Yen Double Bottom

By Colin Twiggs

February 25, 2009 8:00 p.m. ET (12:00 midday AET)

I am trialing a new format of shorter, more frequent newsletters and would appreciate feedback as to whether you find them convenient or not. These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

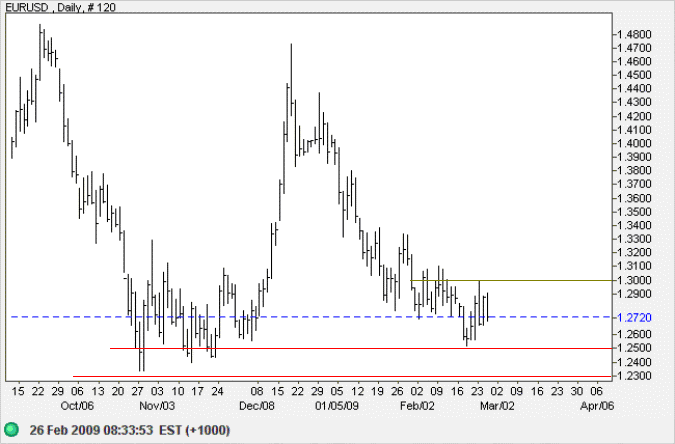

Euro

The euro is testing a band of primary support between $1.23 and $1.25. Uncertainty over almost $1.5 trillion of European bank loans to Eastern Europe is weighing on the euro. Failure of support would offer a long term target of $1.00; calculated as 1.25 - ( 1.50 - 1.25 ). Recovery above short-term resistance at $1.30, while less likely, would signal a bear market rally.

Source: Netdania

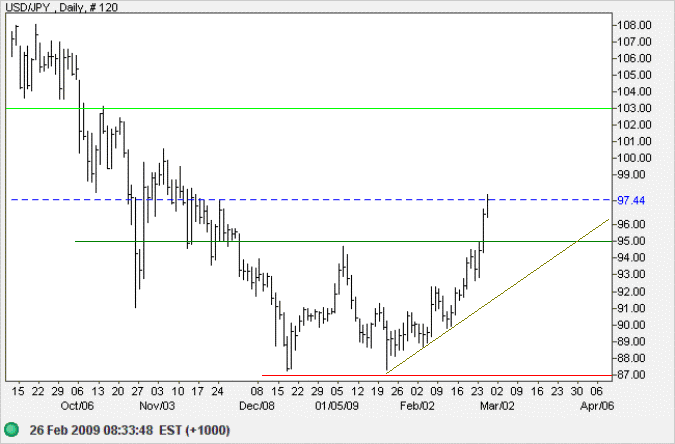

Japanese Yen

The dollar broke through resistance at 95 against the yen, completing a double bottom with a target of 103; calculated as 95 +( 95 - 87 ). This signals reversal to a primary up-trend, but it would be prudent to wait for confirmation before making any long-term commitment. Ideally from a retracement that respects the new support level. Failure of primary support at 87 is now unlikely, but would target the 1995 low of 80.

Source: Netdania

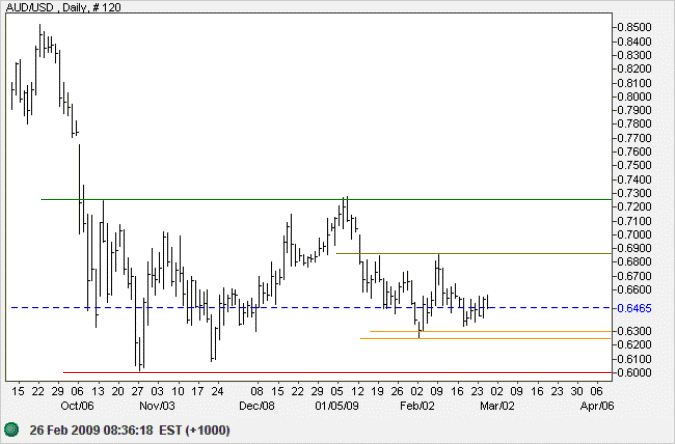

Australian Dollar

The Aussie dollar is testing a narrow band of medium-term support between $0.6250 and $0.6300. Failure is more likely, and would test primary support at $0.60. Recovery above medium-term resistance at $0.6850, on the other hand, would signal another test of $0.7250. In the long term, the primary trend is down and failure of $0.60 would target the 2001 lows between $0.48 and $0.50.

Source: Netdania

There are 10^11 stars in the galaxy. That used to be a huge number. But it's only a hundred billion.

It's less than the national deficit! We used to call them astronomical numbers. Now we should call them economical numbers.

~ Richard Feynman (1918 - 1988)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.