The Show Ain't Over....

By Colin Twiggs

October 14, 2008 8:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

... Until The Fat Lady Sings

The above quote from sportscaster Dan Cook (often attributed to Yogi Berra) is particularly appropriate given the number of experts wheeled out by various news channels to officially pronounce the latest turn of events as the market bottom. This relief rally, sharper than usual because it follows a particularly alarming fall, does not signal the end of the bear market. Because of the ban, there are no short-sellers forced to cover their positions — which could shorten the duration of the rally.

We are witnessing a defining moment in market history; similar to October 1929. This is not merely a correction but the end of an era. The collapse of the largest credit bubble in history. Even in the unlikely event that regulators get most of their responses right, the impact of this crash will remain with us for several years.

Political leaders need to learn from the mistakes of the past. Repeating the same policies would destine us to suffer further similar crises at ever-decreasing intervals.

While governments need to take action to limit damage caused by the collapse, they need to tread warily. Tax rebates or tax cuts are probably the least damaging form of fiscal stimulus, provided that they do not increase the budget deficit. They are also among the most effective as their impact is direct and immediate. Attempts to increase government spending programs or accelerate infrastructure projects, on the other hand, should be treated with suspicion. Spending programs have a ratchet effect: they are easy to introduce, but difficult to later withdraw. Infrastucture projects, on the other hand, are difficult to fast track. Attempts to do so are likely to result in poor planning, poor project selection, and major cost blow-outs.

Another typical mistake is the Australian attempt to stimulate their struggling housing market by announcing a subsidy for first home-buyers. At first glance this appears to be straight assistance for young couples purchasing their first home, but closer examination reveals that it will raise entry level prices (of new homes) and is largely a hand-out to property developers. This is one of the very policies responsible for creating Australia's massive credit/housing bubble in the first place.

Regulation of markets is desirable, but interference with the actual market mechanism is dangerous. Policies that attempt to stimulate or suppress actual supply or demand for a product or service are both naive and reckless. That includes lowering interest rates to increase demand for credit.

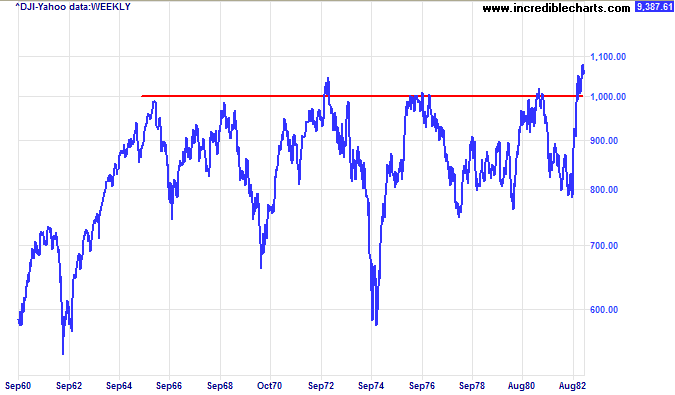

A recession is the market's attempt to regain equilibrium after a period of artificial stimulation (normally through suppression of interest rates). Attempts to block this by further inflationary stimulation merely prolong the painful process of readjustment. Instead of a short, sharp recession with falling prices to restore market stability, we could face a lengthy period of stagflation. Stagflation is a normal recession, but accompanied by high inflation as a consequence of government attempts to prevent readjustment. Typified by lengthy periods of low or zero growth, stagflation was experienced in the US in the 1930s, again in the 1960s to 70s, and in Japan in the 1990s.

The above chart shows nearly two decades of stagflation, between the late 1960s and early 1980s, when the Dow experienced zero growth. Traders are still able to make money in this kind of market, but investors who try to ride out the peaks and troughs will get nowhere.

