No Stimulus Without Stability

By Colin Twiggs

January 29, 2009 12:15 a.m. ET (4:15 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

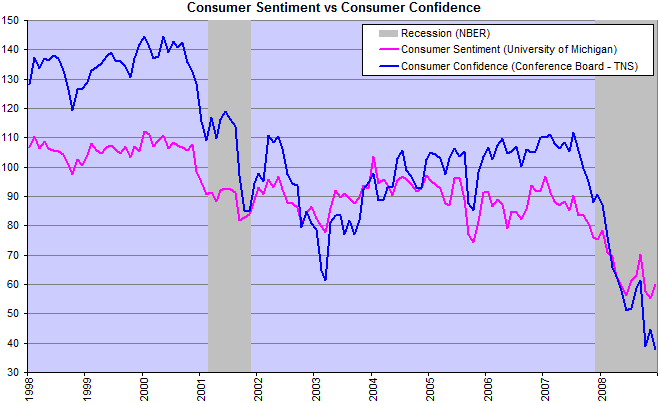

Global leaders are planning capital expenditure programs to promote employment and tax cuts to stimulate consumption. Neither will be effective unless consumer confidence is restored. In 1929 President Hoover implemented similar measures, but with little effect. Confidence had been shaken by the rash of bank failures and soaring unemployment (exacerbated by a commitment to maintain high wages and attendant tariff protection). Consumers increased savings and paid off debt to protect themselves from uncertainty, while business adopted a similar defensive strategy: cutting costs, reducing debt and deferring new capital projects. Their priority was survival.

Herbert Hoover is undoubtedly one of the most capable and business-focused leaders to have graced the White House. A professional engineer with a reputation as an efficiency expert, by the age of 35 he had become financially independent and devoted his life to public service. Serving as Secretary for Commerce under presidents Harding and Coolidge, he earning a reputation for thorough research and a bias for action that made him the obvious successor to Coolidge. Despite this, his efforts to rescue the economy from recession failed dismally.

While Hoover is often blamed for the Great Depression, as Secretary for Commerce he had criticized the Federal Reserve's expansionary (cheap money) policy. His attempts to intervene were thwarted by the independent status of the Fed. Bankers serving on the board of the New York Fed (in those days more dominant than the Federal Reserve Board) resented interference from an outsider. They also sought to preserve the margins enjoyed by borrowing at artificially low interest rates and lending on brokers loans secured by stocks — at call rates between 15 and 20 per cent.

As Secretary for Commerce, Hoover had prepared the economy for a future recession. He planned to smooth out any fall in consumption with increased capital spending programs by federal, state and municipal governments; railroads; and other large corporations over whom he had influence. The increase in capital spending was, however, outweighed by a sharp fall in private sector investment and residential construction. Tax revenues also shrank as the economy declined, restricting further spending. Consumption continued to fall, leading to more business and bank failures, more job losses and declining tax revenues. The downward cycle became self-reinforcing, with the economy only rescued by World War II. Increased war production and, later, conscription helped solve the unemployment problem.

In the present crisis, as in the 1930s, neither business nor consumers are likely to be lured into new capital investment or increased consumption until stability is restored. Stimulus packages treat the symptoms of a recession, but they do not address the underlying cause. Rebuilding confidence requires more effort than increasing government spending and a few media releases. Only when concerns over bank solvency, inflationary monetary policy, ballooning federal debt, business failures and further job losses have been settled are we likely to witness a return to normal consumption and investment patterns. The task requires exceptional leadership as well as a deep understanding of the underlying issues. Otherwise we could end up in a worse position than Herbert Hoover found himself in.

Attempting to stimulate the economy while confidence is this low is like pushing on a piece of string.

Blaming Wall Street

For decades ill-conceived monetary and fiscal policy has insidiously driven investors and consumers into increasingly risky financial behavior. Fiscal deficits and monetary expansion debased the value of most major currencies, with resultant inflation eroding investors capital. Many investors were forced to abandon a conservative investment ethos in favor of speculation based on inflationary gains. Artificially low interest rates compelled others to invest in high risk securities and derivatives in order to derive an adequate income from their capital. Business, seduced by cheap finance and inflationary gains, became fixated on short-term profit growth; while consumers grew overly reliant on cheap finance. All are now bearing the consequences.

