Postponing The Inevitable

By Colin Twiggs

February 23, 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

The market rallied late Friday on rumor that a consortium of banks, including Citigroup and UBS, are close to announcing a bailout of Ambac — in order to save its AAA credit rating. The estimated $3 billion investment is unlikely to save the bond insurer from losses on $566 billion of debt, but will postpone the inevitable write-downs that the banks face. (Bloomberg)

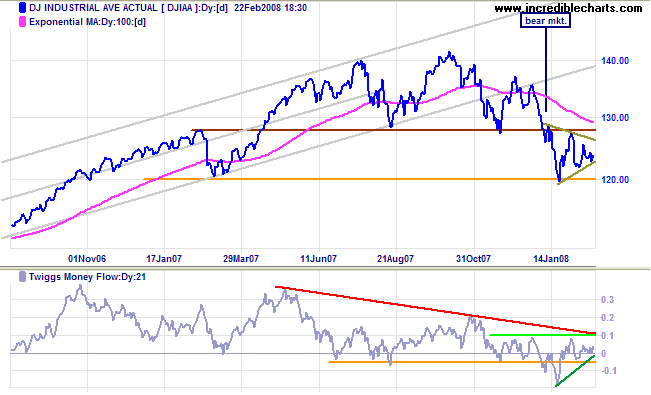

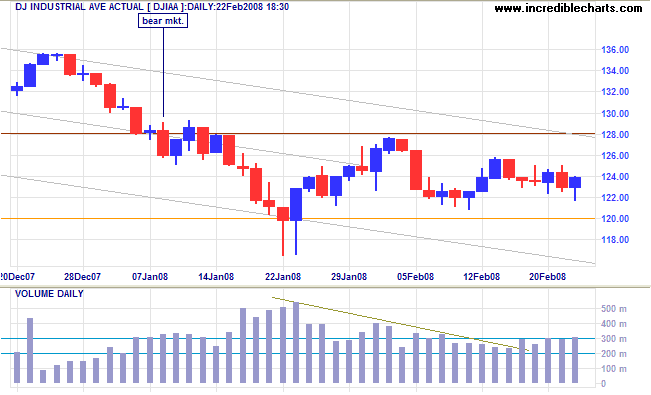

Dow Jones Industrial Average

The Dow continues in a triangle formation between 12000 and 12800. Expect a continuation of the down-trend with a medium-term target of 12000-(12800-12000)=11200. Twiggs Money Flow signals short-term accumulation but long-term selling pressure.

Short Term: Long tails and strong volume indicate buying support, but we have no clear indication of medium-term direction until there is a breakout from the consolidation. A close below 12000 is likely and would indicate the start of another (primary) downward leg; while recovery above 12800 would commence a broad market top — similar to that experienced from 1999 to 2001.

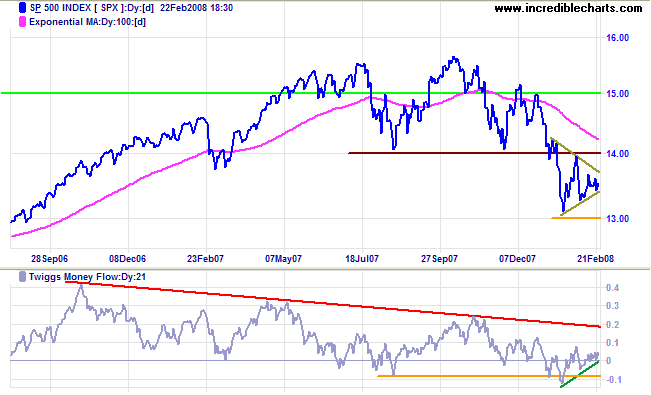

S&P 500

The S&P 500 shows a similar consolidation between 1300 and 1400. Downward breakout is expected and would offer a (medium-term) target of 1300-(1400-1300)=1200.

