Dead Cat Bounce

By Colin Twiggs

July 26, 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

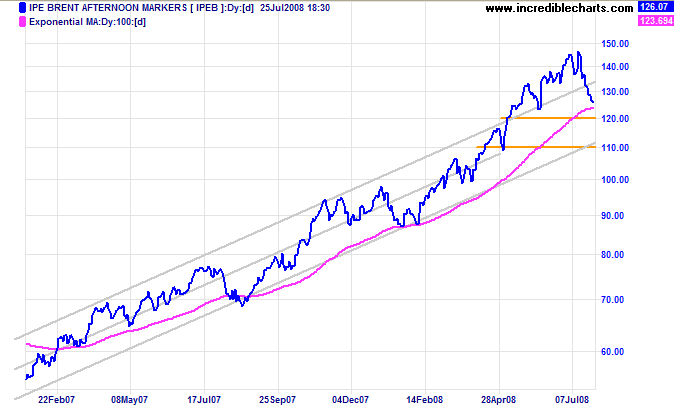

Crude Oil

Brent crude is headed for a test of the lower trend channel. Expect medium-term support at $120/barrel, and again at $110 if needed.

USA

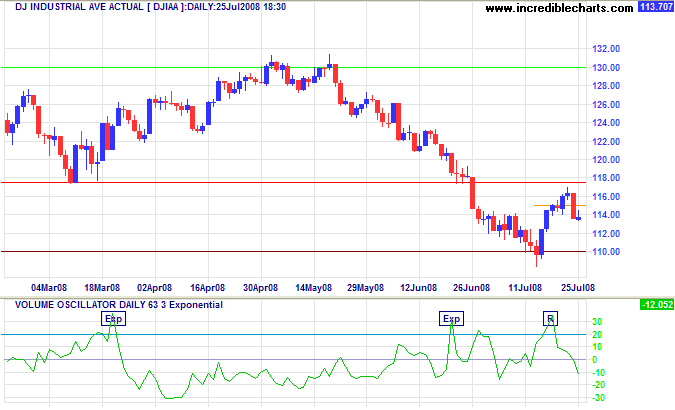

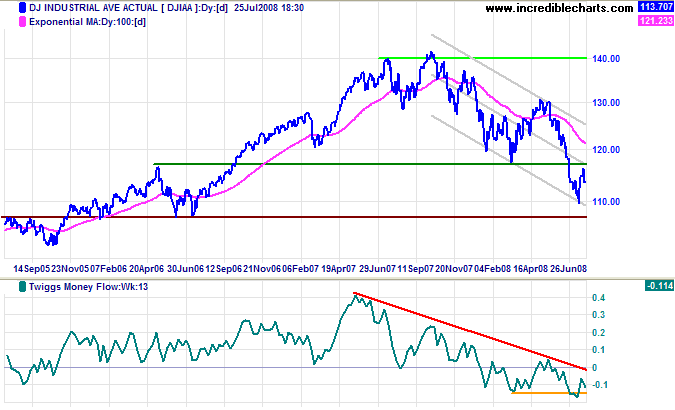

Dow Jones Industrial Average

The dead cat bounce on the Dow ended with a fall below 11500, completing a doji star candlestick reversal. Volume is light, after strong resistance at [R], and we can expect another test of support at 11000.

Long Term: Failure of support at 11000 would signal another down-swing, with a target of 10700 (the June 2006 low). Declining Twiggs Money Flow signals continued selling pressure. If 10700 was to fail, the next major support band would be 10000/9700.

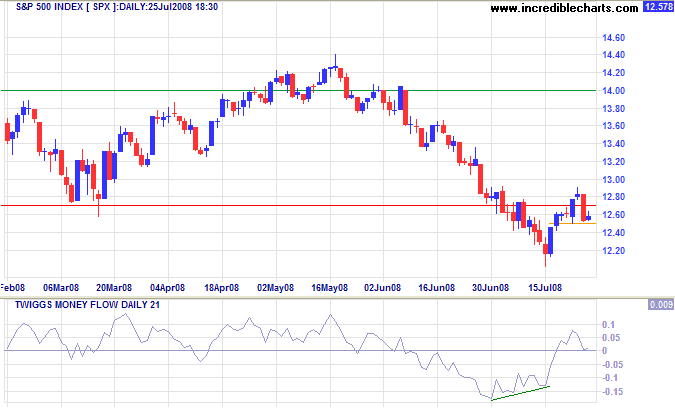

S&P 500

The S&P 500 completed a similar shooting star reversal with a fall below 1270. A break below short-term support at 1250 would confirm the start of another primary down-swing — as would Twiggs Money Flow reversal below zero. The target is 1120 [1270-(1420-1270)].

