Rescuing The Banks

By Colin Twiggs

February 5, 2009 2:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Government plans to set up a "bad bank" to purchase illiquid securities from commercial banks, and warehouse them until the credit crisis has passed, is growing increasingly unpopular. It will be difficult to value the assets when there is no ready market and the cost of setting up such a structure is likely to be high. (Bloomberg) More recent proposals focus on guaranteeing bad assets while leaving them on the bank's balance sheet. Banks would carry the first loss of around 8 to 10 percent on guaranteed assets, with the taxpayer funding any further shortfall. UK banks have run into difficulty with this proposal because Basel II banking regulations require banks to hold 100% capital against any such first loss guarantee. (WSJ) And past guarantees of troubled assets have failed to restore confidence in Citigroup and Bank of America, with both stocks recording further losses.

Governments are also not equipped to manage troubled assets, and banks are only likely to exert themselves while at risk. If the first loss guarantee is ever exercised there is no further incentive for a bank to assist the taxpayer in minimizing losses. The more complex an arrangement is, the more likely that it will result in the mis-use of taxpayer funds. A guarantee, for example, would enhance the value of illiquid bank assets, benefiting stockholders rather than the taxpayer. The simpler the scheme, the greater the transparency — and the less risk of unforeseen losses.

It may be cheaper and more effective to leave illiquid assets on bank balance sheets and to provide further capital to restore solvency. That would avoid any covert subsidy of existing stock- and debenture-holders — and leave an incentive for banks to manage their troubled assets effectively rather than passing the problem on to the unsuspecting taxpayer.

Chinese Recovery

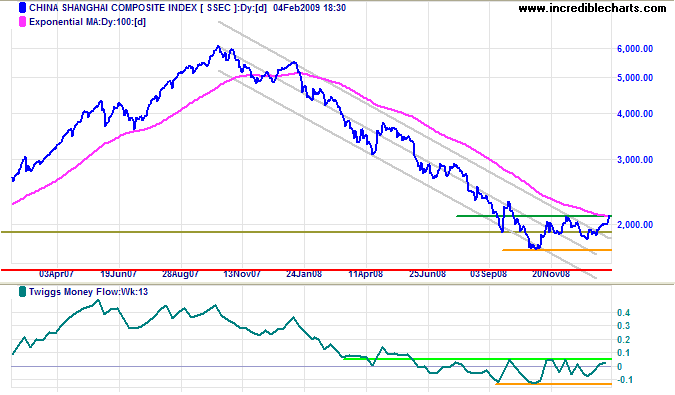

The Shanghai Composite Index broke out from its downward trend channel on the weekly chart, indicating that the primary down-trend is weakening.

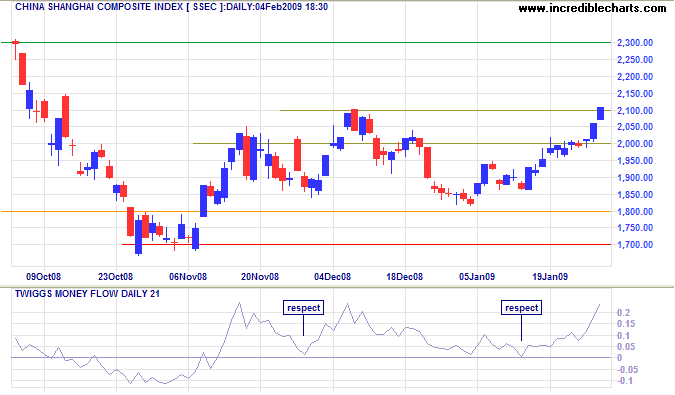

The index has since recovered above its December high, signaling reversal to a primary up-trend, accompanied by a strong surge on Twiggs Money Flow (21-Day). This offers a target of 2400, calculated as 2100 + ( 2100 - 1800 ).

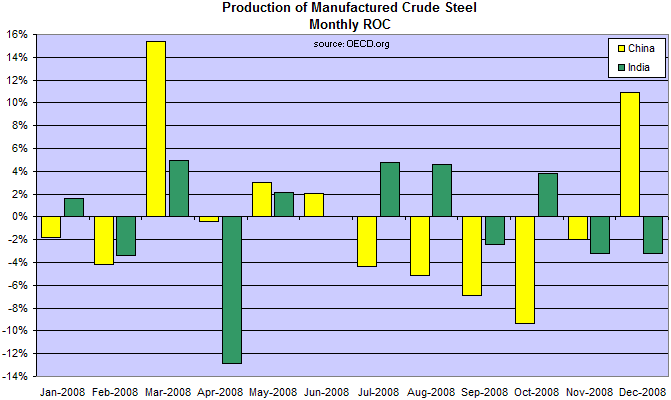

The signal is supported by a December increase in steel production, after 5 months of negative growth.

