Transport Disappoints, Dow Fades

By Colin Twiggs

April 12, 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Overview

The Dow Transport Average reversed below its breakout level, suggesting a false signal, while the Dow and S&P 500 are now unlikely to overcome resistance at their former primary support levels. The Nikkei and Hang Seng indices look more promising, and the resources sector has softened the effect of the cedit crunch in Australia, but Shanghai and India remain weak.

USA

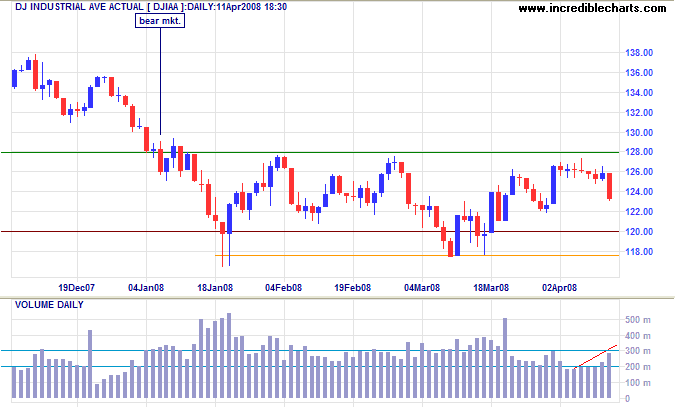

Dow Jones Industrial Average

The Dow broke downwards from its narrow consolidation above 12500, accompanied by strong volume. A fall below 12200 is likely and would signal another test of medium-term support at 12000/11750.

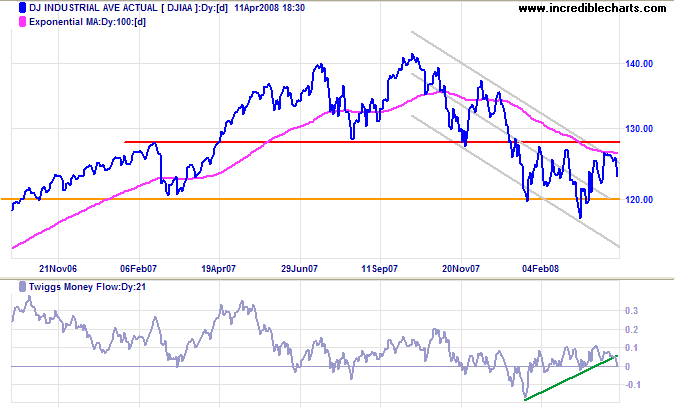

Long Term: Twiggs Money Flow turned down, but so far only signals short-term selling pressure. The Dow reversed at the upper trend channel and is likely to test the lower channel. A fall below support at 12000 would warn of another primary decline — confirmed if support at 11750 is penetrated. The medium-term target would be 12000-(12800-12000)=11200.

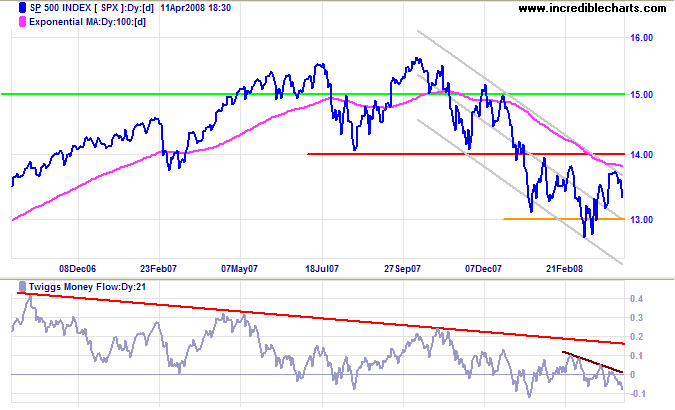

S&P 500

The S&P 500 is headed for a test of support at 1300, while Twiggs Money Flow signals both short-term and long-term selling pressure. A fall below 1300 would offer a medium-term target of 1300-(1400-1300)=1200 — confirmed if support at 1270 is penetrated.

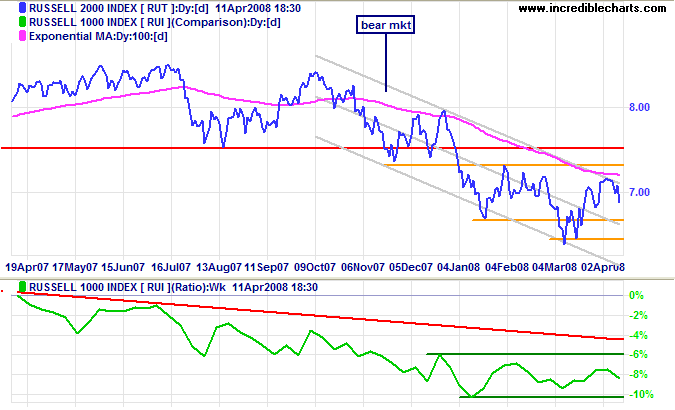

Small Caps

The Russell 2000 turned down at the upper trend channel and is headed for a test of support at 670/650. Breakout below 650 would confirm another primary decline — to the lower channel border. The ratio against the Russell 1000 continues to consolidate; breakout would indicate the future direction of the index.

