Greenspan's Conundrum

By Colin Twiggs

March 20, 2009 2:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

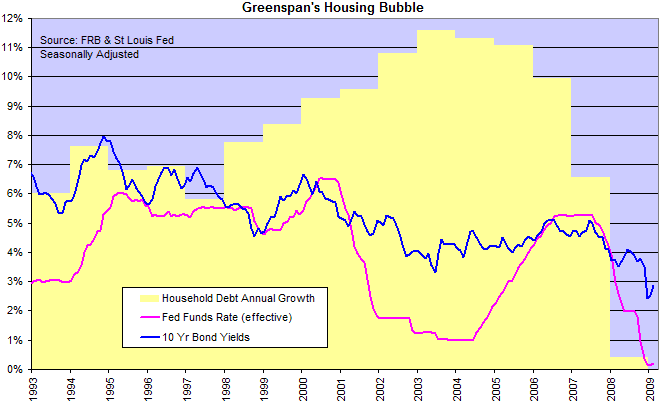

Alan Greenspan maintained in a recent opinion piece in WSJ that the Fed is not to blame for the housing bubble. He pointed out that, while low interest rates caused the bubble, home prices are closely linked to long-term mortgage rates — not the short-term Fed Funds rate. In the past there had always been a close correlation between the two rates: if the Fed raised or lowered the funds rate, long-term rates would soon follow. Between 2002 and 2005, however, the old relationship broke down. China and other Asian exporters started to invest their savings in the US capital market, driving down long-term rates. When the Fed raised short-term rates, the long-term mortgage market failed to respond. Mortgage rates remained low and the bubble continued to expand despite the Fed lifting the funds rate by 4 percent between 2004 and 2006.

I have two issues with this argument. First, household debt had been growing exponentially since the late 1990s — including gains of more than 10 percent in the two years prior to the Fed raising the funds rate. So the Fed response was too little — and far too late.

Second, it implies that the Fed was powerless to prevent the housing bubble. That is not true. They were well aware of the dis-connect between short- and long-term rates and what was causing it. If lifting the funds rate did not produce the desired effect, they should have tried another tool. Yesterday, for instance, the Fed underlined its preparedness to intervene directly in long-term capital markets and drive down mortgage rates. Surely they were capable of entering the same markets to drive up mortgage rates. Selling treasuries into the market would have corrected the imbalance caused by an influx of foreign investment. It may have posed a few problems, such as where to find sufficient treasuries to sell, but these are not insurmountable.

So why did the Fed not put an end to the party? I guess the former chairman has a very human flaw. He enjoyed all the praise and adulation from the market. And did not want it to stop.

Executive Compensation

Payment of $165 million in bonuses to AIG executives incensed taxpayers and brought howls of outrage from politicians. Culminating in the House imposing a 90 percent excise tax on employee earnings of more than $250,000 — at companies who receive $5 billion or more from the financial rescue program. Recently appointed AIG Chairman Edward Liddy and Treasury Secretary Geithner indicated that the bonuses were contractual obligations of the insurer. It is also claimed that they are "retention" bonuses, necessary to retain existing staff. Even though, apparently, eleven of those who received bonuses over $1million are no longer working at AIG.

The AIG bailout was designed to rescue creditors at the taxpayer's expense — in the hope that it would avert a complete melt-down of the financial sector. Goldman Sachs has already received $13 billion and European banks (primarily Deutsche Bank) received $20 billion. (WSJ) If AIG had been liquidated, none of the employees would be collecting bonuses. But if it had been split up into a bad insurer and a viable operating company, with all the good contracts and sound assets, then employees of the sound operation would expect reasonable compensation and incentives. That does not necessarily mean, however, that the existing bonus scheme would continue. The AIG scheme appears to have been far from reasonable — rewarding employees despite spectacularly poor performance in some cases. (WSJ)

Let's analyze this. Bonuses are not paid to "retain employees' services". Salaries are paid to retain employees services. Instead, bonuses are paid to reward employees for past performance. In this case that is questionable, so what other motives could their be? A recurring motive is to raid the cookie jar while the shareholders are not paying attention, or before the new owners (or liquidators) arrive. Merrill Lynch, for example, declared employee bonuses on the eve of its merger with BoA. A second motive is "hush money" — to ensure that no one spills the beans on what was actually going on.

Both of the latter cases are a breach of the directors fiduciary duty to the company (and shareholders) — a criminal offence in most countries. The only way to prevent such theft is to ensure that all directors compensation has to be approved by shareholders of the company in general meeting. Shares held by directors, obviously, should not be eligible to vote. Shareholders could employ independent consultants to review and report on directors compensation, with provision for the company to bear their reasonable costs.

One could also make a case for controlling compensation to employees who are not directors. Setting a general limit, of say $1 million, on individual compensation would be one way of doing this. With any compensation over that limit to be expressly approved by shareholders.

Stock Options

Stock options should be scrapped. They represent a free ride for employees. Shareholders carry the risk and employees reap the rewards. They encourage employees to make big bets with the company's assets in the hope of a massive pay-off. If the bets fail, existing shareholders carry the loss. The best way to align employees interests with those of the company is to make them shareholders. Offer shares at, or even slightly below, the current market price — and arrange finance for 80 or 90 percent of the purchase price. With their own assets on the line, rest assured, employees will be a lot more cautious about risking company assets. "It concentrates the mind" as a former chairman used to say.

Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds

of the bank to speculate in the breadstuffs of the country.

When you won, you divided the profits amongst you, and when you lost, you charged it to the bank.

You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families.

That may be true, gentlemen, but that is your sin!

Should I let you go on, you will ruin fifty thousand families, and that would be my sin!

You are a den of vipers and thieves.

~ Andrew Jackson, 1767-1845, 7th US President,

when forcing the closure of the Second Bank of the US in 1836 by revoking its charter.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.