While I have little sympathy for investment bankers who risked shareholders capital in order to earn exhorbitant bonuses, they are not the cause of this debacle. Merely a symptom.

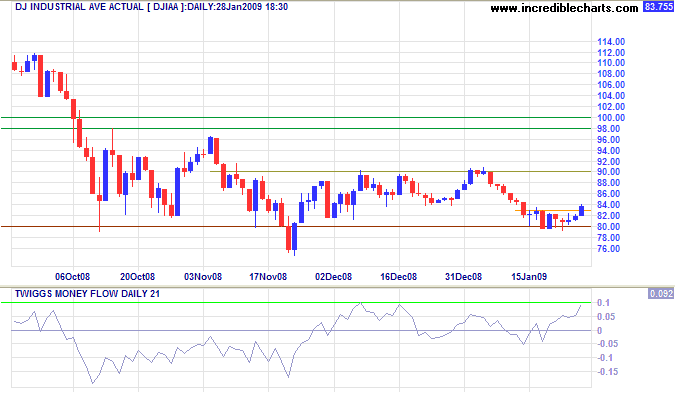

Dow Jones Industrial Average

The Dow respected support at 8000, reversing above 8300 to signal another test of 9000. Twiggs Money Flow retracement that respects the zero line would indicate a secondary rally to test 10000. Long term, the primary trend is down and reversal below 8000 would signal another down-swing with a target of 6000; calculated as 7500 - ( 9000 - 7500 ).

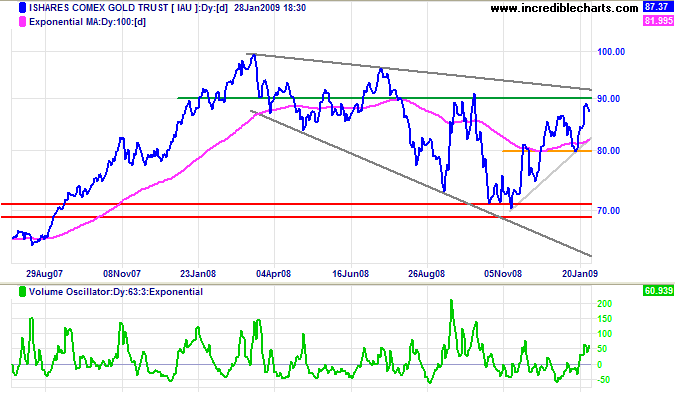

Gold

Spot gold respected resistance at $900; the recent surge in volume signaling selling pressure. The retracement will tell us a lot about the strength of the trend. A weak retracement would signal that upward breakout is likely, which in turn would indicate another test of $1000 (medium term) and a long term target of $1200; calculated as 900 + ( 1000 - 700 ). A test of $800 would mean further consolidation is likely; while failure of this level would warn of another test of $700.

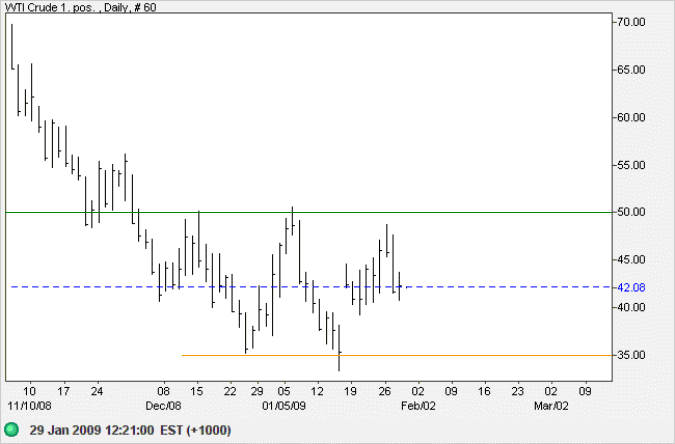

Crude Oil

West Texas Crude is consolidating between $35 and $50/barrel. Shrinking global demand makes another down-swing likely. Failure of support would offer a target of the 2003 low of $20, calculated as 35 - (50 - 35).

