Crude Slides, Stocks Rally

By Colin Twiggs

August 16, 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Overview

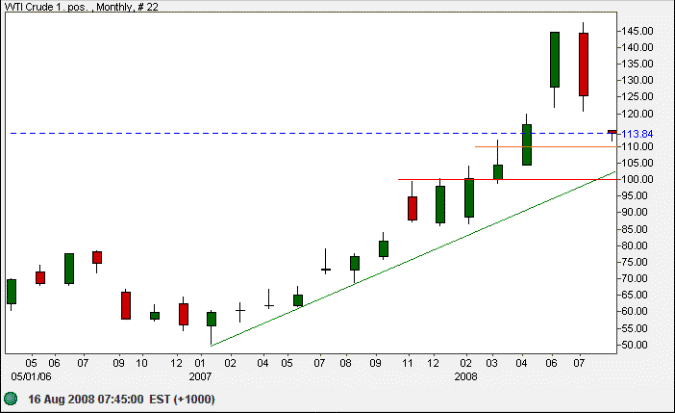

Crude oil is testing short-term support at $110/barrel. Given the steepness of the descent, primary support at $100 is likely to be tested. Failure of this important psychological barrier would warn that the primary trend has reversed downwards.

Crude oil reversal to a primary down-trend would spark a further rally in stocks, especially among struggling auto-manufacturing and transport sectors. It is unlikely, however, that this would signal the end of the bear market. That welcome news would have to wait for recovery of the housing market — which still appears some way off.

USA

Dow Jones Industrial Average

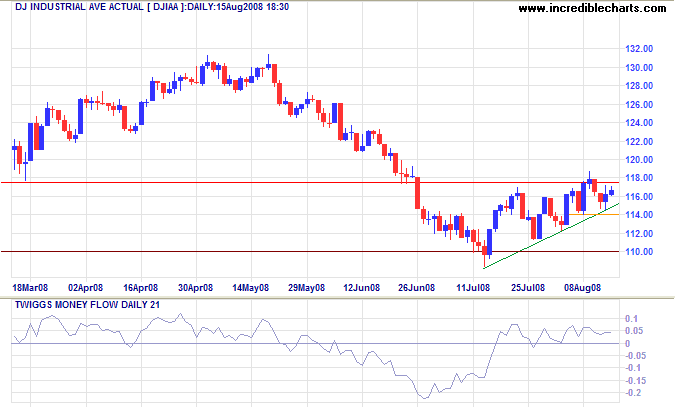

The Dow respected short-term support at 11400, with long tails and Twiggs Money Flow (21-day) holding above zero — signaling short-term buying pressure. Expect the rally to continue.

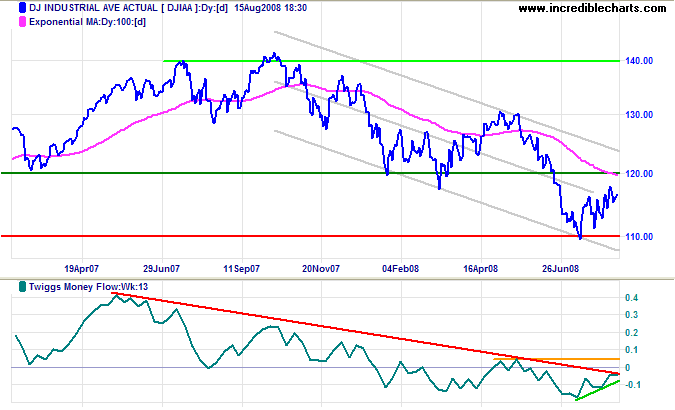

Long Term: The secondary rally is headed for a test of resistance at 12000 and possibly the upper trend channel. Twiggs Money Flow (13-week) confirms the secondary rally, but the long-term signal will remain negative unless there is a rise above the May peak at 0.05.

