S&P 500 Bear Signal

By Colin Twiggs

July 1, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

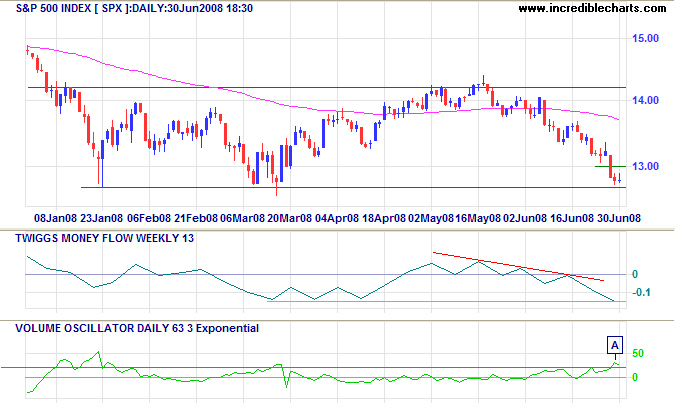

S&P 500

The S&P 500 is consolidating in a narrow range above support at 1270, poised for a downward breakout that would confirm the recent Dow signal of another primary down-swing. Strong volume [A] normally signals buying support but may (as pointed out by reader Barb) in part be due to June 27 rebalancing of the Russell 3000 index. Declining Twiggs Money Flow shows longer term selling pressure. Recovery above 1300, while unlikely, would warn that the bearish pattern has failed.

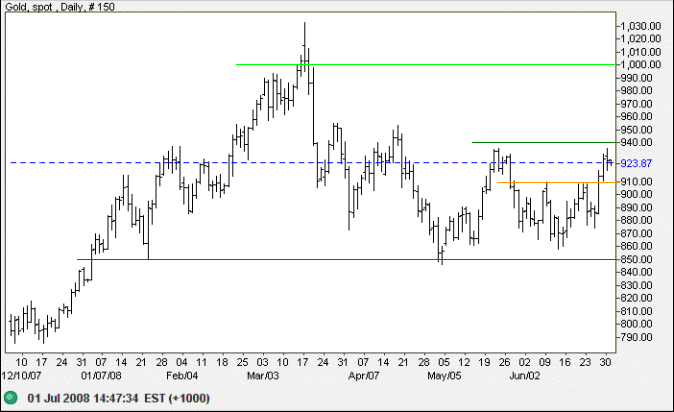

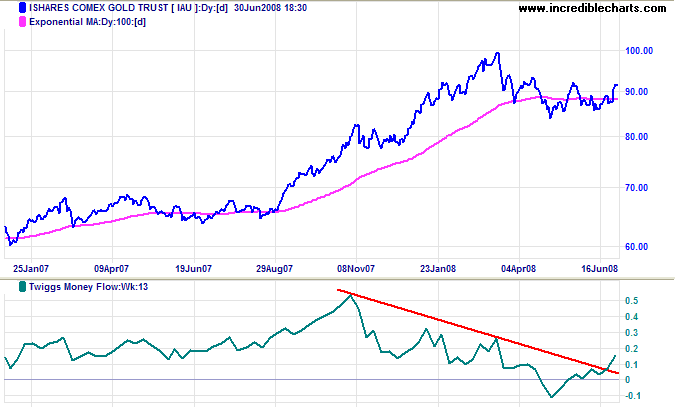

Gold

Spot gold is consolidating in a bullish narrow range below resistance at $940. Breakout would signal a test of $1000. Reversal below $910 is less likely, and would warn of a test of primary support at $850.

Source: Netdania

Rising Twiggs Money Flow (weekly) on the iShares chart (1/10th of an ounce) signals buying pressure.