Source: Netdania

Economic Stability

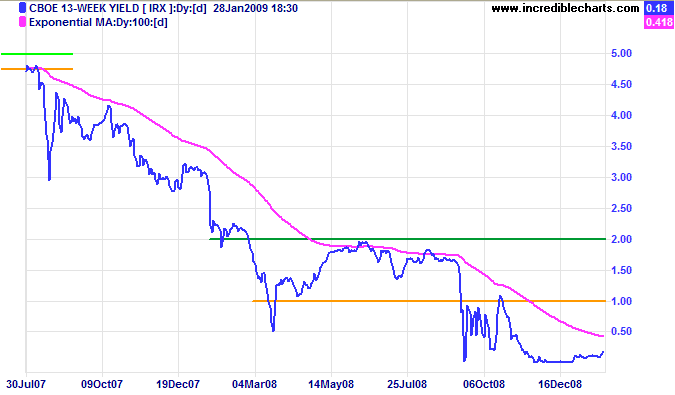

Flight To Safety

Short-term treasury yields remain close to zero, signaling a lack of investor confidence. Investors continue to sacrifice yield in return for safety.

The only way to end this is for banks to volunteer full disclosure of their financial position. And for the taxpayer to provide sufficient capital to restore solvency. Evasiveness does not help: it merely tars all banks with the same brush.

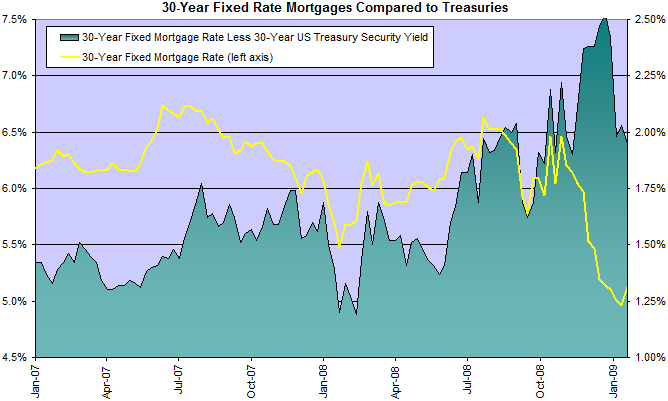

Housing

Fixed mortgage rates are falling in sympathy with treasury yields, but spreads remain high: warning of continued default risk.

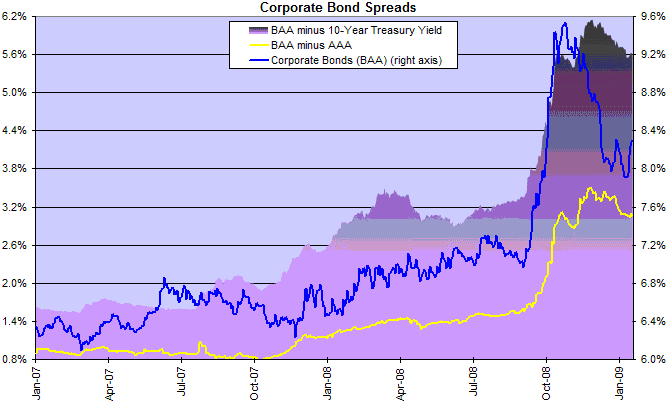

Corporate Bonds

Corporate bonds have similarly fallen in response to lower treasury yields. Again, spreads remain high in anticipation of rising defaults.

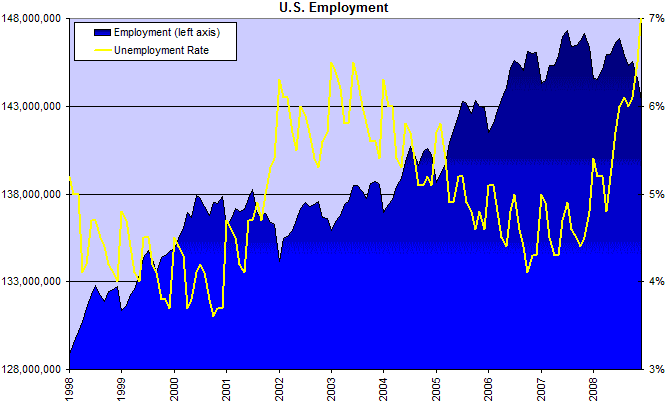

Labor

Unemployment is rising steeply. Every 1 percent increase in unemployment equates too roughly a 2 percent fall in GDP. If we take normalized GDP growth as 3 percent, this would mean that growth has so far fallen to -1 percent.

