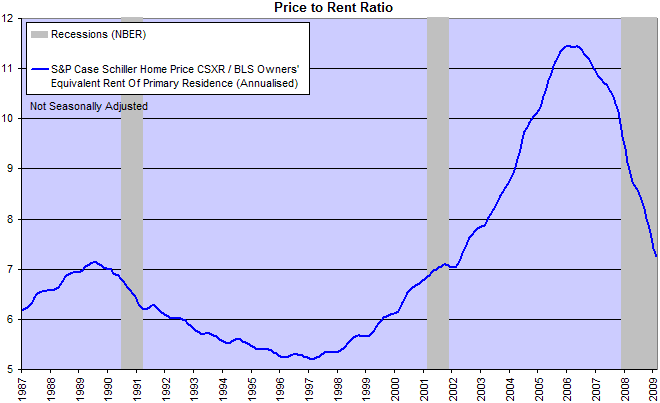

The price-to-rent ratio still has a long way to fall to match the 1997 low. The lower the ratio, the greater the appeal of home ownership compared to rental.

Inflation

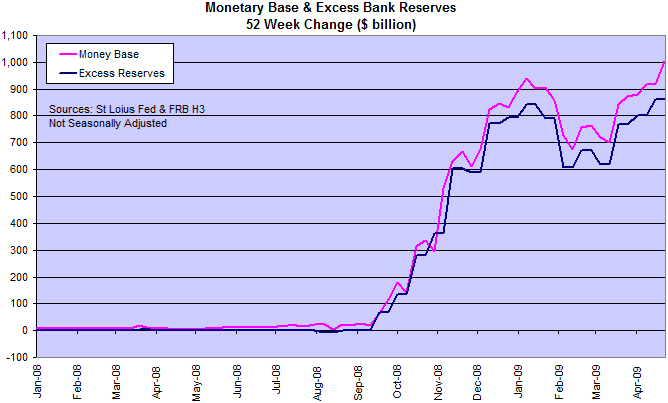

The Fed is rapidly expanding the monetary base in an attempt to stimulate credit expansion and increase inflationary pressures. Their efforts have so far had little effect. Banks are finding it difficult to lend and most of the new money created finds its way back to the Fed — deposited as excess reserves.

A widening of the gap between the monetary base and excess reserves would indicate that demand for credit is increasing — a bullish sign for the economy. And that inflationary pressures are rising — a bullish sign for commodities (especially gold) and the stock market.

It is common to speak as though, when a Government pays its way by inflation, the people of the country avoid taxation.

We have seen that this is not so. What is raised by printing notes is just as much taken from the public as is a beer-duty or an income-tax.

What a government spends the public pay for. There is no such thing as an uncovered deficit.

~ John Maynard Keynes (1923)

Note to readers:

I will be taking a break next week. Newsletters will resume on Monday, May 11th.

Regards, Colin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.