Nationalizing The Banks

By Colin Twiggs

November 27, 2008 1:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

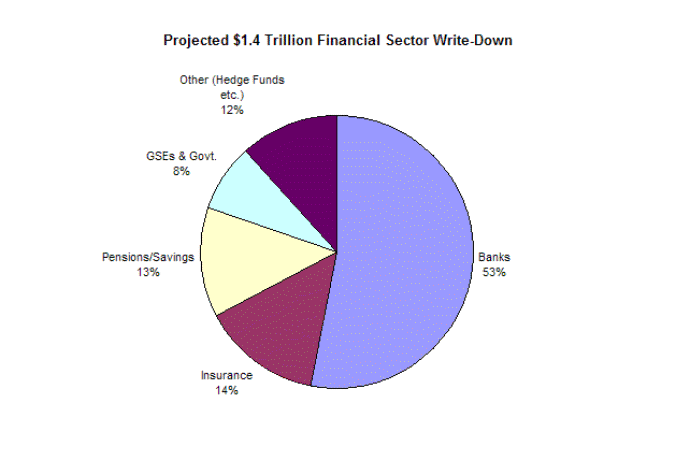

The IMF's October Global Financial Stability Report projected US write-downs for the current financial crisis at $1.4 trillion, of which banks will carry $700 to $800 billion. Far more than write-downs reported so far. The subsequent bail-out of Citigroup, with the Fed underwriting $306 billion of troubled assets, suggests that the final write-down figure may be significantly higher.

Considering that capital and reserves of FDIC-insured institutions were just over $1 trillion at the start of the crisis, the banking sector will need to replace its entire capital base by the time this is over. Private equity is too expensive, with the market hammering financial stocks, leaving the taxpayer as the last remaining source of funds. Restoring stability is essential if we are to avoid the mother of all recessions, but it is important that the taxpayer be adequately rewarded for funding the bailout. At venture capital rates of return.

Flight To Safety

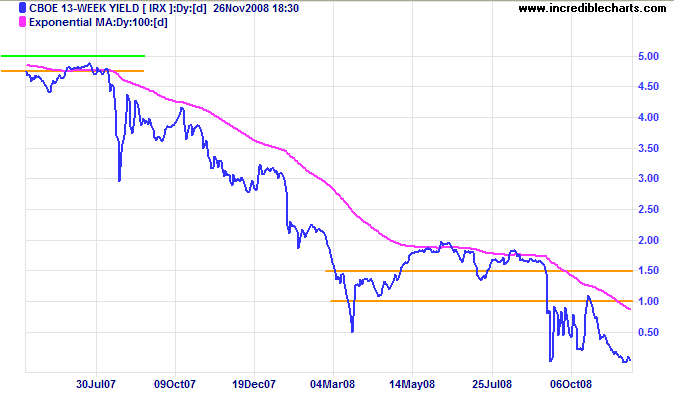

Confidence in bank solvency remains spectacularly low. Short-term treasury yields close to zero indicate that investors are prepared to sacrifice yield in return for safety.

The only way I can see this ending is if the financial sector quits arguing about the applicability of fair value accounting and writes down troubled assets to zero. Then the taxpayer provides truckloads of new capital to restore their balance sheets. Not something that existing shareholders will readily agree to, unless they stand to benefit from the eventual recovery in troubled asset values. Nor something that taxpayers will wholeheartedly support, but decisive action needs to be taken before the contagion does further damage to Main Street.

Treasury Yields

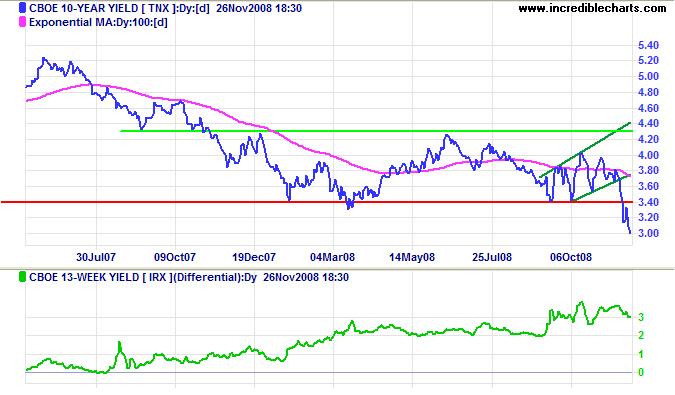

Ten-year treasury yields broke through support at 3.40 percent, offering a long term target of 2.50 percent; calculated as 3.4 - ( 4.3 - 3.4).

