Call To Nationalize Banks

By Colin Twiggs

February 22, 11:00 p.m. ET (3:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

I support Nouriel Roubini's call to nationalize troubled banks, following the precedent of the successful rescue of Swedish banks in the 1990s. Nationalization is a temporary step, allowing greater control over insolvent and under-capitalized banks currently supported by the taxpayer. Vulnerable mega-banks could be split into smaller regional or niche market players, each separately privatized. That would solve the current "elephant in a lifeboat" dilemna facing regulators: too-big-to-fail banks such as BofA and JPMorgan have grown even larger through acquisition of weaker rivals (Bear Stearns, WaMu, Countrywide and Merrill), but remain vulnerable.

Temporary nationalization would clear the uncertainty hanging over the financial sector, but it is essential that we do not solve one problem only to create another. Nationalized banks must not be used for political purposes: lending at low margins or assuming greater risk in order to "stimulate" the economy would only cause further harm. Also, bond-holders in insolvent banks should take a "haircut". That would send a clear message that taxpayer funds will no longer be used to benefit private investors.

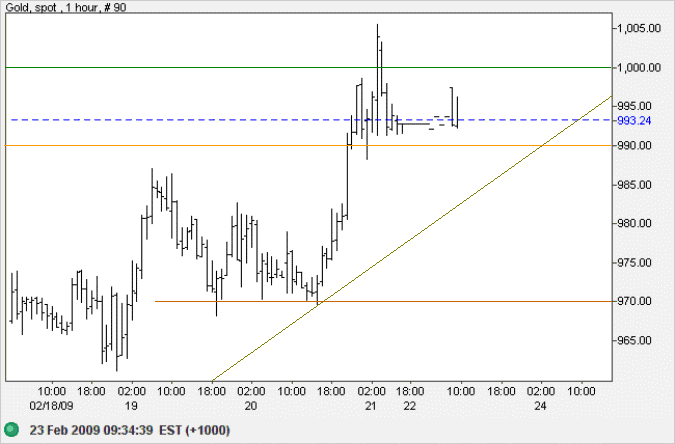

Gold

Spot gold made a false break above $1000 before retreating to test short-term support at $990. Respect of support would be a bullish sign, while reversal below $970 would warn of a secondary down-swing. The long term target for breakout above $1000 is $1200, based on the large recent descending broadening wedge: 900 + ( 1000 - 700 ).

USA

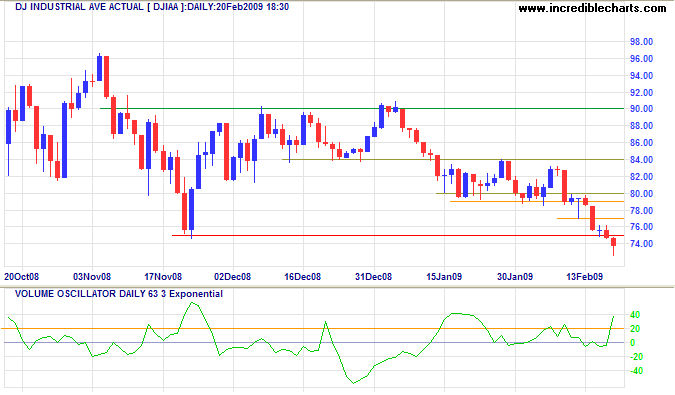

Dow Jones Industrial Average

The Dow's long tail and strong volume Friday indicate buying support. Expect a test of the new resistance level at 7500. Respect would confirm the bear trend, while penetration of 7500 would warn of a possible bear trap.

In the long term, the primary trend is down and the breakout below 7500 offers a target of 6000; calculated as 7500 - ( 9000 - 7500 ). It would be prudent, however, to wait for confirmation from the S&P 500.

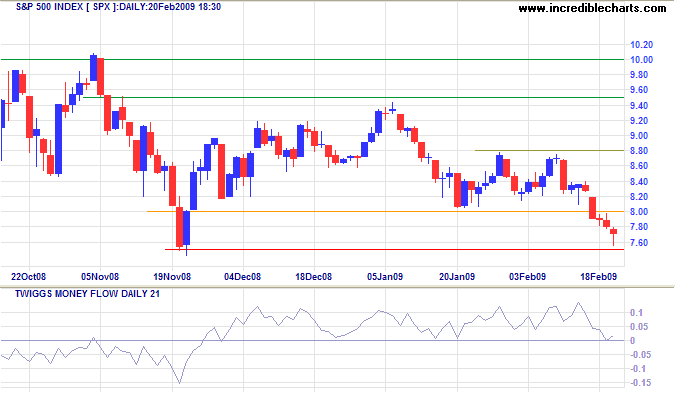

S&P 500

The S&P 500 continues to hold above primary support at 750 — the long tail and strong volume signaling buying support. Twiggs Money Flow (21-Day) above the zero line confirms. In the longer term, failure of support at 750 would confirm the Dow bear signal and offer a target of 600; calculated conservatively as 750 - ( 900 - 750 ). Respect, while less likely, would signal another rally to 950.

