Gold Finds Support At $900

By Colin Twiggs

March 25, 2008 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

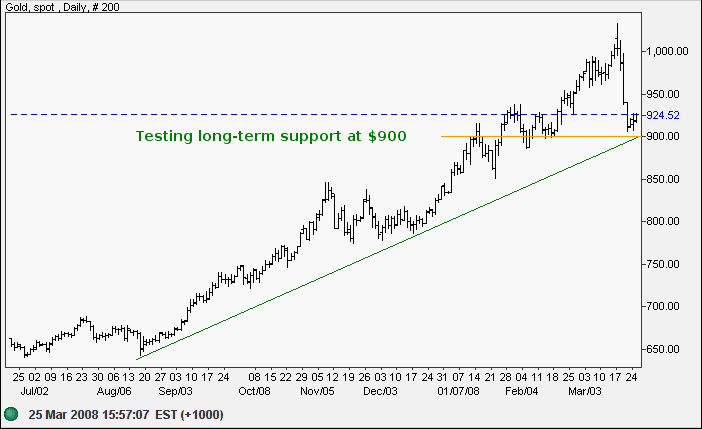

Gold

Spot gold is consolidating above support at $900 — which is expected to hold. Breakout below this level, however, would breach the rising trendline and signal weakness in the primary up-trend.

Source: Netdania

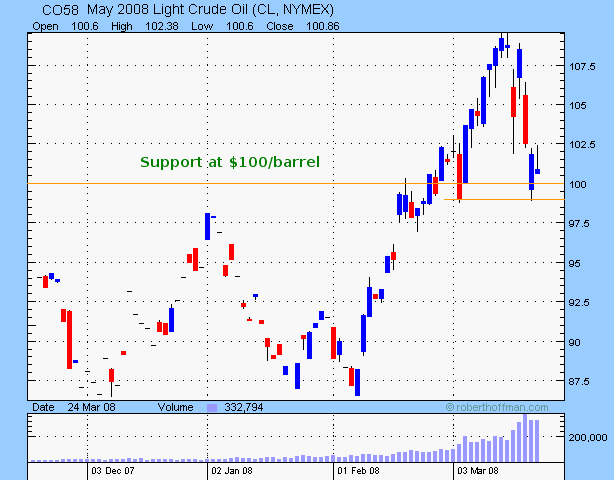

Crude Oil

May 2008 Light Crude formed an open-close reversal signaling strong support at $100. Expect consolidation between $99 and $102.50 followed by an upward breakout (crude is after all in a primary up-trend). A fall below $99, however, would signal a test of primary support at $86.

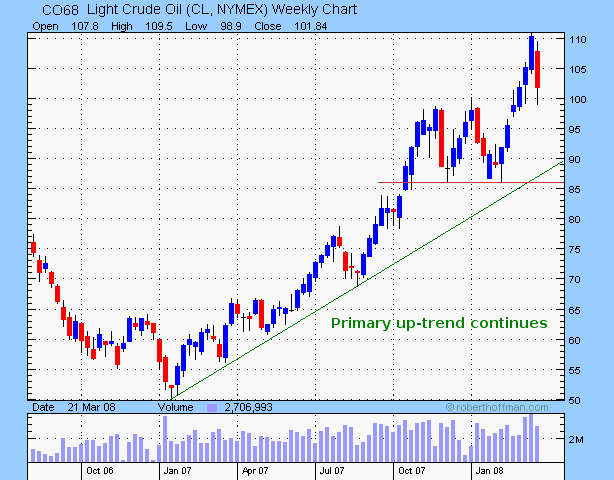

The strong primary up-trend continues on the weekly chart.

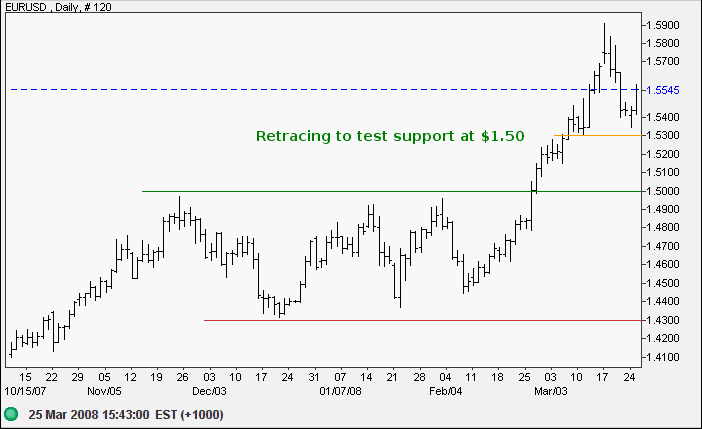

Currencies

The euro found short-term support at $1.53. Penetration of this level would test long-term support at $1.50. Gold and the euro tend to move in sync, so I am expecting a stronger retracement. Respect of support at $1.50 would confirm the strong primary up-trend.