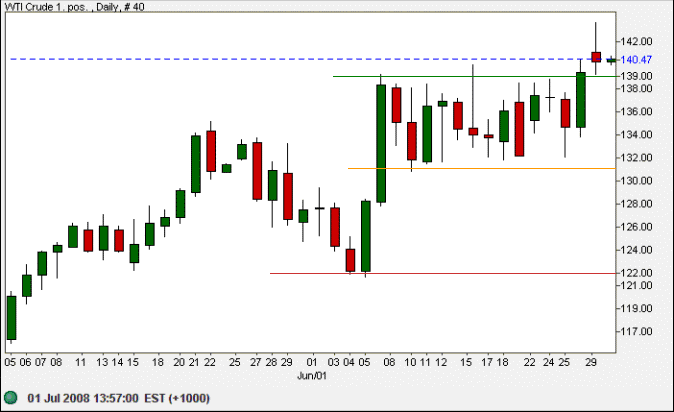

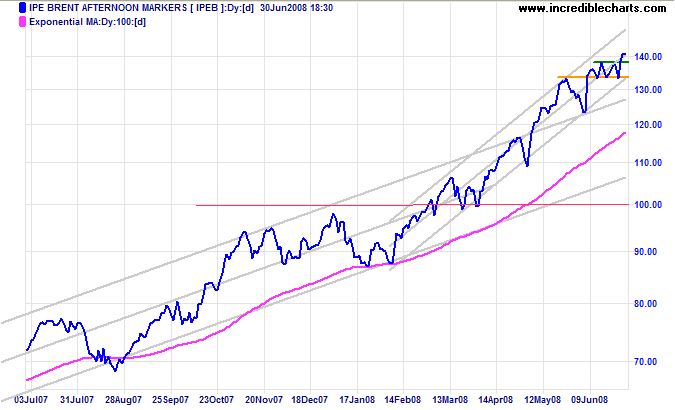

Crude Oil

West Texas Intermediate Crude broke out above $139, offering a target of $135+(135-122)=$148. Short, narrow consolidation above the breakout level is a mildly bullish sign. Reversal below $131 is now unlikely — and would warn of a secondary correction.

Source: Netdania

Looking at the chart for Brent Crude (below), the recent surge in crude prices is contained within a tight channel. A test of the upper channel at around $148 is likely; while downward breakout would warn of a secondary correction, testing support at $100.

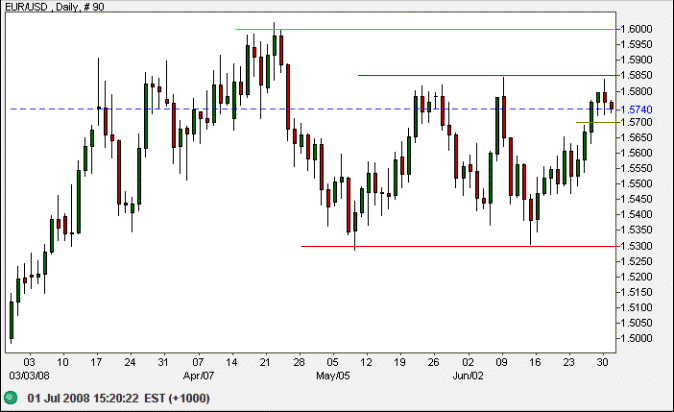

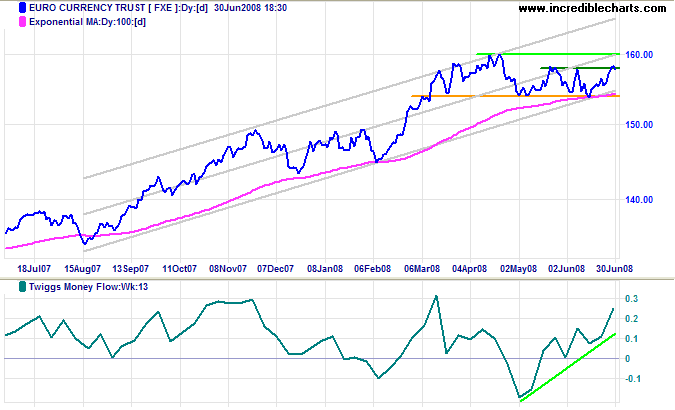

Currencies

The euro is consolidating in a narrow formation below resistance at $1.5850: a bullish sign. There is further resistance at $1.60, but the target would be 1.58+(1.58-1.53)=$1.63. Reversal below $1.57 is not expected — and would warn of another test of $1.53.