S&P 500

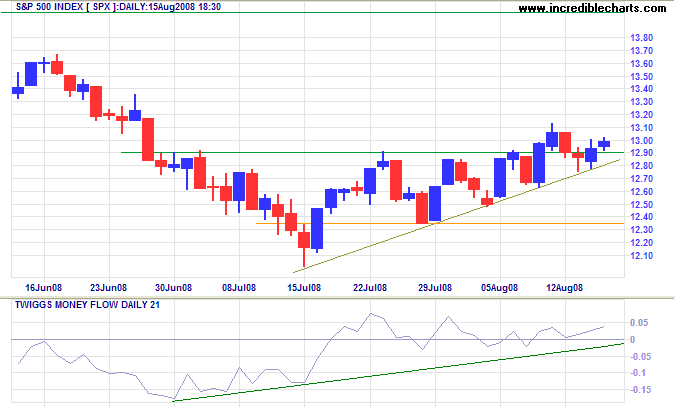

The S&P 500 shows similar short-term buying pressure on 21-day Twiggs Money Flow. Expect the secondary rally to continue.

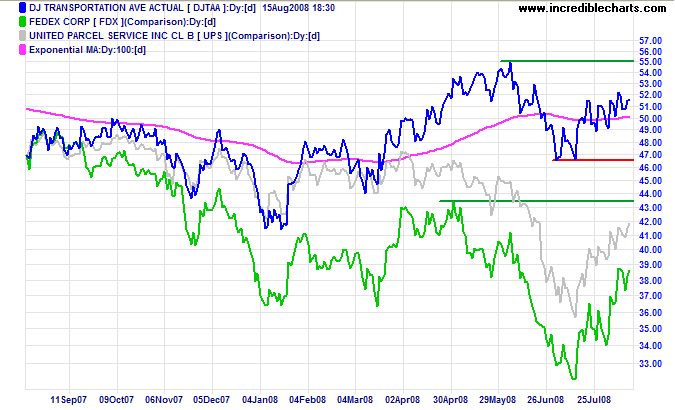

Transport

Transport stocks are rallying on the back of lower oil prices, but Fedex and UPS remain in a primary down-trend. A Transport Average rise above its June peak of 5500 would have positive implications for the broader economy.

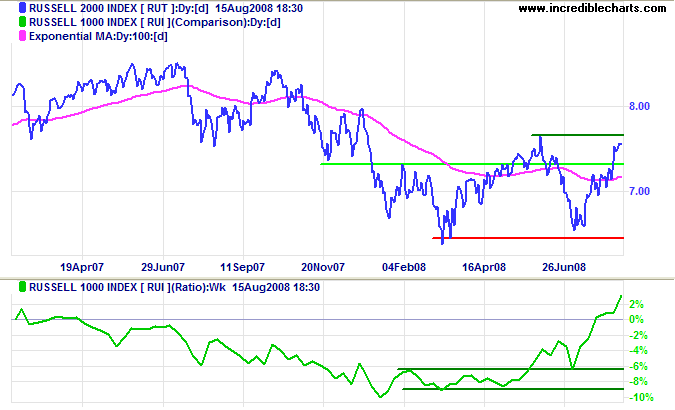

Small Caps

The Russell 2000 Small Caps index continues to out-perform the large cap Russell 1000.

There are three possible reasons:

first, institutional holdings and margin trading are concentrated in large cap stocks

leaving small caps relatively untouched by the liquidity crisis;

second, short sales are concentrated in larger cap stocks;

and last, falling energy stocks have greater representation in the large cap index.

A rise above 765 would signal a primary up-trend,

but this is not as significant — because we remain in an overall bear market.

