Gold Warning

By Colin Twiggs

April 6, 2:00 a.m. ET (4:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

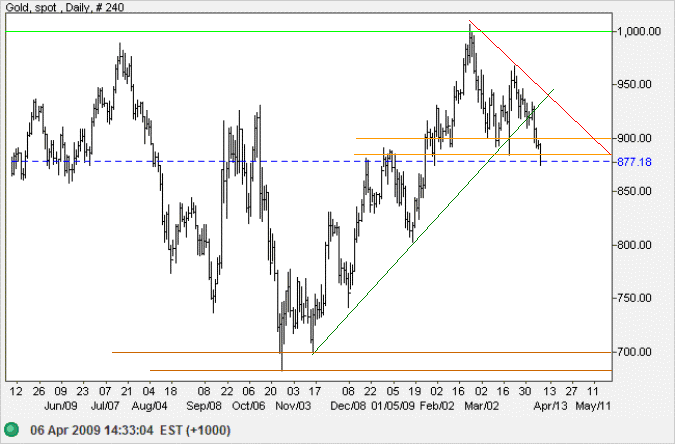

Gold

Spot gold broke through the band of support at $900 after earlier penetrating the rising trendline — signaling reversal to a down-trend. Expect support at the January low of $800, but the target is primary support at $700.

USA

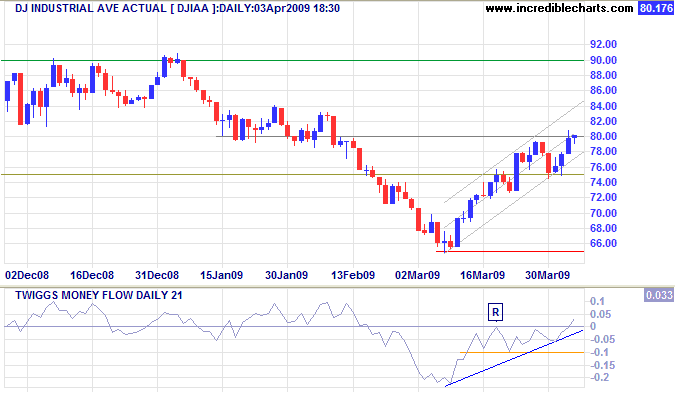

Dow Jones Industrial Average

The Dow closed at short-term resistance at 8000. Twiggs Money Flow (21_day) crossing to above zero indicates continuation of the rally and 9000 is now within reach. The primary trend, however, remains downward and respect of 9000 would warn of another down-swing. Reversal below 6500 would offer a target of 5000 (calculated as 6500 - [ 8000 - 6500 ]).

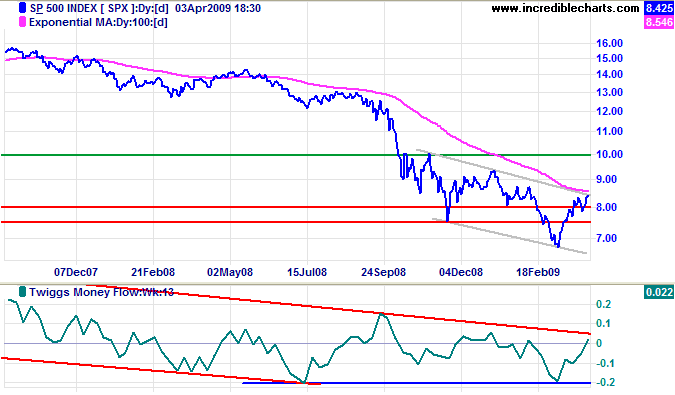

S&P 500

The S&P 500 threatens a breakout above its upper trend channel, which would offer a target of 10000. A Twiggs Money Flow (13-Week) rise above its January high would complete a weak bullish divergence. The primary trend remains down, however — unless we see a higher secondary trough followed by a new high.

