Fed Pulls The Trigger

By Colin Twiggs

March 19, 2009 2:30 a.m. ET (5:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Fed is to buy an additional $750 billion of mortgage-backed securities (bringing the total to $1.25 trillion), an additional $100 billion of agency debt (bringing the total to $200 billion), and $300 billion of longer-term Treasury securities. (FRB) The total of $1.75 trillion may not fully offset the deflationary effects of the collapsing debt bubble, but should go some way towards stabilizing housing prices over the next six months — and consequently bank collateral.

No Offset

To avoid expanding the money supply, the Fed simply has to sell short-term bills for an equivalent amount to its purchases of other securities. The one offsets the other. That is what the Fed were doing until mid-2008, but a gap appeared in the third quarter. And, by the end of October, sales of short-term bills had ceased while security purchases continued. (Market Oracle) The gap widened to $600 billion in November — and is likely to expand dramatically over the next year.

The Multiplier Effect

Purchases of $1.75 trillion of securities have the potential to massively expand the money supply. The Fed does not pay for its purchases with gold or other tangible medium of exchange, but merely issues an IOU in the form of a deposit account with itself. Banks are then able to use the IOU as part of their reserves, expanding their loan assets by up to $17.5 trillion (10 times the reserve amount). This is referred to as the "multiplier effect".

Deflationary Spiral

Banks, however, are trapped in the present deflationary climate. Not only by their overvalued assets, but by their inability to find sound customers who want to borrow. The private sector are shrinking their balance sheets to reduce risk, selling off assets and reducing debt. The Fed is hoping that by expanding the money supply, asset prices will stabilize and restore business and consumer confidence. But the money supply will not expand if the private sector refuses to borrow. Banks would be forced to deposit the new money back with the Fed or buy Treasuries (driving yields even lower) for want of better opportunities. The Fed has to find some way to prime the pump — and break the deflationary spiral.

Expect some "window-dressing" in the months ahead. Like announcements that Citi and other major banks are in the black for the first two months of the year — write-downs are only likely to be made at the end of the quarter. And pressure to relax mark-to-market accounting rules. (WSJ)

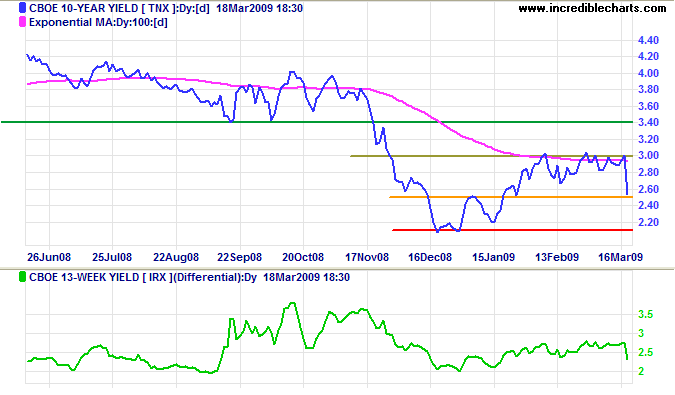

Treasury Markets

The Fed move will suppress long bond yields, and drive down the dollar as investors look for richer pastures. China has already expressed concern. Expansion of the money supply is inflationary and likely to give them a "haircut".

Forex Markets

We may be entering a new era of volatile exchange rates as countries devalue their currencies to improve their competitive position vis-a-vis their major trading partners. The Bank of England has already commenced quantitative easing, with a program to purchase £150 billion of government bonds. The Swiss National Bank followed, with measures to prevent appreciation of their currency. And now the Fed has pulled the inflation trigger, which is likely to weaken the dollar.

Be prepared for a series of retaliations as countries jostle for position. Playing tit-for-tat would be a no-win situation, destabilizing currency markets and further unsettling investors. But there are some existing anomalies, especially with China, that cannot be allowed to continue.

