Stage 3 Distress Selling

By Colin Twiggs

September 29, 2008 10:30 p.m. ET (12:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

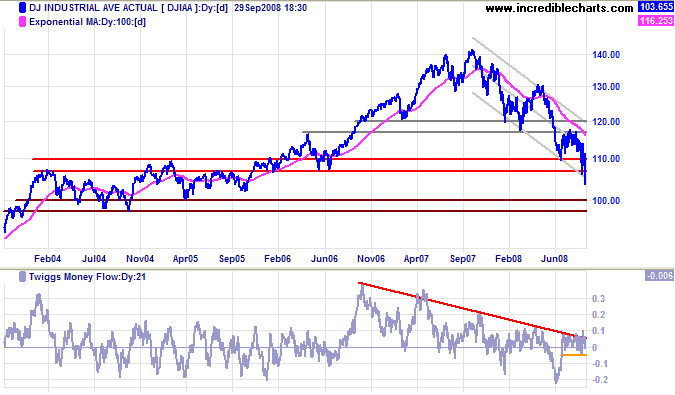

The House of Representatives failure to approve the trouble asset rescue package ("TARP") caused a collapse of market confidence and a massive 780 point drop on the Dow Industrial Average. Support at 10700 has been broken. Expect retracement to test the new resistance level, but the target is now the band of support at 10000/9750, from the 2004 lows.

Markets tend to overreact, in a boom and in a bust. We are likely to see a mad scramble to rescue the TARP package — and a relief rally if this succeeds.

My initial response was anger at the failure of legislators to realize the true impact of their decision. Collapse of the banking system could spark a rapid contraction of credit as investors lose confidence and withdraw funds from the banking system — and banks are forced to recall loans as their deposit base shrinks. Voters may be angry with Wall Street and urging their representatives not to back the plan, but their first thought should be to protect themselves. The attitude of many may be "I own my own house and don't owe any money. Let those fat cats in Wall Street rescue themselves." What they should realize is that tomorrow they could be out of a job — or lose their business because their customers are now unemployed. We may not have contributed to the mess. And in fact may have warned against market excesses. But none of us are immune to a banking collapse and its consequences.

The best way to teach Wall Street a lesson is to hit them where it hurts: in the pocket book. The Fed's rescue of AIG did not take any prisoners. Credit card rates (3-month LIBOR plus 850 points) charged on the $85 billion rescue loan will rapidly erode stockholders equity — and the added 80 percent equity stake will ensure that taxpayers benefit from any upside if AIG is sold off or recovers. If the TARP package is administered on similar terms, Wall Street will not want to risk a repeat — and taxpayers are likely to benefit from the eventual recovery.

Stage 3

Robert Rhea's The Dow Theory identifies three stages in a bear market:

- first, abandonment of the hopes and expectations that sustained inflated prices;

- the second reflects selling due to decreased business and earnings; and

- the third is caused by distress selling of sound securities, regardless of their value.

We are now entering the third stage with investors selling down their positions, taking whatever price is offered in order to get out of the market. Is this a good time to buy? William Peter Hamilton in the Stock Market Barometer sums this up best: "It would be possible to offer endless instances of people who lost money in Wall Street because they were right too soon." It is best to wait for the dust to settle.

Should I sell my existing positions? My comment to anyone still in the market is that you have left it rather late. The best way to answer the question for yourself is to ask: "If I was not in the market at present, would I buy these stocks at their current prices?" If you would consider buying because stocks now offer better value, then they may be worth holding. But if you would consider them too risky to buy, then they are not.

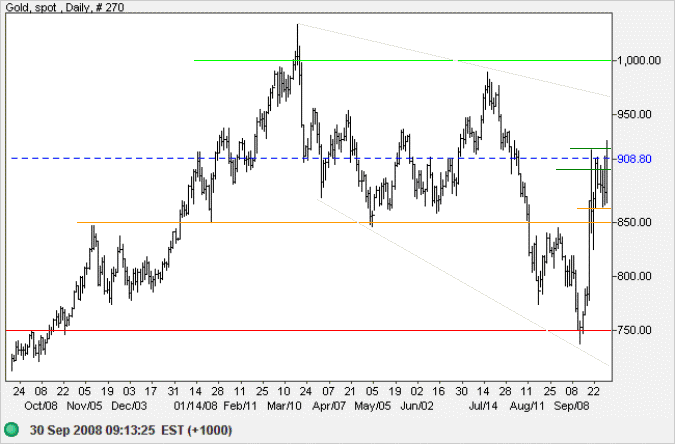

Gold

Uncertainty in financial markets is likely to increase demand for gold. Spot gold is testing the band of resistance between $900 and $920. Repeated false breaks mean that we will have to wait for a retracement to confirm the new support level at $900. Breakout would signal a test of $1000. Reversal below short-term support at $860 is now unlikely, but would warn of another test of $750.

Source: Netdania

Also, note the broadening descending wedge over the last 6 months. A long-term bull signal.

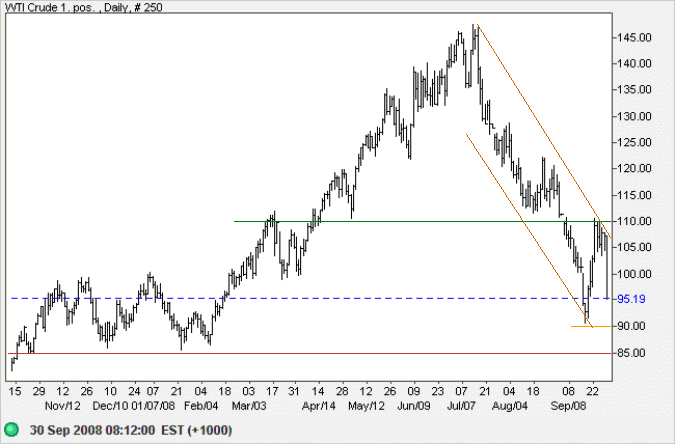

Crude Oil

West Texas Intermediate Crude is headed for a test of support at $90 after briefly visiting the upper trend channel. Failure of the band of support between $85 and $90 would offer a target of $70, calculated as $90 - ( $110 - $90 ). In the long-term, prices are expected to fall as the global economy slides into recession. A test of $50 per barrel is not out of the question.

