Why Has Crude Oil Spiked So High?

By Colin Twiggs

May 27, 2008 5:30 a.m. ET (7:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

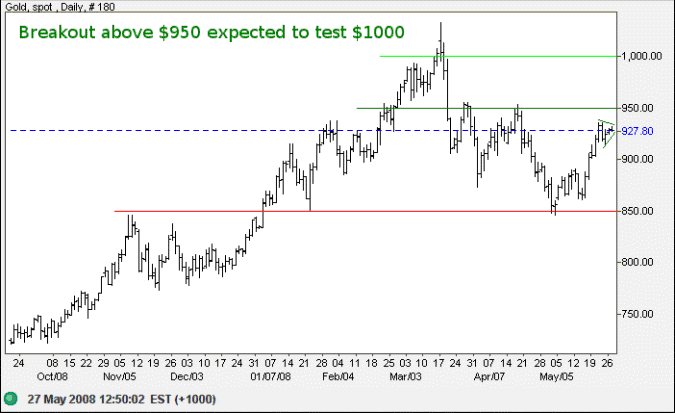

Gold

The short retracement on spot gold signals continuation of the rally. Breakout above resistance at $950 would indicate another primary advance to test of $1000; respect would signal another test of primary support at $850. A correction that ends above $850 would be a bullish sign.

Source: Netdania

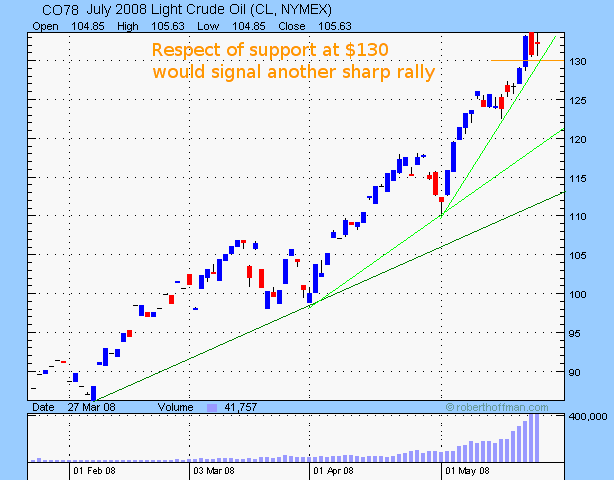

Crude Oil

There has been much debate in the last week over causes of the recent spike in oil prices.

- Oil tanker leasing rates have apparently trebled since April as Iran and Venezuela stockpile crude oil,

restricting supply in anticipation of even higher prices in the months ahead

(World-check). - Low interest rates from the Fed have reduced the carrying cost of stockpiling various commodities.

- Expectation of rising inflation has also fuelled demand for investment in real assets. With the housing market in a state of collapse and equities facing a recession, commodities remain one of the few viable options.

- The growth in commodity index funds from $13 billion to $260 billion over the last 5 years shows a close correlation to rising commodity prices, according to Michael Masters in testimony before the Congressional Subcommittee on Homeland Security and Governmental Affairs. Masters, a hedge fund manager, appealed to Congress to end the practice of index speculation.

The only obvious answer appears to be to slow the economy, thereby reducing demand and inflationary pressures. The Fed cannot raise interest rates, however, without exacerbating the housing crisis and further damaging the already vulnerable banking system. So $150/barrel or $200/barrel oil may be the least painful way of achieving this.

July 2008 Light Crude broke through resistance at $130. Narrow consolidation above the new support level would warn of another sharp rally. Reversal below $130 would be healthier, testing support at $125 and establishing a more solid base for the up-trend. A word of caution: rising trendlines show an accelerating up-trend, or self-reinforcing cycle, which is likely to culminate in a sharp upward spike — followed by an equally sharp drop as the market corrects from its excesses.

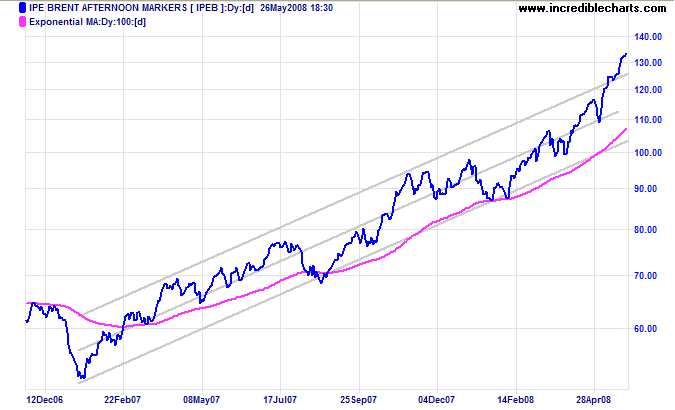

The long-term chart of Brent crude gives a similar warning of an accelerating up-trend, with price breaking above the upper border of the trend channel. Further steep gains would warn of a blow-off spike.

