Inflation v. Deflation

By Colin Twiggs

March 26, 2009 5:30 a.m. ET (8:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

There are two competing views of global markets. One is driven by the rapid contraction of the money supply following collapse of the debt bubble. This points to a protracted deflationary spiral, with falling prices fuelled by debtors attempting to reduce their exposure by selling off assets. The outcome would be high unemployment, low commodity prices, low stock prices and a low gold price.

The second scenario is where the Fed and other central banks expand the money supply, fuelling inflation. Purchasing bonds to expand the monetary supply may be easy, but as the Japanese discovered, this does not necessarily translate into rising prices — bank credit continued to contract throughout the 1990s.

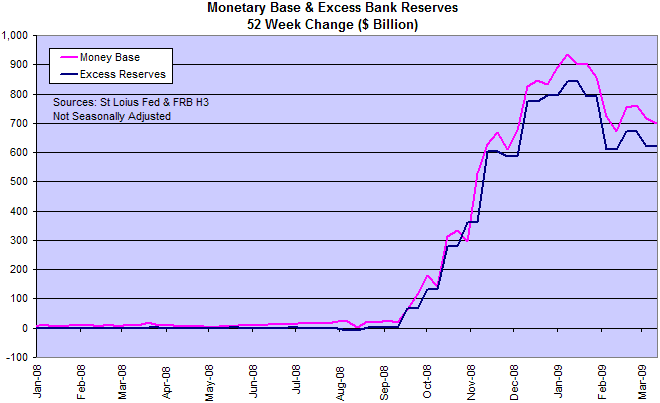

Monetary Base

We have already witnessed a rapid rise in the US monetary base, caused by the Fed's actions to shore up the financial sector. But the surplus has not succeeded in expanding bank lending, most of it finding its way back to the Fed, deposited as excess reserves. Banks are trapped by their inability to find sound customers who want to borrow: the private sector are selling off assets and reducing debt.

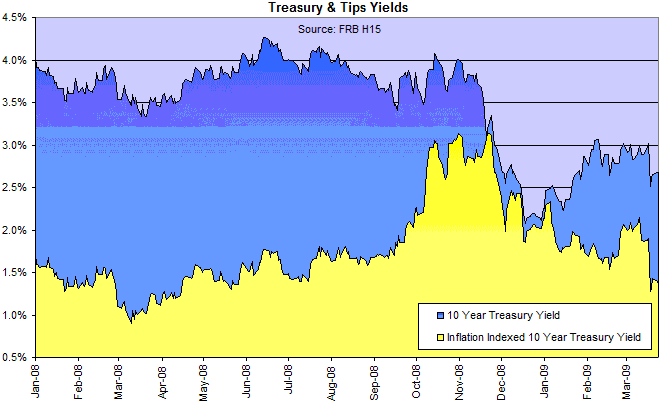

Will the Fed succeed where the Bank of Japan failed — and persuade the private sector to borrow to acquire new assets? The bond market is betting they will fail, with TIPS and treasury yields declining in anticipation of low inflation.

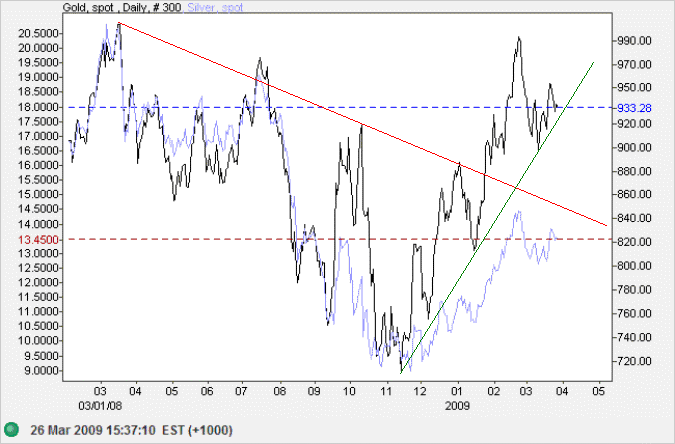

Gold buyers, however, are betting they will succeed and inflation will rise. Though silver appears to be taking the opposite view.

Despite recent signs that the Fed is prepared to inflate, the deflationary spiral will be difficult to break. Expect deflation for a year if not longer, followed by inflation if the Fed succeeds in its attempts to raise bank lending. This is likely to be a protracted recession.

Self-Defeating Behavior

It is interesting to observe most governments attempting to shore up falling asset prices — to protect banks from complete collapse. But their efforts may succeed in prolonging the recession. Low asset and commodity prices are the catalyst that spurs private business and individuals to start borrowing again. At some point the opportunities presented become to good for them to pass up. If prices are prevented from falling, the market stagnates as there is insufficient incentive to take on the additional risk.

When it comes to a trade-off between saving the banks or prolonging the recession, my bet is that the Fed will follow the BoJ and save the banks.

