Dow Tumbles

By Colin Twiggs

June 28, 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

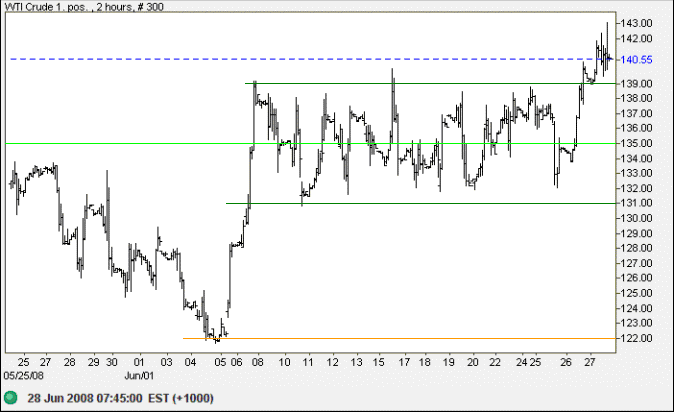

Crude Oil

West Texas Intermediate Crude broke through resistance at $139/barrel before retracing to respect the new support level. The breakout offers a target of $135+(135-122)=$148. Reversal below $139 is now unlikely — and would warn of a test of $131.

Rising fuel prices and the credit squeeze in financial markets are both likely to slow consumption, causing stock markets to weaken.

USA

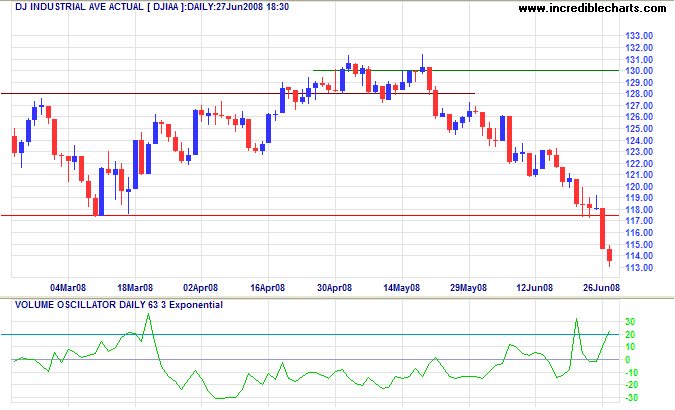

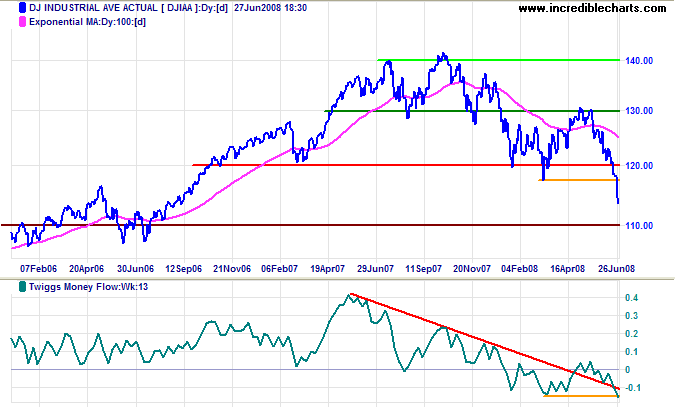

Dow Jones Industrial Average

The Dow broke primary support at 11750, signaling another primary down-swing. Friday's strong volume reveals interest from buyers, but whether this is sufficient to stem the surge of selling will only be evident after a few days.

Long Term: Breach of primary support at 11750 offers a target of 12000-(13000-12000)=11000. Twiggs Money Flow reversal below its March low confirms abnormal selling pressure.

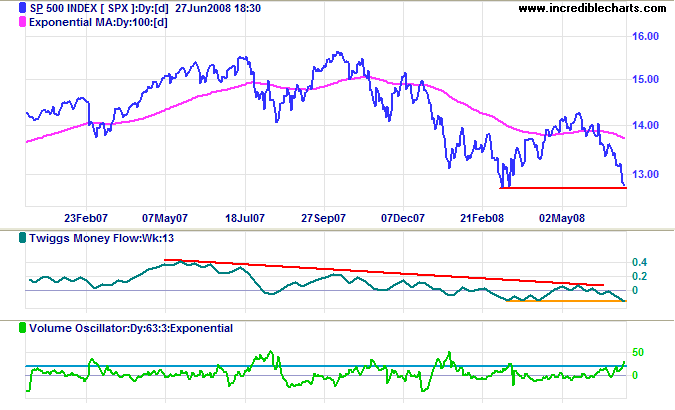

S&P 500

The S&P 500 is testing primary support at 1270. Friday's strong volume indicates buying support. Twiggs Money Flow below its March low, however, warns of another primary decline — with a target of 1270-(1420-1270)=1120.