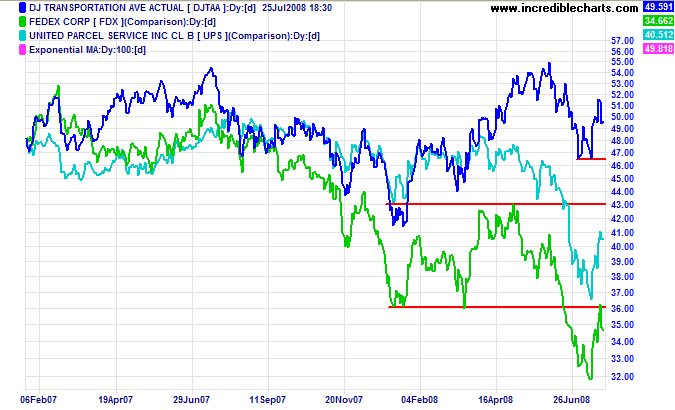

Transport

Fedex and UPS remain in a strong primary down-trend — with negative implications for the broader economy. Both stocks rallied as oil declined. Any recovery in the oil price would cause a further decline — with the transport index falling through primary support at 4650.

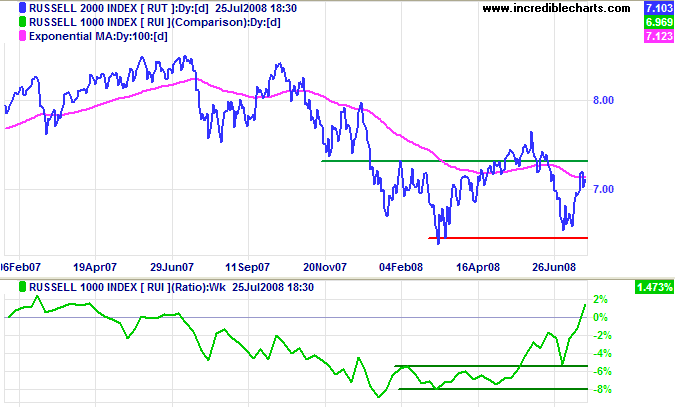

Small Caps

The Russell 2000 Small Caps index is more bullish than the large cap indexes — headed for a test of resistance at 730. The rising ratio to the Russell 1000 confirms that small caps are being favored over "safer" large caps.

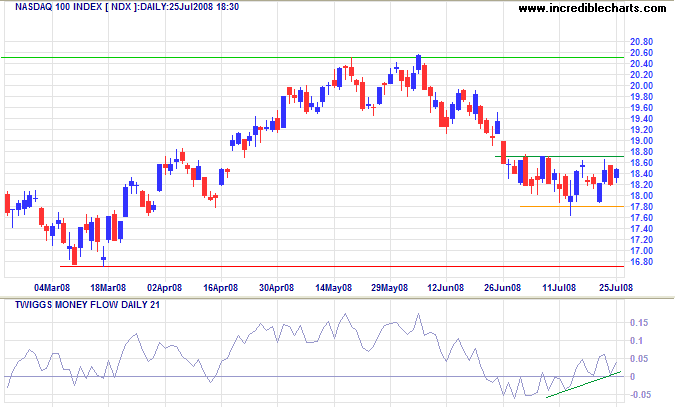

Technology

The Nasdaq 100 is consolidating between 1780 and 1870. Rising Twiggs Money Flow increases the likelihood of an upward breakout, with a target of 2050. Failure of support at 1780, however, would test primary support at 1670.

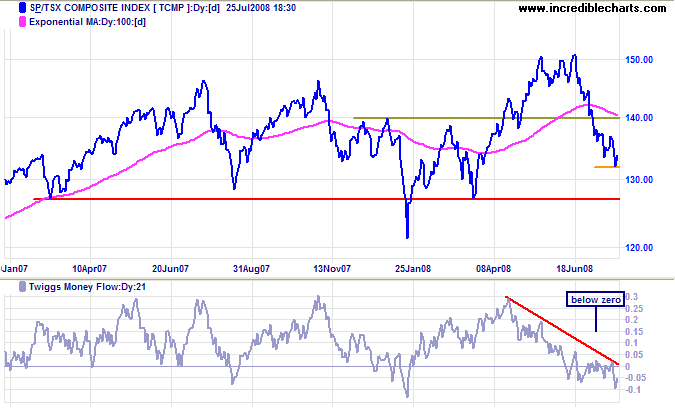

Canada: TSX

The TSX Composite is testing support at 13200. Twiggs Money Flow holding below zero signals selling pressure, increasing the likelihood of a downward breakout and test of primary support at 12700/12600.