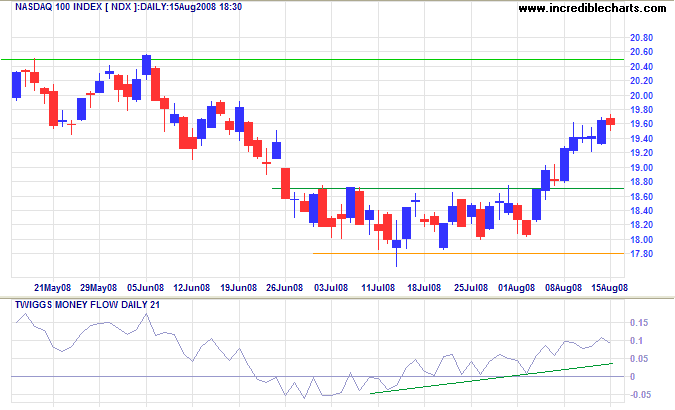

Technology

The Nasdaq 100 is headed for a test of resistance at 2050, with Twiggs Money Flow (21-day) lifting clear of the zero line — signaling strong buying pressure. Breakout above 2050 would indicate the start of a primary up-trend.

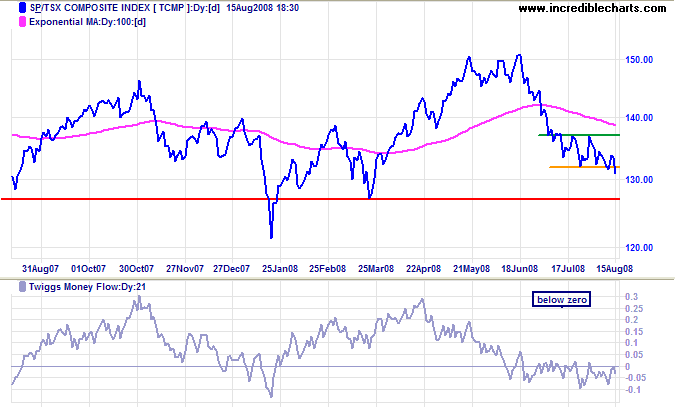

Canada: TSX

The TSX Composite broke through medium-term support at 13200 and is headed for primary support at 12700/12600. Twiggs Money Flow (21-day) holding below zero warns of continued selling pressure.

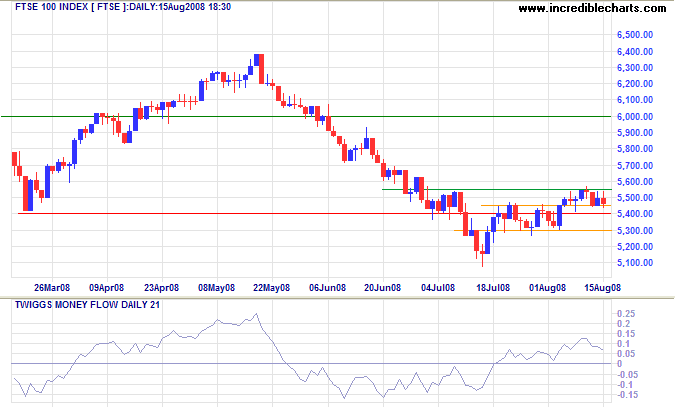

United Kingdom: FTSE

The FTSE 100 is consolidating in a bullish narrow range after breaking through resistance at 5450. Twiggs Money Flow (21-day) rising clear of the zero line signals strong short-term buying pressure, while the longer term 13-week indicator remains bearish. Expect the secondary rally to continue in the short term, but reversal below 5300 in the longer term — and another primary down-swing with a target of 4300.

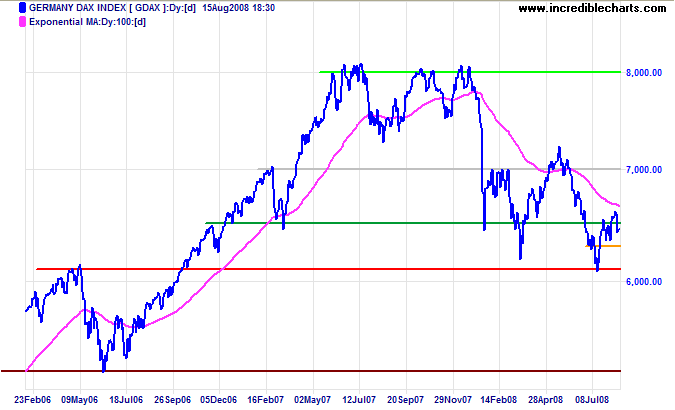

Europe: DAX

The German Dax reversed below 6500, but the secondary rally is likely to continue unless support at 6300 fails. Failure (of support) is not expected at present, but would warn of another primary down-swing, with a target of 5300 (the June 2006 low).