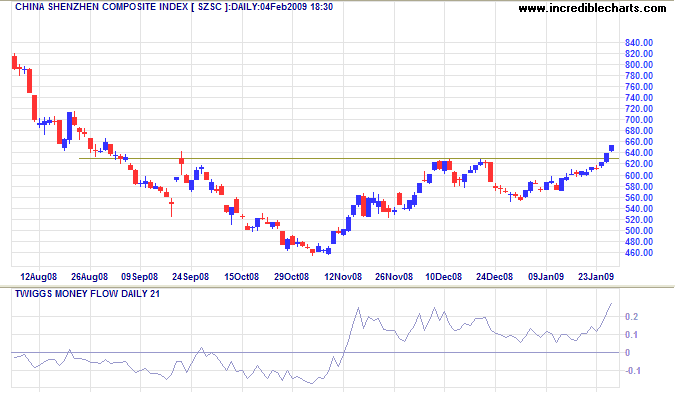

But the Shenzhen Composite Index is ambivalent: the December retracement would not qualify as a secondary reaction — so the primary trend has not reversed.

It would be prudent to wait for confirmation from a retracement that respects the new support level of 2100 on the Shanghai Composite Index.

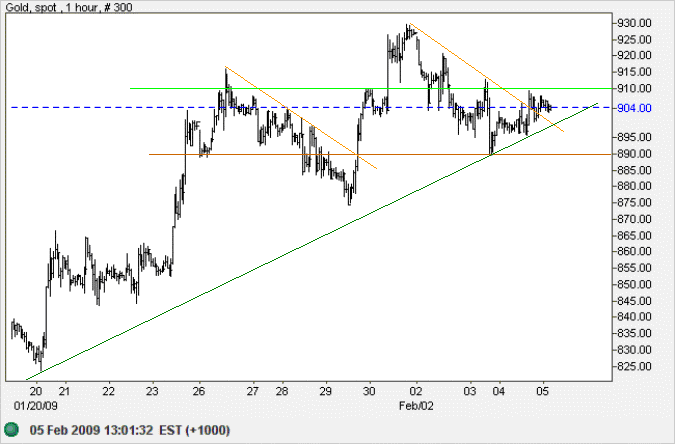

Gold

Spot gold found support at $890 before breaking its short-term downward trendline on the hourly chart. Recovery above $910 would signal another test of $930, while breakout below the rising (green) trendline would warn of a retracement. In the longer term, breakout above $930 would indicate another test of $1000 (medium term) and a long term target of $1200; calculated as 900 + (1000 - 700). Reversal below $800 is unlikely at present, but would warn of another test of $700.

Source: Netdania

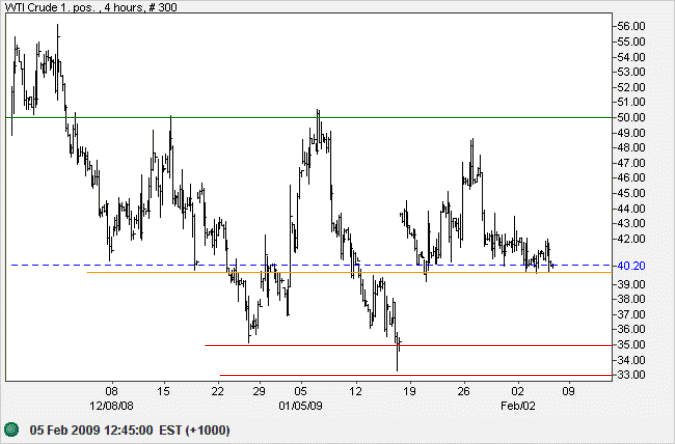

Crude Oil

West Texas Crude is consolidating in a narrow band above $40/barrel on the intra-day chart. Downward breakout is likely, which would test the band of support between $33 and $35. In the longer term, failure of support would offer a target of the 2003 low of $20, calculated as 35 - (50 - 35).

