April Fools

By Colin Twiggs

April 1, 2009 3:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The G20 Summit

Is it a coincidence that world leaders are arriving in London on April Fools Day for the start of the G20 conference? Projecting an image of confidence, they assure the media of their resolve to overcome the current crisis. But if they knew what they were doing, we would not be in a crisis in the first place.

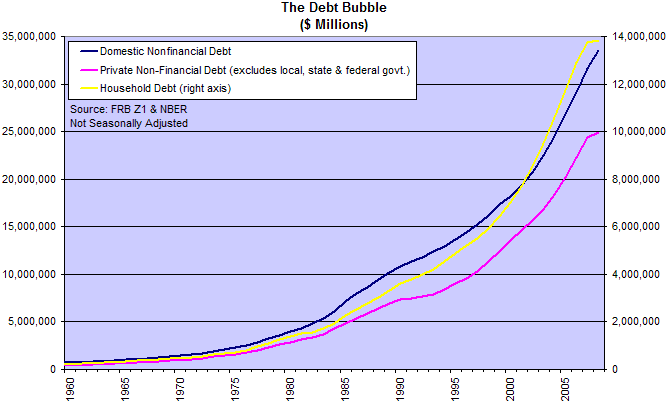

While there is bound to be plenty of rhetoric on curbing executive compensation and regulating greedy banks, this is just papering over the cracks. The real cause of the crisis was the debt bubble.

Debt Growth

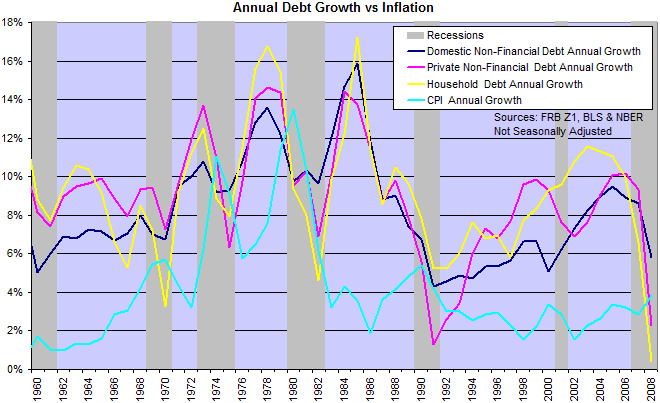

Annual debt growth above 5 percent should set off alarm bells at the Fed. There are two factors that contribute to debt growth: GDP growth and inflation. With GDP seldom growing at above 3 percent, debt growth above 5 percent warns that inflation is getting out of hand — either consumer price inflation or a stock or real estate bubble.

Since the 1980s CPI has hardly lifted in response to rising debt growth. Far from signaling the end of inflation, it merely indicates that asset prices rather than consumer prices were rising. When interest rates are low, the market had learned to borrow cheap money and buy real assets — in the knowledge that asset prices will appreciate for as long as the Fed encourages creation of new money.

It is no coincidence that debt spiked upwards before each major recession. That is bound to happen when interest rates are suppressed. Just as inevitable is the sharp contraction as the Fed raises interest rates in response to rising inflation. The only exception is 2001, where household debt continued to grow despite a contraction in corporate debt. Which is why the next down-turn was so severe.

These are the same tools that the G20 hopes will correct the current down-turn. The definition of stupidity is to repeat the same action — and expect a different result.

Causes Of Financial Instability

Banks fund most of their long-term assets (loans and securities) with short-term deposits because of the sizable spread between short-term/call rates and long-term rates (that match the maturity of their lending book). While highly profitable, this maturity mis-match is a major cause of financial instability. Making them vulnerable to bank runs in times of crisis, when they are unable to liquidate assets fast enough to meet depositors demand for cash. Collapse of one bank would set off a run on others, which is why we have the Fed — to act as lender of last resort and provide banks with liquidity in times of crisis. Otherwise the entire system would collapse. Many countries also employ a second safety mechanism: guaranteeing bank and thrift deposits to maintain public confidence.

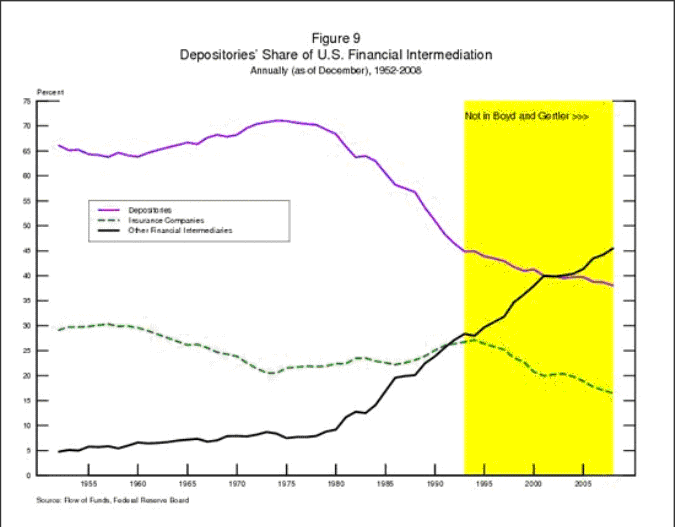

The reason these measures failed to adequately protect us in the current crisis is clearly illustrated by this chart from Fed governor Elizabeth Duke. The share of financial intermediation performed by banks and thrifts (depositories) has fallen sharply since the early 1980s. And the percentage performed by non-regulated intermediaries (other) climbed from 5 percent to above 45 percent of the total. When the crisis broke, this highly leveraged and unregulated shadow banking system had no protection. Its collapse caused a massive credit contraction which has so far cost the US taxpayer $3 trillion. (WSJ)

The role of unregulated financial intermediaries must be restricted. There is no need to regulate intermediaries who match maturities — placing corporate bonds with long-term investors such as pension funds for instance. But any form of maturity mis-match threatens the stability of the whole financial sector and, with few exceptions, should be supervised by banking regulators. Mortgage securities funded with short-term commercial paper and auction-rate securities are prime examples. Repurchase agreements are another. Repos backed by government bonds could possibly be excluded, because of the quality of the security held by the purchaser, but any other form of repo — including corporate bonds, mortgage receivables, bills or equities as security — warrants close scrutiny.

This would also restrict money market funds in the type of securities they purchase — if they want to escape supervision.

Hedge Funds

Hedge funds and private equity funds are another convenient whipping boy for politicians. They were not the cause of the current crisis. Besides imposing basic reporting requirements and restricting bank ownership, I see no sense in attempting to regulate them. Complex hedging strategies make it difficult to assess their risk exposure. The most effective control is to constrain their leverage by restricting unregulated financial intermediation.

Many of today's policy proposals start from the view that "greed" and "incompetence" and "poor risk assessment" are the ultimate source of what went wrong.

In fact, they were not the true cause at all. Moreover, even if they had been, it is fatuous to think that we will now create a post-crash generation of bankers and traders

who are not greedy, much less a new generation of quants who will be able to assess and manage risks much better than "the idiots" who have brought us to the current abyss.

Greed cannot be exorcised. Nor can the inherent inability of any quants to determine the "true" probability distributions of all-important events

whose true probabilities of occurrence can never be assessed in the first place.

~

Horace "Woody" Brock

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.