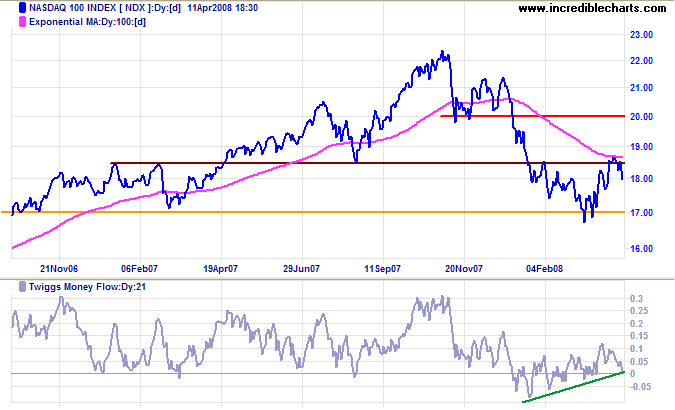

Technology

The Nasdaq 100 completed a false break above resistance at 1850 and Twiggs Money Flow turned down to signal short-term selling pressure. Expect a test of support at 1700. The index is in a primary down-trend, but appears more resillient than the Dow and S&P 500. Respect of support would indicate consolidation between 1700 and 1850, while failure would signal another primary decline — with a target of 1500 (the July 2006 low).

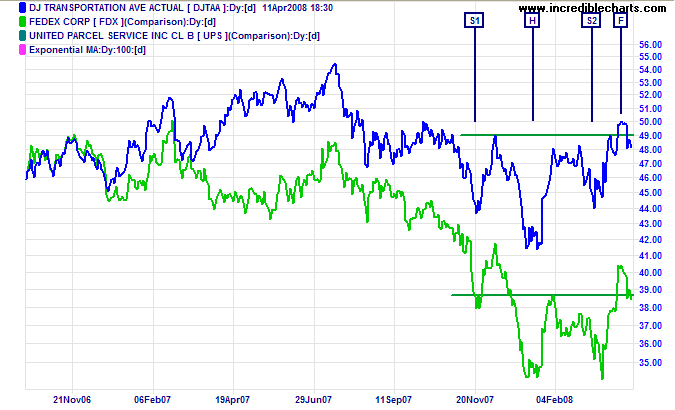

Transport

The Dow Jones Transportation Average reversed below support at 4900, from the recent inverted head and shoulders formation — suggesting a false signal (or bull trap). Fedex has also reversed below the neckline from its recent double bottom.

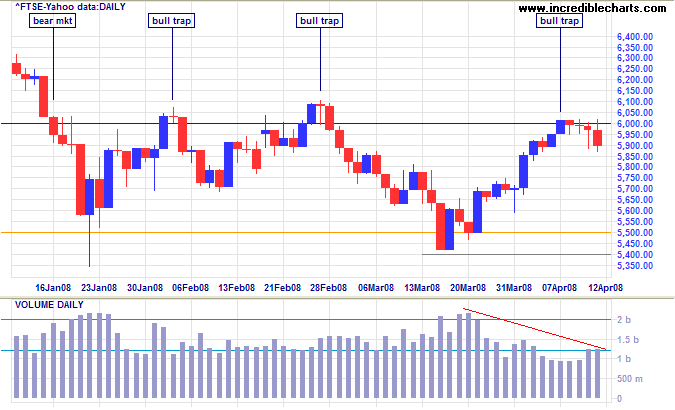

United Kingdom: FTSE

The FTSE 100 sprung another bull trap with a failed/false breakout above resistance at 6000.

Twiggs Money Flow is rising, but continued low volume indicates that there are insufficient buyers to force a breakout.

Another test of support at 5400 is likely.

Reversal above 6000 is not expected and should be treated with caution: we have already seen three false breaks.

Wait for retracement to confirm the new support level.

