Bull Trap

By Colin Twiggs

March 13, 2008 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Bank Exposure

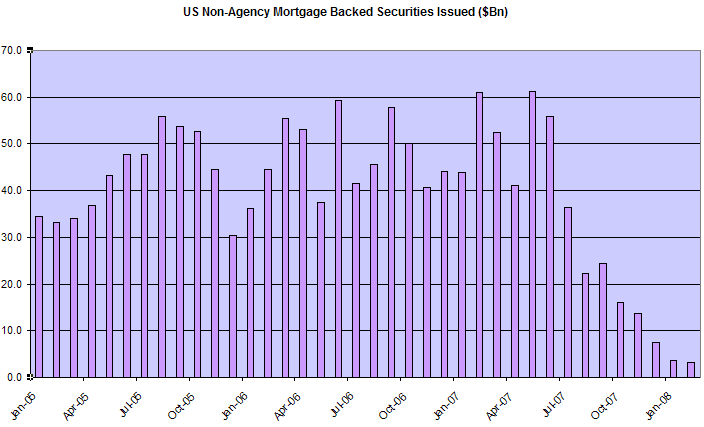

The Fed announced a new temporary lending facility that will allow banks and bond dealers to swap mortgage-backed securities, that they can't currently sell, for highly liquid Treasuries. This will increase the total amount of money that the Fed has pumped into the financial system to over $400 billion, in an attempt to sustain the flow of credit to consumers. So far the increased liquidity has not had much effect. A slow-down in credit extension would cause a sharp down-turn in the economy.

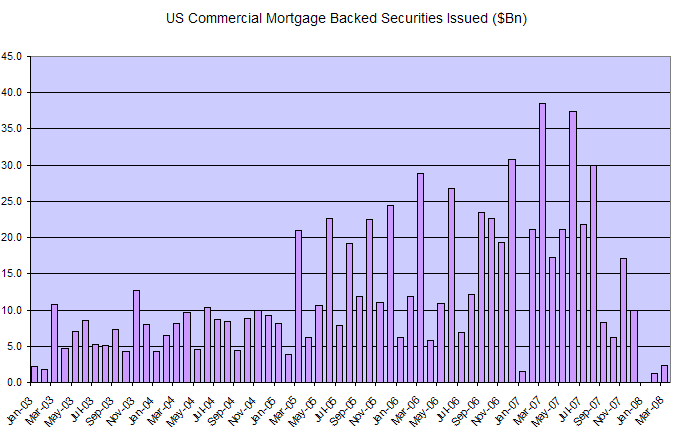

Loss of liquidity in the mortgage-backed security market is best illustrated by the chart of new issues.

During the week I spoke with fixed income specialist Neil King

of RIM Securities Limited.

His view of the Fed's bail-out plan is that it will improve

liquidity but does not address the solvency issues faced by a

number of banks.

"Repurchase agreements add short term liquidity only. But if a

CDO is valued at 20c in the dollar, repos will not change

this."

I also agree with Neil that the positive sentiment offers "an

excellent opportunity to liquidate long positions —

before people realise it is nothing more than a bull trap and

the markets once again move lower."

Treasury Yields

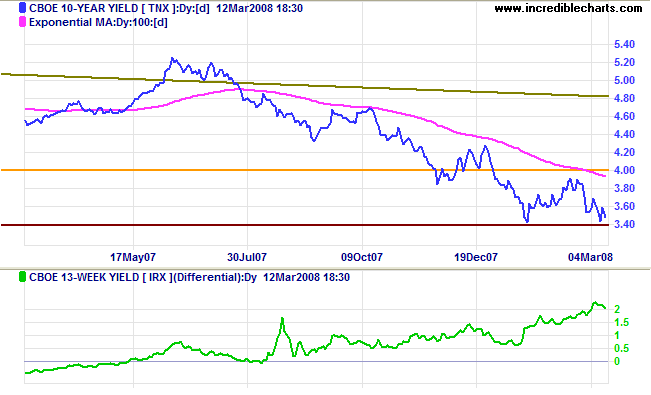

Ten-year treasury yields are again testing support at 3.40%. The strong down-trend, however, is likely to continue. The rising yield differential is caused by falling short-term rates.