Source: Netdania

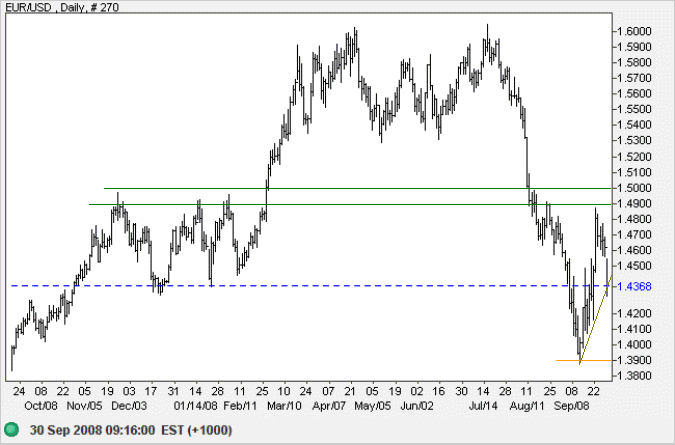

Currencies

The euro is headed for a test of support at $1.39. Failure of support is likely as the euro is in a primary down-trend. The target would be $1.29, calculated as $1.39 - ( $1.49 - $1.39 ).

Source: Netdania

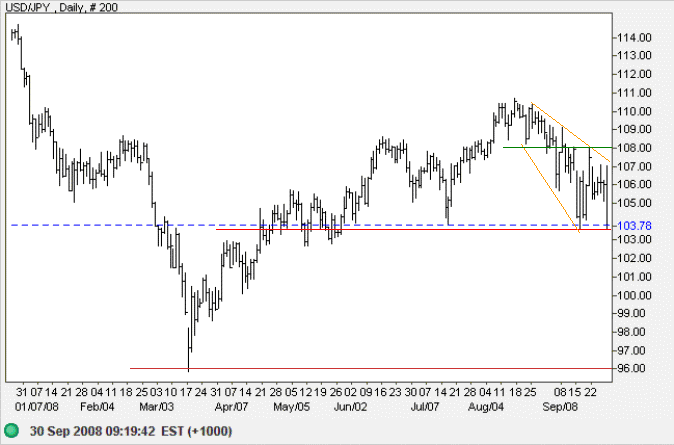

The descending broadening wedge against the yen is a bullish sign for the dollar. But failure of support at 103.50 would signal a primary down-trend. And respect of the new resistance level (103.50) would confirm the target of 96 yen. Breakout above 108 remains as likely, however, and would confirm the up-trend.

Source: Netdania

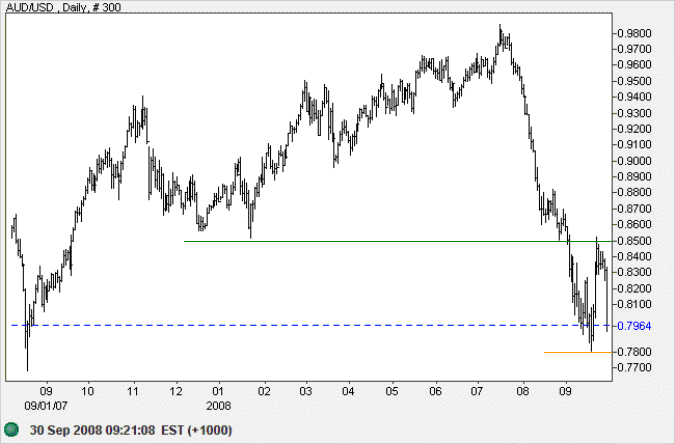

The Australian dollar is headed for a test of support at $0.78. The primary trend is down, indicating that breakout is likely. The target would be $0.70, roughly $0.78 - ( $0.85 - $0.78 ).

Source: Netdania

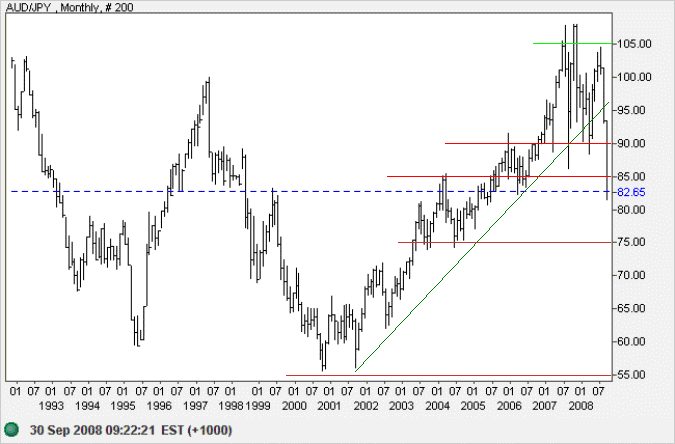

The Aussie broke through support at 85 against the yen. The monthly chart shows the primary trend change and the target calculation: 90 - ( 105 - 90 ) = 75. But first expect a retracement to test the new band of resistance at 85 to 90. In the long term, failure of support at 75 would revisit the 2001 lows of 55.

Source: Netdania

I have come to the conclusion that politics are too serious a matter to be left to the politicians.

~ Charles De Gaulle

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.