Source: Netdania

Economic Stability

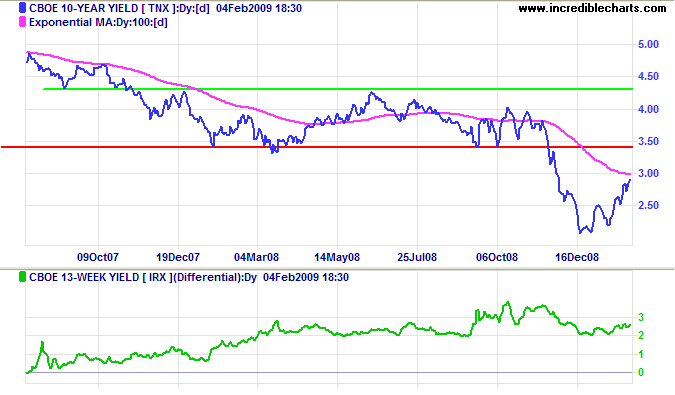

Treasury Yields

Ten-year treasury yields are recovering from their December low, but the primary trend remains downward. Expect resistance at 3.50 percent. The yield differential remains healthy, at above 2 percent. If only the Fed could maintain this level throughout the business cycle — the cycle would pass almost unnoticed.

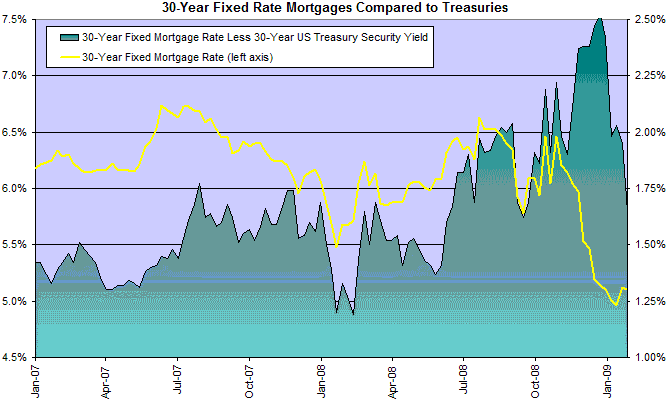

Housing

Fed purchases of mortgage backed securities are driving mortgage rates lower despite the up-turn in treasury yields.

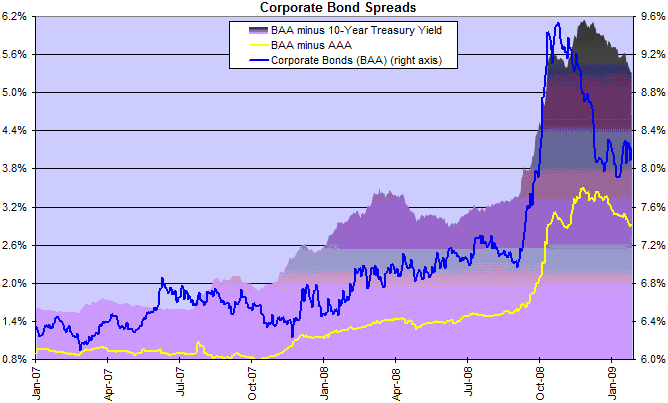

Corporate Bonds

Corporate bond spreads remain high, however, in anticipation of rising defaults.

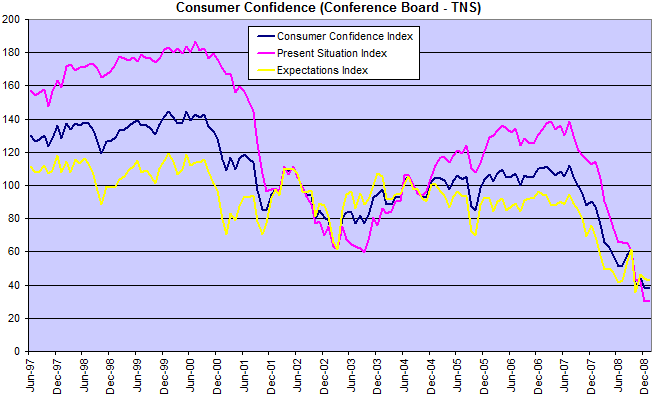

Consumer Confidence

Consumer confidence is one of the keys to unlocking the present downward spiral. Lower mortgage rates, offering support to the housing market, should bolster confidence. The other requirement is clear and unambiguous government action to restore confidence in the banking and corporate sectors.

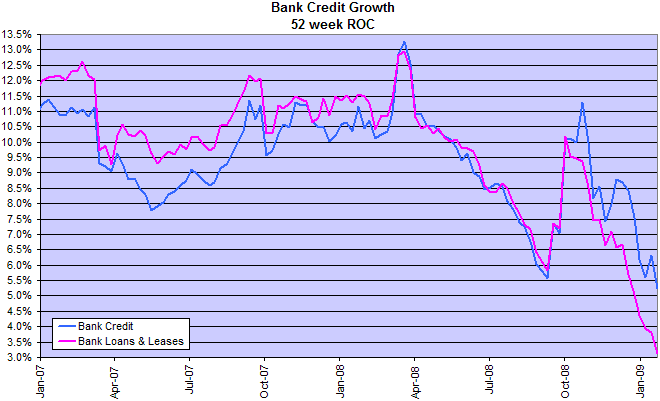

Bank Lending

Bank lending is falling sharply in sympathy with consumer confidence.