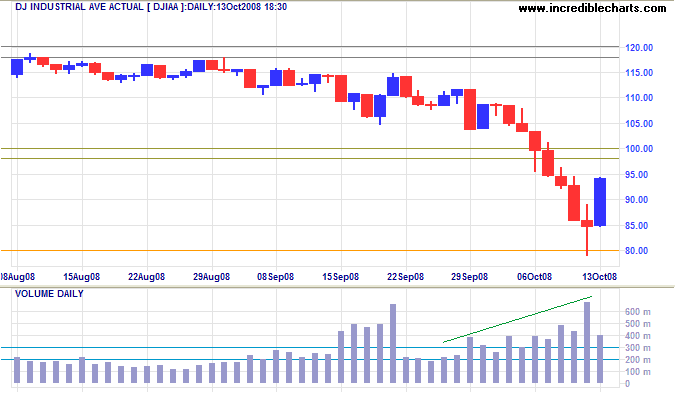

Stock Markets

The Dow Jones Industrial Average rallied sharply on news of a coordinated government and central bank campaign to shore up the battered global financial system. Expect resistance at 10000. If that is penetrated, the rally could carry as high as 12000, but would not indicate that the bear market is over.

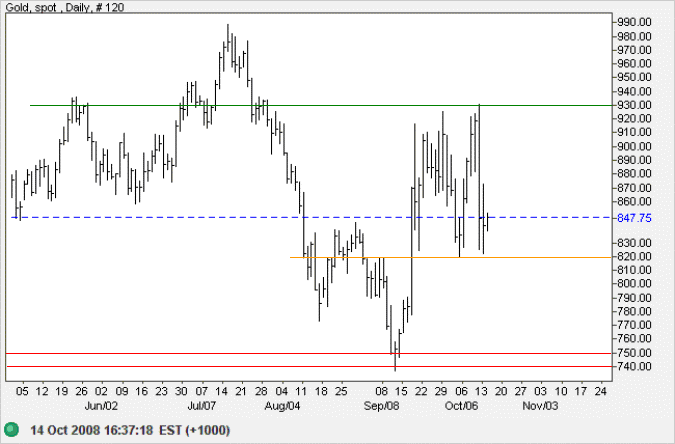

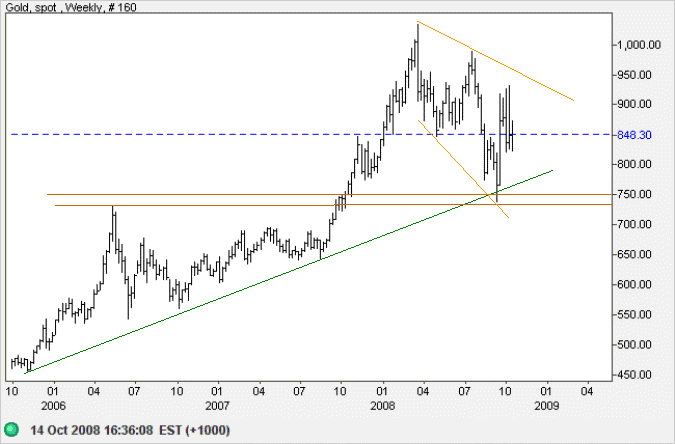

Gold

Spot gold is oscillating in a wide range, between $820 and $930, signaling uncertainty. Failure would signal a test of $740, while upward breakout would offer a target of $1000.

In the long term, a broadening descending wedge over the last 6 months is a bullish sign. Upward breakout would offer a target of 1200, calculated as 950 + ( 1000 - 750 ).

