Gold & Euro Find Support

By Colin Twiggs

July 8, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

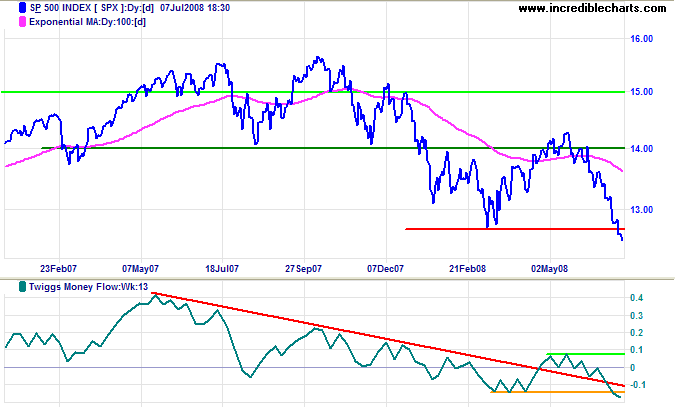

S&P 500

The S&P 500 made a clear break below support at 1270, signaling another primary down-swing. The target is 1100 [1270-(1430-1270)=1110]. Declining Twiggs Money Flow indicates selling pressure. Recovery above 1300 is now most unlikely — and would warn that the breakout has failed.

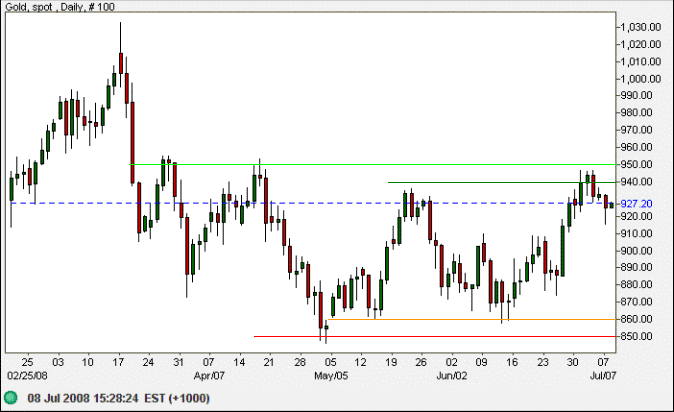

Gold

Spot gold made a failed breakout above resistance at $940, but Monday's long tail indicates (short-term) buying support. Recovery above $950 would signal a test of $1000. A fall below $910 would warn of a test of primary support at $850.

Source: Netdania

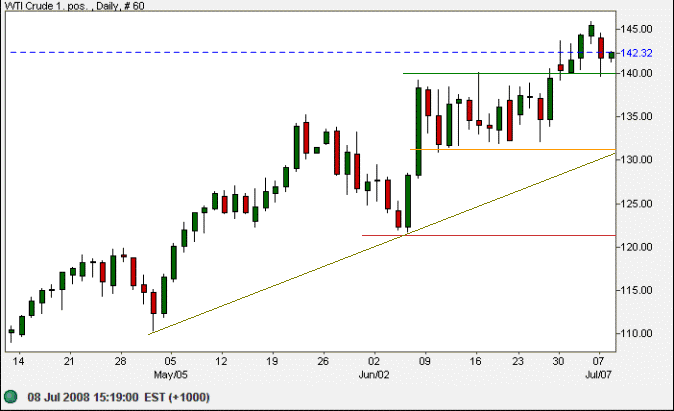

Crude Oil

West Texas Intermediate Crude is testing short-term support at $140/barrel. Respect of support would offer a target of $135+(135-122)=$148; failure would test the rising trendline at $131.

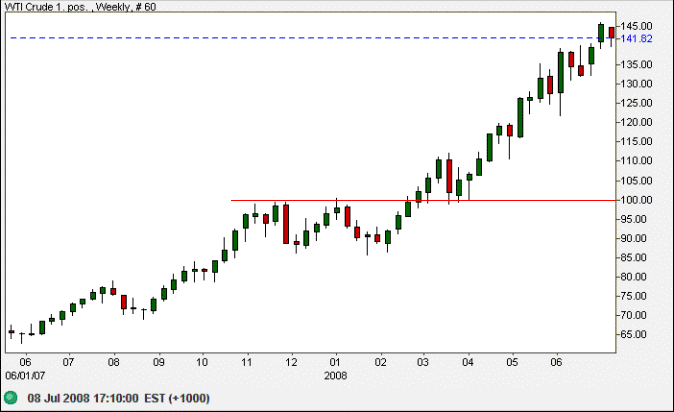

In the longer term, reversal below $131 is unlikely — and would warn of a secondary correction. Primary support remains at $100/barrel.

Source: Netdania

Currencies

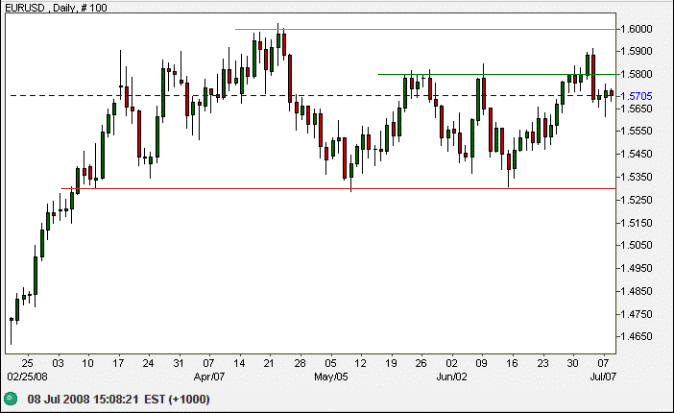

The euro made a failed break above $1.5800, but Monday's long tail indicates short-term support. Recovery above $1.58 would warn of another attempt at $1.60; while reversal below Monday's low would test primary support at $1.53. In the longer term, expect strong resistance at $1.60 — and equally strong support at $1.53.

