Dollar Falls

By Colin Twiggs

February 28, 2008 9:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

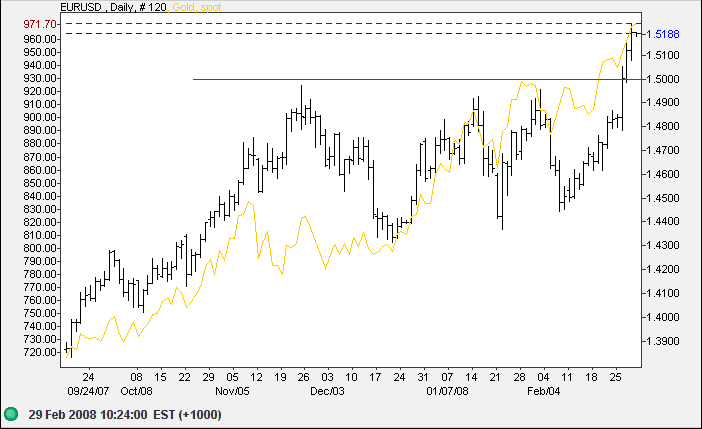

The Dollar, Euro & Gold

The Fed chairman has indicated his intention to cut rates in order to avert a recession. The euro responded with a strong breakout above resistance at $1.50, followed shortly after by gold. There is even probability of retracement to test the new support level — presenting an ideal entry point.

Long-term targets are:

- euro — $1.50+(1.50-1.43)=$1.57;

- gold — $1000.

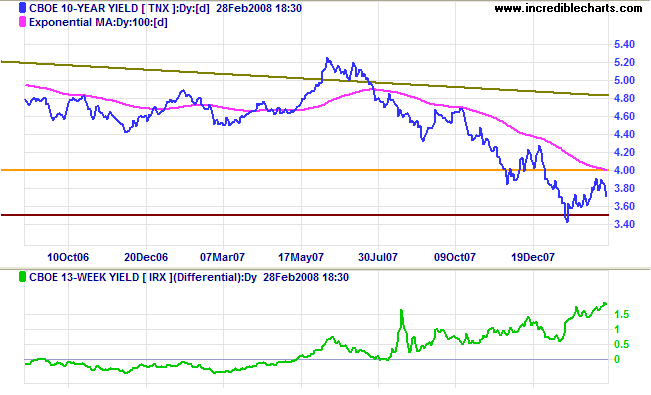

Treasury Yields

Ten-year treasury yields failed to reach 4.00% and are retracing to test support at 3.50%, continuing a strong down-trend. The rising yield differential results from short-term rates falling faster than t-bonds.

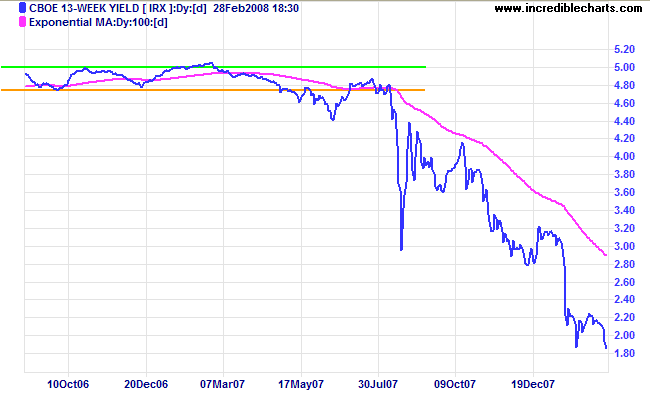

Short-term yields also remain in the steep part of the down-trend, having broken support at 2.00%.