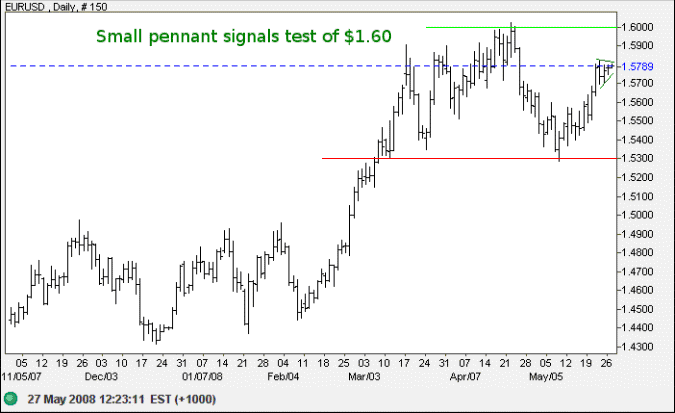

Currencies

A small pennant on the euro signals continuation of the rally and a test of $1.60. Reversal below $1.57, while unlikely, would warn of a test of primary support at $1.53. In the longer term, expect consolidation between $1.60 and $1.53. Central banks are likely to intervene, strengthening resistance at $1.60, to prevent further appreciation of the euro against the dollar.

Source: Netdania

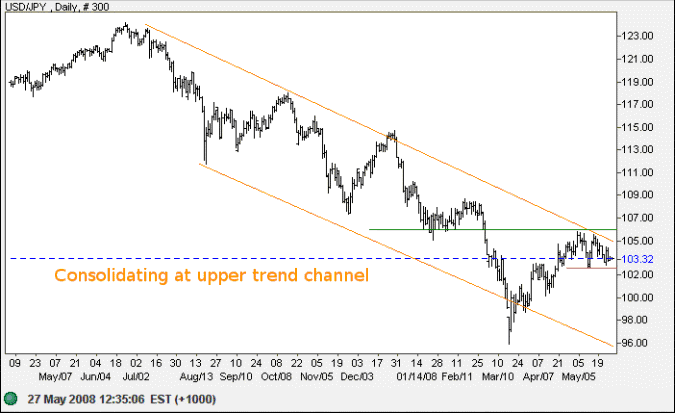

The greenback is consolidating below 106 yen. Upward breakout would warn that the primary down-trend is weakening; while failure of short-term support would signal another test of 100.

The descending triangle on the monthly chart is a bear signal, but we could see support at 100 yen strengthened by central bank intervention.

Source: Netdania

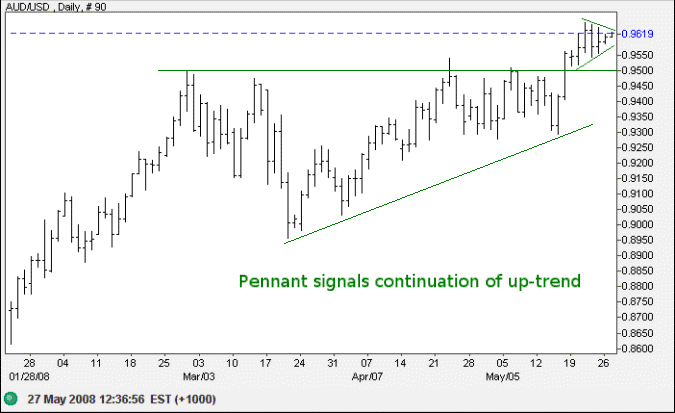

The Australian dollar formed a pennant after breaking through resistance at $0.95, signaling continuation of the up-trend. Abolition of the 10% Interest Withholding Tax on Australian semi-government bonds should see increased interest from offshore investors. Expect a test of parity in the weeks ahead.

Source: Netdania

The Aussie encountered strong resistance at 100 yen, but narrow consolidation below the resistance level is a bullish sign. Breakout would offer a target of 108. Reversal below 96, now less likely, would signal a test of long-term support at 86/88.

Source: Netdania

Simplicity is an acquired taste.

Mankind, left free, instinctively complicates life.

~ Katherine F. Gerould

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.