Currencies

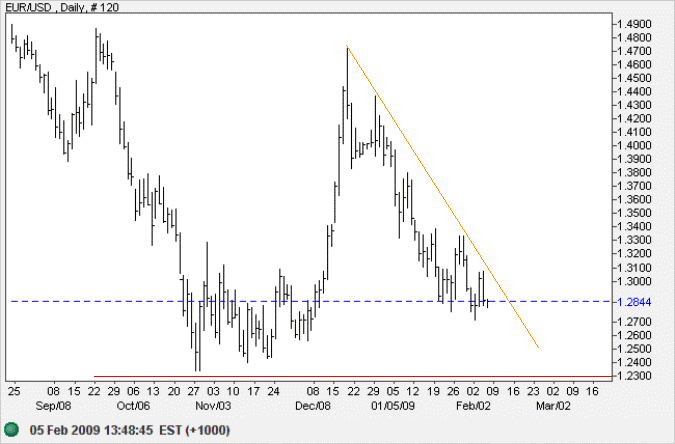

Euro

The euro is retracing toward support at $1.23. A break of the downward trendline would signal buying support — and a low formed above the support level would be a bullish sign. Failure of support, on the other hand, would offer a target of $1.00; calculated as 1.25 - ( 1.50 - 1.25 ).

Source: Netdania

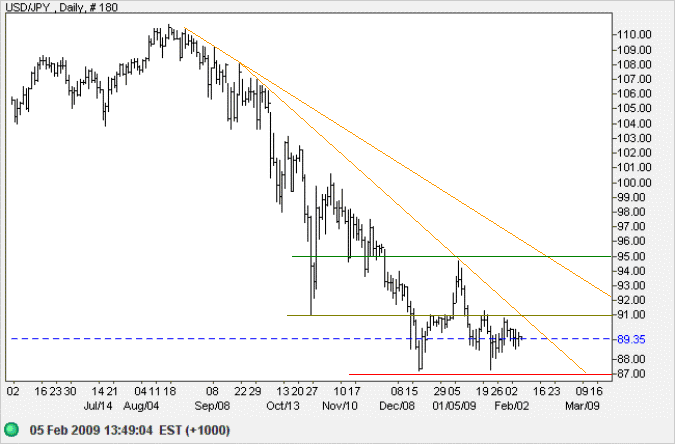

Japanese Yen

The dollar is testing support at 87 against the yen. Failure would test the 1995 low of 80. Recovery above 91 would signal a secondary retracement to test 95.

Source: Netdania

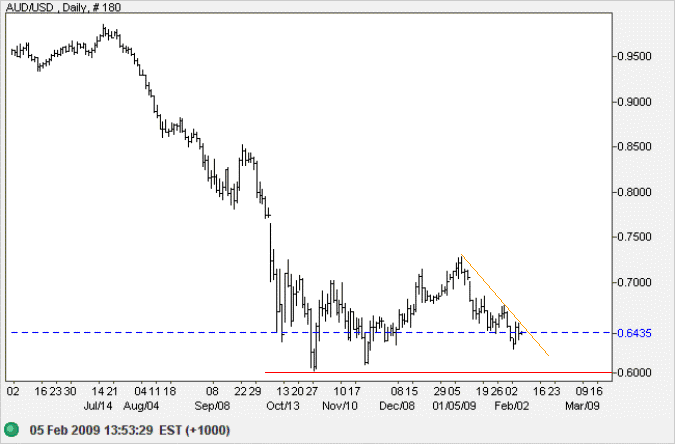

Australian Dollar

Similar to the euro, the Australian dollar is headed for a test of primary support at $0.60. Failure would offer a target of $0.50. A break of the downward trendline while above the support level, on the other hand, would be a bullish sign.

Source: Netdania

The crisis which began in the US sub-prime mortgage market in early 2007 and

then spread broadly and deeply was not the first banking crisis. It was closer to the

100th....... If an

event with widespread and severe economic and social consequences keeps on

repeating itself, the onus is surely on the authorities to change something.

~

ICMB-CEPR Geneva Report: The Fundamental Principles of Financial Regulation

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.