Interbank Lending Remains Under Pressure

By Colin Twiggs

October 29, 2008 4:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

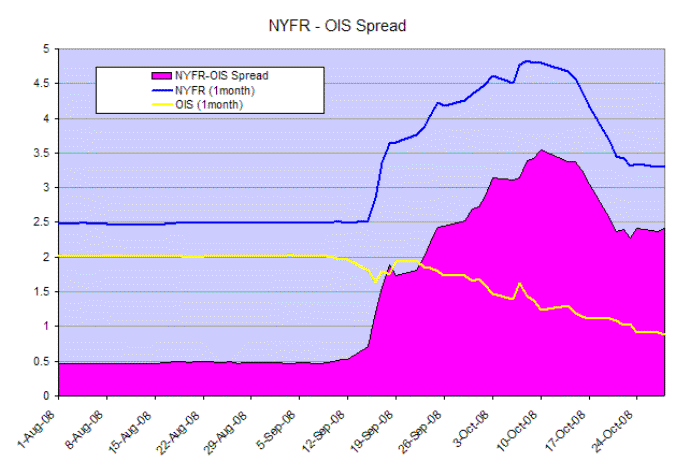

The 1-month NYFR-OIS spread remains elevated at close to 250 basis points, showing continued concern over defaults in the inter-bank market. The ICAP New York Funding Rate is an alternative to LIBOR that is less open to manipulation and indicates the rate at which banks are prepared to lend to each other in the open market. The Overnight Index swap rate reflects traders' best estimates of the effective fed funds rate — pointing at a 50 basis point rate cut.

Treasury Yields

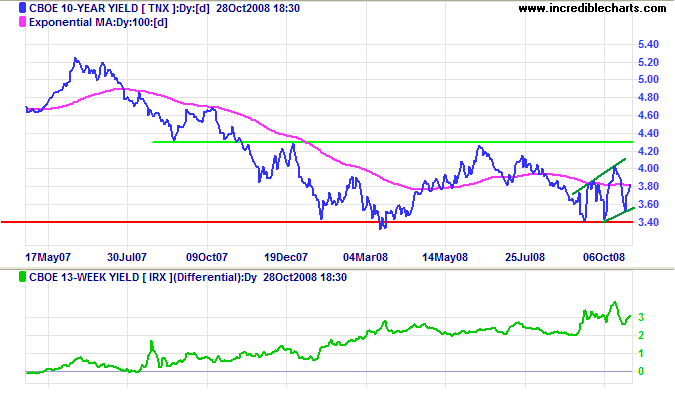

Ten-year treasury yields are headed for a test of resistance at 4.30%, but the ascending broadening wedge is a bearish formation, warning of further weakness. Rising yield differentials are probably the only healthy sign for the banking sector: boosting bank margins.

When Is A Bank Not A Bank?

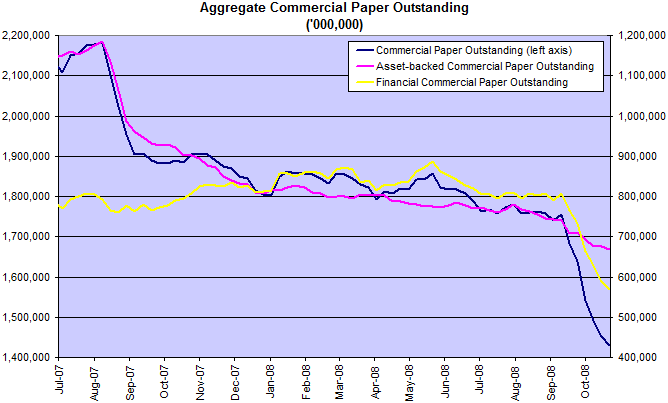

The $10 trillion shadow banking system continues to unravel. Commercial paper finance, for instance, has contracted by almost $800 billion in the last year. Investors are now risk averse. Expect a similar outflow from money market funds, hedge funds and other high-yield investments.