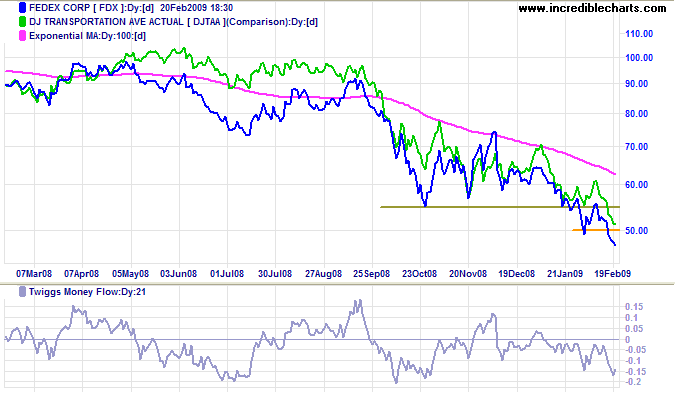

Transport

Fedex and the Dow Transport index continue another down-swing, signaling further weakness in the economy. Twiggs Money Flow (21-Day) holding below the zero line confirms selling pressure.

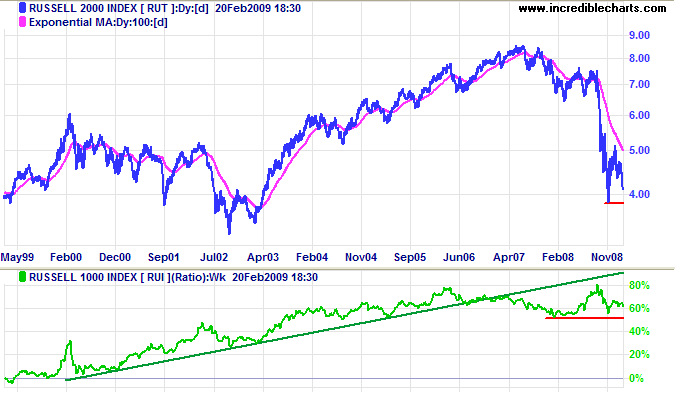

Small Caps

The Russell 2000 Small Caps index is headed for a test of support at 380. Failure would offer a target of 300, calculated as 400 - ( 500 - 400 ) — below the 2002 low of 325. The ratio to the large cap Russell 1000 is weakening as the credit contraction shifts from Wall Street to Main Street.

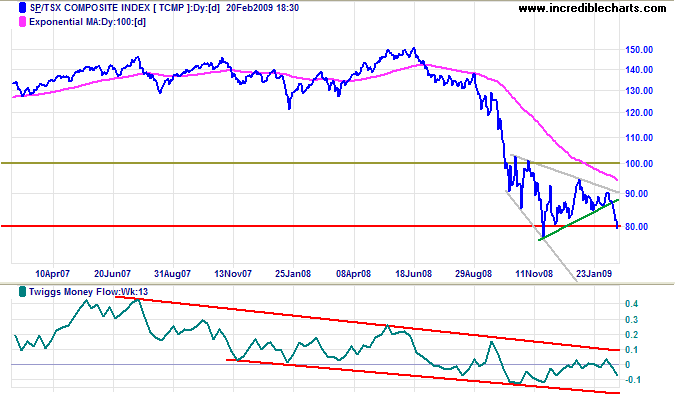

Canada: TSX

The TSX Composite descending broadening wedge occurs in a down-trend and should not be interpreted as a bullish consolidation. Reversal below the key 8000 level warns of a further down-swing; confirmed if the 2008 low of 7700 is penetrated or retracement respects the new 8000 resistance level. The target for the down-swing is 6000, calculated as 8000 - (10000 - 8000) — near the October 2002 low of 5700. Recovery above 8000 is unlikely in the present circumstances, but would warn of a possible bear trap.