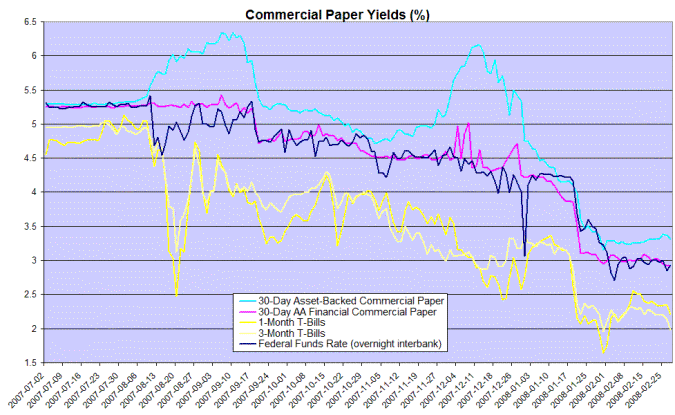

Financial Markets

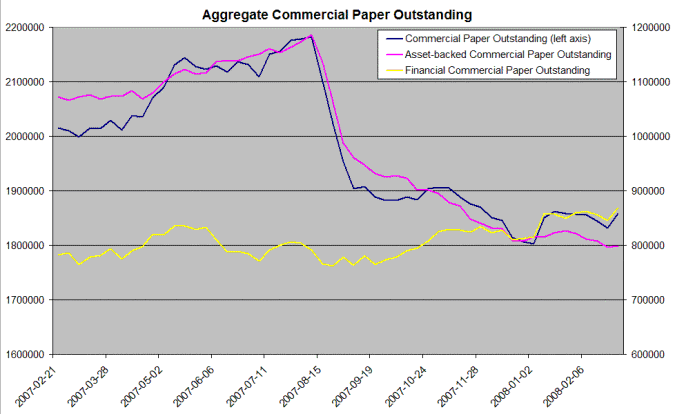

T-bill rates are again falling, in anticipation of further rate cuts. The fed funds rate dipping below its 3.0% target tends to confirm this. The widening spread between asset-backed and financial commercial paper shows the continued aversion to risk, making it difficult for a number of sectors to raise short-term finance.

Total asset-backed commercial paper issued has already shrunk by close to $400 billion and is likely to sink still further. This increases pressure on banks to make up the shortfall and to slow credit growth. At present the Fed is providing banks with additional funding through its Term Auction Facility, in order to avoid a credit crunch.

Commercial Mortgages

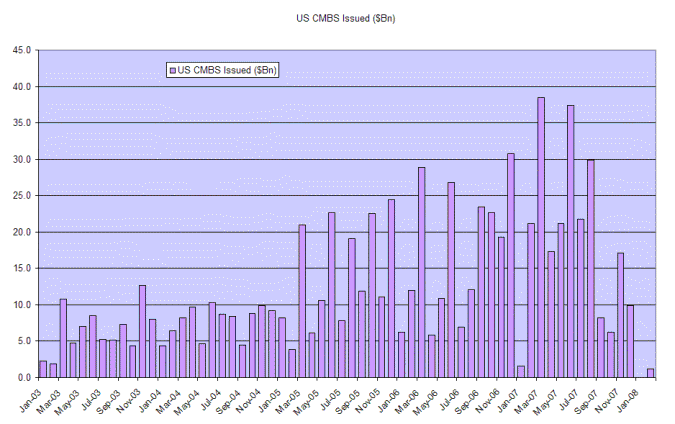

While default rates remain relatively low, new issues of commercial mortgage-backed securities have dwindled to almost zero, causing commercial real estate prices to fall.

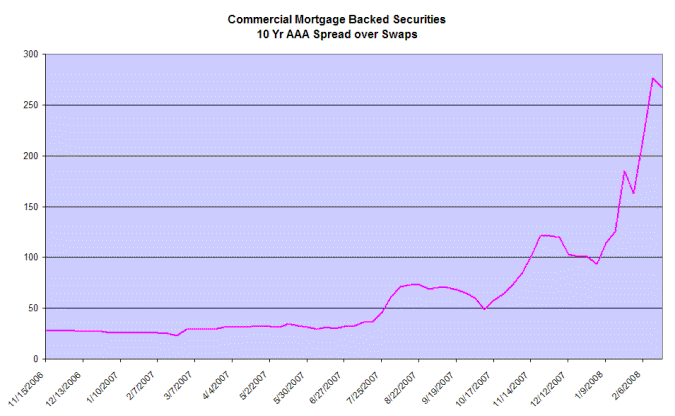

Spreads for AAA rated (10-year) commercial mortgage-backed securities remain at more than 250 points above the swap rate. Contraction of the commercial real estate market has the potential to further de-stabilize financial markets.