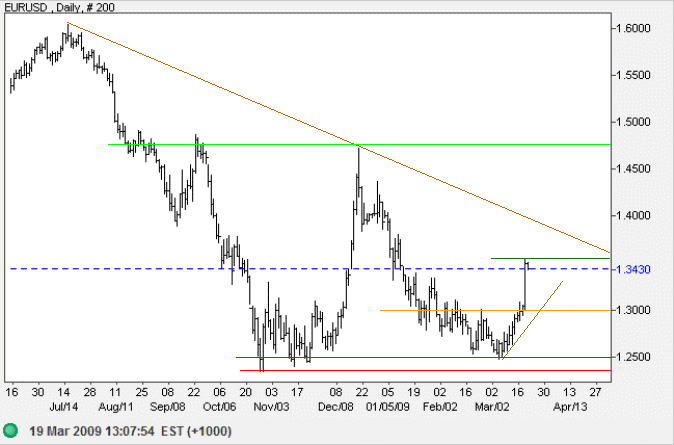

Euro

The euro is testing resistance at $1.35 after a sharp spike following the Fed announcement. Narrow consolidation would indicate further gains, while retracement that respects support at $1.30 would confirm the secondary up-trend. The primary trend remains down, but reversal below the band of support between $1.23 and $1.25 is unlikely in the next few weeks. In the long-term, failure of support would offer a target of $1.00; that is 1.25 - ( 1.50 - 1.25 ).

Source: Netdania

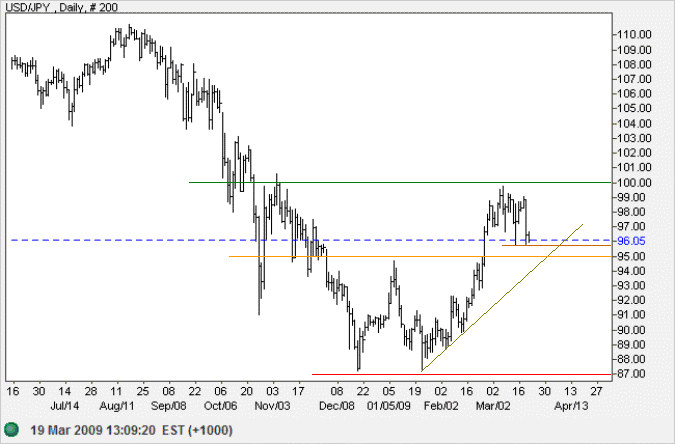

Japanese Yen

The dollar is testing short-term support between 95 and 96 against the yen. Failure would break the rising trendline, warning of another test of support at 87. Unless 87 is broken, however, the primary trend remains up. In the long term, failure of primary support (at 87) would target the 1995 low of 80, while breakout above 100 would offer a target of 110.

Source: Netdania

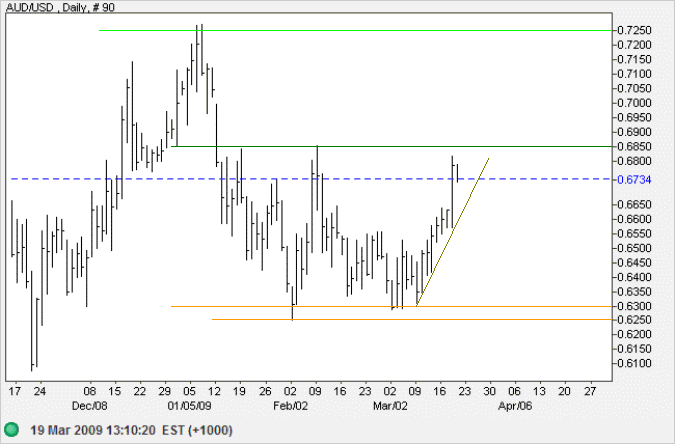

Australian Dollar

The Australian dollar broke out of its recent range (between $0.63 and $0.66) against the greenback and is testing resistance at $0.6850. Breakout would offer a target of the January high of $0.7250, while respect would indicate another test of $0.63. In the long term, failure of $0.60 would target the 2001 lows between $0.48 and $0.50. And breakout above 72.50 would offer a target of the September high of $0.85; calculated as 0.7250 + ( 0.7250 - 0.6000 ).

Source: Netdania

It is well enough that people of the nation do not understand our banking and monetary system,

for if they did, I believe there would be a revolution before tomorrow morning.

~ Henry Ford

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.