Another Stimulus Package?

By Colin Twiggs

August 26, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Richard Russell

Some of you may not be aware that Richard Russell suffered a mild stroke last Friday. The doyen of newsletter writers, aged 84, has been writing the monthly Dow Theory Letter since 1958. We wish him a speedy recovery.

Stimulus Package?

I am convinced that the stock market is in serious trouble. We face the contraction of a credit bubble that was 30 years in the making. The Fed cannot save major banks from insolvency if housing prices continue to fall. The political system has failed to address the problem, preferring to merely postpone it by printing more money. That is a road to nowhere: the credit bubble will simply grow bigger and bigger until the system collapses. This may be our last chance to avoid a 1930s style depression. Any candidate in the November election who proposes to borrow more money for another stimulus package is being fiscally irresponsible. What we need is for someone to take charge and clean up the mess — not throw another party.

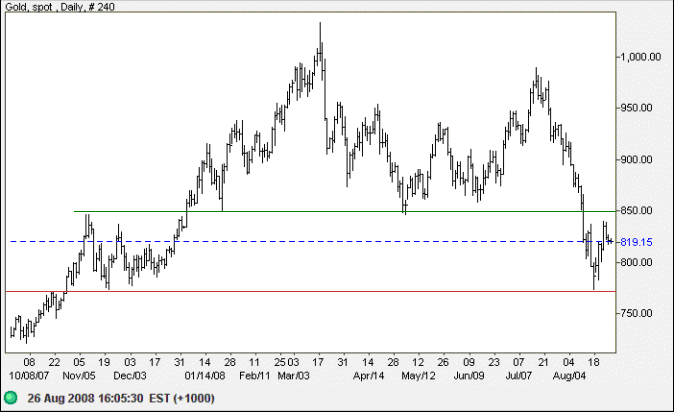

Gold

Spot gold bounced off support at $770, the low of December 2007, and is headed for a test of the new resistance level at $850. V-bottoms normally fail — expect another test of support at $800.

The long-term target for the primary down-trend is $700, calculated as $850 - ($1000 - $850).

Source: Netdania

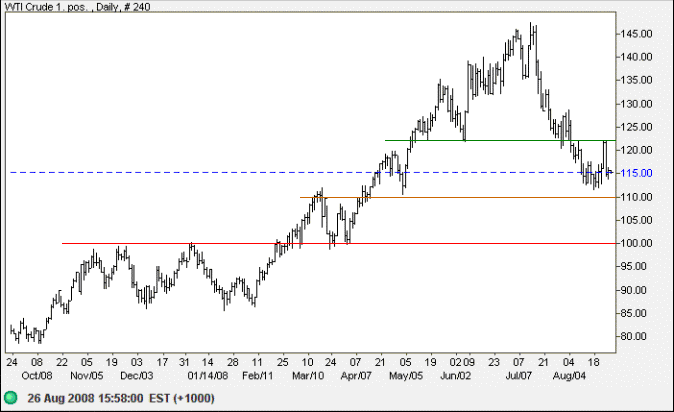

Crude Oil

West Texas Intermediate Crude respected the new resistance level at $122 and is headed for another test of support at $110/barrel. Failure of support would warn of a primary down-trend — confirmed if the key psychological level of $100 is broken.

A primary down-trend could test the 2007 low of $50/barrel, but this depends on whether China maintains existing consumption levels or follows other major economies into recession.

Source: Netdania

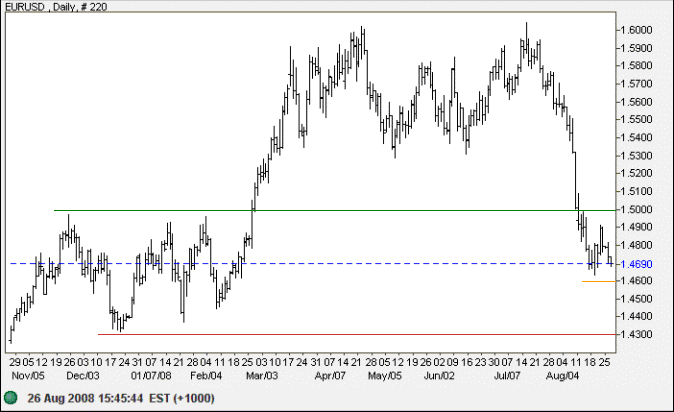

Currencies

The euro retracement fell short of the new resistance level at $1.50 and is headed for another test of $1.46. Support at $1.46 is unlikely to hold — expect a test of $1.43.