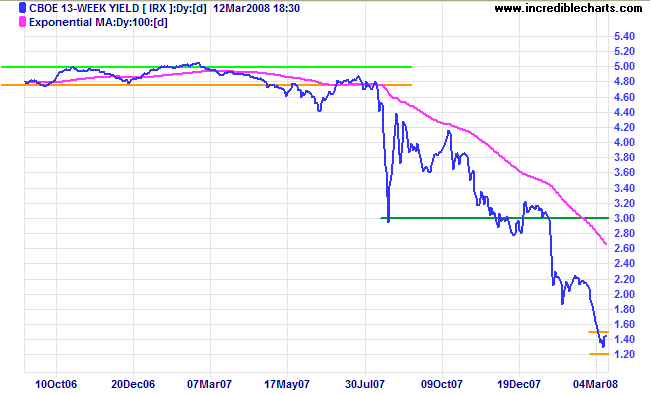

Three-month treasury bills yields are now consolidating between 1.20% and 1.50%; more than 150 points below the current fed funds target rate of 3.00%, compared to 25 to 50 points in a normal market. The market remains highly risk-averse and the strong down-trend (in short-term rates) continues.

Financial Markets

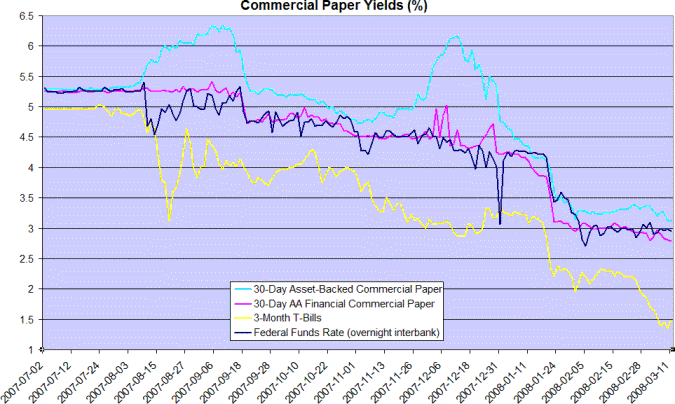

The wide spread between treasury bill and commercial paper rates reflects investors aversion to lending in the financial markets. A further half-percent cut in the fed funds rate is expected at the March 18 FOMC meeting.

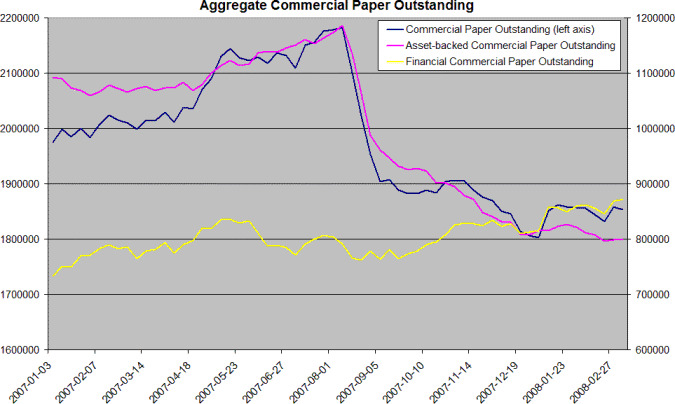

Total asset-backed commercial paper issued is holding at $800 billion, after a drop of almost $400 billion. The rise in financial commercial paper shows banks raising additional funds as they are forced to take asset-backed debt back onto their balance sheets.

Commercial Real Estate

While default rates remain relatively low, new issues of commercial mortgage-backed securities have also dwindled, placing downward pressure on commercial real estate prices.

