What Is Seen and What Is Not Seen

By Colin Twiggs

December 9, 2008 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Cape Town

I am travelling to Cape Town, South Africa, on Thursday and my newsletters over the next six weeks will be irregular and brief. One of the world's most beautiful cities, Cape Town is a must visit on any travellers itinerary. Unfortunately, like Rio, it is surrounded by immense poverty and social problems that in the long term threaten to engulf it. It is ten years since my last visit and I hope that it has not lost that unique blend of French, Dutch, Malay and English culture that make it such a special place.

Take care during the holidays and I wish you both spiritual and economic enlightenment in the year ahead.

What Is Seen

Frederic Bastiat's 19th century Ce qu'on voit et ce qu'on ne voit pas — that which is seen and that which is not seen — suggests that we should examine not only the visible effects of government actions but also the hidden consequences.

Broken Window

He uses the example of a shopkeeper whose son has broken a window. While the shopkeeper bemoans his loss, passersby console themselves that at least some good will come of it: the glazier has to earn a living and will be called to repair the window. Bastiat points out the fallacy of this thinking. The shopkeeper will part with 6 francs to repair the window — and has to forego the purchase of a pair of shoes or a book that he would otherwise have made. What is hidden is the cost to the cobbler who does not sell a pair of shoes — or the cost to the bookseller who does not sell a book. Also the tanner does not sell leather nor do the printer and author receive any income from sale of the book.

Government spending inevitably has a visible benefit and a hidden cost. We always need to examine the hidden consequences. Is there a cobbler who loses his livelihood while we create work for glaziers? And what will happen when the intervention ceases: are we going to have a large number of unemployed glaziers — who took up the trade because work was available?

Dig a bit further and we find more hidden consequences. The price of glass rises because of increased demand for window repairs, making construction of new shops more expensive. If we extend this analogy to other input costs, demand for new shops would fall, causing a loss of livelihood to shop-builders, shopkeepers and shop assistants.

On the other hand, if the shopkeeper had intended to invest in a new soda machine, rather than shoes or a book, he may now have to forego the purchase. And will no longer need to employ an additional shop assistant to operate the soda machine. So there would be less employment for both the makers of soda machines and for shop assistants.

So when journalists write of government's bold new stimulus package, they look no further than the visible benefits and ignore the hidden costs. If a bridge it to be built, construction workers and steelmakers will no doubt benefit — like the glazier in Bastiat's example. But there are hidden costs. The price of steel and construction wages will be higher, discouraging private investment. If the funds are to be borrowed in the marketplace, that will restrict funds available for private investment. And what will happen to unemployment when the bridge is completed?

The key to recovery is sustainable investment — not temporary jobs.

Welfare Spending

If you give a man a fish he will have a single meal.

If you teach him how to fish, he will eat all his life.

~ Kuan-tzu, Taoist philospher (7th century BC).

This popular proverb glosses over the likelihood that if you give a man a fish, he will return the next day for another one. And if you continue to feed him, in a few years he will return with his wife and several children and explain that it is unfair that you only give him one fish as he has so many mouths to feed, while you have so few. I am not against welfare. It plays an important role, not only in feeding the poor but in strengthening the bonds of society. But we must take care to avoid a culture of entitlement. Where welfare becomes self-perpetuating — and the problem grows exponentialy.