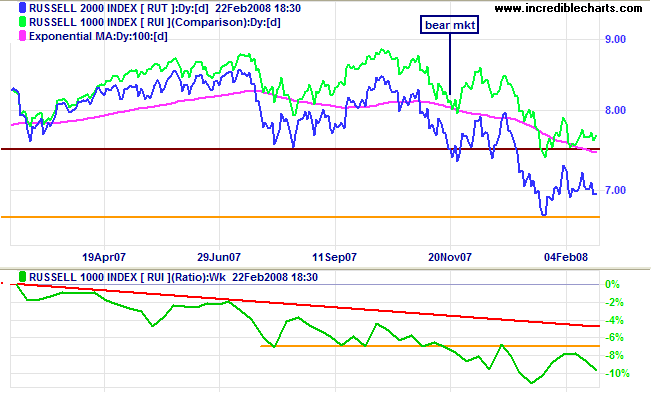

Small Caps

The Russell 2000 is also consolidating, between 690 and 730. Downward breakout is expected, which would test support at 650. The falling ratio against the Russell 1000 signals migration to the relative safety of large cap stocks.

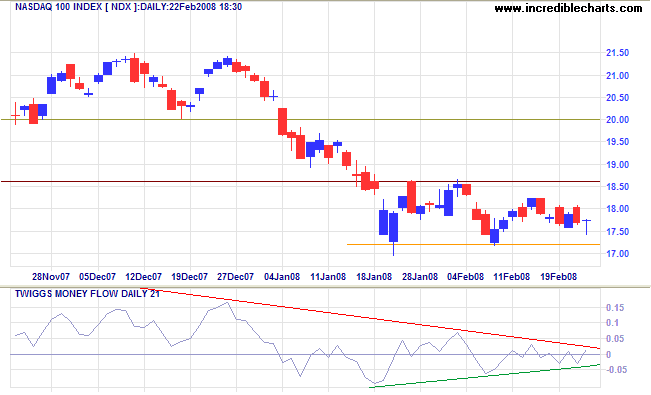

Technology

The Nasdaq 100, likewise, is consolidating between 1720 and 1860. Breakout below 1720 is likely and would signal another (primary) down-swing; while recovery above 1860 would indicate continuation of the market top. Twiggs Money Flow signals short-term accumulation but long-term selling pressure.

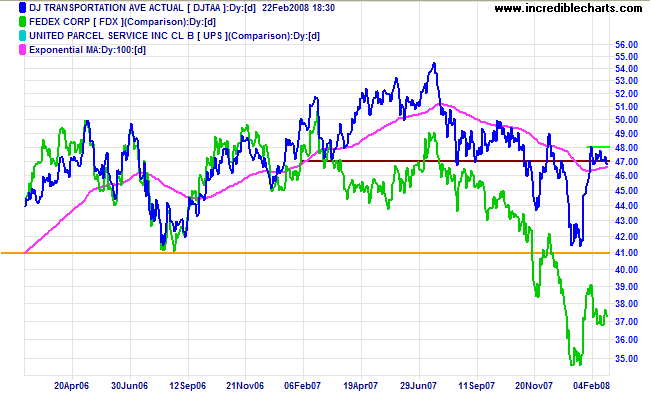

Transport

The Dow Jones Transportation Average is also in a short-term, narrow consolidation — likely to resolve in another test of 4100.

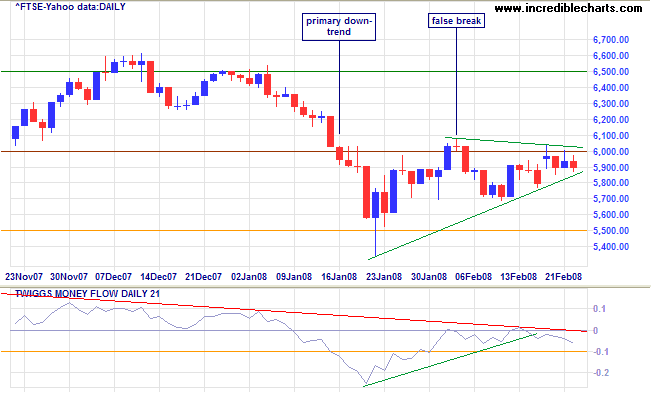

United Kingdom: FTSE

The FTSE 100 shows similar consolidation to the Dow, but Twiggs Money Flow reversed to signal short-term, as well as long-term, selling pressure. Breakout below 5700 remains likely — and would test 5500. Failure of the support level would offer a (medium-term) target of 5500-(6000-5500)=5000.