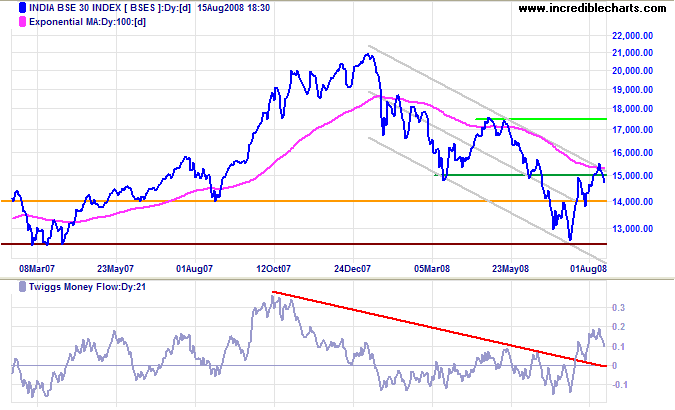

India: Sensex

The Sensex reversed below 15000, respecting the upper trend channel. Twiggs Money Flow (21-day) above the zero line continues to signal short-term buying pressure. Expect a test of 14000. Failure is less likely at present — but would warn of a test of primary support at 12500.

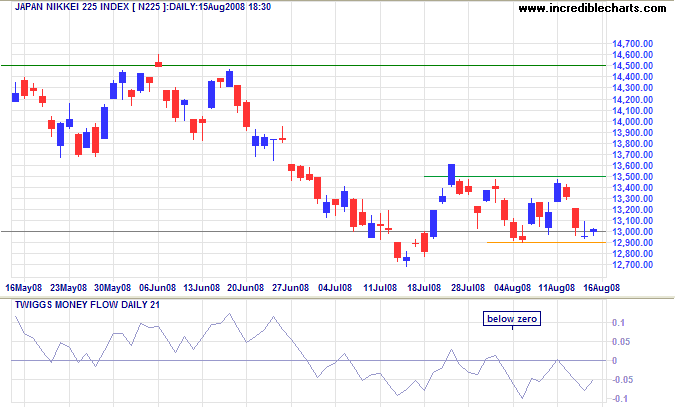

Japan: Nikkei

The Nikkei 225 is consolidating in a narrow range between 12900 and 13500. Twiggs Money Flow (21-day) holding below zero indicates that support is likely to fail — which would test primary support at 12000. Breakout above 13500 is unlikely — and would test the June high of 14500.

China

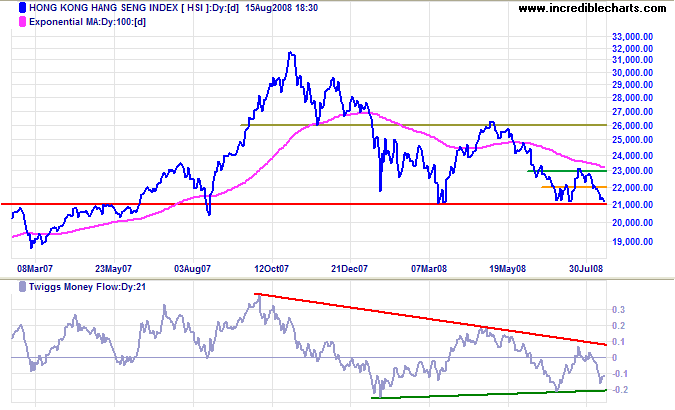

The Hang Seng is testing primary support at 21000. Twiggs Money Flow (21-day) holding below zero indicates selling pressure. Failure of 21000 would offer a target of 16000. That is 21000 minus (26000 - 21000). Recovery above 23000 remains unlikely — and would signal a rally to 26000.