Gold

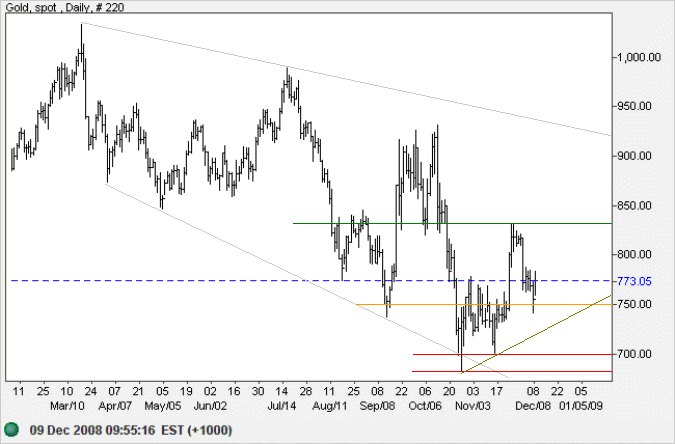

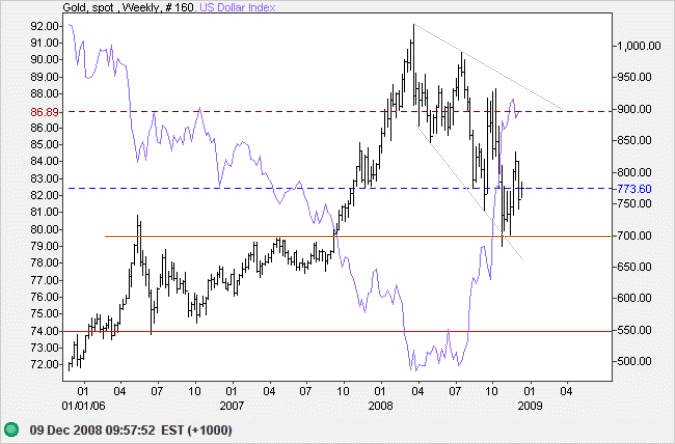

Spot gold made a failed break through short-term support at $750 and is now rallying to test resistance at $830. Breakout would test the upper border of the long-term broadening descending wedge formation, while respect would mean another test of $750.

Source: Netdania

In the long term, breakout above the broadening descending wedge formation would offer a target of 1200; calculated as 900 + (1000 - 700). Failure of support at $700 would signal a test of the June 2006 low at $550. The US Dollar Index continues to strengthen, suggesting gold weakness.

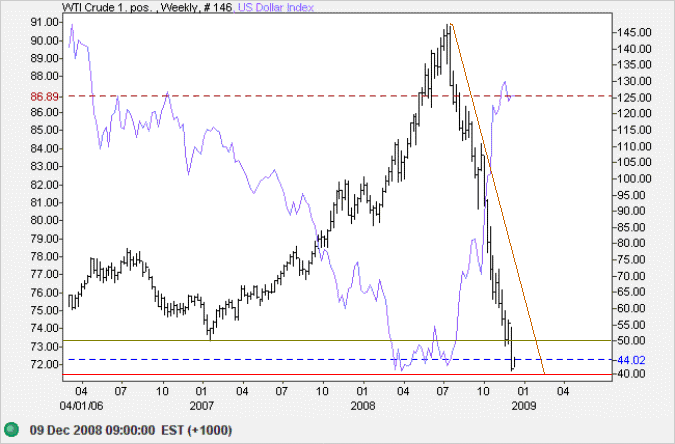

Crude Oil

West Texas Intermediate Crude is testing primary support at $40/barrel. Expect retracement as far as $50. Failure of support would signal a test of $20, the 2002 low.

Source: Netdania

Currencies

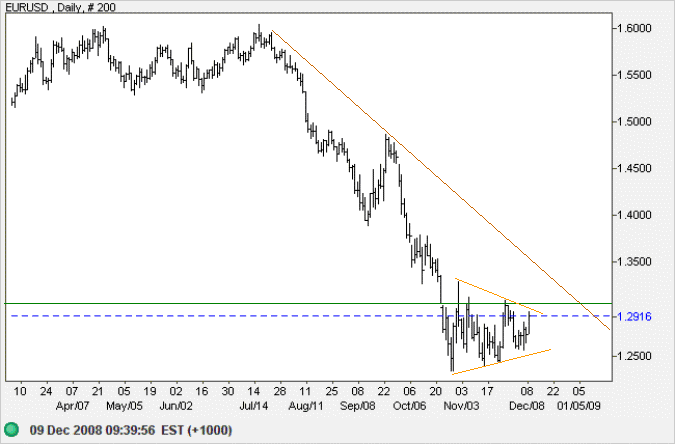

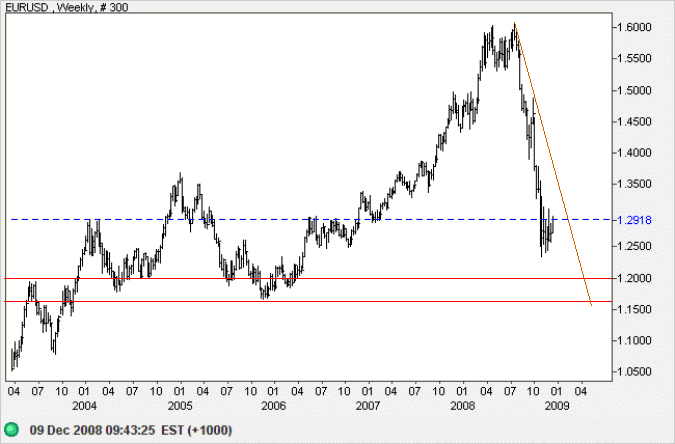

Euro

The euro is consolidating between $1.25 and $1.30, roughly in the form of a symmetrical triangle. Upward breakout would signal a bear market rally with a target of $1.35, while downward breakout would test the 2005 low of $1.16.