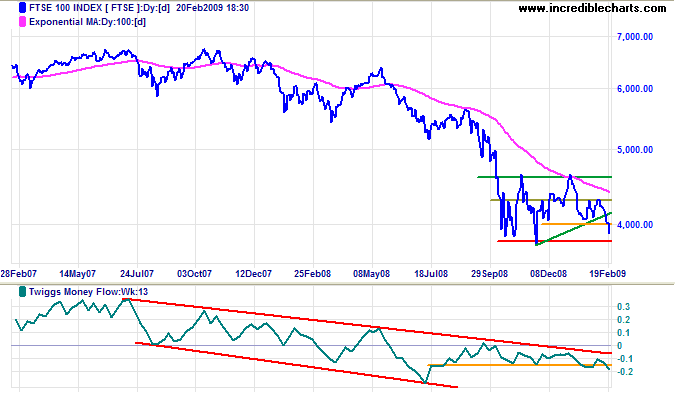

United Kingdom: FTSE

The FTSE 100 is falling sharply, headed for a test of primary support at 3800. Twiggs Money Flow (13-Week) also commenced a swing to the lower trend channel, signaling long-term selling pressure. Failure of 3800 would offer a target of 3000; calculated as 3800 - (4600 - 3800).

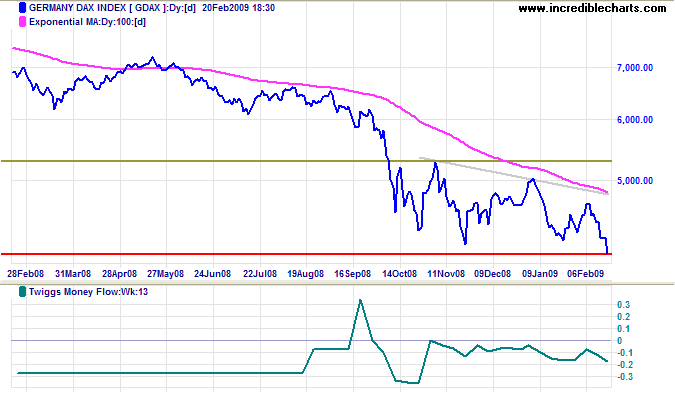

Europe: DAX

The DAX is testing primary support at 4000. Descending peaks and Twiggs Money Flow (13-week) holding below zero warn that downward breakout is likely. The target would be 3000; calculated as 4000 - (5000 - 4000).

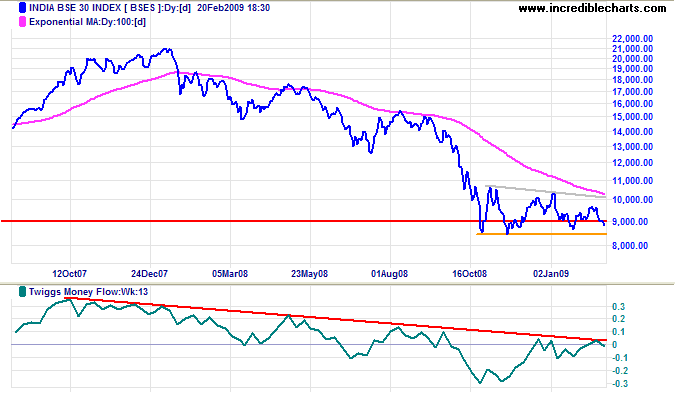

India: Sensex

The Sensex is headed for a test of support at 8500. Again, descending peaks and weak Twiggs Money Flow (13-week) warn that downward breakout is likely. A conservative target would be 7000; calculated as 8500 - ( 10000 - 8500 ).

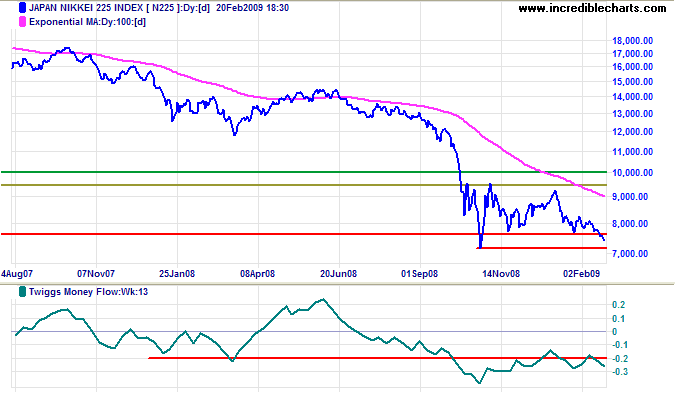

Japan: Nikkei

The Nikkei 225 descended below its April 2003 low of 7600. A bearish sign. Twiggs Money Flow (13-week) reversing below zero signals continued selling pressure. Breakout below 7000 would confirm another down-swing with a target of 5000; calculated as 7000 - (9000 - 7000).