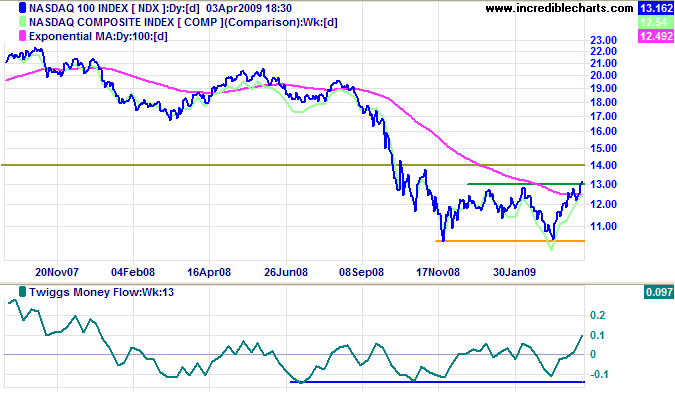

Technology

Nasdaq 100 broke through resistance at 1300 to complete a wide double bottom reversal — offering a target of 1550 (calculated as 1300 + [ 1300 - 1050]). Look for confirmation from the Nasdaq Composite [COMP] rising above 1650. The index is more bullish than its counterparts, supported by strong gains from the likes of Apple [AAPL], Amazon [AMZN] and Sun Microsystems [JAVA]. However, tech stocks do not trade in isolation and a poor earnings season for the Dow/S&P 500 would drag the Nasdaq lower.

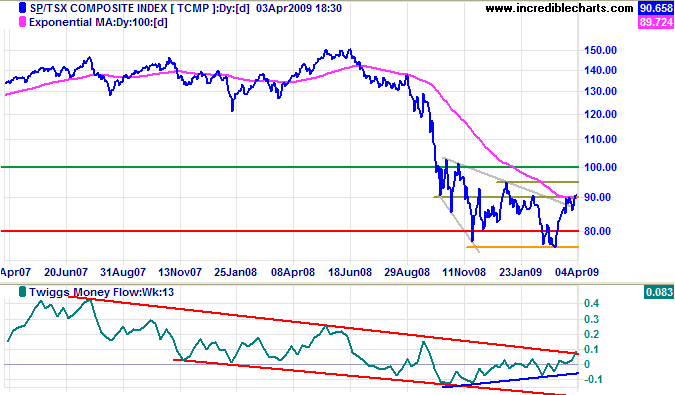

Canada: TSX

The TSX Composite broke through resistance at 9000 after completing a descending broadening wedge pattern — signaling a rally to 10000 (the highest point in the pattern). Bullish divergence on Twiggs Money Flow (13-Week) offers further confirmation. A rise above 9500 would complete a double bottom reversal similar to the Nasdaq 100.

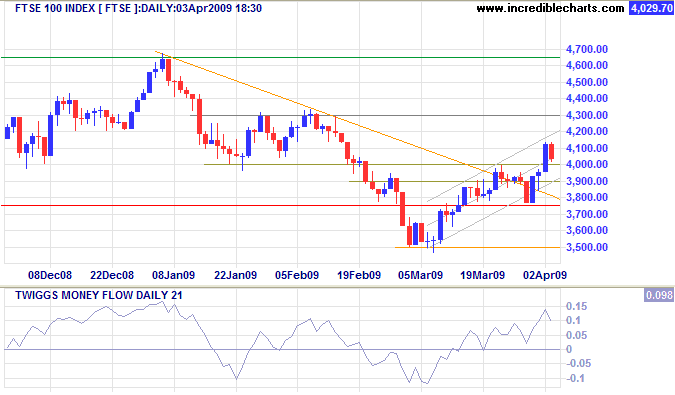

United Kingdom: FTSE

The FTSE 100 retraced Friday; expect support near the lower trend channel at 3900. Failure would warn of trend weakness, while respect would signal continuation of the rally. In the long term, the primary trend remains down. Breakout below the trend channel would signal another test of 3500. Likelihood of a primary trend reversal would increase if resistance at 4650 is penetrated, but would not be confirmed until there is a higher secondary trough followed by a new high.

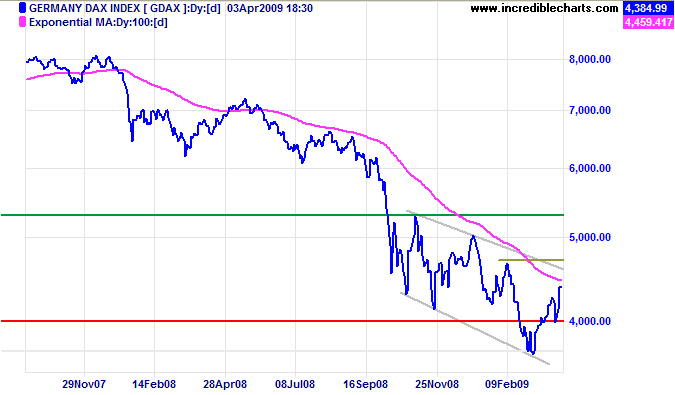

Europe: DAX

The DAX is headed for a test of the upper trend channel, around 4700. Twiggs Money Flow (21-Day) rising sharply confirms buying pressure. Breakout above the trend channel would offer a target of 5300, the highest point of the descending broadening wedge formation. The primary trend remains down, however, with a target of 3000 (calculated as 4000 - [ 5000 - 4000 ]).

