Judgement Day

By Colin Twiggs

September 16, 2008 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use. To understand my approach, please read About The Trading Diary.

The current market melt-down is not a failure of the free market system. It is a failure of market intervention. Markets need strong regulation to curb excesses, as the latest debacle illustrates, but regulation should not interfere with the market's underlying price-setting mechanism. The invisible hand of the market, as Adam Smith so aptly described it. The root cause of the credit bubble, whose rupturing has decimated the financial sector, is interference with this natural market mechanism which matches borrowers and investors. Suppressing interest rates to artificially low levels created a mis-match, destroying savings, fuelling inflation, encouraging speculation rather than investment in productive assets, and triggering the trade deficit. The fact that this distortion has been allowed to survive and grow for almost three decades attests to the lobbying power of special interest groups and their ability to subvert government to their own ends. The financial sector has benefitted hugely from the credit bubble, but now face their day of judgement. Hopefully the survivors will learn from the mistakes of the past.

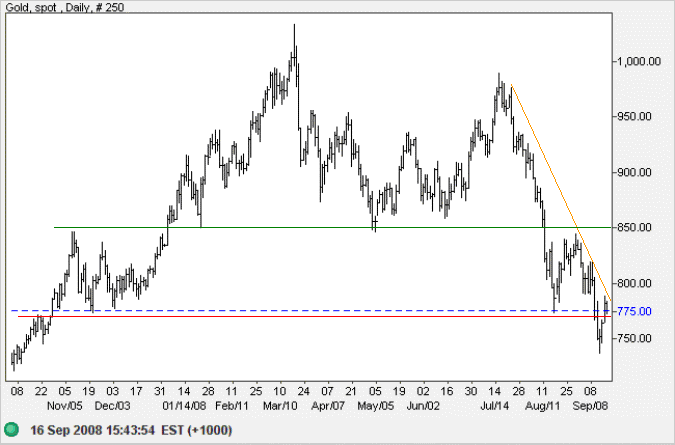

Gold

Spot gold broke through primary support at $770, warning of another primary down-swing. But reversal above the new resistance level signals indecision. Retreat below $775 would offer a target of $700, calculated as $775 - ( 850 - 775 ). Breakout above the falling trendline, while less likely, would signal a test of resistance at $850.

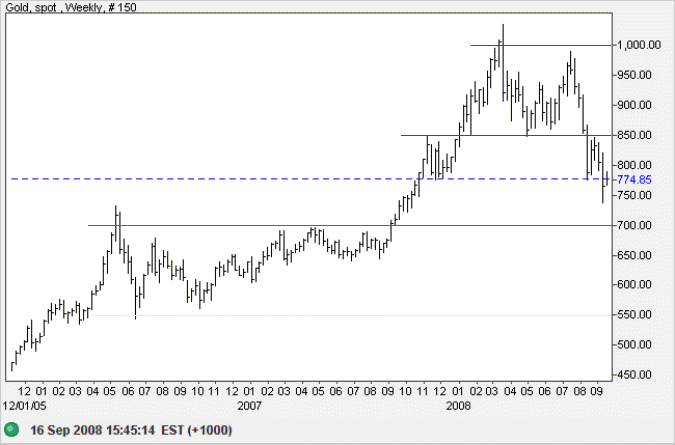

The weekly chart reveals four key levels: resistance at $1000; former primary support at $850; the current target of $700 [ 850 - ( 1000 - 850 )]; and $550, from the lows of mid-2006. Expect a test of $700. And $550 if support fails.