Bank Credit

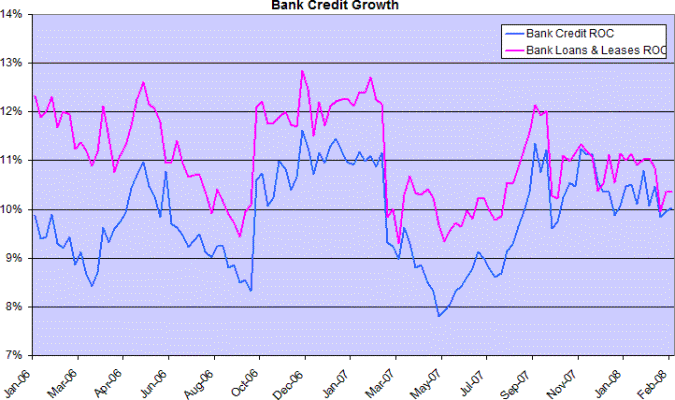

Bank credit growth is expected to fall below 10%. A sharp decline would signal a full-blown recession.

Consumer Credit

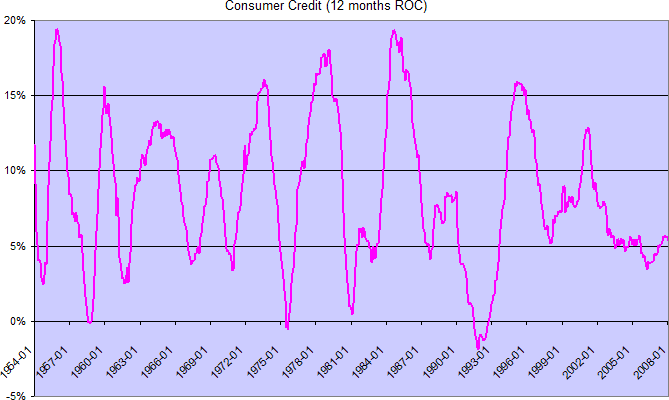

Consumer credit growth has turned down, but the position is so far not alarming compared to earlier recessions.

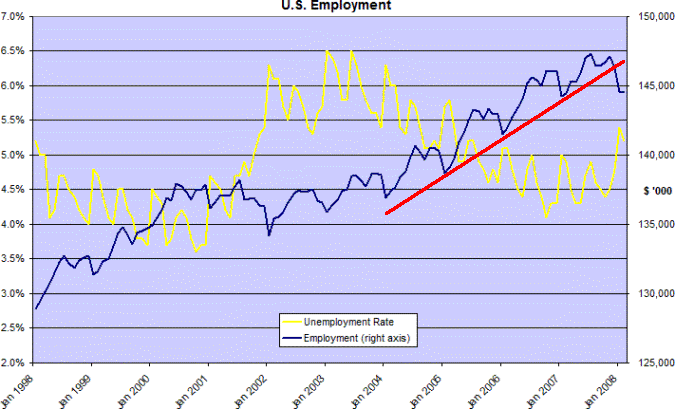

Employment

Employment has broken out of its up-trend. We now have to wait and see if the market consolidates, as in recent recessions, or trend downwards, which would warn of a depression.

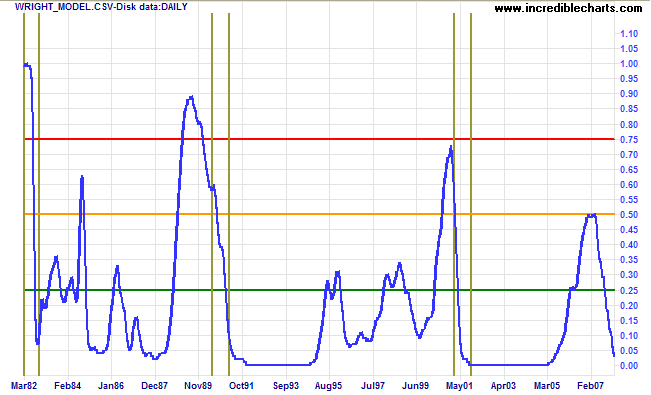

Wright Model

Jonathan Wright's recession prediction model shows probability

of a recession in the next four quarters at 3 percent.

I would prefer to stop publishing the model, as I believe it

failed to predict the current recession in a relatively low

interest rate environment. Some readers, however, have

indicated that they still find it useful; so I continue to

include it — solely for their benefit.

The only things worth learning are the things you learn after

you know it all.

~

Harry S Truman.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.