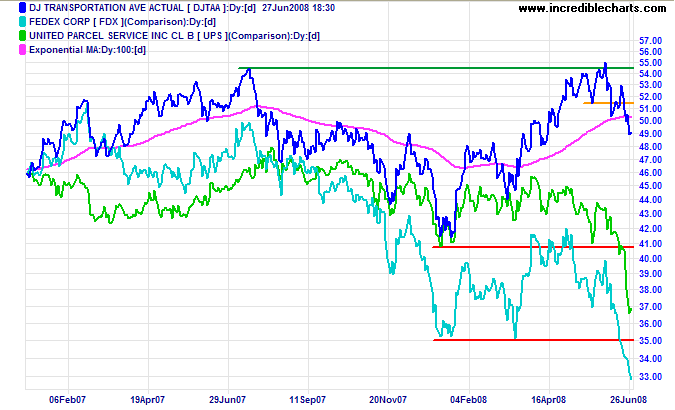

Transport

FedEx and UPS both show strong primary down-trends, with the Dow Transport Index likely to follow. The wider economy looks in for a rough time over the next 6 to 12 months.

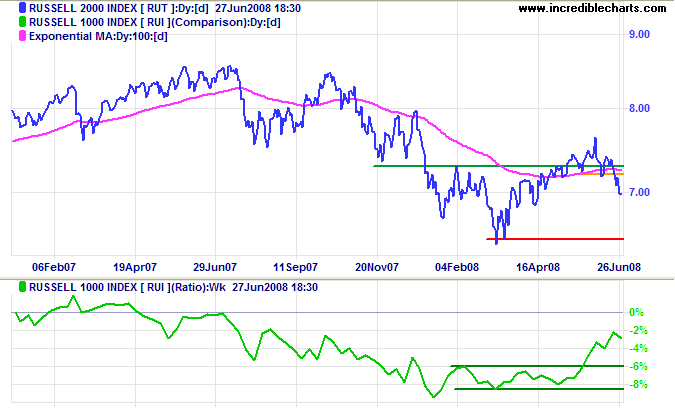

Small Caps

The Russell 2000 Small Caps index fell through short-term support and is headed for a test of primary support at 645. The ratio to the large cap Russell 1000 continues to rise, indicating that small caps are favored over large cap stocks.

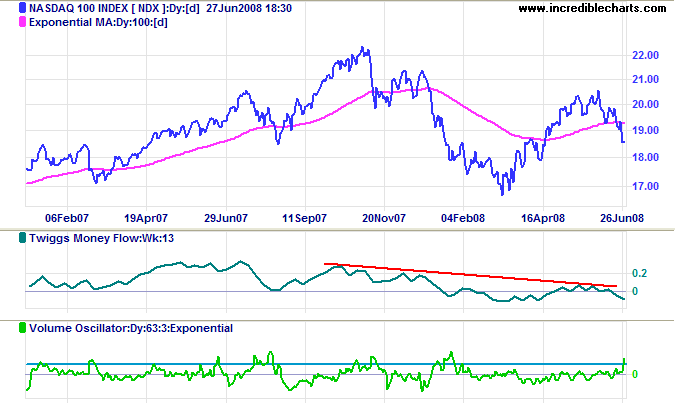

Technology

The Nasdaq 100 signals a test of primary support at 1700. Twiggs Money Flow (13-week) below its March low would warn of another primary decline — with a target of 1700-(2000-1700)=1400. Strong volume, however, indicates interest from buyers: expect short-term support around 1800.