Source: Netdania

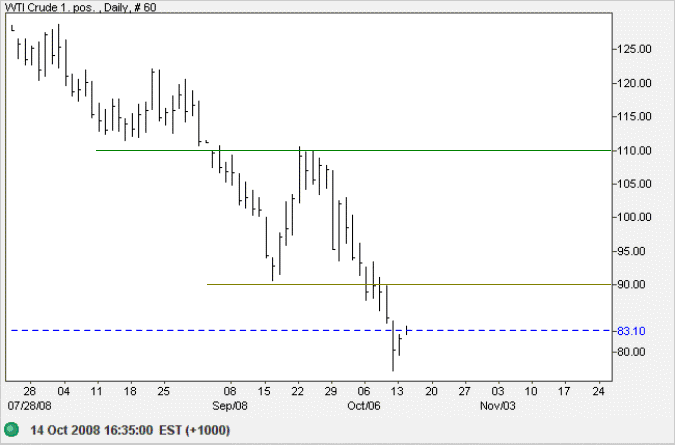

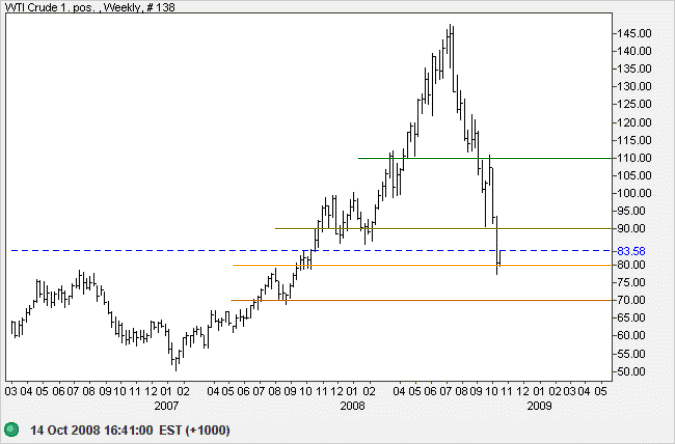

Crude Oil

West Texas Intermediate Crude found support at $80 and is now retracing to test the new resistance level at $90.

In the long term, crude prices are expected to fall as the global economy slides into recession. Respect of resistance at $90 is likely, followed by another attempt at $70 per barrel. If support at $70 had to fail, that would mean a test of $50.

Source: Netdania

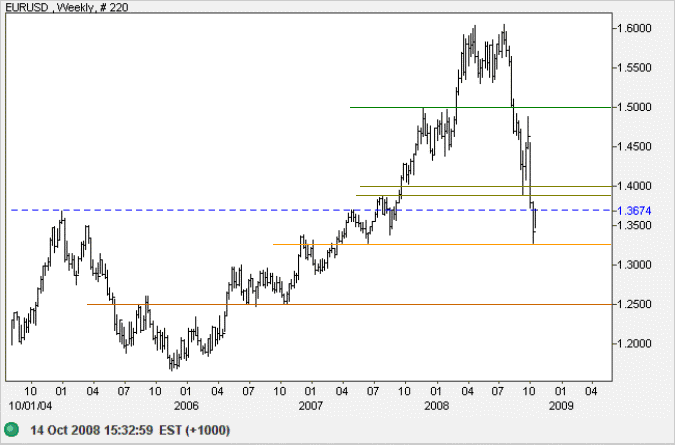

Currencies

The euro is retracing to test the band of resistance between $1.39 and $1.40. Respect would warn of another down-swing. Reversal below the recent low of $1.3250 would offer a target of $1.25, calculated as $1.3250 - ( $1.4000 - $1.3250 ).

Source: Netdania

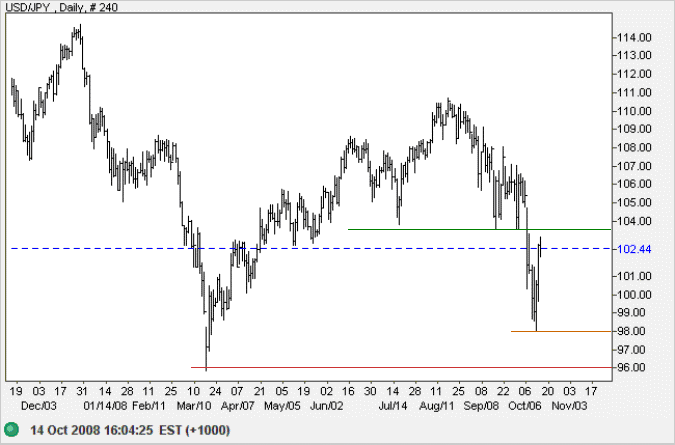

The dollar is retracing to test the new resistance level of 103.50 against the yen. Respect would confirm the down-trend, warning of another test of 96.