Long term, failure of support at $1.16 would offer a target of parity. Calculated as 1.15 - (1.30 - 1.15).

Source: Netdania

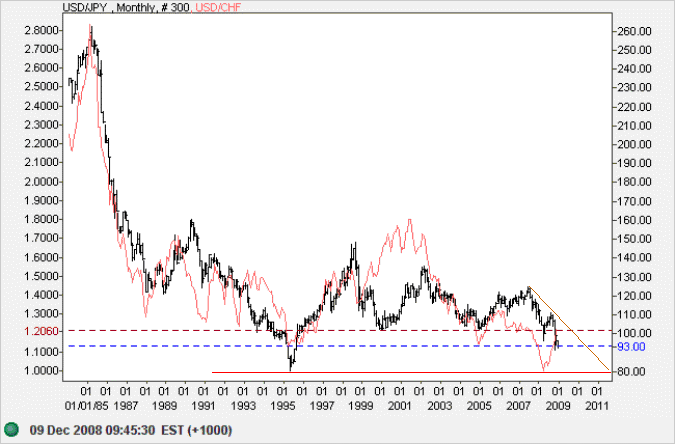

Japanese Yen

The dollar is weakening against the yen. The primary down-trend offers a target of 80, the 1995 low.

The swiss franc displays similar long-term appreciation against the greenback. The Swiss, like the Japanese, are net lenders in the international market, so recent weakness is out of character and may relate to excessive bank leverage or exposure to troubled assets.

Source: Netdania

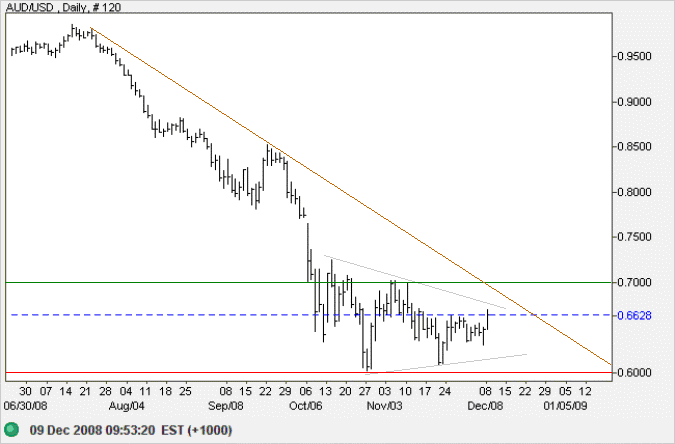

Australian Dollar

The Australian dollar is consolidating in a symmetrical triangle between $0.60 and $0.70 against the greenback. The RBA is attempting support at $0.60; so downward breakout would signal strong selling pressure and may overshoot the target of $0.50. Upward breakout is unlikely considering falling commodities prices, but would signal retracement to $0.80.

Source: Netdania

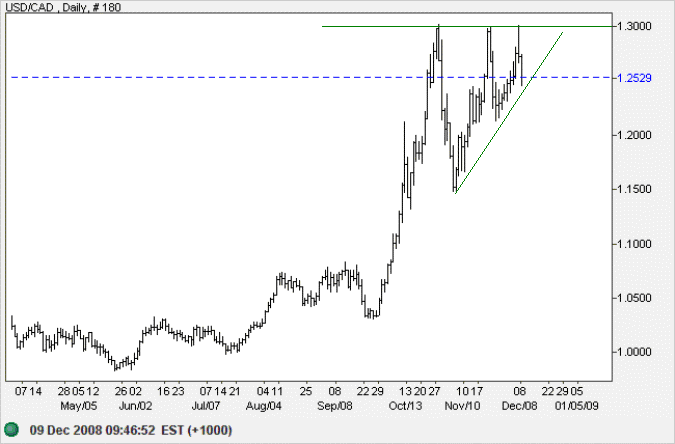

Canadian Dollar

The greenback strengthened sharply against the Canadian Dollar, forming a bullish ascending traiangle. Breakout above 1.30 would offer a target of 1.45; calculated as 1.30 + (1.30 - 1.15). Reversal below 1.20 would be bearish.

Source: Netdania

The unexamined life is not worth living.

~ Socrates

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.