Bank Credit

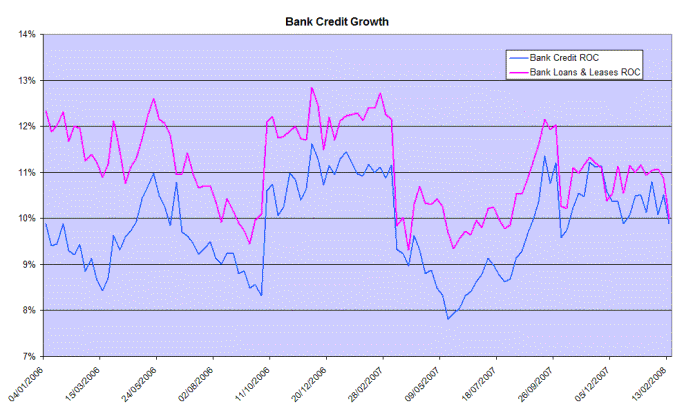

Bank credit growth is expected to fall below 10%. A sharp decline would threaten a full-blown recession.

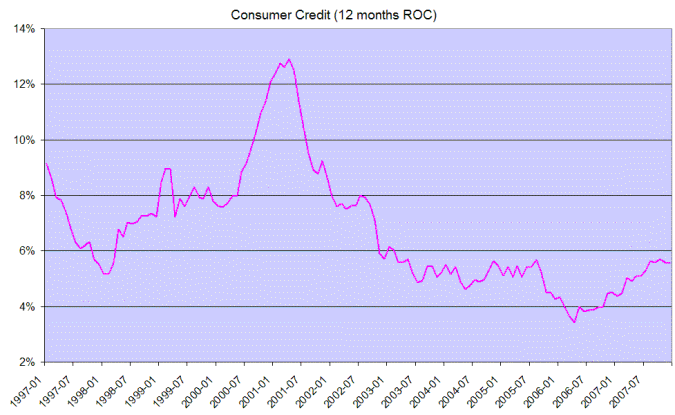

Consumer Credit

Consumer credit, however, continues to grow at a healthy 6 percent.

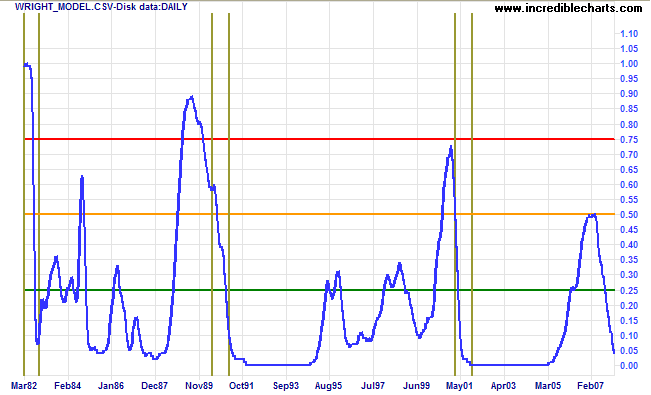

Wright Model

Jonathan Wright's recession prediction model shows probability of a recession (in the next four quarters) is now at 4 percent. My criticism of the model is that it underestimated the probality of recession at the end of 2006. The recent peak should have been a lot higher — around 70 to 80 percent. And I do not believe that the probability of recession 12 months ahead is low — I would assign a probability of 40 to 50 percent.

Gold was not selected arbitrarily by governments to be the

monetary standard. Gold had developed for many centuries on the

free market as the best money; as the commodity providing the

most stable and desirable monetary medium.

~ Murray N. Rothbard.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.