Gold Testing $1000

By Colin Twiggs

March 4, 2008 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

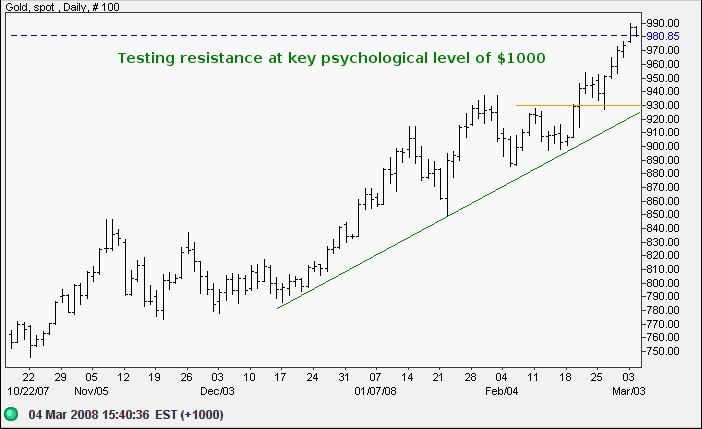

Gold

Spot gold is headed for a test of resistance at the key psychological level of $1000/ounce. Narrow consolidation below the resistance level would be a strong bull signal. Retracement below the rising green trendline is unlikely — and would warn that the up-trend is weakening.

Source: Netdania

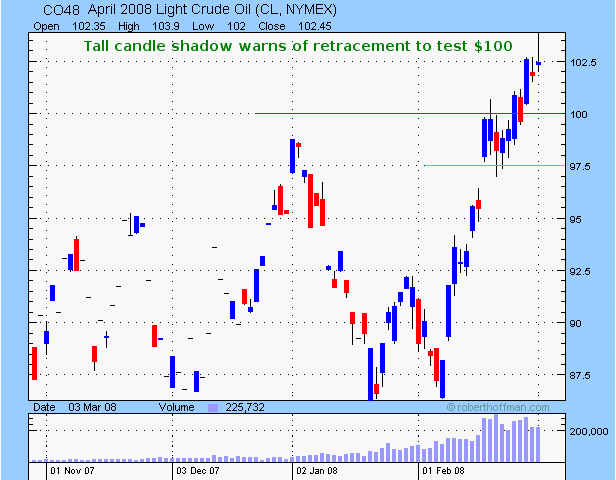

Crude Oil

April 2008 Light Crude broke through resistance at $100/ barrel — after a narrow consolidation. The tall shadow on the latest candle warns of a retracement to test support at $100 (resistance when broken becomes support).

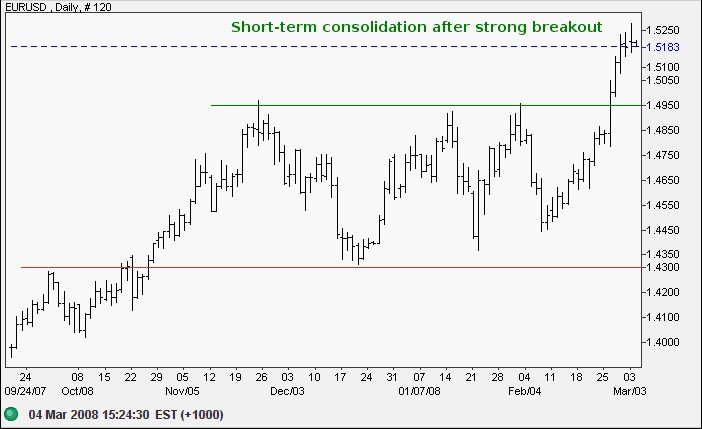

Currencies

The euro broke through resistance at $1.4950/$1.5000

and, after a strong rally, is consolidating above $1.5150.

There is even chance of a consolidation at this level, followed

by an upward breakout, or a retracement to test the new support

level at $1.4950/$1.5000 — affording traders an excellent

entry point.

Retracements and advances tend to be symmetrical, with advances

after a breakout roughly equal to the previous retracement. The

medium-term target for the upward breakout is therefore

calculated as 1.50+(1.50-1.43)=$1.57.

