Another Down-Swing

By Colin Twiggs

November 20, 2008 5:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

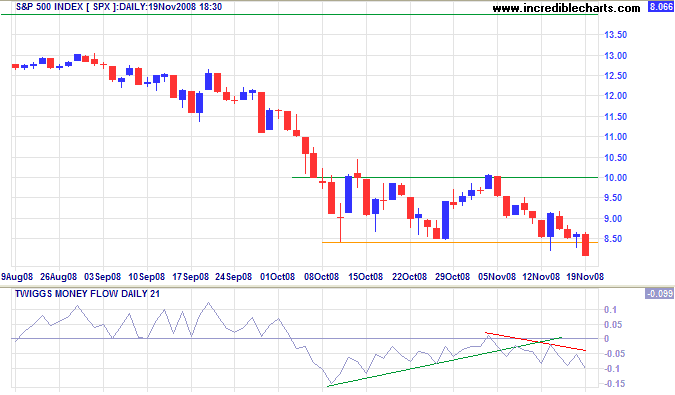

The S&P 500 index broke through support at 840. Expect further support between 800 and 780, the 2002 low — and 50 percent retracement level. The calculated target is lower, however, at 700. That is 850 - (1000 - 850). The Twiggs Money Flow peak at zero indicates strong selling pressure. The Dow and Nasdaq 100 also broke their support levels, signaling a similar down-swing.

Country Risk

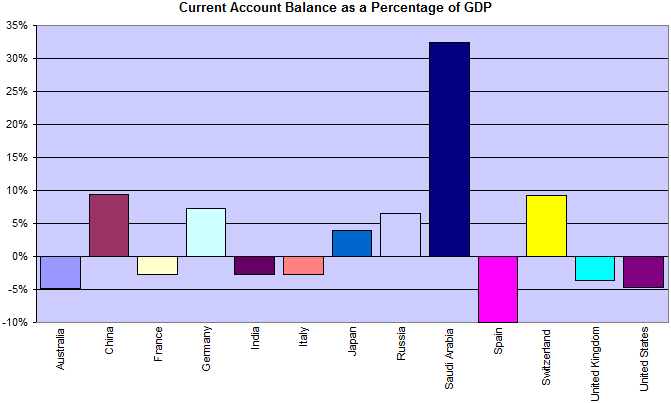

The latest IMF forecasts reveals countries that are living beyond their means. The Saudis are in by far the strongest financial position, investing more than 30 percent of GDP in offshore loans and securities. The next tier includes China, Japan and Switzerland. All show healthy trade surpluses and should see their currencies appreciate if this continues. Spain and Greece (not shown) are in real trouble, with deficits of 10 percent or more; while Australia, the UK and US are in an uncomfortable position, with deficits approaching 5 percent of GDP.

The impact of a current account deficit in any one year is not significant, but continued deficits are generally unsustainable in the long term — especially where funded by offshore borrowings. I say generally, because there is a possible exception, highlighted by Ricardo Hausmann and Federico Sturzenegger in 2005. The US has run up current account deficits for almost 30 years, but appears unaffected. A possible explanation is that it is a large exporter of know-how. For example, Intel may build a new plant in Thailand at a cost of $300 million. Given the know-how provided by Intel, the asset created may generate an income far in excess of the debt servicing costs, and be worth say $1 billion — but the investment is only valued at the original cost. In effect a hidden asset of $700 million.

Treasury Yields

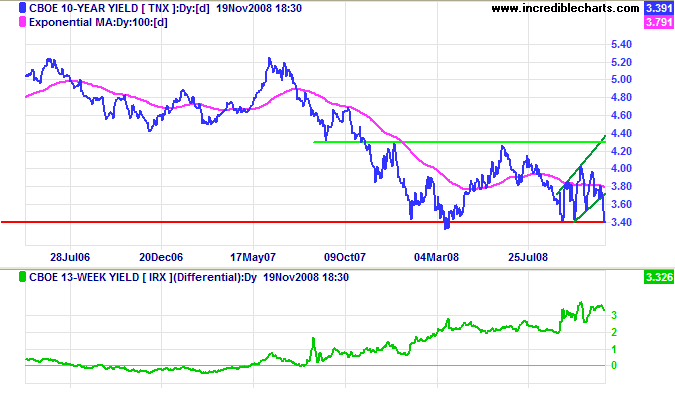

Ten-year treasury yields fell sharply to 3.40 percent. Downward breakout would offer a target of 2.50 percent, calculated as 3.4 - ( 4.3 - 3.4).