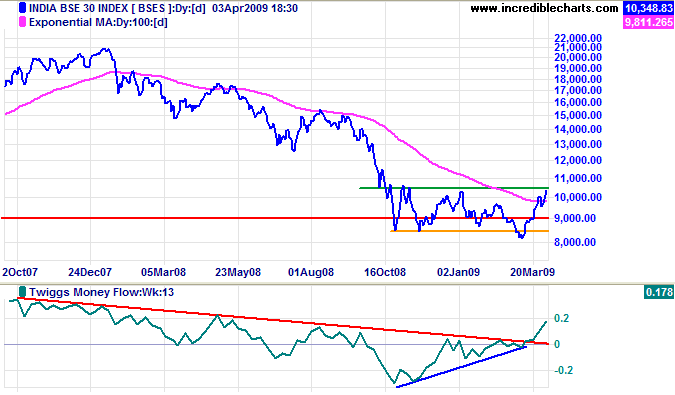

India: Sensex

The Sensex is testing resistance at 10500; breakout would confirm reversal to an up-trend. Twiggs Money Flow (13-Week) shows a strong bullish divergence. Respect of resistance, while unlikely, would warn of another test of 8000.

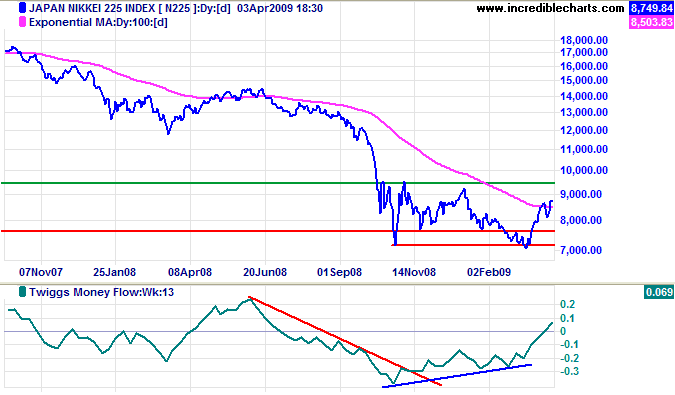

Japan: Nikkei

The Nikkei 225 likewise displays a bullish divergence on Twiggs Money Flow (13-Week) and is headed for a test of resistance at 9500. Breakout would confirm a wide double bottom reversal and offer a target of 12000 (calculated as 9500 + [ 9500 - 7000 ]). Respect of resistance, while less likely, would warn of another test of 7000.

I find resilience of the Japanese market surprising, considering their sharp contraction in exports. Fundamentals point to falling corporate profits. I suspect that repatriation of funds by Japanese investors has increased demand for local equities.

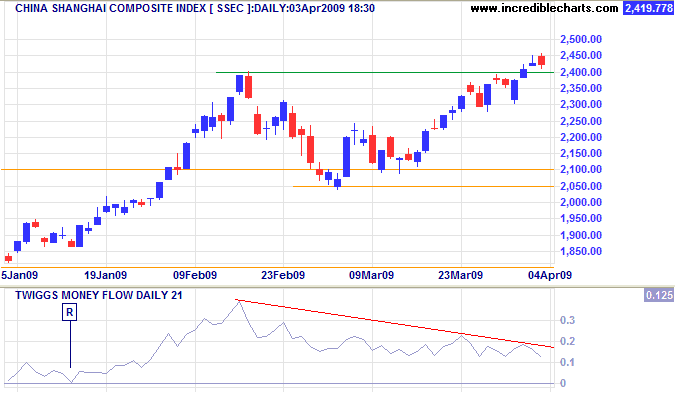

China

The Shanghai Composite retraced to test support after breaking out above the February high of 2400. Respect of support would confirm the primary advance and offer a target of 2750 (calculated as 2400 + [ 2400 - 2050]). Bearish divergence on Twiggs Money Flow (21-Day) warns of a possible bull trap — confirmed if the index reverses below the recent low of 2300.

