What's New

By Colin Twiggs

October 25, 2008

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

New Stock Screener - First Beta Version

Some readers will find the new beta version disappointing because it does not yet include any new filters. We have developed a completely new interface that enables users to save and retrieve stock screens and would like you to test this and provide us with feedback before we release the full version.

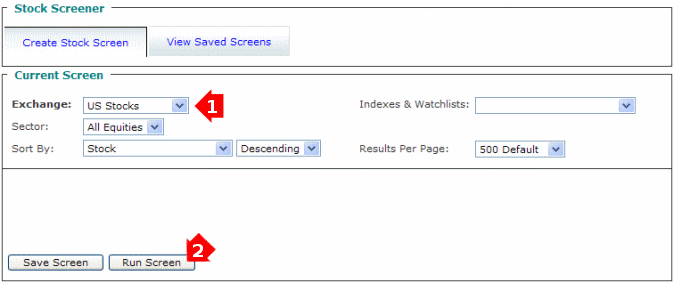

To test that the screener is working:

- Select an Exchange

- Click the Run Screen button

Stock Screener - Save Screen

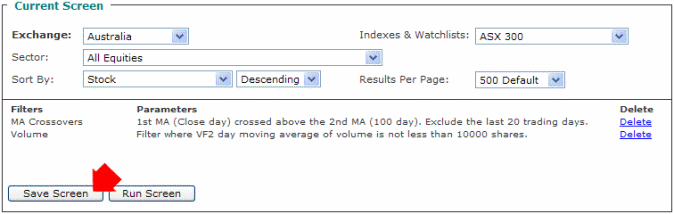

To save a screen, first add filters using the Add Filters menu. These will be displayed in the Current Screen section.

Second, click the Save Screen button.

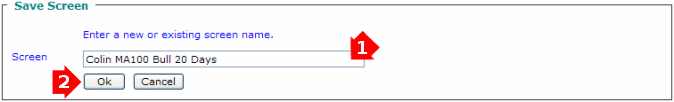

And create a unique name for your saved screen.

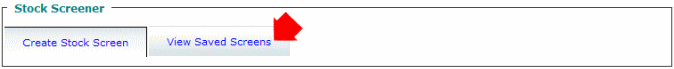

The saved screen will then be displayed on the View Saved Screens tab.

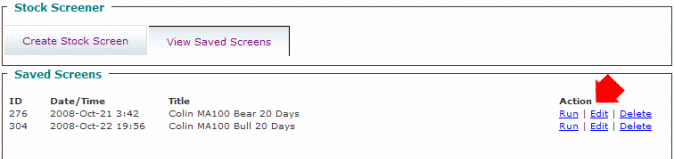

Stock Screener - Saved Screens

To view your saved screens, select the Saved Screens tab at the top of the Stock Screener.

The Saved Screens tab offers you the option to either Run, Edit, or Delete a saved screen.

Run

The Run command will use your latest settings for:

- Exchange

- Index

- Watchlist

- Sector

If unsure of these settings, rather select Edit and then Run Screen after you have checked/adjusted them.

Feedback

Please give us your feedback. Try the new stock screener, then click the button below.

The expectations of life depend upon diligence;

the craftsman that would perfect his work

must first sharpen his tools.

~ The Analects of Confucius

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.