I was interested to read a recent comment that the shallow inversion of the yield curve in 2006/2007 indicates a shallow US recession ahead. What has not been taken into account is that the lag between the start of the inversion and the subsequent recession is a lot longer than the typical 6 to 9 months. That is because banks were securitizing assets to compensate for the margin squeeze — increasing their leverage way past prudent limits. They not only succeeded in postponing the inevitable recession, but also amplified it into a once in a lifetime event.

Flight To Safety

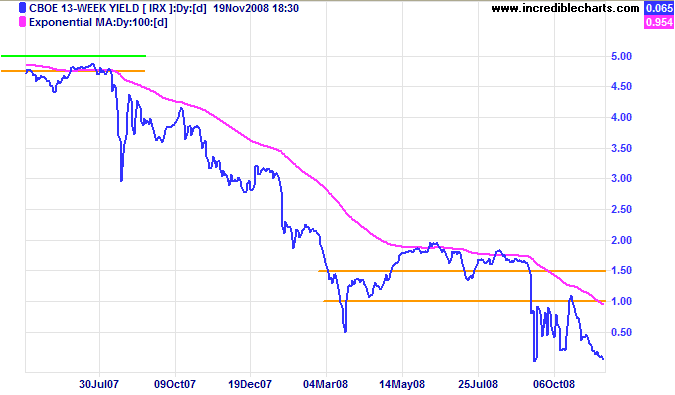

Short-term treasury yields are close to their all-time low of 0.10 percent, indicating that investors are seeking safety over yield. Market confidence remains at a low ebb.

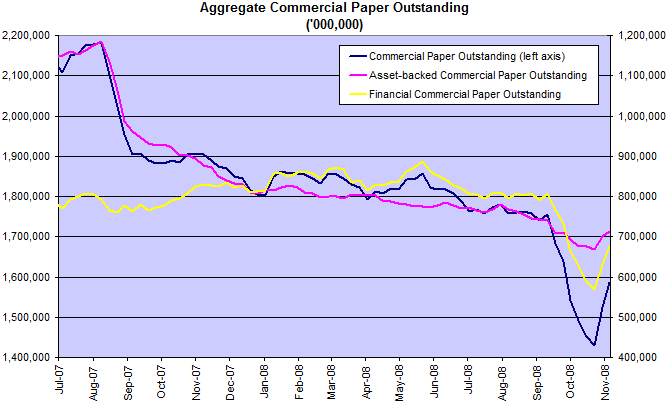

The Shadow Banking System

Commercial paper in issue contracted by roughly $800 billion before Fed intervention, but that is only the tip of the iceberg. A far bigger threat is the expected contraction of hedge fund investments by a similar amount, as investors flee to safer ground. The difference is that hedge funds are leveraged. If we assume a leverage ratio of 2.5 times, then a $800 billion contraction of investor funds would require a $2 trillion reduction in hedge fund assets.