The Shadow Banking System

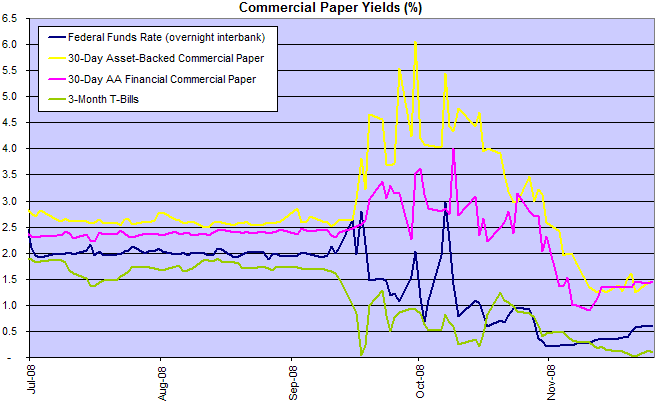

Deleveraging is expected to continue, with investors withdrawing from the commercial paper market, corporate bonds, reverse repos, money market funds, hedge funds and any other financial instrument that does not carry a treasury or FDIC guarantee.

The effective fed funds rate at 0.50 percent continues to point to another rate cut.

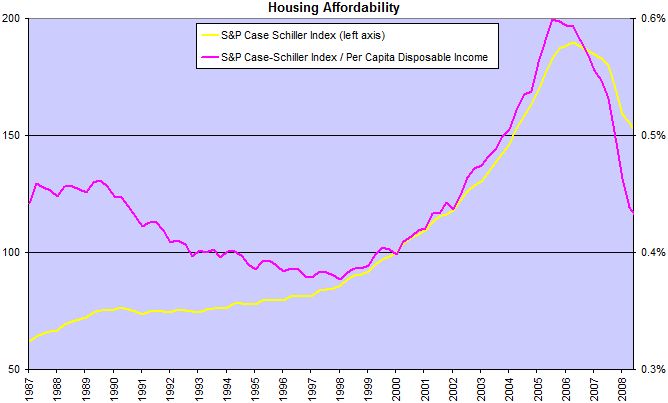

Housing

House prices continue to fall, according to the Case Shiller Index, but still have further to go when we compare the index to per capita disposable income.

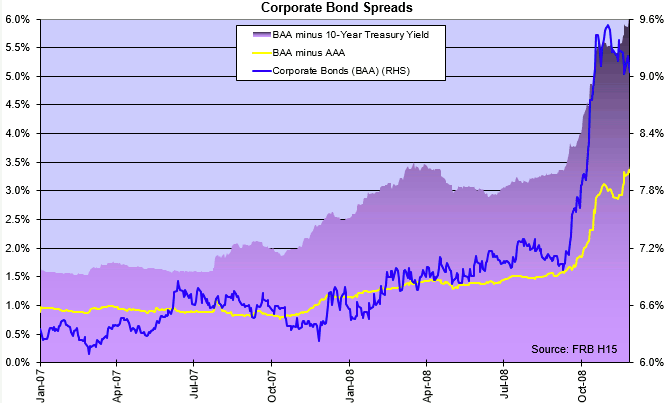

Corporate Bonds

While treasury yields are falling, corporate bond yields are headed in the opposite direction — in anticipation of rising defaults. Underlining the need for a quick resolution to the banking crisis.

The steps that we have taken to make the markets more attuned to our investment desires

— the ability to trade quickly, the integration of financial markets into a global whole,

ubiqutous and timely market information, the array of options and other derivative instruments

— have exaggerated the pace of activity and the complexity of financial instruments

that make crises inevitable. Complexity cloaks catastrophe.

~ Richard Bookstaber: A Demon Of Our Own Design

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.