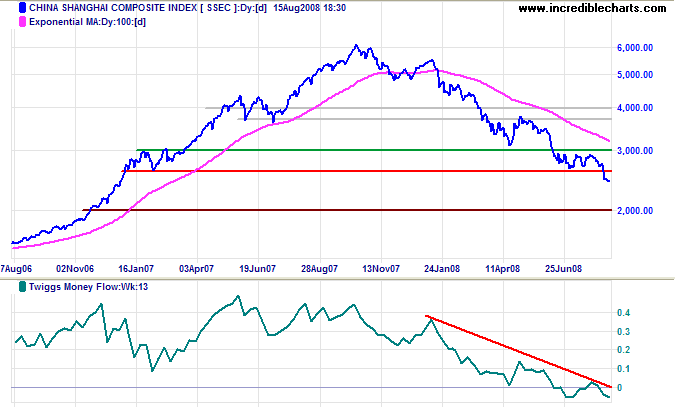

The Shanghai Composite broke through support at 2600, offering a target of 2000. Twiggs Money Flow (13-week) continues in a down-trend, signaling weakness. Recovery above 2600 is now unlikely — and would warn of a bear trap.

Australia: ASX

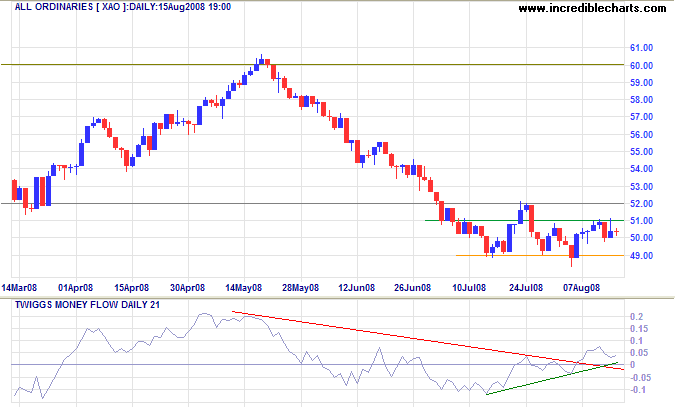

The All Ordinaries is consolidating between 4900 and 5100. Rising Twiggs Money Flow indicates that upward breakout is likely, which would signal another bear market rally.

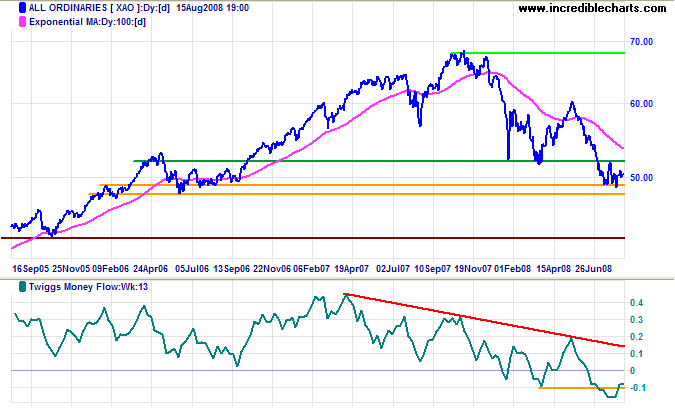

Long Term: Declining 13-week Twiggs Money Flow warns that we remain in the midst of a bear market. Failure of the band of support at 4800/4900 would offer a target of 4300 (the October 2005 low).

If you desire great things, do not attempt to lay hold of them with little effort;

but give up some things entirely,

and postpone others for the present.

~

Epictetus: Enchiridion

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.