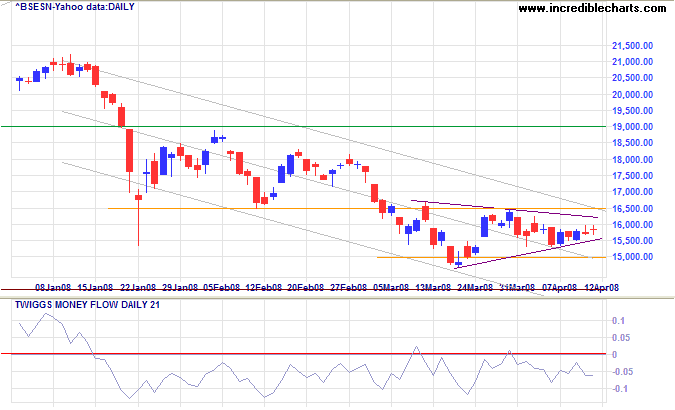

India: Sensex

The Sensex is consolidating in a pennant between 16500 and 15000, favoring continuation of the primary down-trend. The target is 14000, from the August 2007 low. Twiggs Money Flow holding below zero signals continued selling pressure.

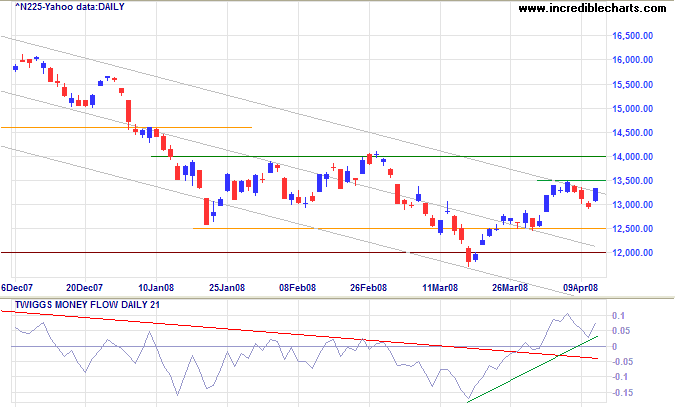

Japan: Nikkei

The Nikkei 225 is testing the upper trend channel. A rise above 13500 would complete a breakout, signaling that the primary-down-trend

is weakening, while reversal below 12500 would warn of a test of the lower channel.

Twiggs Money Flow

respected the zero line (from above) on its recent retracement, signaling medium-term buying pressure.

The outlook is more positive than it has been for some time.

A rise above 14000 would signal a primary trend reversal, while long-term consolidation between 12000 and 14000 is more likely.

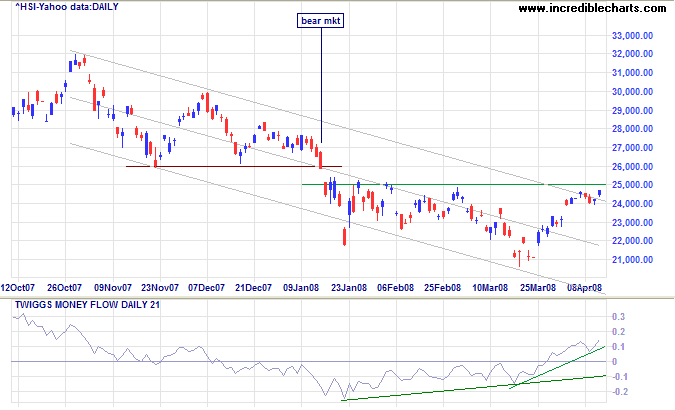

China: Hang Seng & Shanghai

The Hang Seng index is threatening its upper trend channel. Breakout above 25000 (while January - February may not be a classic line) would signal reversal to a primary up-trend. Rising Twiggs Money Flow indicates short- and medium-term buying pressure. Reversal below 24000, however, would indicate another test of the lower channel.

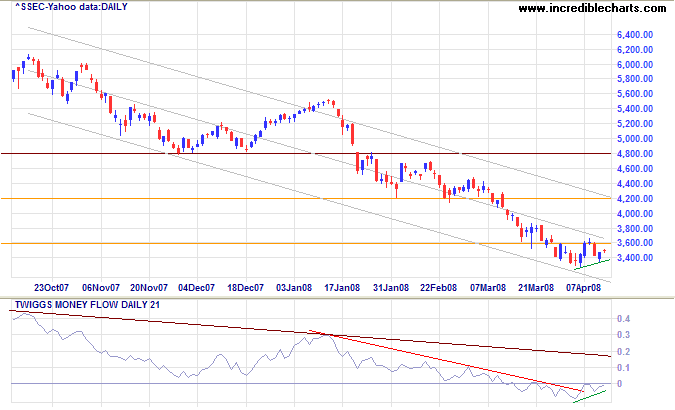

The Shanghai Composite remains in a strong primary down-trend. The index found short-term support at 3300 and a rise above 3600 would indicate a test of the upper trend channel. Twiggs Money Flow is rising but remains below zero, indicating that selling pressure dominates. Reversal below 3300 would offer a short-term target of 3000.