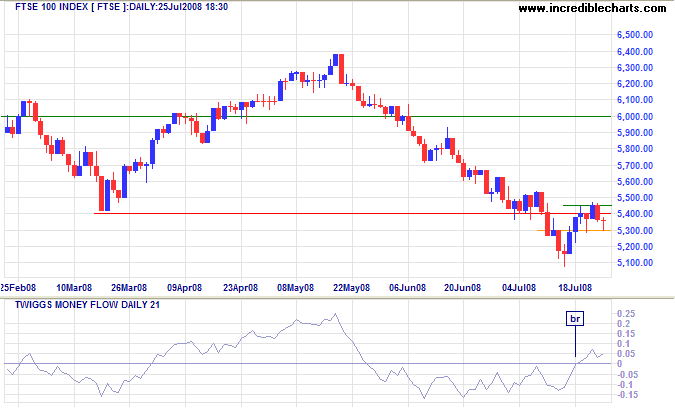

United Kingdom: FTSE

The FTSE 100 is consolidating between 5300 and 5450. Rising Twiggs Money Flow (21-day) signals (short-term) buying pressure — and an upward breakout, with a medium-term target of 6000. Reversal below 5300, however, would warn of another primary down-swing, with a target of 4300.

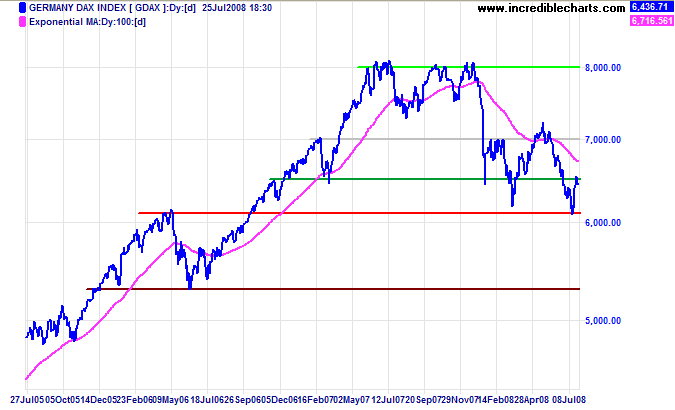

Europe: DAX

The German Dax is testing medium-term resistance at 6500. Upward breakout would test 7000, while reversal below 6350 would warn of another primary down-swing, with a target of 5300 — the June 2006 low.

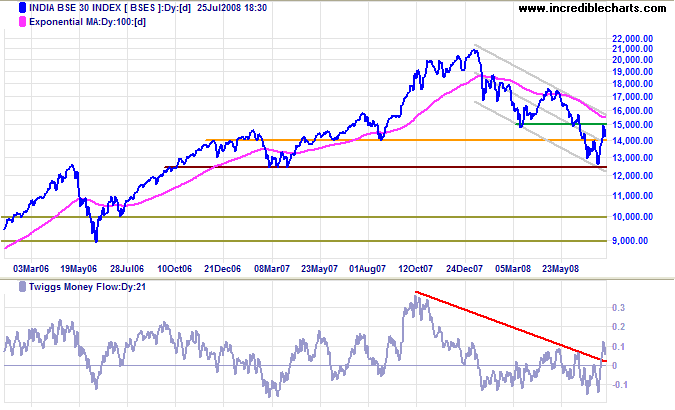

India: Sensex

The Sensex successfully tested resistance at 15000. Reversal below 14000 would warn of another test of primary support at 12500, while recovery above 15000 would signal that the primary down-trend is weakening. Twiggs Money Flow holding above zero would support this. In the long term, failure of 12500 would warn of another primary down-swing.

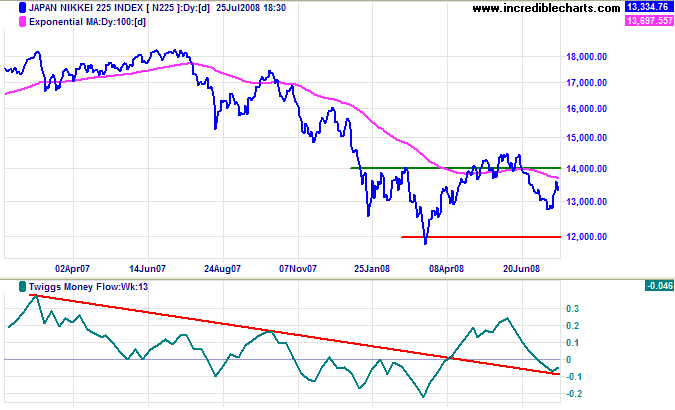

Japan: Nikkei

The Nikkei 225 made a sharp rally above support at 13000. The next correction respecting 13000 would be a bullish sign — as would Twiggs Money Flow (13-week) recovery above zero, completing a higher low. Reversal below 13000, on the other hand, would warn of a test of primary support at 12000/11800.