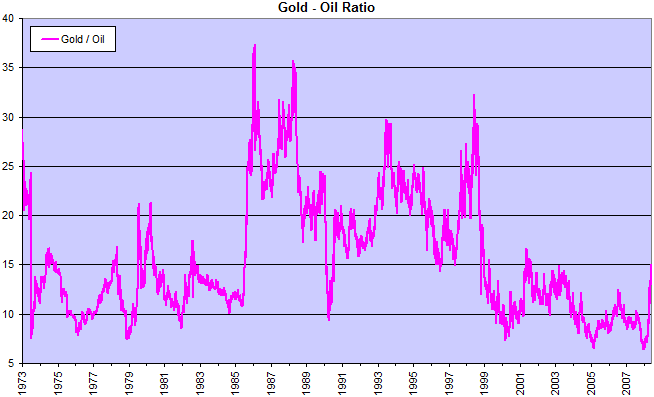

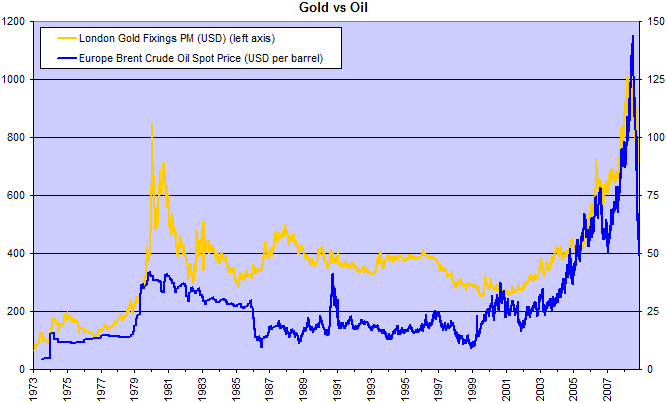

The Gold-Oil Ratio

The Gold-Oil ratio is rising as oil prices fall faster than gold. Beware of taking this as a buy signal.

Previous buy signals were generated when the oil price rose faster than gold, warning that excess oil profits would soon drive up the price of gold. This time oil profits are likely to go negative as the price falls — increasing selling pressure on gold as oil producers liquidate their earlier surpluses to maintain current expenditure levels.

Deflation is another threat. Falling price levels would increase demand for appreciating monetary assets and reduce demand for gold.

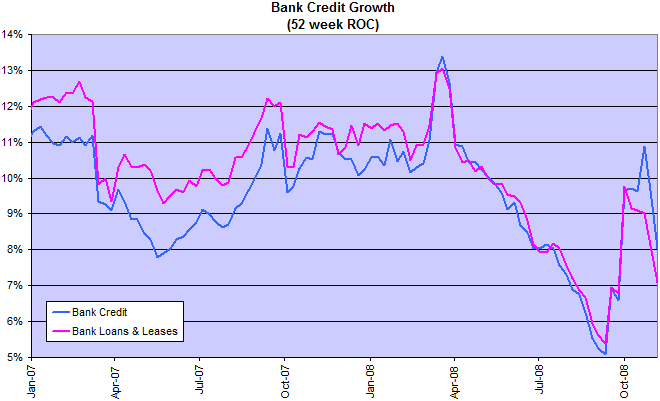

Banks

Bank credit growth is slowing, but even these figures are deceptive. A large portion of new bank lending is merely replacement of credit withdrawn from the shadow banking sector.

Consumers

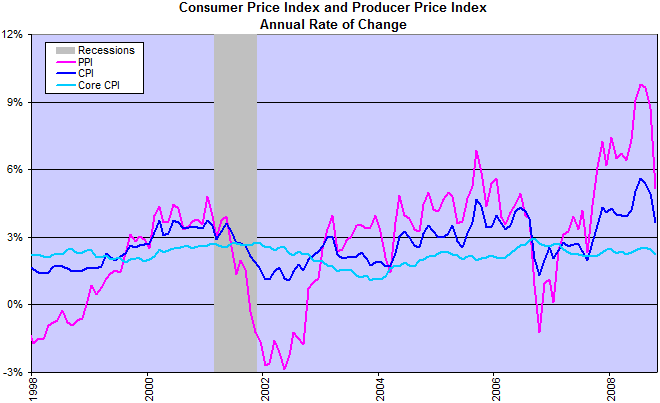

The sharp fall in the Producer Price Index (PPI) and Consumer Price Index (CPI) evoked a rash of announcements that deflation has arrived. When we look at core CPI, however, which excludes food and fuel costs, the down-turn is less dramatic. Most of the recent spike in PPI and CPI is attributable to the hike in oil prices — and likewise the latest fall.

There are two conflicting forces at work: the contraction following the massive credit bubble; and the Fed creating new money in a frantic attempt to offset the deflationary effect of the contraction. As powerful as the Fed may be, they are unlikely to reverse the outgoing tide.

We must always remember that America is a great nation today not because of what government did for people

but because of what people did for themselves and for one another.

~ Richard Nixon

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.