Currencies

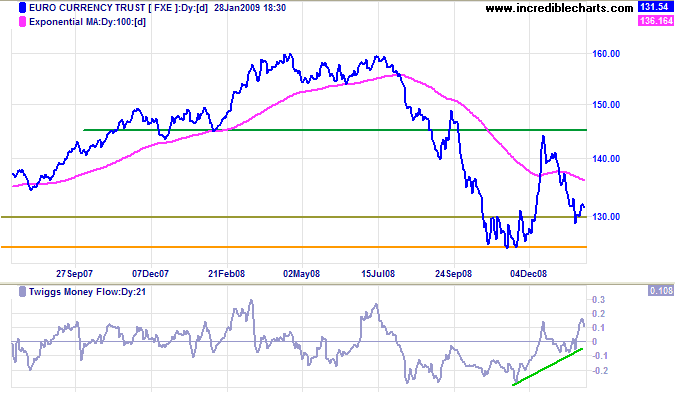

Euro

The euro is retracing to test support at $1.25, but rising Twiggs Money flow signals buying support at $1.30. Respect of this level would be a bull signal, but the primary trend will only reverse if the currency recovers above $1.45. Failure of $1.25 now appears less likely — and would offer a target of $1.00; calculated as 1.25 - ( 1.50 - 1.25 ).

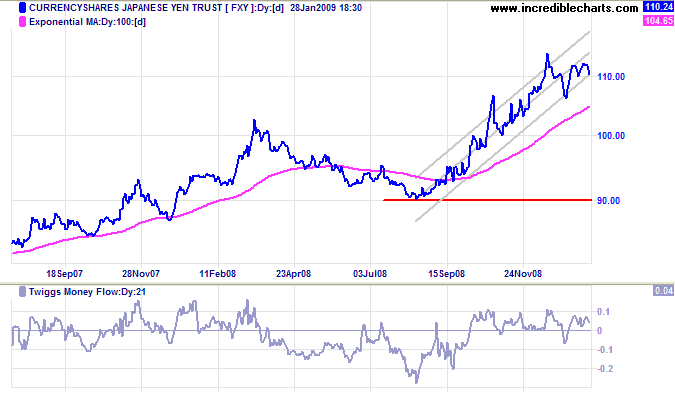

Japanese Yen

The yen enjoyed a strong up-trend over the last few months against the dollar, but is now testing the lower border of the trend channel. Twiggs Money Flow reversal below zero would warn of trend weakness. Primary support is at 90.

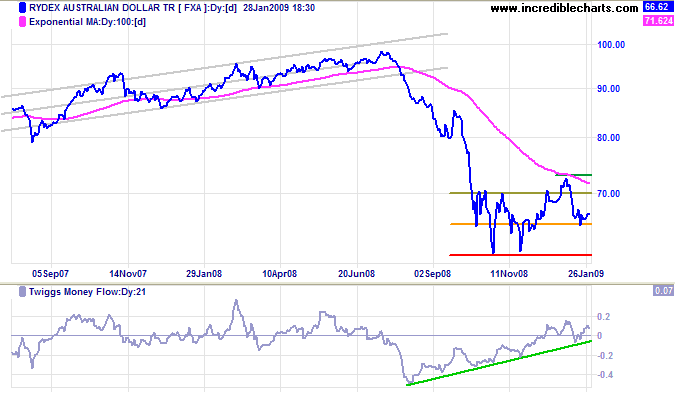

Australian Dollar

The Australian dollar likewise is testing $0.65, with Twiggs Money Flow signaling buying support. Reversal above $0.73 would signal a primary up-trend. Failure of support at $0.60 now appears unlikely and would offer a target of $0.50.

1931 was also a year in which Babe Ruth's earnings as a New York Yankee exceeded the salary of the president of the United States.

Though some citizens saw an incongruity between the rewards for sport and for statecraft,

Ruth pointed out that he had had a better year.

~ William J. Barber, From New Era to New Deal

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.