Source: Netdania

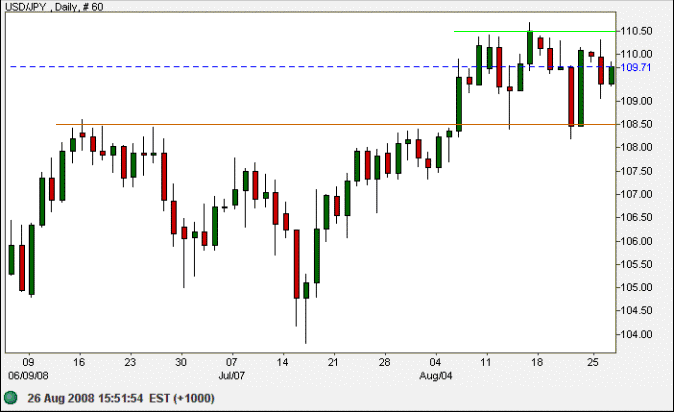

The dollar is in a primary up-trend against the yen and has twice respected the new support level at 108.50 in the last two weeks. That is normally a bullish sign, but the latest lower high warns of another test of support. Failure of support would warn of a bull trap; while breakout above 110.50 would confirm the up-trend.

Source: Netdania

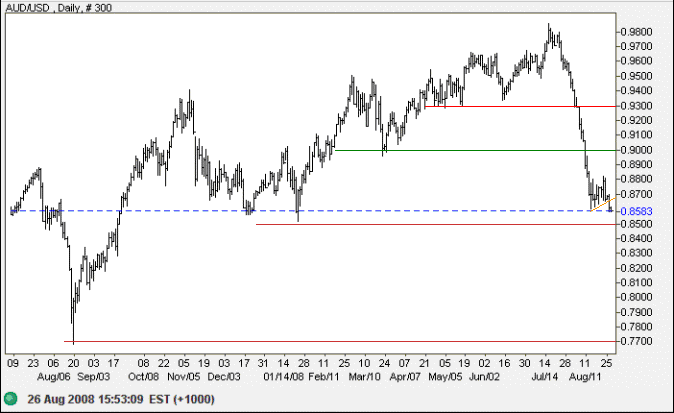

The Australian dollar is testing a band of support between $0.85 and $0.86. Retracement to test the new resistance level at $0.90 is now unlikely; while failure of support would warn of a test of $0.77.

Source: Netdania

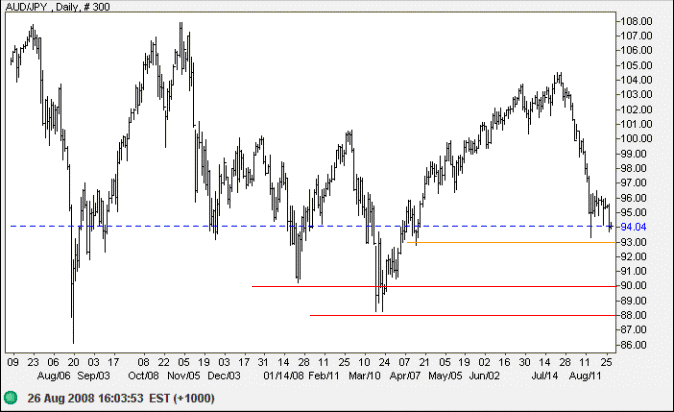

The Aussie also failed to rally off short-term support against the yen and is headed for another test of short-term support at 93. Further retracement is now unlikely — and failure of 93 would test the band of primary support between 88 and 90.

Source: Netdania

In the distance, I see a frightful storm brewing in the form of untethered government debt.......

Unless we take steps to deal with it, the long-term fiscal situation of the federal government

will be unimaginably more devastating to our economic prosperity than the subprime debacle

and the recent debauching of credit markets that we are now working so hard to correct.

~ Federal Reserve Bank of Dallas President, Richard Fisher

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.