Forex Markets

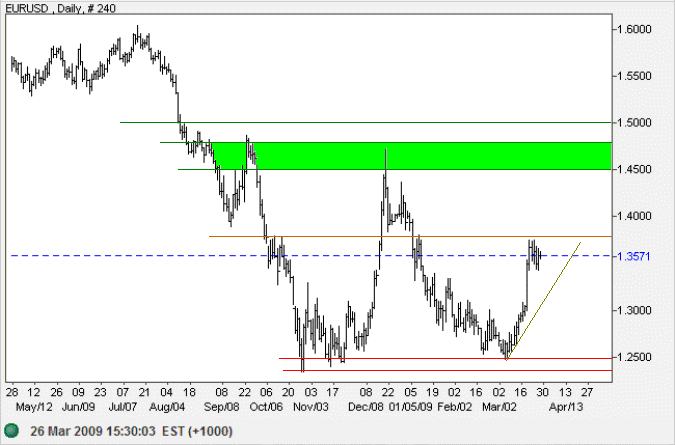

Euro

The euro shows a small flag continuation pattern below resistance at $1.37 against the euro. Breakout would test the band of resistance between $1.45 and $1.47. Penetration of the rising trendline, however, would warn that the up-trend is weakening. In the long-term, failure of the band of support between $1.23 and $1.25 would offer a target of $1.00; that is 1.25 - ( 1.50 - 1.25 ). Recovery above $1.47, signaling a primary trend change, remains unlikely — but would test previous highs at $1.60.

Source: Netdania

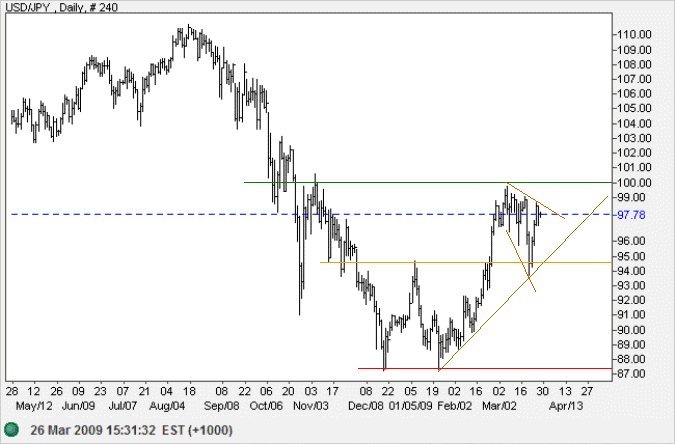

Japanese Yen

The dollar displays a descending broadening wedge just below 100 against the yen — a bullish pattern signaling continuation of the up-trend. Upward breakout would offer a target of 105; calculated as 99 + ( 100 - 94 ). Penetration of the rising trendline, however, would warn that the up-trend is weakening. In the long term, failure of primary support at 87 would target the 1995 low of 80, while breakout above 100 would offer a target of 110 (the August 2008 high).

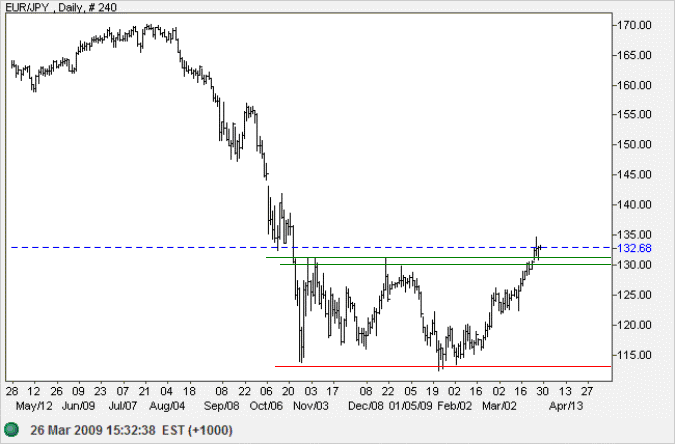

The euro broke out above resistance at 130 against the yen, offering a target of 145; calculated as 130 + ( 130 -115 ). Look for a retracement to confirm the breakout.

Source: Netdania

Japanese exports plunged by a record 49 percent in February, conmpared to a year ago. (WSJ) Expect a major contraction in the local economy — where previous recoveries were export-led.

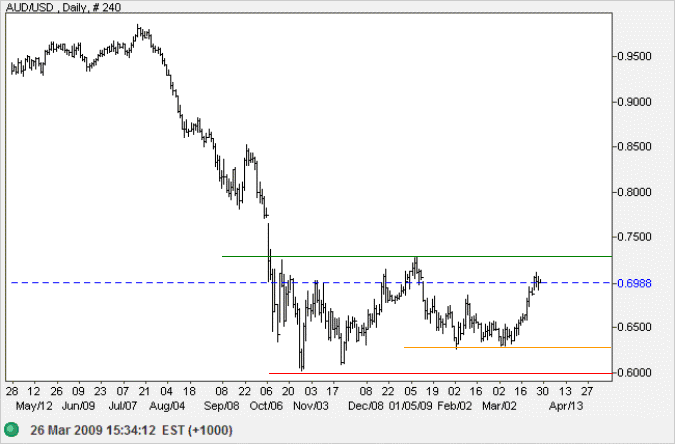

Australian Dollar

The Australian dollar and the euro are both rising against the greenback. Expect the Aussie to test resistance at the January high of $0.7250. Whether it will be able to make further headway is questionable, however, given that US inflation is likely to remain muted for the medium term. In the long term, failure of $0.60 would target the 2001 lows between $0.48 and $0.50, while breakout above 72.50 would offer a target of the September high of $0.85 — calculated as 0.7250 + ( 0.7250 - 0.6000 ).

Source: Netdania

The difficulty lies not so much in developing new ideas as in escaping from old ones.

~ John Maynard Keynes

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.