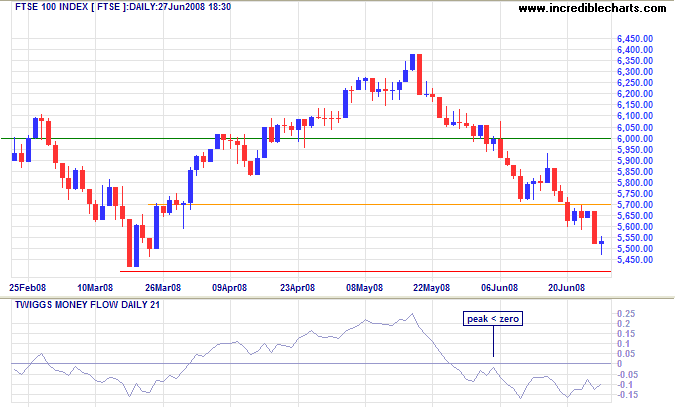

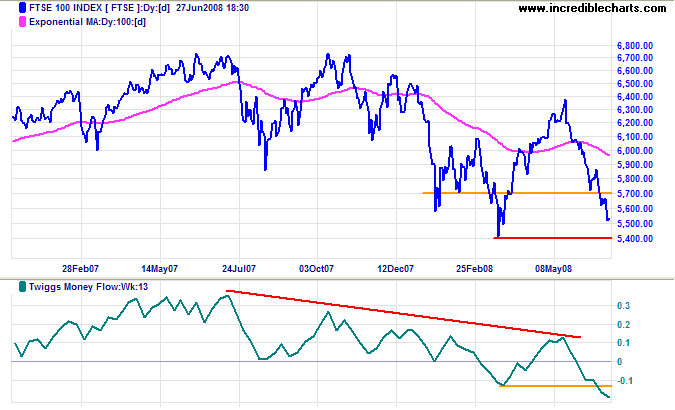

United Kingdom: FTSE

The FTSE 100 is headed for a test of primary support at 5400. Friday's doji candlestick indicates short-term consolidation at 5500,but Twiggs Money Flow (21-day) holding below zero warns of strong selling pressure in the longer term.

Twiggs Money Flow (13-week) below its March low warns that primary support is not likely to hold. Breach of 5400 would offer a target of 5400-(6400-5400)=4400.

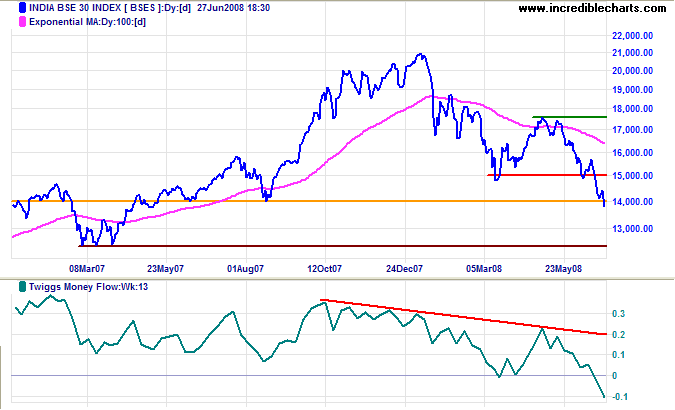

India: Sensex

The Sensex encountered only short-term support at 14000 and is headed for a test of the next primary support level at 12500. Twiggs Money Flow (13-week) below zero indicates unusual selling pressure.

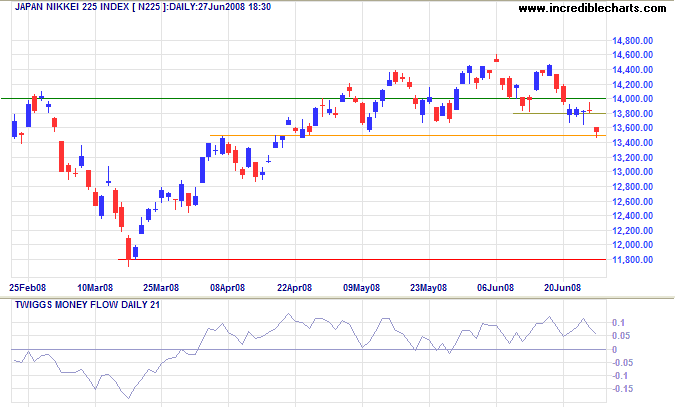

Japan: Nikkei

The Nikkei 225 broke through short-term support at 13800, warning of another secondary correction. Failure of support at 13500 would confirm this. Twiggs Money Flow oscillating above zero continues to signal buying pressure, but this is likely to be overwhelmed by the bearish influence of international markets.

