Gold Update

By Colin Twiggs

April 2, 2008 12:00 a.m. ET (4:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Gold

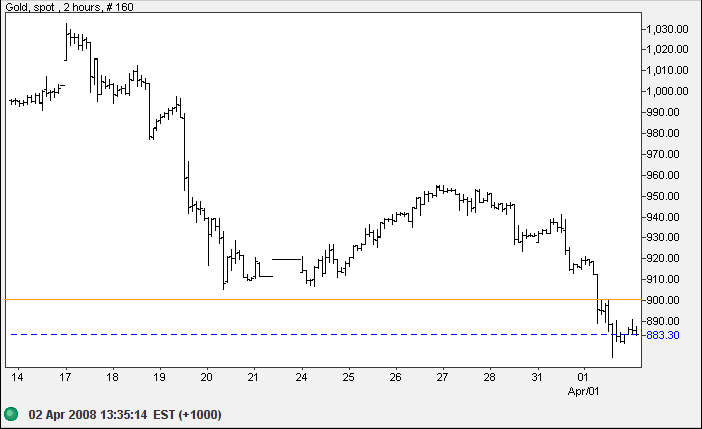

Since yesterday's newsletter, gold has fallen through support at $900.

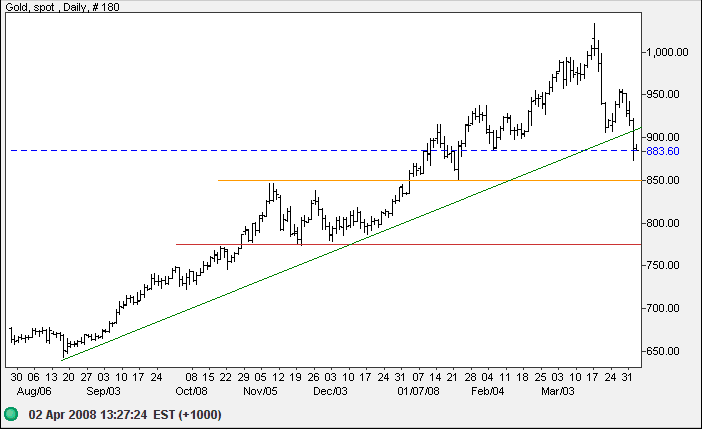

Penetration of the long-term rising trendline warns of a secondary correction. The metal is likely to find support at $850 in the short-term, but could go as low as $775 in the next downward leg.

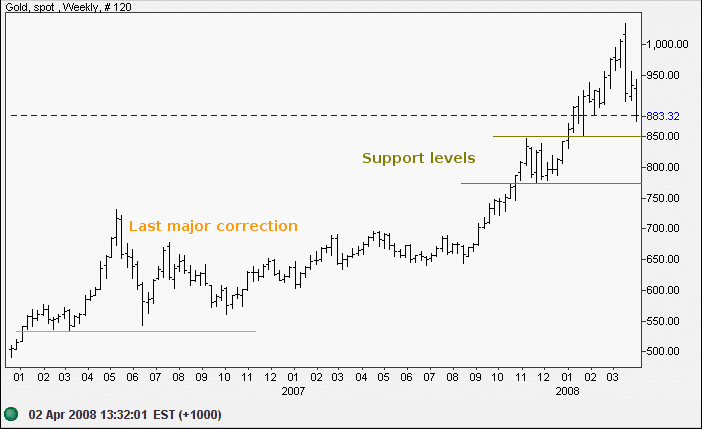

The weekly chart shows that gold experienced a similar correction in mid-2006. And we may see a similar consolidation to establish a new base this time. The primary up-trend remains intact and would only be threatened if there is a fall below support at $775.

Source: Netdania

Let him buy one-fifth of his full line. If that does not show

him a profit he must not increase his holdings because he has

obviously begun wrong; he is wrong temporarily and there is no

profit in being wrong at any time.

~ Jesse Livermore in Edwin Lefevre's Reminiscences of a Stock Operator

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.