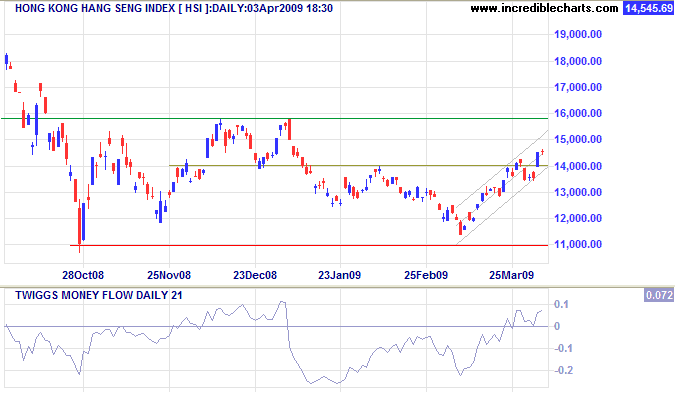

The Hang Seng Index broke through 14000 and is headed for a test of the December/January highs at 15800. Breakout above 15800 would complete a wide double bottom reversal, offering a target of 21000 (calculated as 16000 + [ 16000 - 11000 ]). Twiggs Money Flow (21-Day) respecting zero from above signals buying pressure, while Twiggs Money Flow (13-Week) completed a bullish divergence, crossing above zero to indicate primary trend reversal. Respect of resistance, while less likely, would warn of another test of 11000.

Australia: ASX

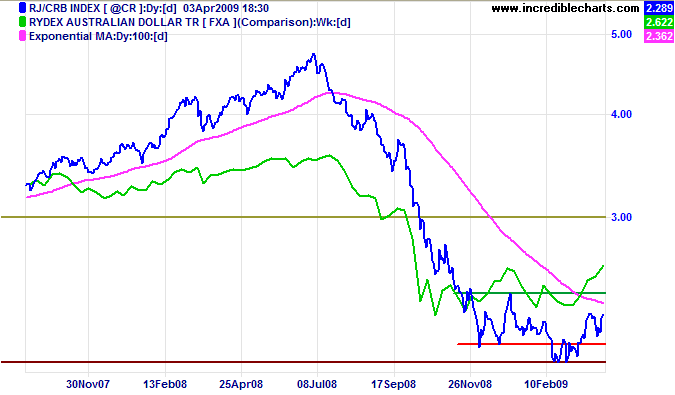

The CRB Commodities Index is headed for a test of resistance at 245. Failure would increase the chance of a trend reversal, but this remains unlikely given the state of the global economy.

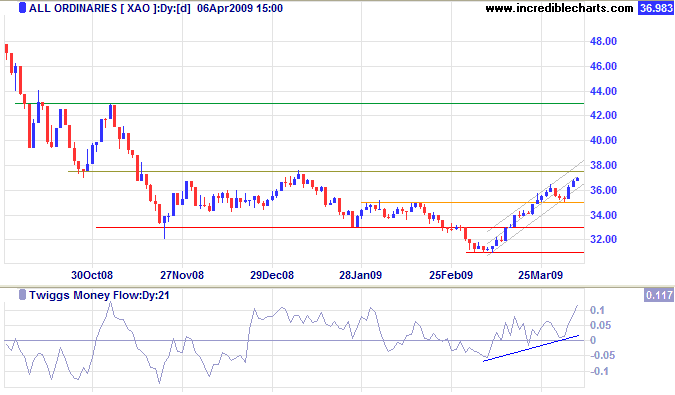

The All Ordinaries respected support at 3500 and is headed for a test of 3750. Twiggs Money Flow (21-Day) holding above the zero line indicates buying pressure. Breakout would increase the chance of a trend reversal, but wait for a higher (secondary) trough followed by a new high to confirm. Unless that happens, the primary down-trend remains — with a target of 2700.

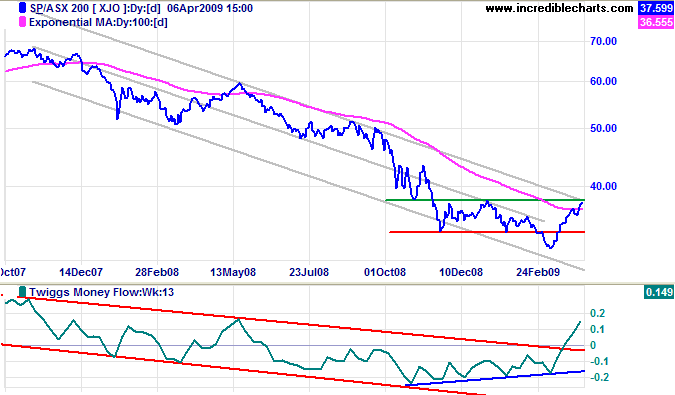

The ASX 200 completed a bullish divergence on Twiggs Money Flow (13-Week), indicating reversal of the primary trend. Breakout above 3800 would increase the likelihood of a reversal, but again wait for a higher (secondary) trough followed by a new high to confirm. Until then, the target for the primary down-trend remains the March 2003 low of 2700.

There are two kinds of failures: those who thought and never did, and those who did and never thought.

~ Laurence J. Peter

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.