Source: Netdania

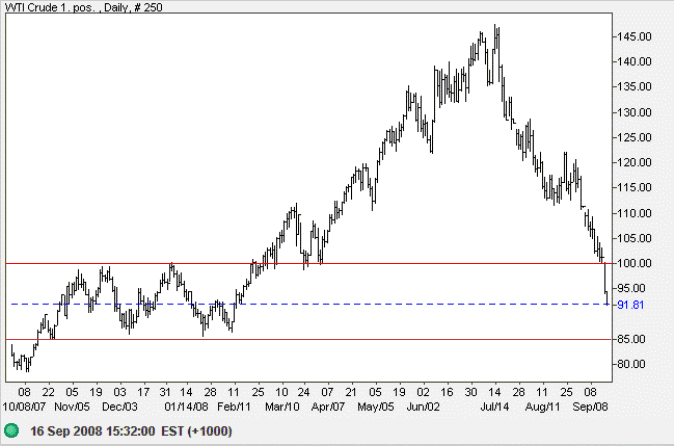

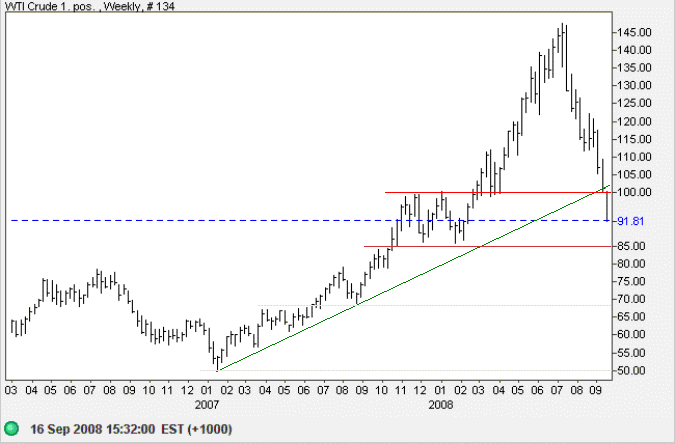

Crude Oil

West Texas Intermediate Crude broke through the key psychological level of $100, confirming the strong primary down-trend. Prices are expected to fall further as major economies slide into recession.

Expect a test of support at $85 per barrel. Further contraction of demand could see support at $70 and $50 tested, but this remains far from certain.

Source: Netdania

Currencies

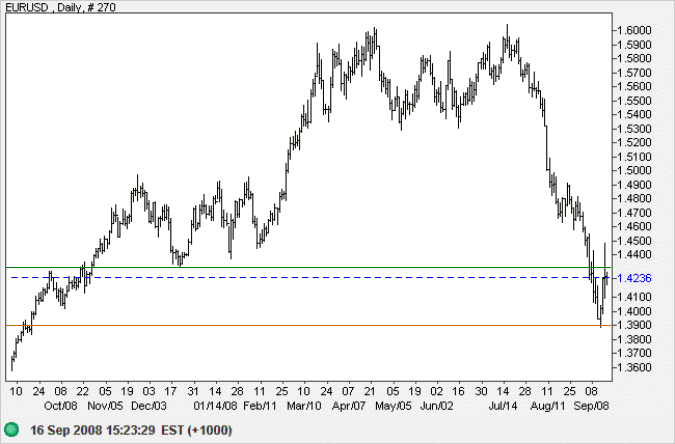

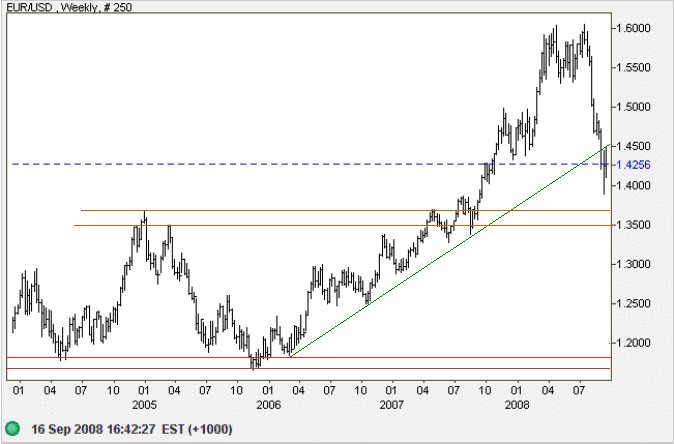

The euro found short-term support at $1.39 before retracing to test resistance at $1.43. The failed breakout and tall shadow indicate further weakness. Expect another test of $1.39.

In the longer term, expect a test of the band of support above $1.35. Failure of this band, would threaten support at $1.16 to $1.18.