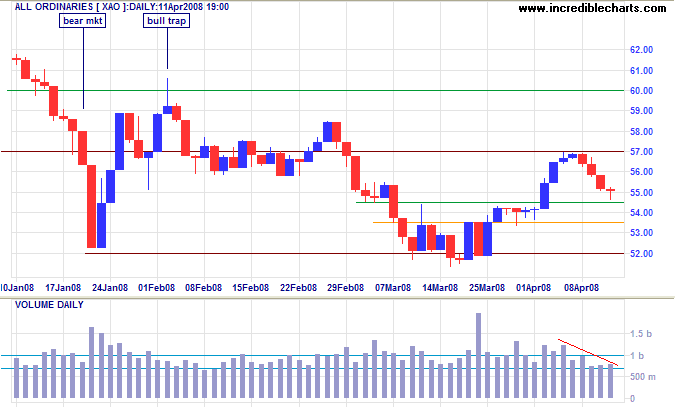

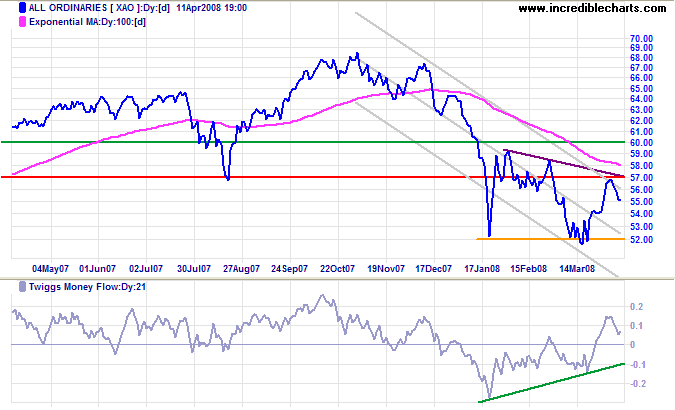

Australia: ASX

The All Ordinaries encountered short-term resistance at 5700 and retraced on light volume for four days. Friday's long tail indicates support at 5450, suggesting another rally — but selling pressure sparked by Friday's 2 percent fall on the Dow is likely to overwhelm any buyers who have not fled. Expect a test of medium-term support at 5200. Recovery above 5700 is unlikely in the present circumstances.

Long Term: Failure of support at 5200 would warn of a primary decline, with a target of the June 2006 low of 4800. Rising Twiggs Money Flow signals buying pressure, but this picture will change if the Dow continues to fall. Resistance at 6000 is expected to hold.

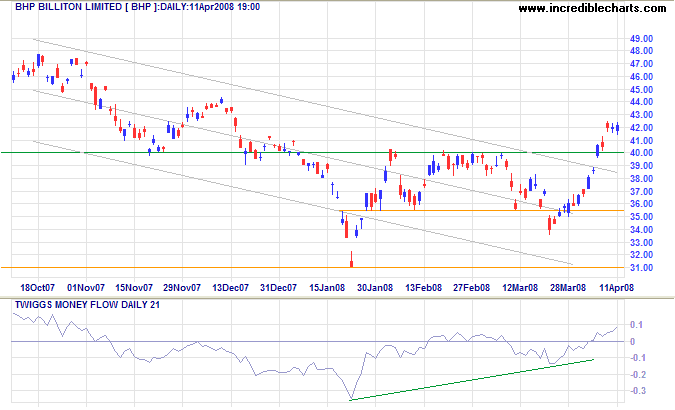

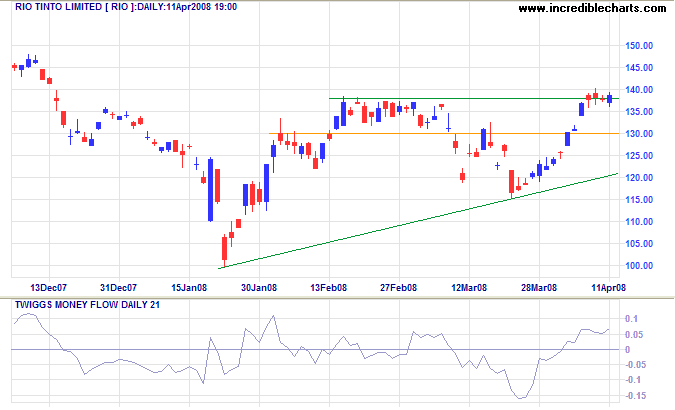

Mining giants BHP and Rio Tinto both broke through resistance to signal primary up-trends. Wait for retracement to respect the new support level before we can safely say that the resources sector is on the road to recovery. [Note that the charts are in AUD, not USD].

It's plain hokum. If you can't convince 'em, confuse 'em.

It's an old political trick. But this time it won't work.

~ President Harry S Truman

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.