Source: Netdania

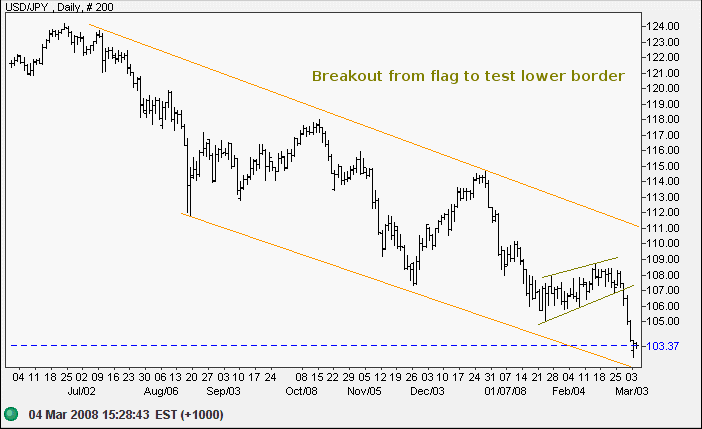

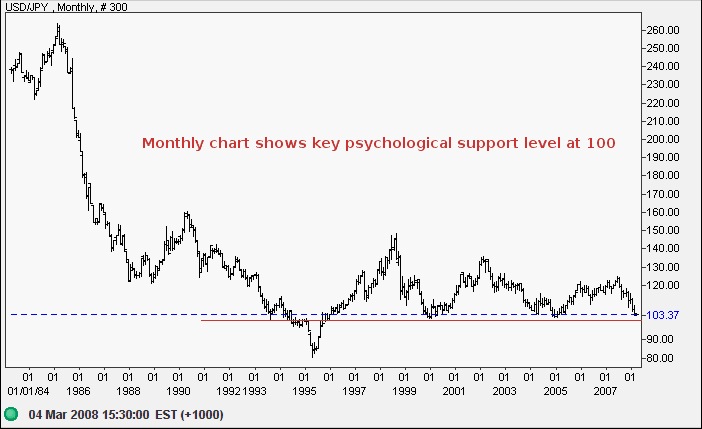

The dollar broke downwards from the flag formation against the yen and is headed for a test of the lower channel border. Long-term and short-term targets now coincide at 100.

Source: Netdania

The significance of support at 100 is clearly shown on the monthly chart.

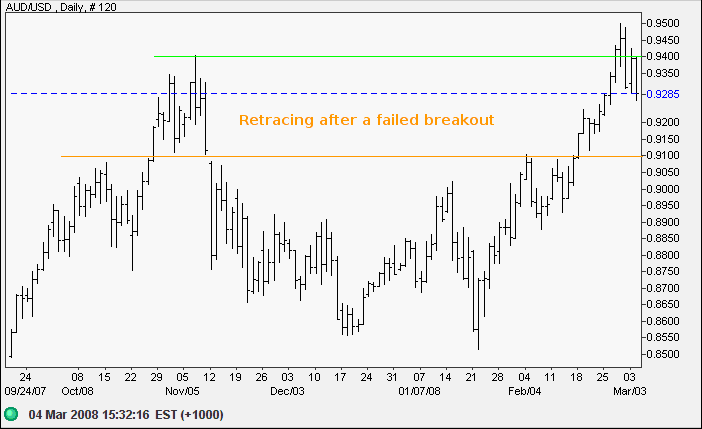

The Australian dollar is retracing after a failed breakout above $0.94. Today's 0.25% rate rise by the RBA should strengthen support and, provided price holds above $0.91, the outlook remains bullish. In the long-term, recovery above $0.94 would offer a target of parity; while reversal below $0.91 would test primary support at $0.85.

Source: Netdania

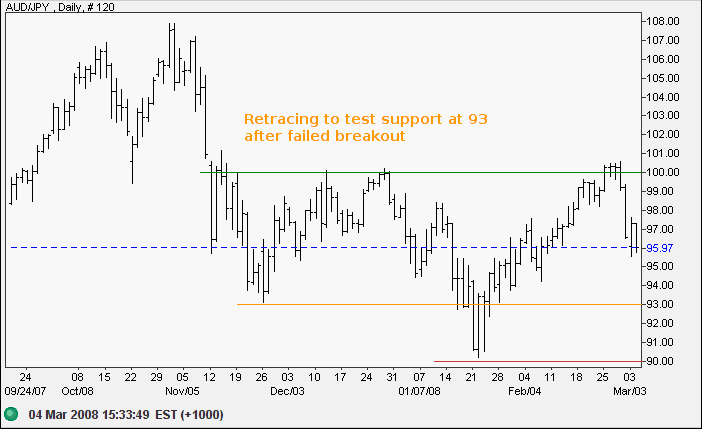

The Aussie made a similar failed break above 100 against the yen, followed by a sharp retracement. Expect support at 93; while a fall below 90 would signal continuation of the down-trend — with a target of 90-(100-90)=80.

Source: Netdania

The delight of the people at the success of their new

wealth-creating machinery was about this time abruptly chilled.

From some unknown cause the mystic wand of the magician was

losing its power. At the very moment when all apprehension had

passed away the spectre of depreciation appeared.

~ from an article on the Continental Currency in The New York

Herald, January 1863.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.