Source: Netdania

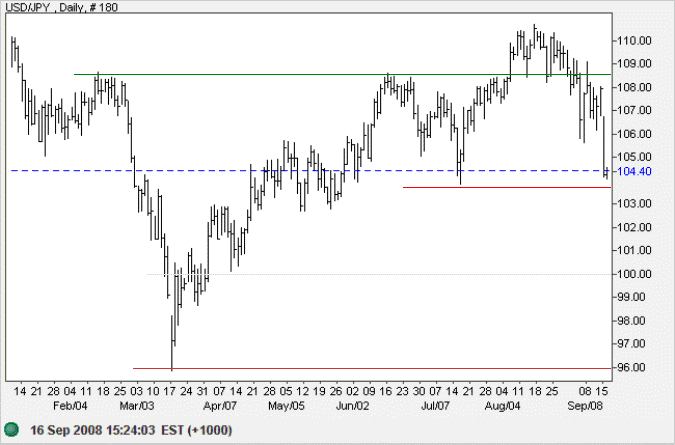

The dollar is testing primary support at 103.50 against the yen. Failure would test support at 96. Recovery above 111.00, on the other hand, would confirm the primary up-trend.

Source: Netdania

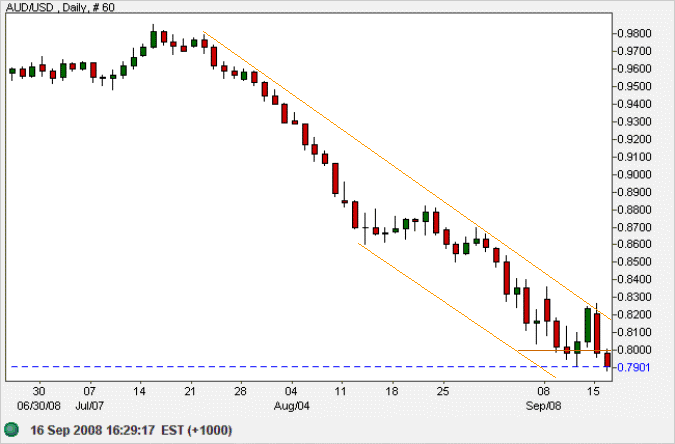

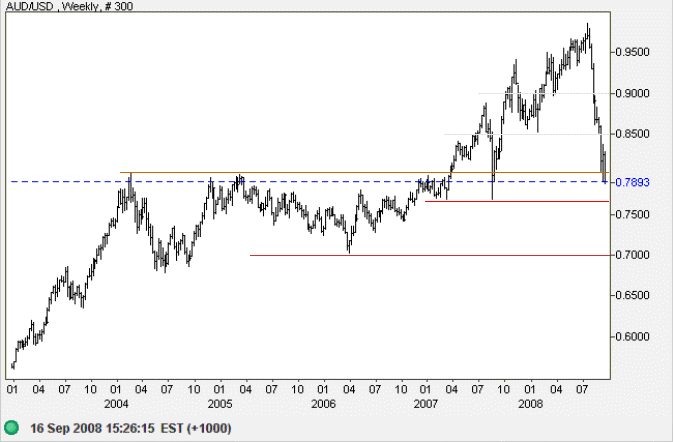

After a short retracement, the Australian dollar broke through support at $0.80 against the greenback, signaling a test of medium-term support at $0.77.

Failure of support would warn of a test of the 2006 low of $0.70.

Source: Netdania

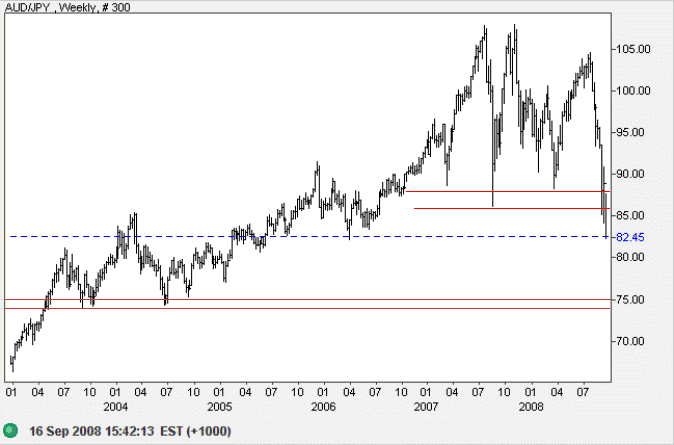

The Aussie broke through support at 86 against the yen, signaling a test of the lows of 2004 — between 74 and 75.

Source: Netdania

Disintegration within the Roman Empire made it impossible for the Romans to resist aggression from without.

Although the aggression was no worse than that which the Romans had resisted again and again in the preceding centuries.....

The truth is that what destroyed this ancient civilization was something similar,

almost identical to the dangers that threaten our civilization today:

on the one hand it was interventionism, and on the other hand, inflation.

~

Ludwig von Mises

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.