Source: Netdania

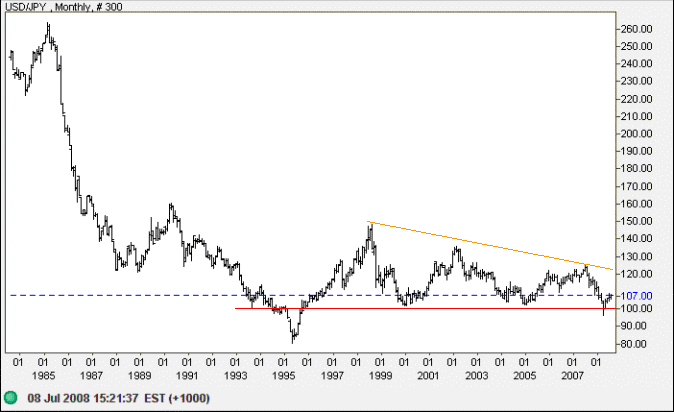

The monthly chart shows the greenback rallying after a failed break below 100 yen, but the bearish descending triangle continues.

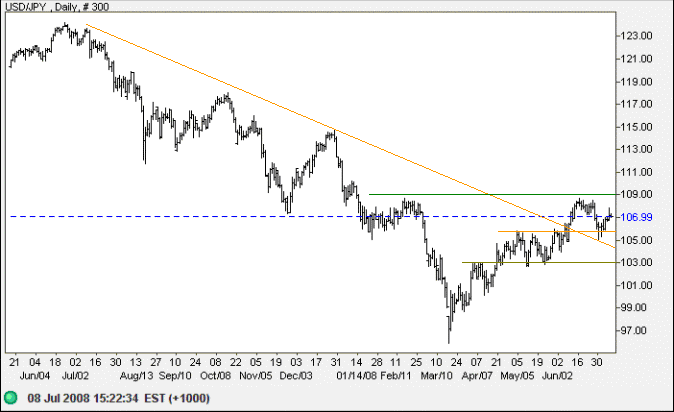

In the shorter term, the dollar successfully tested support at 106 yen and is headed for resistance at 109. Breakout would confirm the end of the primary down-trend, but we need to be cautious of the new up-trend: V-shaped bottoms are prone to failure. Reversal below 106 would warn of a test of primary support at 100/96.

Source: Netdania

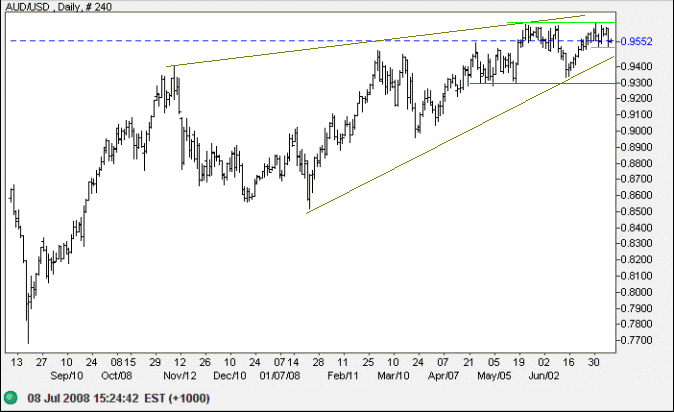

The Australian dollar is consolidating in a narrow band between $0.9500 and $0.9700: a bullish sign. Breakout would signal a test of parity. In the longer term, the rising wedge is a bearish pattern and reversal below $0.9300 would signal a secondary correction.

Source: Netdania

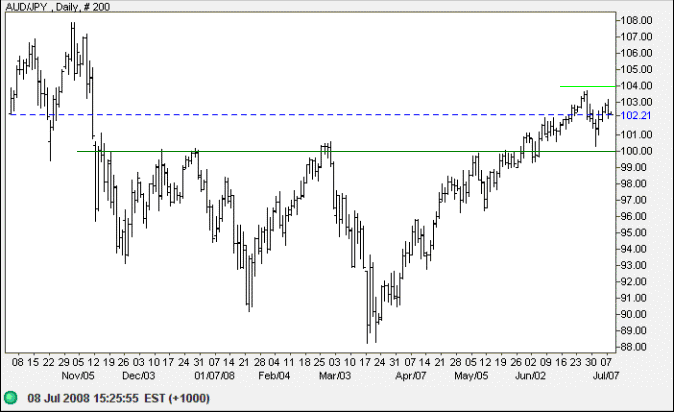

The Aussie successfully tested support at 100 yen and breakout above 104 would signal an advance to 108. Reversal below 100 is now unlikely — and would test 90/88.

Source: Netdania

If you hear that someone is speaking ill of you, instead of trying to defend yourself you should say:

"He obviously does not know me very well, since there are so many other faults he could have mentioned."

~ Epictetus (55 A.D. - 135 A.D.)

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.