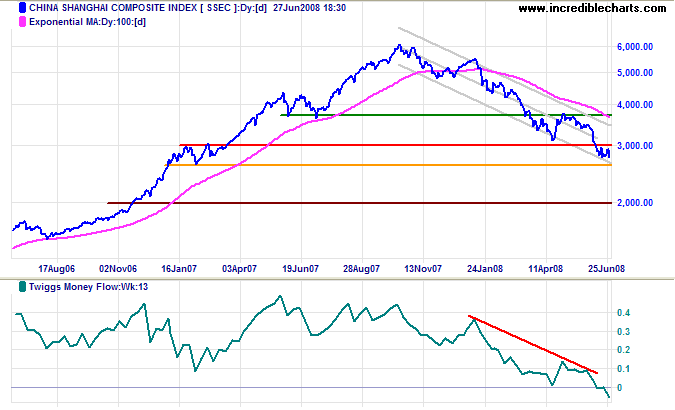

China

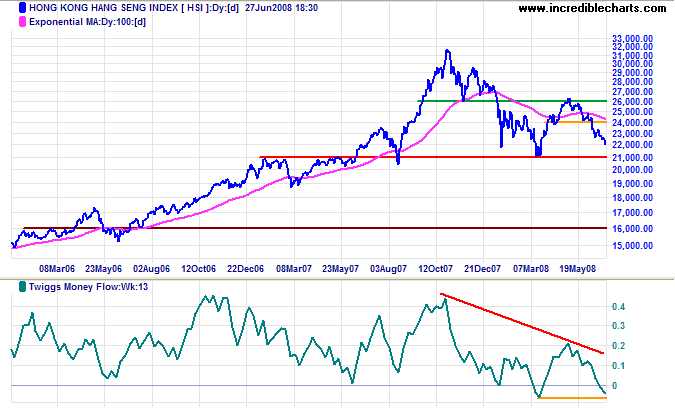

The Hang Seng is headed for a test of primary support at 21000. Failure of primary support would offer a target of 21000-(26000-21000)=16000. Twiggs Money Flow reversal below its March low would also warn of a primary down-swing.

The Shanghai Composite is consolidating between 3000 and 2700. Failure of the short-term support level would offer a target of 2000. Twiggs Money Flow (13-week) below its March low warns of unusual selling pressure. Given the bearish influence from the US and other major markets, the index is unlikely to recover above 3000 in the short-term.

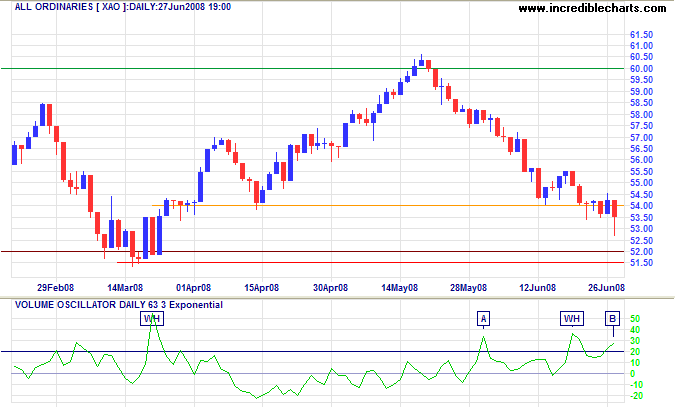

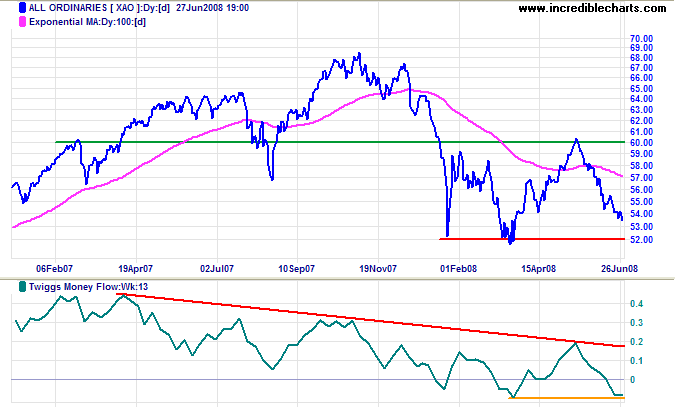

Australia: ASX

Friday's long tail and strong volume [B] on the All Ordinaries signal buying support. As [A] previously showed, however, support does not always lead to a trend reversal — and a test of primary support at 5150 remains more likely. Recovery above 5450 is not expected but would warn that the down-swing may be ending — confirmed if the index rises above 5550.

Long Term: Failure of primary support would offer a target of 5200-(6000-5200)=4400. Respect of primary support remains less likely — and would signal another test of 6000. Twiggs Money Flow (13-week) below its March low would warn of a primary down-swing.

.....where Fortune is concerned:

she shows her force where there is no organized strength to resist her;

and she directs her impact there

where she knows that no dikes and embankments are constructed to hold her.

~ Niccolo Machiavelli:

The Prince (1532)

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.