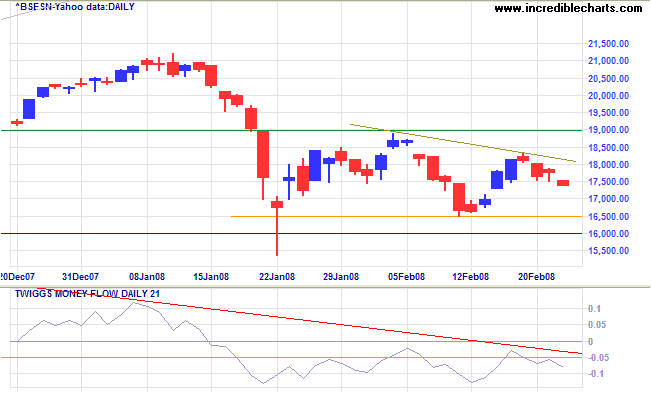

India: Sensex

The Sensex is consolidating between 16500 and 19000. Downward breakout is expected, especially after this week's lower high, and offers a target of 16500-(19000-16500)=14000. Twiggs Money Flow signals long-term selling pressure.

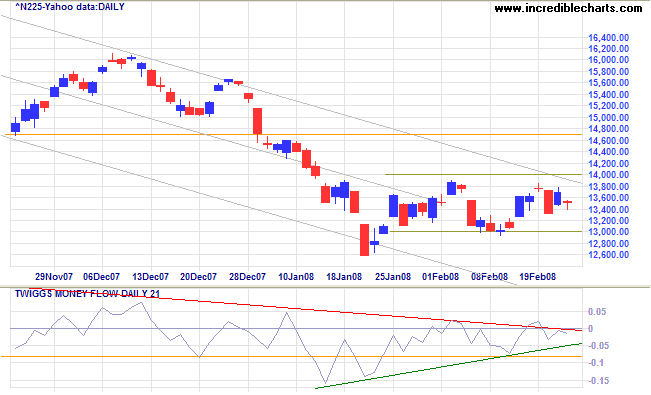

Japan: Nikkei

The Nikkei 225 continues to consolidate between 13000 and 14000. Downward breakout is expected, signaling another (primary) down-swing. Twiggs Money Flow indicates long-term selling pressure but short-term accumulation.

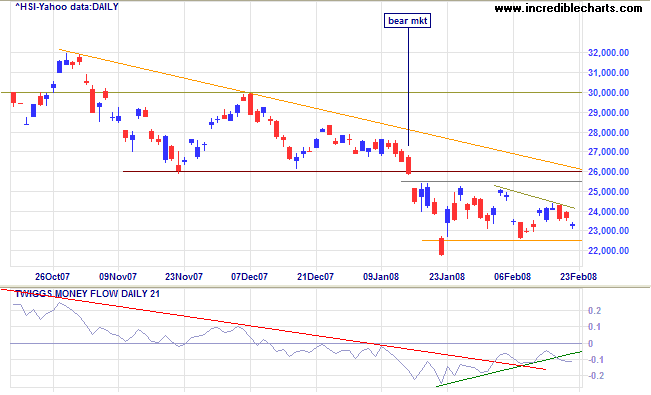

China: Hang Seng & Shanghai

The Hang Seng is consolidating between 22500 and 25500. Downward breakout is expected, especially after this week's lower high — and would warn of another (primary) down-swing with a target of 20000 (from August 2007). Recovery above 26000 remains unlikely — and would indicate that the primary down-trend is weakening. Twiggs Money Flow signals short-term accumulation but long-term selling pressure (the indicator is above the downward trendline but remains below zero).

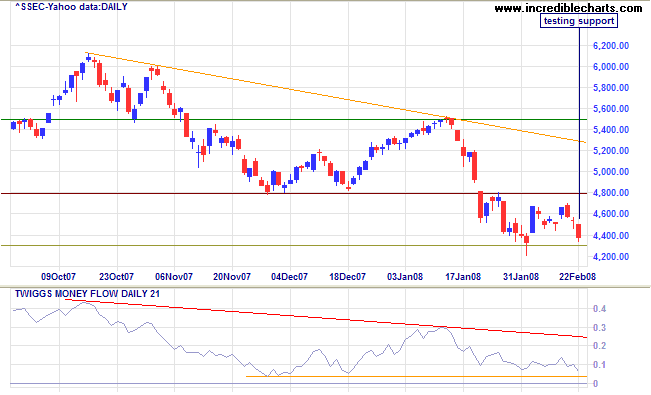

The Shanghai Composite threatens support at 4300 — possibly because of concerns over rising inflation in China. Downward breakout would warn of a primary down-swing, with a target of 3600 (from July 2007). Recovery above 4800 remains unlikely. Twiggs Money Flow indicates long-term selling pressure — and a fall below 0.04 would strengthen the bear signal.