China

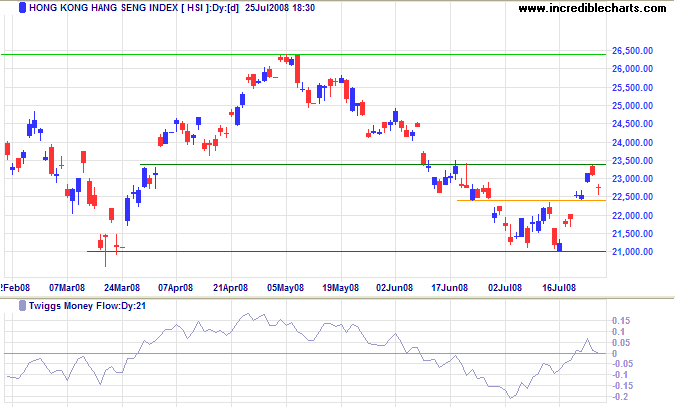

The Hang Seng found resistance at 23400 and is now testing support at 22400. Failure of support would test primary support at 21000, while recovery above 23400 would test 26400. Twiggs Money Flow (21-day) at zero indicates uncertainty; reversal below zero would be bearish, while a rise above 0.1 would signal buying pressure.

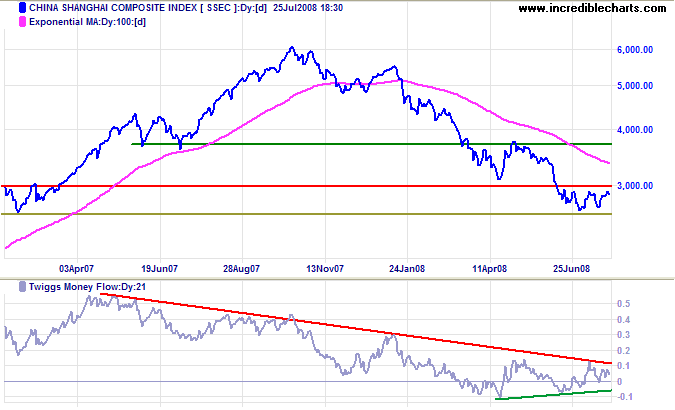

The Shanghai Composite is consolidating between 2600 and 3000: a continuation signal. Reversal below 2600 would warn of a primary down-swing, with a target of 2000; while recovery above 3000 would offer a target of 3700. Twiggs Money Flow breakout from its triangle would indicate future direction.

Australia: ASX

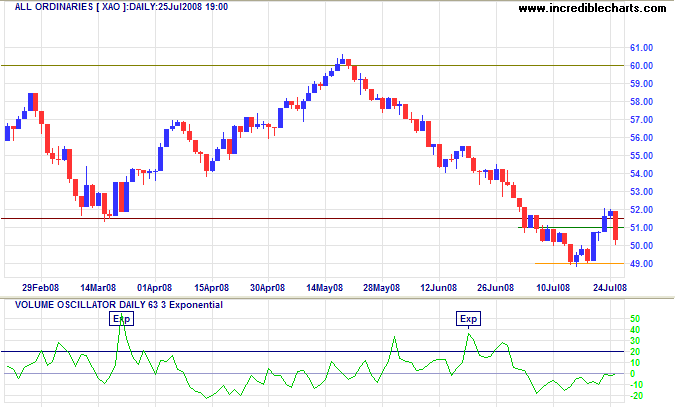

The All Ordinaries reversed sharply on Friday, penetration of 5100 completing a doji star reversal. Light volume indicates that the down-trend is likely to continue.

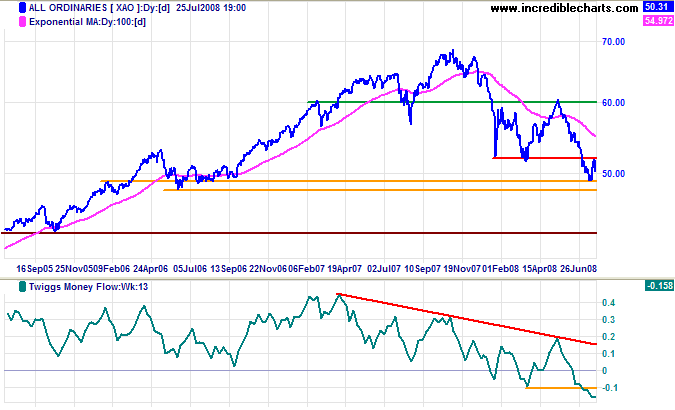

Long Term: Reversal below support at 4900 would offer a target of 4400 [5200-(6000-5200)]. Declining Twiggs Money Flow signals continued selling pressure.

To sit back hoping that someday, some way, someone will make things right,

is to go on feeding the crocodile, hoping he will eat you last

— but eat you he will.

~

Ronald Reagan

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.