Remember What Got Us Into This Mess

By Colin Twiggs

March 10, 2009 3:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

With the G20 summit approaching, the US government is calling for increased government spending, on a global basis, to compensate for declining consumer spending. Some European counterparts, particularly Germany, are decidedly wary of this approach. Given their history of post WWI hyperinflation, successive German governments placed a high priority on economic stability — at times accepting low growth or high unemployment rather than risk stimulating the economy. The German economy has prospered in this stable environment, recently becoming the world's largest exporter. Their reaction to the current crisis is understandably more muted than the US and UK. "The Germans have an economic crisis," says Wolfgang Twardawa, a consumer analyst at research firm GfK, "but they don't have a financial crisis, and they certainly don't have a property crisis." (New York Times).

By comparison the US and UK have been too ready to adopt Keynesian-style stimulation whenever growth slowed or unemployment threatened to rise. They have played a game of "pass the parcel" — each administration passing the ticking bomb of burgeoning debt on to their successor — rather than confront the tough choices facing them. While this may have seemed "clever" politics, it has led the global economy to an inevitable crash.

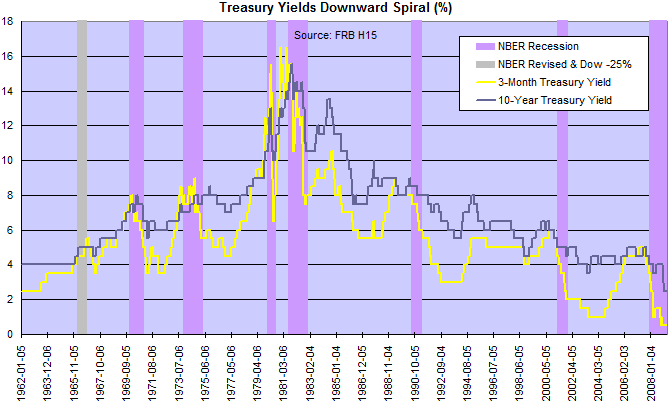

Paul Volcker was the last Fed chairman to confront these tough choices, rescuing the US economy from soaring inflation early in his term at the Fed (1979 - 1987). Ever since, the Fed has marched towards the current crisis, imposing deeper rate cuts in an attempt to lift the economy out of successive recessions — until we arrived at the present zero interest rate policy. With nowhere further to run. And the avalanche of 20 years excesses overtaking us. Little wonder that Germany is skeptical of economic advice from across the Atlantic.

The chart above shows how suppression of short-term interest rates (represented by 3-month treasury yields), in repeated attempts to stimulate the economy out of recession, resulted in a downward spiral with long-term yields falling lower and lower. Low long-term yields lead to inflated asset prices — with an inevitable crash when yields re-adjust.

The only long-term cure for this is a spell of Volcker/German style austerity. Unfortunately, I cannot see that happening anytime soon.

Are You Unemployed Or Are You Jobless?

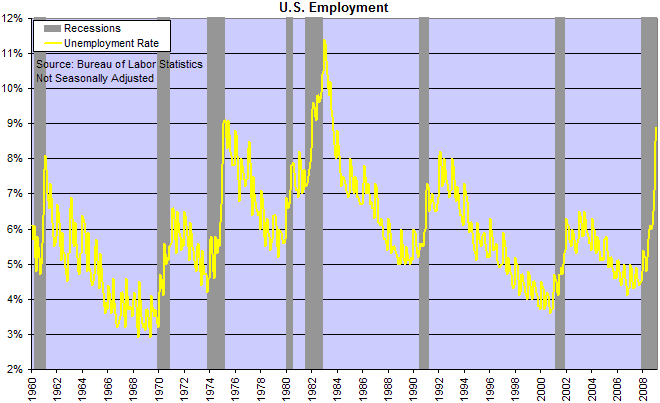

Unemployment is approaching the 9.0 percent reached in the 1974 recession, but still has some way to go to catch the 11.2 percent from 1982.

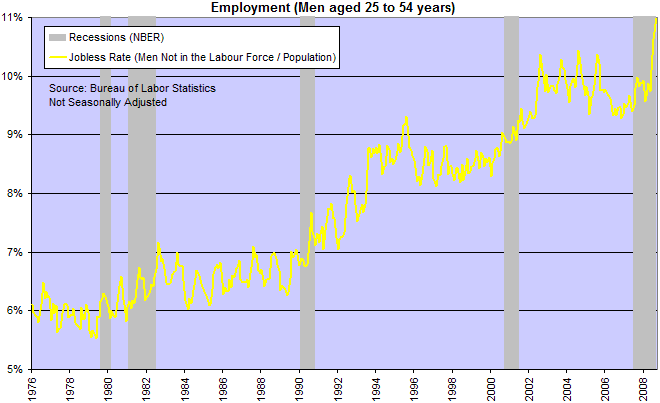

Unemployment measures only those who are actively seeking work but unable to find employment. It does not include anyone who has given up looking for work. The jobless rate — the percentage of males 25 to 54 years of age who, for whatever reason, do not have a job — tells a vastly different story.

Unemployment and consumer confidence go hand-in-hand. Consumers withhold spending when confidence is low, resulting in lower sales and more lay-offs. The risk is that a downward spiral may develop, with rising lay-offs causing further falls in confidence and contractions in spending.

Government is the great fiction, through which everybody endeavors to live at the expense of everybody else.

~

Frederic Bastiat

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.