Source: Netdania

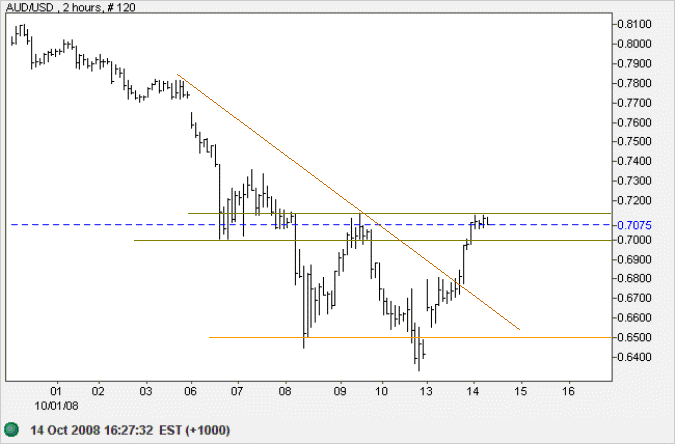

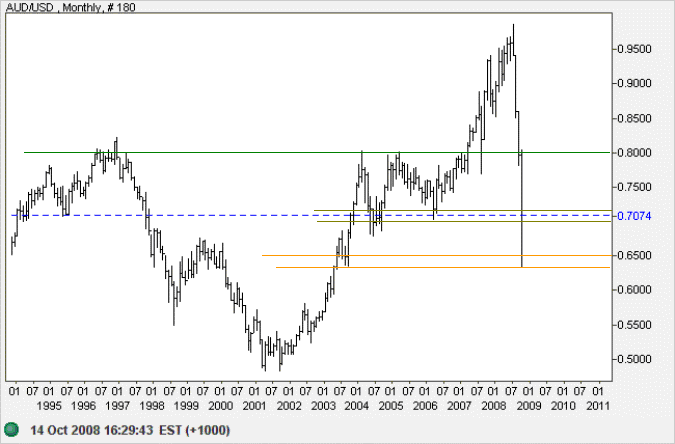

The Australian dollar found support around $0.65 against the greenback and is now testing the band of resistance between $0.7000 and $0.7150 on the short-term chart. Breakout would signal a short-term rally with a target around $0.78.

In the long term, expect strong resistance at $0.80 followed by another test of the band of support around $0.65.

Source: Netdania

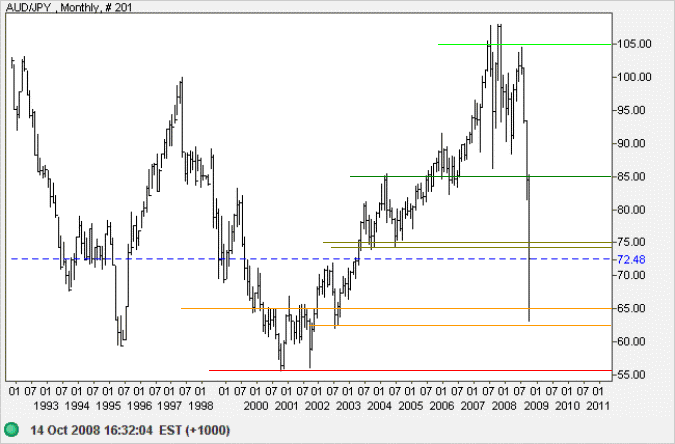

If we look at the long-term chart, the Aussie fell from 105 to 85 and then to 65 against the yen. It has now found support and is retracing towards the first band of resistance at 74/75. If this fails to hold, expect a test of 85 — the 50 percent mark.

Source: Netdania

.....where Fortune is concerned:

she shows her force where there is no organized strength to resist her;

and she directs her impact there

where she knows that no dikes and embankments are constructed to hold her.

~ ~ Niccolo Machiavelli,

The Prince (1532)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.