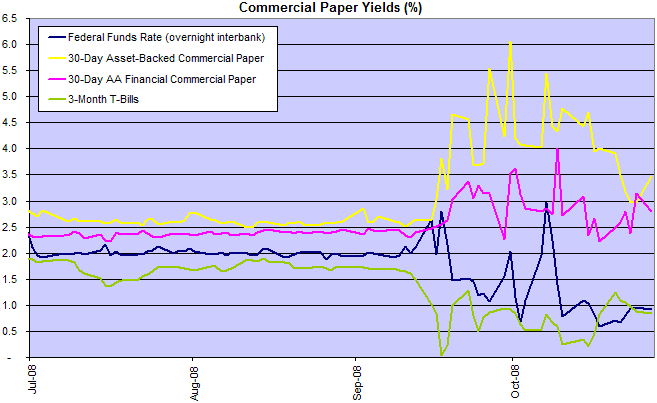

The effective fed funds rate remains at 1 percent, warning of a 50 basis point (0.50%) cut in the target rate. Short-term treasury yields should closely shadow the fed funds rate, now that the Fed has increased the interest rate payable on excess bank reserves to 0.35 percent below the target rate.

Commercial paper rates are maintaining a substantial premium over the fed funds rate, reflecting market aversion to risk. Even General Electric had to seek short-term funding directly from the Fed.

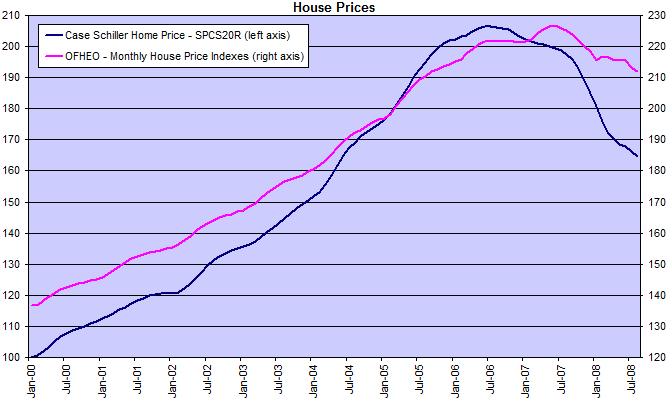

Housing

House prices continue to fall according to the latest Case-Schiller report.

The housing bottom will be determined by four factors:

- mortgage rates;

- expectations of future house prices;

- availability of credit; and

- employment.

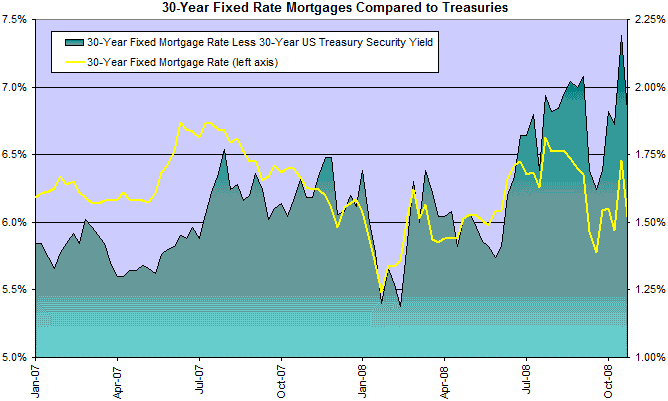

Expectations of further falls are currently deterring buyers from entering the market despite realtively low mortgage rates. Banks face shrinking capital reserves as they write down bad investments and will find it difficult to raise new capital. Growing their mortgage base will remain low on their list of priorities for some time to come. Rising unemployment will also dampen demand: if you lose your job, you are more likely to be a seller than a buyer.

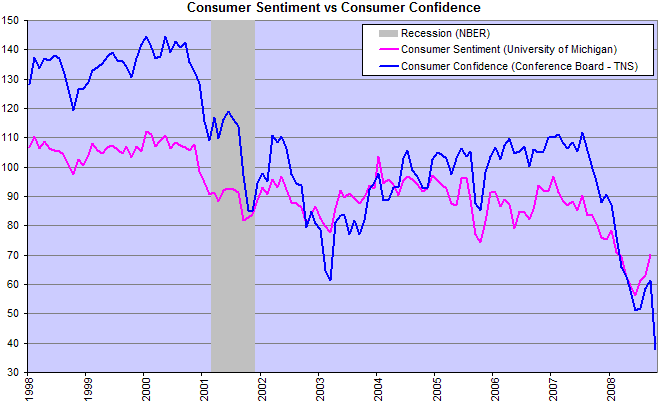

Consumers

Consumer confidence fell to a record low, warning of a further drop in consumption. Falling consumption is likely to lead to a fall in GDP — and a recession.

Failure is the key to success;

each mistake teaches us something.

~ Morihei Ueshiba

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.