Source: Netdania

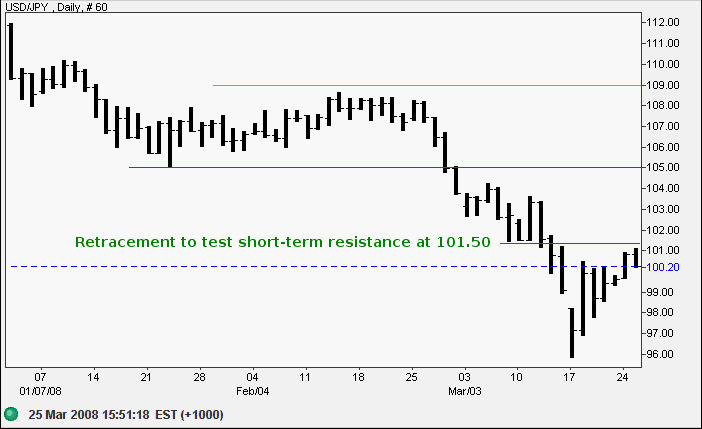

The dollar retraced to test short-term resistance at 101.50 yen. Respect of this level would confirm the strong primary down-trend, with a target of the all-time low at 80.

Source: Netdania

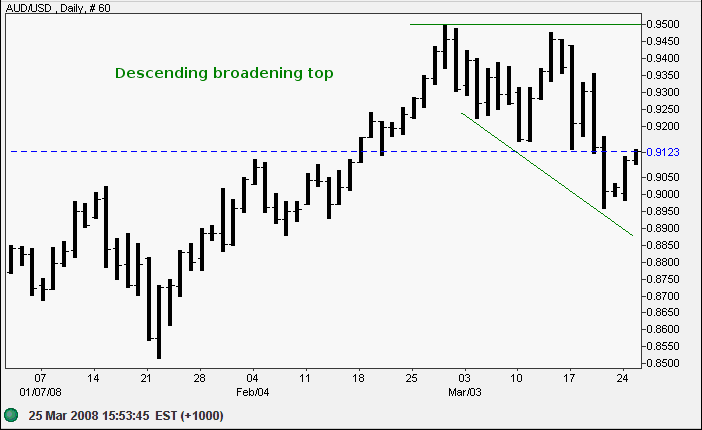

The Australian dollar continues in a descending broadening top. Expect strong resistance at $0.9450 to $0.9500. A failed up-swing would warn of a breakout and test of primary support at $0.85.

Source: Netdania

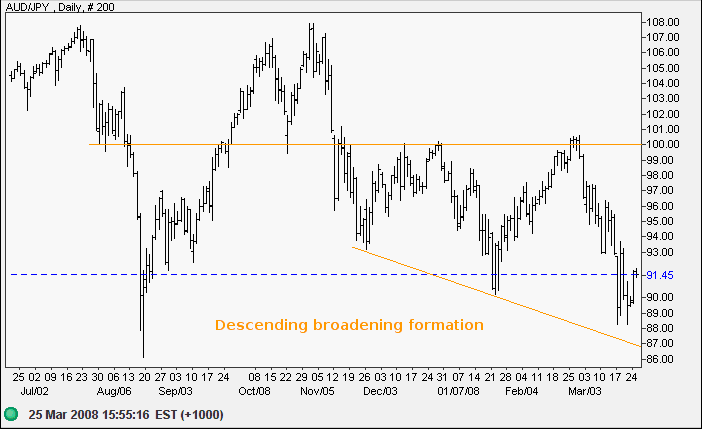

The Aussie also displays a descending broadening pattern against the yen. Expect strong resistance at 100. A failed up-swing or (downward) breakout would offer a long-term target of 86-(108-86)=64.

Source: Netdania

If freedom loving people throughout the world do not speak out

against China’s oppression in Tibet we have lost all

moral authority to speak on

human rights anywhere in the world.

~ House speaker Nancy Pelosi

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.