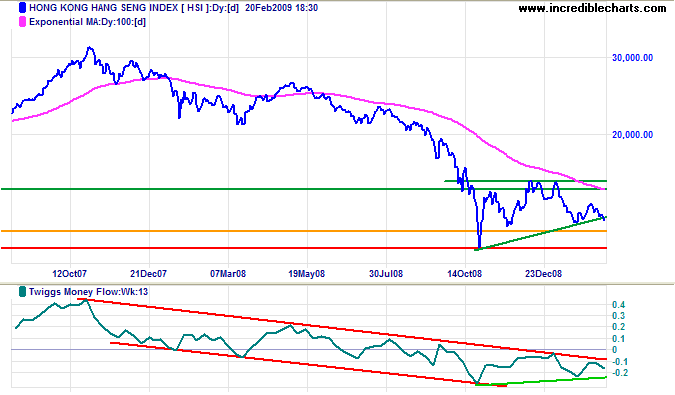

China

The Hang Seng index is testing short-term support at 12500 (orange); failure would warn of a test of primary support at 11000 (red). Twiggs Money Flow (13-week) reversal below zero would indicate continued selling pressure. In the longer term, the primary trend is down and breakout below 11000 would offer a target of 8500, the April 2003 low.

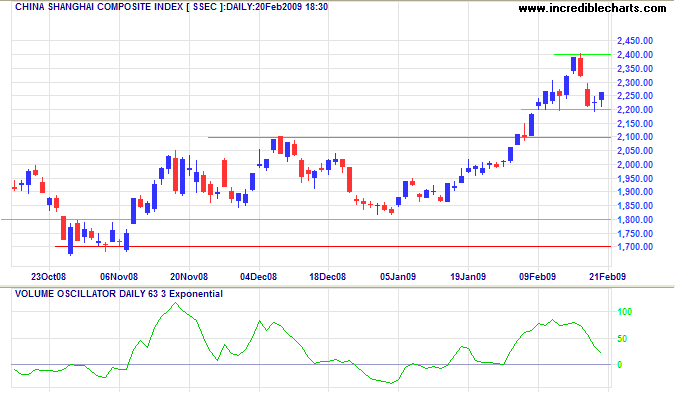

The Shanghai Composite is testing short-term support at 2200, while low volume indicates an absence of buyers. Failure of 2200 would warn of a secondary retracement. Respect of the new support level at 2100 would signal (up) trend strength, while failure of 1800 would reverse to a primary down-trend.

Australia: ASX

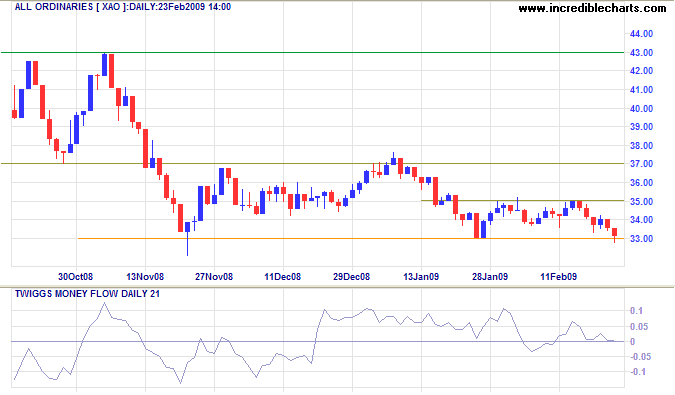

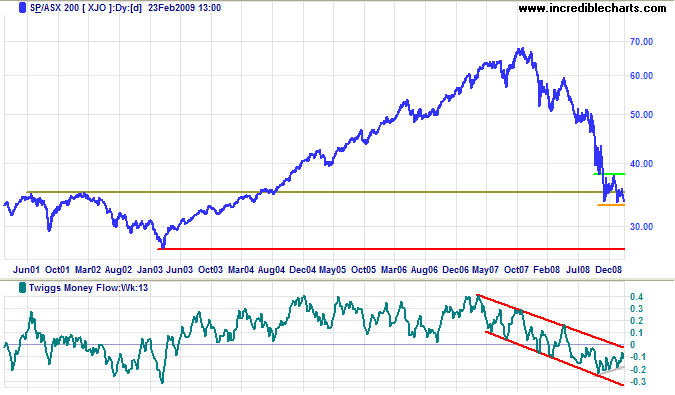

The All Ordinaries is testing primary support at 3300. Failure is likely, given negative sentiment in US and Japan, and would warn of a primary down-swing with a target of 2700, the March 2003 low. Look for the ASX 200 and Twiggs Money Flow (21-Day) breakout below zero to confirm.

The ASX 200 index is similarly testing support at 3350. Failure would target an identical 2003 low of 2700. Twiggs Money Flow (13-Week) respecting the upper trend channel would confirm.

The key thing for the American people to realize is: don't get caught up in all the numbers. Just remember, it's your money.

When politicians spend, they get it from you. And if they say they're going to give you a free lunch, just remember, they're using your credit card, your money......

You're eventually going to be getting the bill.

~ Steve Forbes

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.