Source: Netdania

Rising Twiggs Money Flow signals buying pressure on the Rydex Euro Currency chart (100 euros).

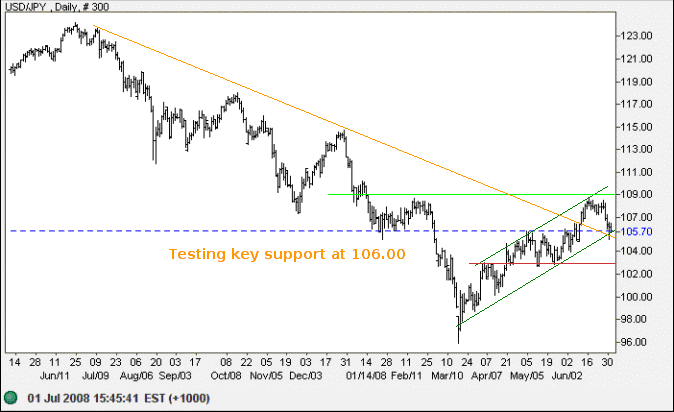

The greenback retraced to test key support at 106 yen. Respect of the support level, or breakout above $109, would signal the start of a primary up-trend. We need to be cautious, however, as V-shaped bottoms are prone to failure. Reversal below 106 remains as likely — and would warn of a test of primary support at $96.

Source: Netdania

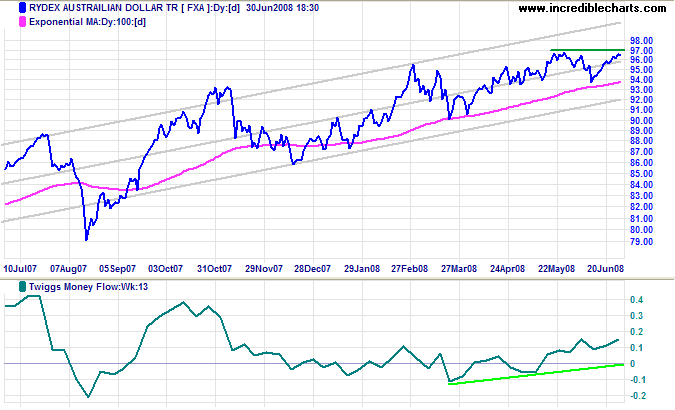

The Australian dollar is testing resistance at $0.9700. Breakout would signal a test of parity. Rising Twiggs Money Flow signals buying pressure. Reversal below $0.9300 is not expected — and would test primary support at $0.9000.

Source: Netdania

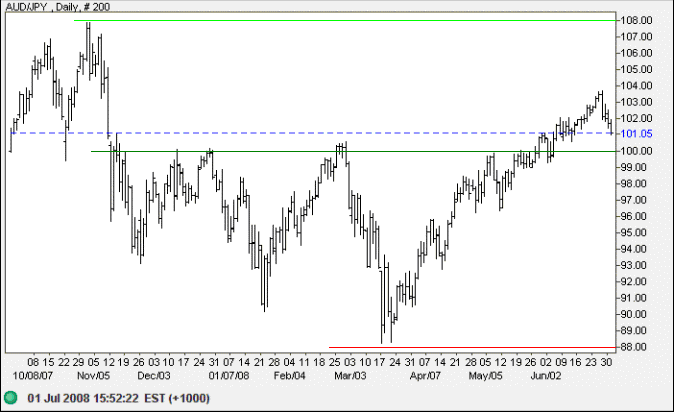

The Aussie is retracing to test the new support level at 100 yen. Expect support to hold and an advance to 108 in the longer term. Failure of support is not expected — and would test long-term support at 88 yen.

Source: Netdania

The nice part about being a pessimist is that you are constantly being either proven right

or pleasantly surprised.

~ George Will

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.