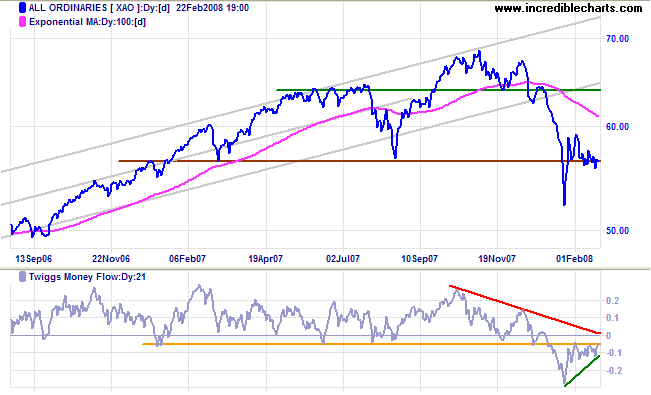

Australia: ASX

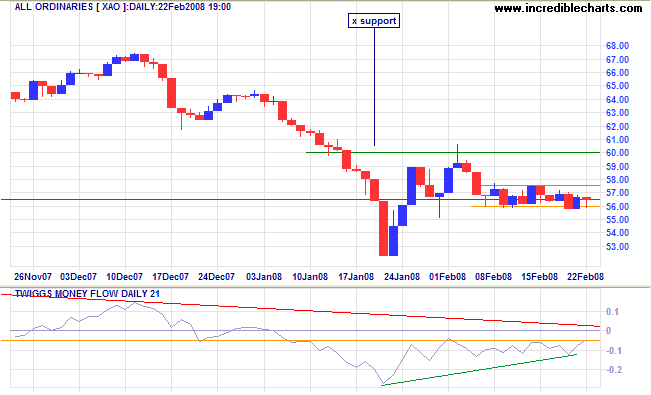

The All Ordinaries is edging lower, but Twiggs Money Flow signals short-term accumulation. Recovery above 6000 remains unlikely — and would signal continuation of the market top rather than a bull market. Breakout below 5600 is expected, given the bearish influence of international markets, and would offer a long-term target of 4800 (from June 2006).

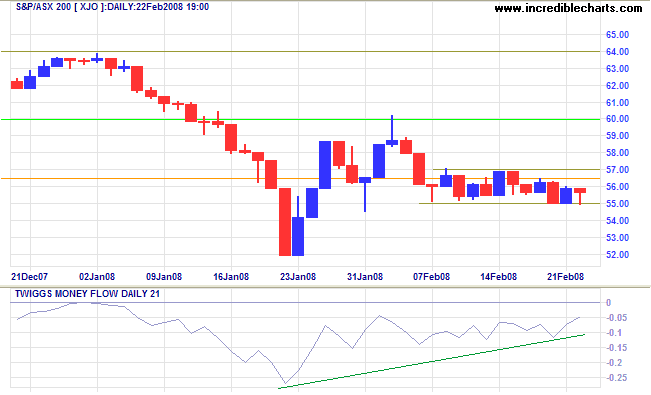

Short Term: It pays to compare signals from the All Ords and the ASX 200 — in a similar fashion to the Dow and S&P 500. On Wednesday the XAO signaled a breakout, offering a short-term target of 5200 (the January low).

The ASX 200, however, respected support at 5500 — failing to confirm.

When the market goes against you, you hope that every day will

be the last day — and you lose more than you should had

you not listened to hope. And when the market goes your way,

you become fearful that the next day will take away your profit

and you get out — too soon. The successful trader has to

fight these two deep-seated instincts.

~ Jesse Livermore in Edwin Lefevre's Reminiscences of a Stock Operator

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.