Dow at 8000

By Colin Twiggs

January 22, 2009 7:00 p.m. ET (11:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

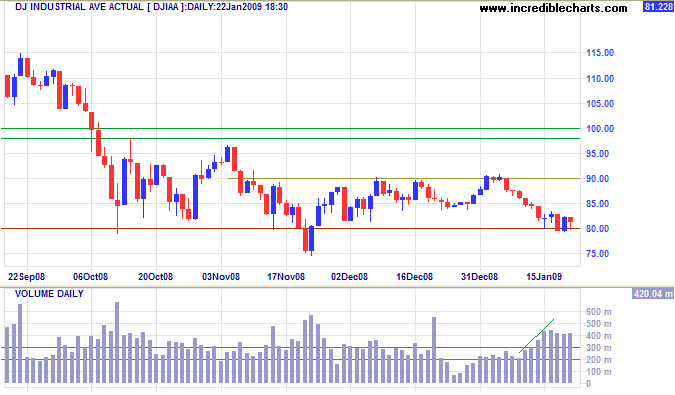

Dow Jones Industrial Average

The Dow is testing support at 8000, with rising volume indicating buying pressure. Respect would signal another test of 9000, while failure would warn of a primary down-swing. In the longer term, expect further support at the November low of 7500; but the target is 6000: 7500 - ( 9000 - 7500 ).

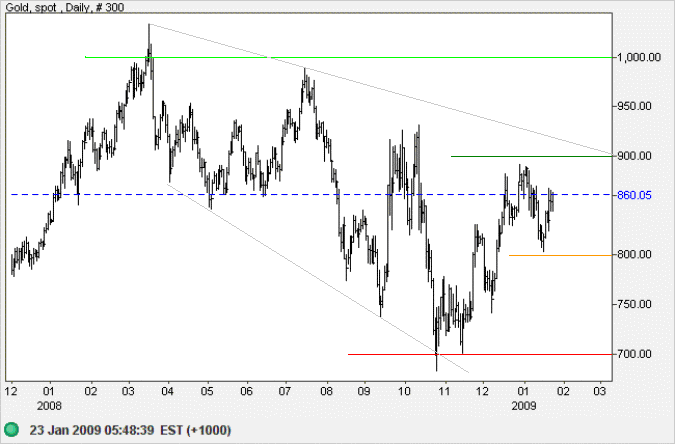

Gold

Spot gold is headed for another test of $900, close to the upper border of the long-term descending wedge formation, and resistance is likey to be stronger. Breakout would signal the start of a new (primary) up-trend — but wait for confirmation from a retracement that respects the new support level ($900). Failure to breach resistance remains as likely, however, and would signal another test of support at $800.

Source: Netdania

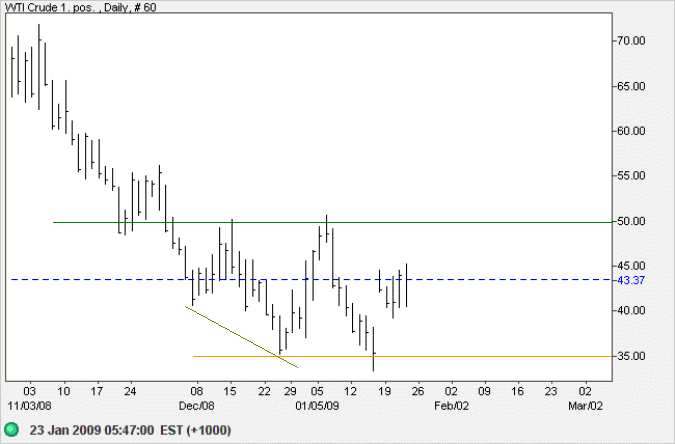

Crude Oil

West Texas Crude is headed for another test of resistance at $50/barrel. Shrinking global demand is likely to lead to retracement to test support at $35. Failure of support would offer a target of the 2003 low of $20/$25, calculated as 35 - (50 - 35).

Source: Netdania

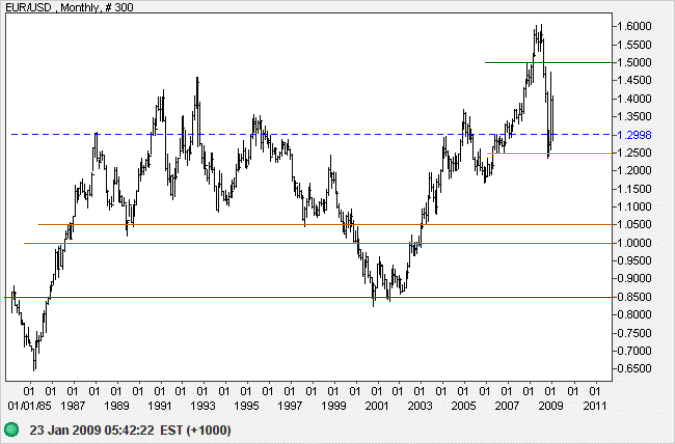

Currencies

Euro

The euro is retracing to test support at $1.25. Failure would offer a target of $1.00 as shown on the monthly chart below, and calculated as 1.25 - ( 1.50 - 1.25 ). The primary trend is uncertain and respect of support would signal another test of $1.45/$1.50.

Source: Netdania

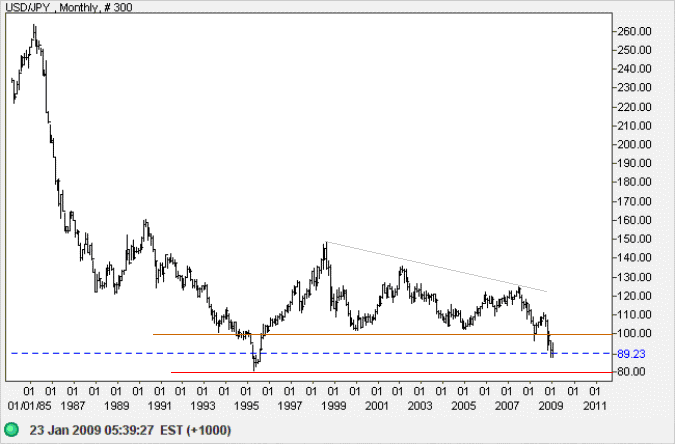

Japanese Yen

The dollar continues in a primary down-trend against the yen, headed for a test of the 1995 low of 80.

Source: Netdania

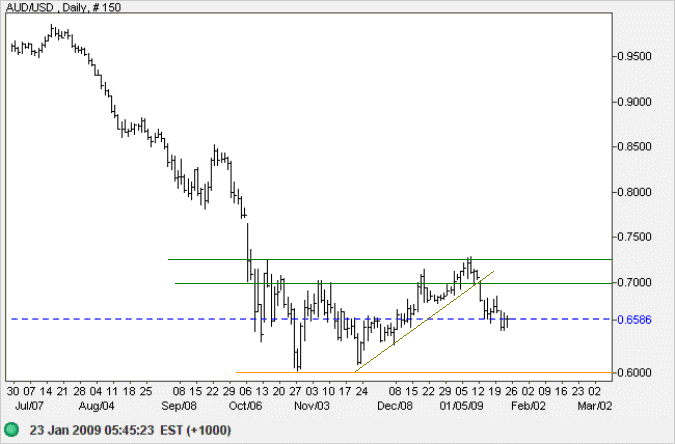

Australian Dollar

The Australian dollar is retracing for another test of support at $0.60. Failure would offer a target of $0.50, while respect of $0.60 would be a bullish sign.

Source: Netdania

If a man is proud of his wealth, he should not be praised until it is known how he employs it.

~ Socrates

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.